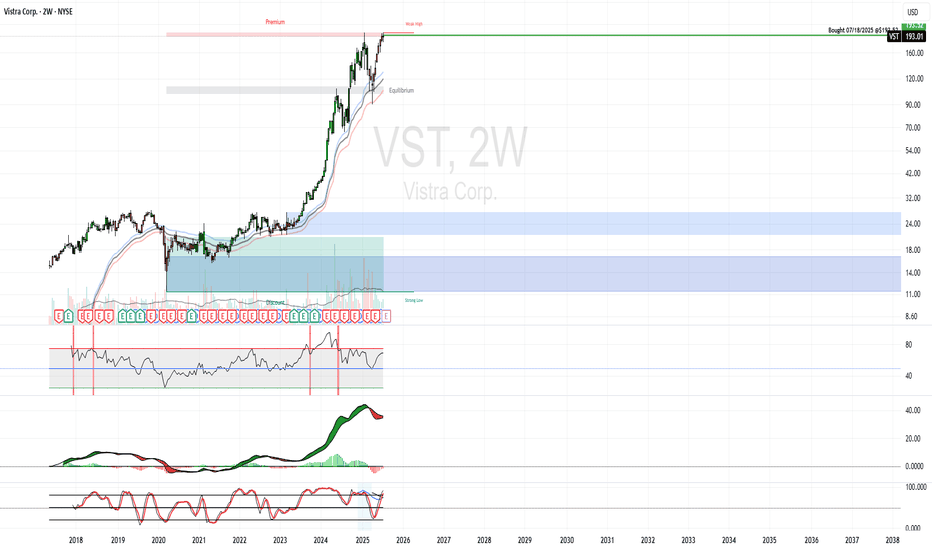

VST Purchase - Nuclear ThemeVistra Corp. (VST) – Cash Flow Machine

$4.09B TTM operating cash flow, highest among peers 2.

Strong nuclear and renewables mix, with AI data center exposure.

Thesis: Balanced growth and income play with upside from AI-driven demand.

Purchased CEG earlier. AI megatrend is tied to nuclear.

N

Key facts today

UBS has maintained its 'Buy' rating for Vistra Corp. (VST) and raised its price target to $230.00 per share, an increase from the previous target of $207.00.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

133.27 MXN

55.44 B MXN

404.00 B MXN

336.42 M

About Vistra Corp.

Sector

Industry

CEO

James A. Burke

Website

Headquarters

Irving

Founded

1882

FIGI

BBG00YT5P754

Vistra Corp. is a holding company, which engages in the provision of electricity and power generation. It operates through the following segments: Retail, Texas, East, West, Sunset, and Asset Closure. The Retail segment sells electricity and natural gas to residential, commercial, and industrial customers. The Texas and East segments are involved in electricity generation, wholesale energy sales and purchases, commodity risk management activities, fuel production and fuel logistics management. The West segment represents the company's electricity generation operations in CAISO. The Sunset segment includes generation plants with announced retirement plans. The Asset Closure segment refers to the decommissioning and reclamation of retired plants and mines. The company was founded in 1882 and is headquartered in Irving, TX.

Related stocks

VST Weekly Analysis Summary (2025-04-16)VST Weekly Analysis Summary (2025-04-16)

Below is a consolidated analysis synthesizing the key points from all the model reports:

──────────────────────────────

Comprehensive Summary of Each Model’s Key Points

• Grok/xAI Report

– Technicals on 5‑minute and daily charts show price holding above key

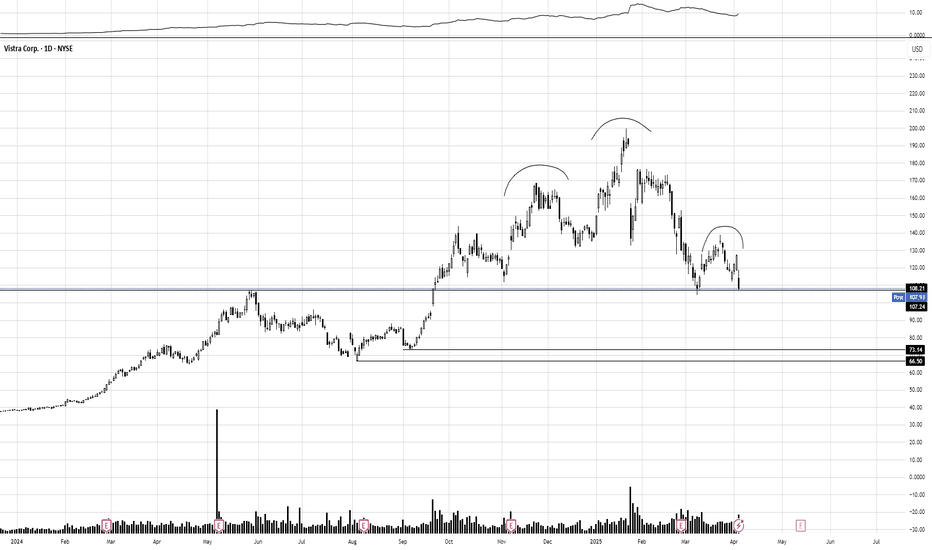

OptionsMastery: Looking at a H&S on VST! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

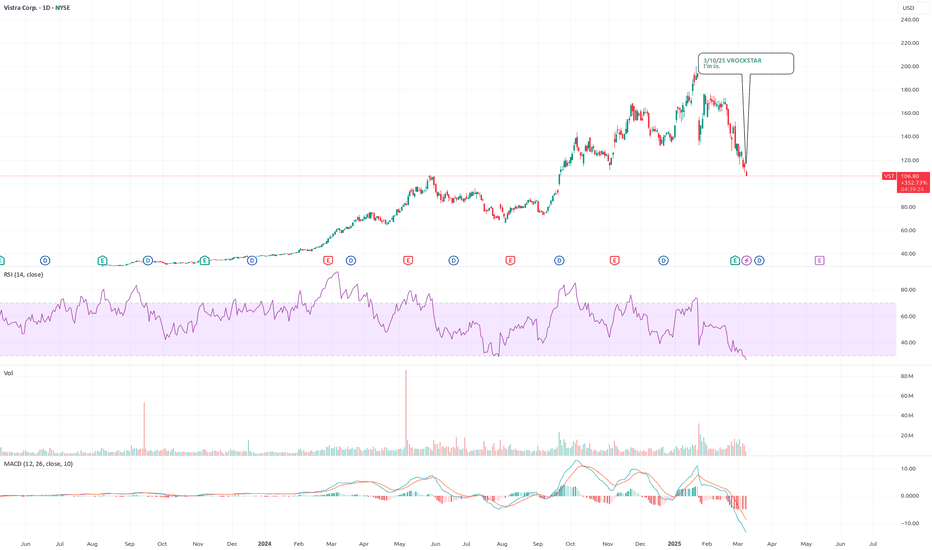

3/10/25 - $vst - I'm in.3/10/25 :: VROCKSTAR :: NYSE:VST

I'm in.

- as we rearrange chairs on the titanic

- i am actively finding the chairs already generating >5% fcf yield (ideally closer to 10%), growing, not having missed, good charts, mgmt etc.

- think i have a portfolio of 20-25 of these. trying to trim down to 10-

Vistra May Have Shaken Off DeepSeek Vistra fell in January because of DeepSeek. It quickly rebounded and now some traders may expect its longer-term uptrend to continue.

The first pattern on today’s chart is the rally between the low of January 27 and the high of January 30. The nuclear-power company has held above a 50 percent retra

VistraVistra could be worth considering for traders who like volatility and the potential for price movement. The recent drop might set up a solid swing trade if the technical indicators and market sentiment line up. With its recovery potential, Vistra could be a good play for those looking to trade aroun

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

VSTE5789672

Vistra Operations Co. LLC 6.875% 15-APR-2032Yield to maturity

6.62%

Maturity date

Apr 15, 2032

VST5651497

Vistra Operations Co. LLC 7.75% 15-OCT-2031Yield to maturity

6.44%

Maturity date

Oct 15, 2031

VST5789673

Vistra Operations Co. LLC 6.875% 15-APR-2032Yield to maturity

6.35%

Maturity date

Apr 15, 2032

VSTE5789663

Vistra Operations Co. LLC 6.0% 15-APR-2034Yield to maturity

6.04%

Maturity date

Apr 15, 2034

VST4790088

Vistra Operations Co. LLC 5.625% 15-FEB-2027Yield to maturity

5.64%

Maturity date

Feb 15, 2027

VST5789664

Vistra Operations Co. LLC 6.0% 15-APR-2034Yield to maturity

5.41%

Maturity date

Apr 15, 2034

VST5944429

Vistra Operations Co. LLC 5.7% 30-DEC-2034Yield to maturity

5.41%

Maturity date

Dec 30, 2034

VST5651428

Vistra Operations Co. LLC 6.95% 15-OCT-2033Yield to maturity

5.39%

Maturity date

Oct 15, 2033

VST4843716

Vistra Operations Co. LLC 5.0% 31-JUL-2027Yield to maturity

5.26%

Maturity date

Jul 31, 2027

VST5180250

Vistra Operations Co. LLC 4.375% 01-MAY-2029Yield to maturity

5.25%

Maturity date

May 1, 2029

17XA

VISTRA OP.C. 21/29 144AYield to maturity

5.23%

Maturity date

May 1, 2029

See all VST bonds

Frequently Asked Questions

The current price of VST is 3,634.59 MXN — it has increased by 0.04% in the past 24 hours. Watch VISTRA CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange VISTRA CORP stocks are traded under the ticker VST.

VST stock has risen by 6.40% compared to the previous week, the month change is a 2.61% rise, over the last year VISTRA CORP has showed a 168.81% increase.

We've gathered analysts' opinions on VISTRA CORP future price: according to them, VST price has a max estimate of 4,305.86 MXN and a min estimate of 2,691.17 MXN. Watch VST chart and read a more detailed VISTRA CORP stock forecast: see what analysts think of VISTRA CORP and suggest that you do with its stocks.

VST stock is 1.11% volatile and has beta coefficient of 2.34. Track VISTRA CORP stock price on the chart and check out the list of the most volatile stocks — is VISTRA CORP there?

Today VISTRA CORP has the market capitalization of 1.21 T, it has decreased by −5.46% over the last week.

Yes, you can track VISTRA CORP financials in yearly and quarterly reports right on TradingView.

VISTRA CORP is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

VST earnings for the last quarter are −19.05 MXN per share, whereas the estimation was 10.99 MXN resulting in a −273.39% surprise. The estimated earnings for the next quarter are 22.91 MXN per share. See more details about VISTRA CORP earnings.

VISTRA CORP revenue for the last quarter amounts to 80.58 B MXN, despite the estimated figure of 93.18 B MXN. In the next quarter, revenue is expected to reach 92.32 B MXN.

VST net income for the last quarter is −5.49 B MXN, while the quarter before that showed 9.19 B MXN of net income which accounts for −159.72% change. Track more VISTRA CORP financial stats to get the full picture.

Yes, VST dividends are paid quarterly. The last dividend per share was 4.28 MXN. As of today, Dividend Yield (TTM)% is 0.46%. Tracking VISTRA CORP dividends might help you take more informed decisions.

VISTRA CORP dividend yield was 0.63% in 2024, and payout ratio reached 12.48%. The year before the numbers were 2.13% and 22.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 6.85 K employees. See our rating of the largest employees — is VISTRA CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VISTRA CORP EBITDA is 213.70 B MXN, and current EBITDA margin is 45.72%. See more stats in VISTRA CORP financial statements.

Like other stocks, VST shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VISTRA CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VISTRA CORP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VISTRA CORP stock shows the buy signal. See more of VISTRA CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.