WDAY trade ideas

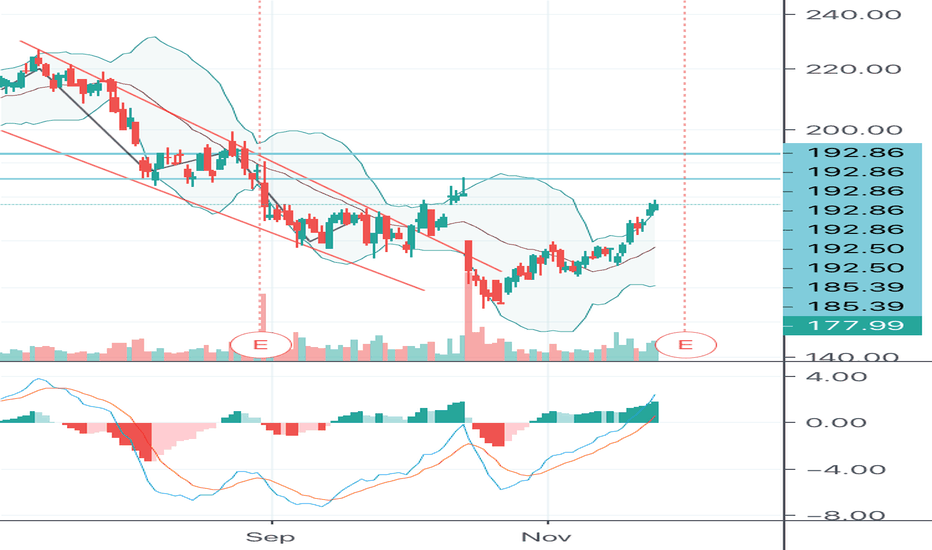

WDAY Top Hits Weak Support LevelWDAY topped on the short-term trend, but it is bouncing off of weaker support from money highs in 2018. WDAY remains at risk for more downside slip slide action, until it enters the Platform candlestick pattern formation from 2018. That support level offers stronger support due to a prior Dark Pool Buy Zone™ with minimal accumulation.

Too many Tweets to trade WorkdayOur last trade has worked out perfectly and the gap has been filled, now as earnings approach tomorrow we think its time to sit on the sidelines.

In the past 2 sessions Tech has taken quite a hit and given the amount of tweets from the POTUS and more trade war announcements tonight, its just to much risk to trade into earnings, there is a possibility that we could retest the monthly lows in the $150 region on and negative news from the company.

Company profile

Workday, Inc. engages in the development of enterprise cloud applications for finance and human resources. It delivers financial management, human capital management, and analytics applications designed for companies, educational institutions, and government agencies. The company was founded by David A. Duffield and Aneel Bhusri in March 2005 and is headquartered in Pleasanton, CA.

$WDAY IS the bottom in for Workday.?Possible entry level @ $160 with $187 as price target.

Recent volume may have signalled the final capitulation.

Evercore upgrades from Inline to outperform.

Company profile

Workday, Inc. engages in the development of enterprise cloud applications for finance and human resources. It delivers financial management, human capital management, and analytics applications designed for companies, educational institutions, and government agencies. The company was founded by David A. Duffield and Aneel Bhusri in March 2005 and is headquartered in Pleasanton, CA.

$WDAY Selling may be overdone in Workday.We will be keeping a strong watch for some serious buyers coming into WDAY looking for a bargain.

The fundamentals of the company have not changed but market sentiment and Analysts downgrades kicked the stock at the wrong time.

The 31% decline from July highs may be coming to a end.

Workday - Great Cloud Based SoftwareThis is an excellent company with excellent growth with nothing in the way of further growth. HR solutions in the cloud will ultimately reduce the need for HR on site, especially for larger companies who have greater need for higher numbers of HR generalists. Im waiting for a sign on the higher time frame for confirmation for further movement up.