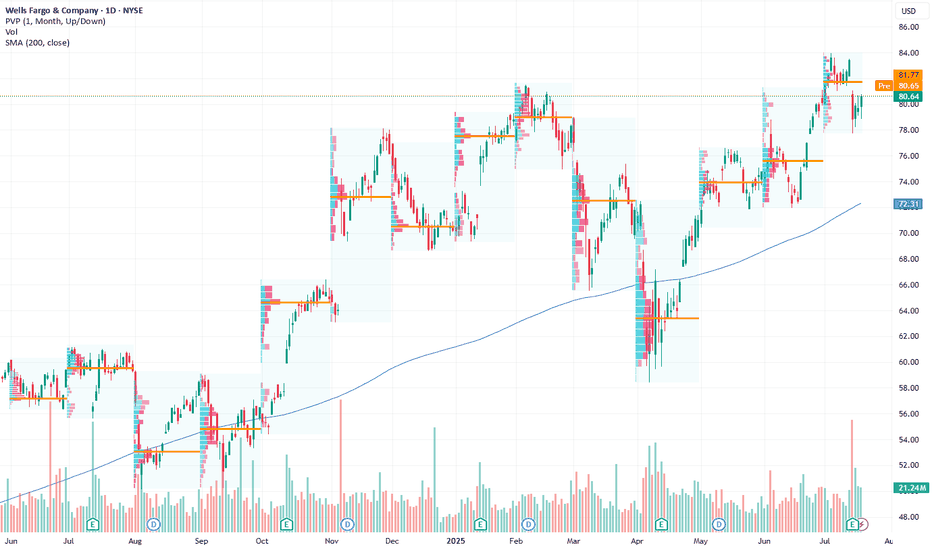

Trade Setup: LONG on WFC!📈

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Bull flag / descending channel breakout

📉 Previous Trend: Uptrend with healthy retracement

🧭 Setup: Breakout from short-term correction, aligning with trendline support

🧩 Technical Breakdown:

Support Zones:

$83.00 (holding on ascending trendline)

$82.50

Key facts today

Wells Fargo is the lead underwriter for Firefly Aerospace's IPO, expected to raise $696.6 million by selling shares priced between $41 and $43.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

110.72 MXN

411.19 B MXN

2.63 T MXN

3.25 B

About Wells Fargo & Company

Sector

Industry

CEO

Charles William Scharf

Website

Headquarters

San Francisco

Founded

1852

FIGI

BBG00JX0P7Y1

Wells Fargo & Company is a bank holding company. The Company is a diversified financial services company. It has three operating segments: Community Banking, Wholesale Banking, and Wealth and Investment Management. The Company offers its services under three categories: personal, small business and commercial. It provides retail, commercial and corporate banking services through banking locations and offices, the Internet and other distribution channels to individuals, businesses and institutions in all 50 states, the District of Columbia and in other countries. It provides other financial services through its subsidiaries engaged in various businesses, including wholesale banking, mortgage banking, consumer finance, equipment leasing, agricultural finance, commercial finance, securities brokerage and investment banking, computer and data processing services, investment advisory services, mortgage-backed securities servicing and venture capital investment.

Related stocks

Wells Fargo Stock Chart Fibonacci Analysis 073025Hit the 84.5/423.60% resistance level.

Trading Idea

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise fr

Wells Fargo: Bearish Sentiment Signals Potential DownsideCurrent Price: $80.64

Direction: SHORT

Targets:

- T1 = $77.62

- T2 = $74.81

Stop Levels:

- S1 = $82.25

- S2 = $84.12

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identi

WFC Earnings Setup – 07/14/2025 $86C | Exp. July 18 | Betting on

📈 WFC Earnings Setup – 07/14/2025

$86C | Exp. July 18 | Betting on a Bank Bounce

⸻

🔥 EARNINGS HEAT CHECK

💼 WFC reports BMO (07/15)

📊 Historical move avg: ~3–5%

📍 Current price: $82.53

📈 Above 20D/50D MAs → trend intact

⚠️ RSI = 78.07 = overbought 🚨

💥 Expected move: $2.89

⸻

🧠 SENTIMENT SNAPS

WFC · Daily — Rising-Channel Breakout Idea Toward $89-90Why This Setup Caught My Eye

Multi-year rising channel: Since late 2022 price has respected a neat parallel channel; we’re now testing the upper rail.

Fresh bull-flag breakout: The June pullback carved a tight triangular flag. Last week’s high-volume close above $83 confirmed the breakout.

Measure

Shorting WFC for short-term correction NYSE:WFC is looking at near-term weakness after a strong bearish counter attack candle was seen rejecting the 123.6% Fibonacci extension of the range (71.82-76.50) and the 88.6% deep retracement level of the larger swing low to high (50.20-80.70).

23-period ROC is looking at a bearish divergence

WFC eyes on $74: Major Resistance going into FED rate decision WFC testing a Major Resistance zone going into FED day.

Looking for a Rejection or a Break-and-Retest for next move.

Financials in general are doing well but due for a little dip.

$73.56-74.11 is the key zone of interest.

$68.91-69.60 is first good support below.

==================================

WFC Trade LevelsEither or set-up while in this range.

For day trades, expect price to move between 64.86-66.30 where there is a daily gap down.

For now, the gap is acting as resistance.

When trading gaps, it depends on your objective. Scalpers might be interested in playing off the H/L of the gap.

While intraday

WFC - Faster Up PhaseAs price transitions through fib circle acceleration of price upwards is allowed

Price has been going through an upward movement however slowly, I expect price to move up faster

This is similar to Tesla's moves upward. Kind of moving up in chunks or in big waves

Weekly timeframe

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

WFC5760754

Wells Fargo & Company 0.0% 28-FEB-2039Yield to maturity

8.85%

Maturity date

Feb 28, 2039

94CY

WELLS FARGO & COMPANY 2.5% SNR EMTN 02/05/29Yield to maturity

7.50%

Maturity date

May 2, 2029

WFC.MS

Wachovia Corporation 6.605% 01-OCT-2025Yield to maturity

6.90%

Maturity date

Oct 1, 2025

WFC5679614

Wells Fargo & Company 6.75% 06-NOV-2033Yield to maturity

6.66%

Maturity date

Nov 6, 2033

WFC4776290

Wells Fargo & Company 4.661373% 06-DEC-2028Yield to maturity

6.62%

Maturity date

Dec 6, 2028

WFC5673508

Wells Fargo & Company 6.65% 26-OCT-2033Yield to maturity

6.60%

Maturity date

Oct 26, 2033

WFC5530567

Wells Fargo & Company 5.05% 25-JAN-2026Yield to maturity

6.55%

Maturity date

Jan 25, 2026

WFC.MI

First Union Corporation 7.574% 01-AUG-2026Yield to maturity

6.50%

Maturity date

Aug 1, 2026

US94974BGT1

WELLS FARGO 2046 MTNYield to maturity

6.37%

Maturity date

Jun 14, 2046

WFC5679616

Wells Fargo & Company 6.8% 06-NOV-2038Yield to maturity

6.33%

Maturity date

Nov 6, 2038

WFC4541243

Wells Fargo & Company 5.58411% 15-SEP-2027Yield to maturity

6.28%

Maturity date

Sep 15, 2027

See all WFC bonds

Curated watchlists where WFC is featured.

Frequently Asked Questions

The current price of WFC is 1,467.00 MXN — it has decreased by −1.49% in the past 24 hours. Watch WELLS FARGO CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange WELLS FARGO CO stocks are traded under the ticker WFC.

WFC stock has fallen by −1.97% compared to the previous week, the month change is a 1.00% rise, over the last year WELLS FARGO CO has showed a 37.88% increase.

We've gathered analysts' opinions on WELLS FARGO CO future price: according to them, WFC price has a max estimate of 1,813.37 MXN and a min estimate of 1,416.70 MXN. Watch WFC chart and read a more detailed WELLS FARGO CO stock forecast: see what analysts think of WELLS FARGO CO and suggest that you do with its stocks.

WFC stock is 3.89% volatile and has beta coefficient of 1.30. Track WELLS FARGO CO stock price on the chart and check out the list of the most volatile stocks — is WELLS FARGO CO there?

Today WELLS FARGO CO has the market capitalization of 4.78 T, it has decreased by −2.47% over the last week.

Yes, you can track WELLS FARGO CO financials in yearly and quarterly reports right on TradingView.

WELLS FARGO CO is going to release the next earnings report on Oct 14, 2025. Keep track of upcoming events with our Earnings Calendar.

WFC earnings for the last quarter are 30.01 MXN per share, whereas the estimation was 26.43 MXN resulting in a 13.55% surprise. The estimated earnings for the next quarter are 28.80 MXN per share. See more details about WELLS FARGO CO earnings.

WELLS FARGO CO revenue for the last quarter amounts to 390.58 B MXN, despite the estimated figure of 389.34 B MXN. In the next quarter, revenue is expected to reach 397.54 B MXN.

WFC net income for the last quarter is 103.06 B MXN, while the quarter before that showed 100.26 B MXN of net income which accounts for 2.79% change. Track more WELLS FARGO CO financial stats to get the full picture.

Yes, WFC dividends are paid quarterly. The last dividend per share was 7.78 MXN. As of today, Dividend Yield (TTM)% is 2.06%. Tracking WELLS FARGO CO dividends might help you take more informed decisions.

WELLS FARGO CO dividend yield was 2.14% in 2024, and payout ratio reached 27.96%. The year before the numbers were 2.64% and 26.90% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 217 K employees. See our rating of the largest employees — is WELLS FARGO CO on this list?

Like other stocks, WFC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade WELLS FARGO CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So WELLS FARGO CO technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating WELLS FARGO CO stock shows the buy signal. See more of WELLS FARGO CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.