Key stats

About FINALCIAL SELECT SECTOR SPDR

Home page

Inception date

Dec 16, 1998

Structure

Open-Ended Fund

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

SSgA Funds Management, Inc.

Distributor

ALPS Distributors, Inc.

XLF offers efficient exposure to the heavyweights in the US financials segment. Its cap-weighted, S&P 500-only portfolio means that its concentrated in large banks and avoids small-caps. For many investors and traders, XLF has been the go-to ETF for financials exposure, although there are more comprehensive funds out there for long-term exposure. Note: XLF spun off its real estate exposure in September 2016, consistent with the GICS reclassification that elevated real estate to sector-level status. The change was material: Real estate comprised about 20% of the fund at the time. For each share held, XLF shareholders as of 9/16/16 received 0.139146 shares of XLRE, State Street Global Advisors' real estate ETF. (Immediately prior to the distribution, XLF had swapped its REITs for shares of XLRE.)

Classification

What's in the fund

Exposure type

Finance

Stock breakdown by region

Top 10 holdings

Rhythm of the Great BearUndead Bear Captain's Log

April 27, 2025

Will make one final attempt to chart and navigate the murky waters of the Great Bear.

XLF may be a good candidate with still distinct waves, like XRT, XLRE and XHB.

All other sectors, especially SPY are skewed by tech, same-day options and basically uncharta

XLF Trade LevelsThe financial sector interests me, especially with an upcoming interest rate meeting, earnings report, and declining consumer sentiment.

Ultimately, I like to swing the Sector ETF's but they also make for affordable day trades!

With XLF being in a tight range on the Weekly+ timeframes, it makes i

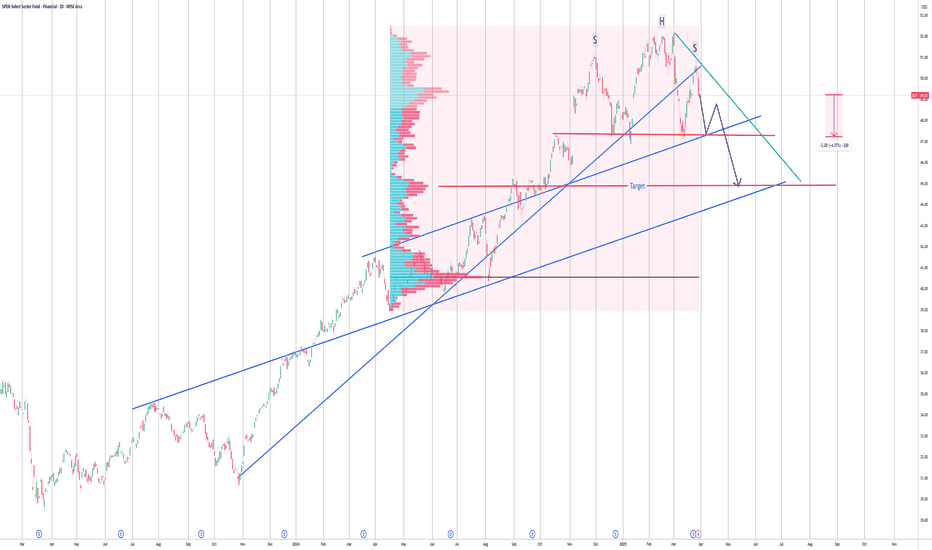

XLF Head and Shoulders patternEarlier today I commented not to go long today because XLF hasn't completed it's pattern yet. This is the pattern I was talking abut, H&S on the daily chart. So unless congress does something over the weekend to rescind tariffs, XLF will complete this pattern Monday.

I didn't short it because I e

XLF DaytradingI was way late to the party buying puts today because I thought it'd bounce when my futures indicators hit oversold, but I did catch part of the initial drop, and then re-entered the trade when SPX broke support and financials lagged a bit.

Figured XLF had to also make a new low, and the "h" patter

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Related funds

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

XLF trades at 960.48 MXN today, its price has fallen −0.52% in the past 24 hours. Track more dynamics on XLF price chart.

XLF net asset value is 964.21 today — it's fallen 0.50% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

XLF assets under management is 927.79 B MXN. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

XLF price has fallen by −3.75% over the last month, and its yearly performance shows a 27.47% increase. See more dynamics on XLF price chart.

NAV returns, another gauge of an ETF dynamics, have risen by −0.50% over the last month, have fallen by −0.50% over the last month, showed a 1.51% increase in three-month performance and has increased by 29.75% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by −0.50% over the last month, have fallen by −0.50% over the last month, showed a 1.51% increase in three-month performance and has increased by 29.75% in a year.

XLF fund flows account for 29.61 B MXN (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

XLF invests in stocks. See more details in our Analysis section.

XLF expense ratio is 0.09%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, XLF isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, XLF technical analysis shows the strong sell rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating XLF shows the buy signal. See more of XLF technicals for a more comprehensive analysis.

Today, XLF technical analysis shows the strong sell rating and its 1-week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating XLF shows the buy signal. See more of XLF technicals for a more comprehensive analysis.

Yes, XLF pays dividends to its holders with the dividend yield of 1.40%.

XLF trades at a premium (0.05%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

XLF shares are issued by State Street Corp.

XLF follows the S&P Financial Select Sector. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Dec 16, 1998.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.