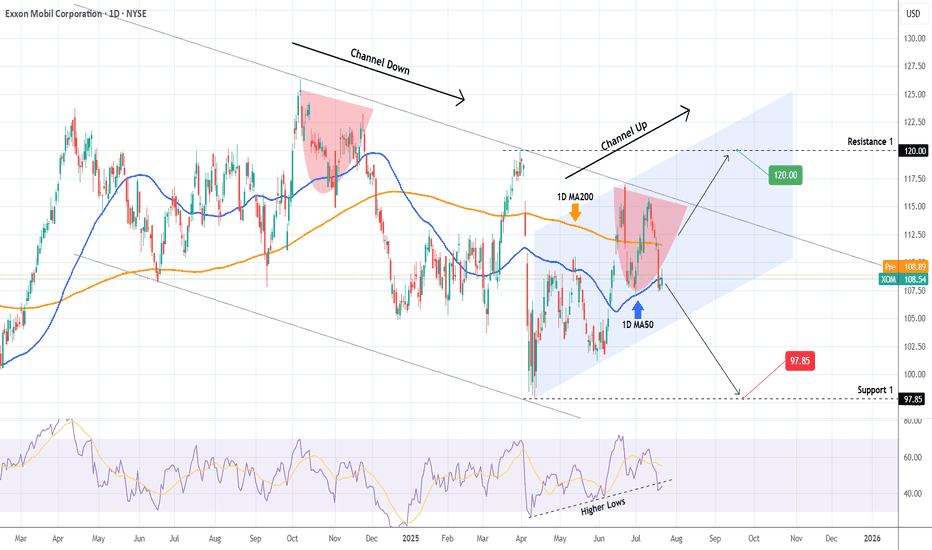

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and te

Key facts today

ExxonMobil has launched its third 'EXCITE' training program in Cairo, with 57 participants from 16 markets, aimed at boosting cooperation in automotive and industrial lubricants.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

132.85 MXN

702.21 B MXN

7.09 T MXN

4.31 B

About Exxon Mobil

Sector

Industry

CEO

Darren W. Woods

Website

Headquarters

Spring

Founded

1882

FIGI

BBG00JX0P110

Exxon Mobil Corp engages in the exploration, development, and distribution of oil, gas, and petroleum products. It operates through the following segments: Upstream, Downstream and Chemical. The Upstream segment produces crude oil and natural gas. The Downstream segment manufactures and trades petroleum products. The Chemical segment offers petrochemicals. The company was founded by John D. Rockefeller in 1882 and is headquartered in Irving, TX.

Related stocks

Top-Down Analysis in Action – Live Trade: Where I Enter and WhyIn this video, I walk you through my full trading process – starting with a clean top-down analysis.

I begin on the daily chart to spot key market structure and levels, then zoom in to the 1-hour chart for confirmation, and finally execute my trade on the 5-minute chart.

You’ll see:

✔️ How I define

Exxon Mobil Corporation (XOM) – BUY IDEA📌 We’re watching a strong bullish structure in XOM. After a sharp open, price retraces to fill the GAP and respects the key Low zone 🟧, signaling institutional interest.

🟢 Entry aligns with downside liquidity sweep followed by bullish momentum. This trade has confluence between previous liquidity,

Energy giants surge: Top 5 stocks to watchJune 2025 was marked by heightened volatility across the global energy sector . Amid fluctuating oil prices, geopolitical uncertainty, and ongoing industry transformation, major oil and gas companies delivered mixed results. Let’s break down the key drivers behind the moves in Shell, TotalEnergies,

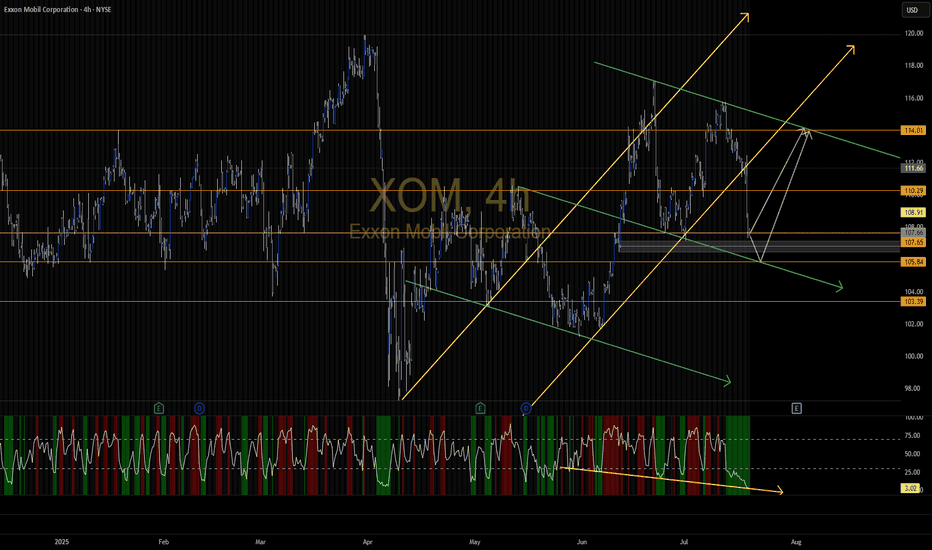

XOM - Bullish Trade ideaXOM Trade Idea... 🎯 Entry Plan:

Base Entry Zone (accumulation):

ENTRY OPTION 1: $110.60–$111.50 → Retest 12-moving average

ENTRY OPTION 2 momentum trigger: Bullish reversal candle on 2H or 1H + reclaim of $113.00 (this means let price break above $113 after you get a fresh inverse Arc or Level 3

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where XOM is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of XOM is 2,065.18 MXN — it has decreased by −2.63% in the past 24 hours. Watch EXXON MOBIL CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BIVA exchange EXXON MOBIL CORPORATION stocks are traded under the ticker XOM.

XOM stock has risen by 0.47% compared to the previous week, the month change is a 0.75% rise, over the last year EXXON MOBIL CORPORATION has showed a −6.36% decrease.

We've gathered analysts' opinions on EXXON MOBIL CORPORATION future price: according to them, XOM price has a max estimate of 2,644.50 MXN and a min estimate of 1,794.48 MXN. Watch XOM chart and read a more detailed EXXON MOBIL CORPORATION stock forecast: see what analysts think of EXXON MOBIL CORPORATION and suggest that you do with its stocks.

XOM stock is 2.70% volatile and has beta coefficient of 0.46. Track EXXON MOBIL CORPORATION stock price on the chart and check out the list of the most volatile stocks — is EXXON MOBIL CORPORATION there?

Today EXXON MOBIL CORPORATION has the market capitalization of 8.93 T, it has decreased by −1.84% over the last week.

Yes, you can track EXXON MOBIL CORPORATION financials in yearly and quarterly reports right on TradingView.

EXXON MOBIL CORPORATION is going to release the next earnings report on Oct 24, 2025. Keep track of upcoming events with our Earnings Calendar.

XOM earnings for the last quarter are 30.76 MXN per share, whereas the estimation was 29.41 MXN resulting in a 4.60% surprise. The estimated earnings for the next quarter are 32.81 MXN per share. See more details about EXXON MOBIL CORPORATION earnings.

EXXON MOBIL CORPORATION revenue for the last quarter amounts to 1.53 T MXN, despite the estimated figure of 1.51 T MXN. In the next quarter, revenue is expected to reach 1.57 T MXN.

XOM net income for the last quarter is 132.85 B MXN, while the quarter before that showed 158.02 B MXN of net income which accounts for −15.93% change. Track more EXXON MOBIL CORPORATION financial stats to get the full picture.

Yes, XOM dividends are paid monthly. The last dividend per share was 19.30 MXN. As of today, Dividend Yield (TTM)% is 3.58%. Tracking EXXON MOBIL CORPORATION dividends might help you take more informed decisions.

EXXON MOBIL CORPORATION dividend yield was 3.57% in 2024, and payout ratio reached 49.00%. The year before the numbers were 3.68% and 41.41% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 61 K employees. See our rating of the largest employees — is EXXON MOBIL CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EXXON MOBIL CORPORATION EBITDA is 1.16 T MXN, and current EBITDA margin is 18.76%. See more stats in EXXON MOBIL CORPORATION financial statements.

Like other stocks, XOM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EXXON MOBIL CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EXXON MOBIL CORPORATION technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EXXON MOBIL CORPORATION stock shows the neutral signal. See more of EXXON MOBIL CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.