DeGRAM | DXY continued growthThe DXY is in an ascending channel between the trend lines.

The price is moving from the support level, the lower boundary of the channel and the lower trend line, which has already acted as a rebound point.

The chart has formed a harmonic pattern and successfully held the 50% retracement level.

We expect the growth to continue.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DX.F trade ideas

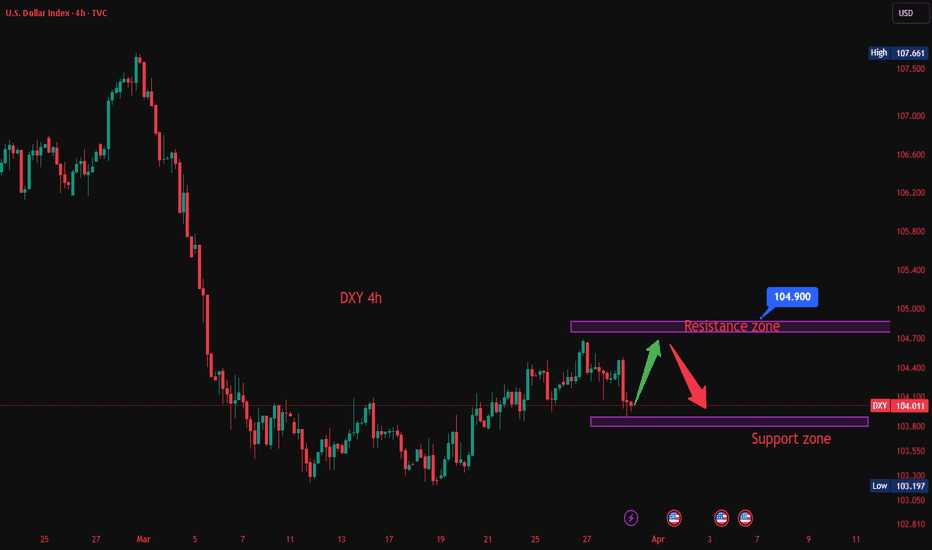

DXY Bounces Back: I’m Staying BullishAfter breaking below the 104 support and hitting a low of 103.75, TVC:DXY staged a strong recovery, reclaiming support and signaling a potential false breakout.

The overnight retest of 104 established a higher low, suggesting further upside potential.

As long as 104 holds, I remain bullish and will look to sell EUR/USD and GBP/USD.

DXY April 1 AnalysisDXY April 1 Analysis

*My parent bias is still bear coming into this week.

*News 10

*Previous session price is in a premium and in a discount on current trading range in a consolidation cycle.

Price opened in Asia to the down side taking sell side from last Thursday, creating equal lows, London Price retraced to the 50 level which was my original target and in NY rebalance Fridays FVG closing in consolidation.

I suspected higher prices for the beginning of this week. Great delivery. Today I suspect that Price will come up to take the noted buy side and seek to rebalance the noted FVG, possibly take the noted clean equal highs.

I am bull on this day.

Stay humble to what Price prints and don't get stuck in any idea yet be nimble.

DXY:Seize the opportunity to sell short at high pricesThe situation in the Middle East is clearly deteriorating, which undoubtedly has a huge stimulating effect on the global risk aversion sentiment. More funds have started to seek safe havens. However, the best choice at present is not the US dollar. With the continuous rise of the East, more and more capital will favor this side of the East. Therefore, the pressure on the US dollar index is actually increasing, and it will be very difficult for it to rise.

Regarding the trend of the US dollar index today, although the current situation exerts great pressure, the actions to support the market of the US dollar index still take effect from time to time. So the price will not keep falling, and there will still be some oscillatory patterns. However, even if it moves in an oscillatory pattern, the upward pressure on the US dollar index will be significant. Therefore, when the price reaches the effective resistance level, it will be an excellent opportunity to short the US dollar index.

DXY Trading Strategy:

buy@104.500

TP:103.500

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

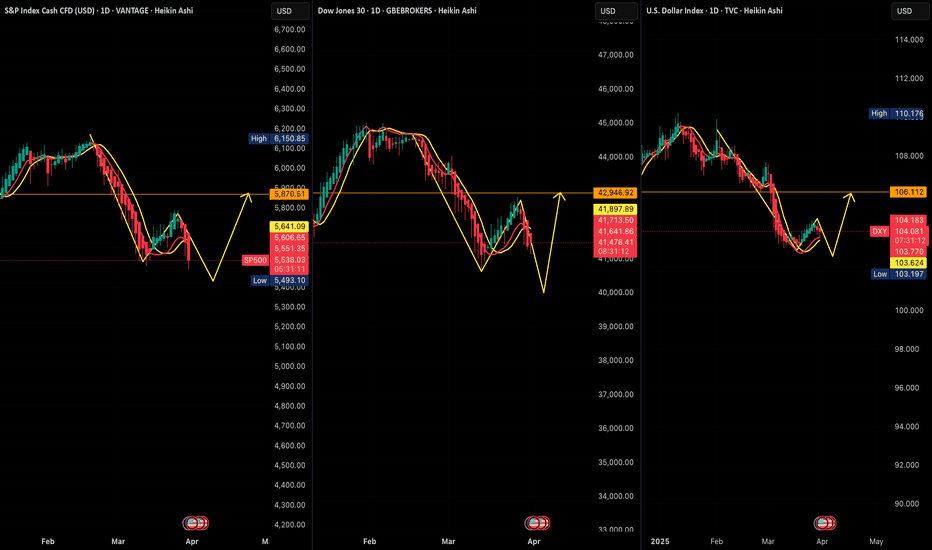

WHAT WILL HAPPEN NEXT IN THE U.S. ECONOMY WHAT WILL HAPPEN NEXT IN THE U.S. ECONOMY

It’s the Dollar Index (DXY) forming a bottom on the D1 timeframe and adjusting upward to the 106 zone. Naturally, U.S. stock markets will experience positive growth again.

This is a signal for the rise of BTC and, conversely, a decline in gold prices. Gold will soon peak in this month of April, making way for the growth of DXY, BTC, U.S. stocks, and technology shares.

This is the art of capital flow within the economy, the financial environment, and the continuous rotation driven by market makers.

Good luck.

DXY on the EdgeTrump's trade policies in Q1 have significantly influenced global markets, with critics arguing that his import tariffs are destabilizing the economic and monetary order. These measures have sparked concerns about U.S. dollar confidence, potentially leading to financial instability and broader economic consequences.

🔹 DXY Technical Analysis

The US Dollar Index (DXY) is at a critical juncture, currently hovering around 103.376—a key level that will determine the next major move.

📈 Bullish Scenario:

If DXY holds above 103.376, it may push towards the 106.160 and 107.595 resistance levels.

📉 Bearish Scenario:

A break below 103.376 could send DXY further down, targeting 101.805 and 100.235 as potential support zones.

📌 Key Levels:

Resistance: 106.160, 107.595

Support: 103.376, 101.805, 100.235

⚠ Risk Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice or a trading signal. Always confirm with your own strategy before making any trading decisions.

Sunday Viper Upcoming week overview. On Sunday's i break down the DXY and the rest of the market giving a forward look and expectation of what we can expect or look for upcoming. I breakdown US30, Nas100, Gold, Oil, BTC and some forex pairs. Possibly a big week ahead with Tariffs coming out April 2nd and NFP on Friday. Looking forward to an exciting volatile week.

Dollar IndexWe are expecting Dollar index to give us reaction above he recent top, if it corrects above the Top then NFP will push it further up otherwise break it down to break the last bottom.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

My idea for the DXY OANDA:EURUSD OANDA:GBPUSD

Looking at the chart we're seeing buyers exhausting their strength to push price higher, seeing sellers stepping in to take control of the market, if we get a break of the previous low then we'll be expecting price to ride us down to the next demand for possible buy opportunity.

And this move we be good for EU and GU respectively, however I welcome thoughts on this as believe a pipful week is possible. Shalom.

DXY March 30 Weekly AnalysisDXY March 30 Weekly Analysis

*My parent bias is still bear coming into this week.

*No news Monday

*Previous session price is in a discount and in a consolidation cycle.

*Note that price is weaving in between 2 HFT inefficiencies.

*Study Sundays delivery

Since March 18 Price has had a run on buy stops. Price pivoted on Wednesday at the 50 level of the range its trading in.

I like how Price came up to the 50 level of the range its trading in and didn't spend much time there before breaking down. Avoiding the market on high resistance days like Thursday is getting easier to identify. When price is high resistance it is tipping its hand to a larger move coming so be patience and wait for price to come to my levels.

NFC is this week. Will complete my weekly idea once Sundays delivers. My bias is lower prices and suspect it could be a violative week of Price delivery.

Stay humble to what Price prints and don't get stuck in any idea yet be nimble.

DXY Analysis - 31 March - 4 April 2025Key Observations:

Break of Structure (BoS): Multiple bullish BoS on H4 and H1 suggest a potential bullish reversal in the coming week.

Demand Zone (DZ): The H1 demand zone is still holding, indicating a possible liquidity sweep before resuming bullish momentum.

Supply Zone (SZ): Two H1 supply zones above current price act as resistance levels.

Critical Level at 103.84: If price breaks below 103.84, a bearish reversal may align with the higher time frame (HTF) bearish outlook.

Support & Resistance: Several significant support and resistance levels are marked.

RSI Indicator: The RSI is around 31.24, indicating the market is approaching oversold conditions.

Outlook:

Bullish Scenario: If the demand zone holds, the price could reverse upwards, targeting the supply zones.

Bearish Scenario: A break below 103.84 may trigger a deeper drop, aligning with the broader bearish trend.

DXY:It is about to witness a quarterly declineBecause concerns about tariffs causing a slowdown in U.S. economic growth have pushed down U.S. Treasury bond yields, the stock market, and the U.S. dollar exchange rate. The U.S. dollar is likely to experience a quarterly decline next week, and we can seize the opportunity to short on rebounds.

Trading strategy:

buy@104.500

TP:103.500

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

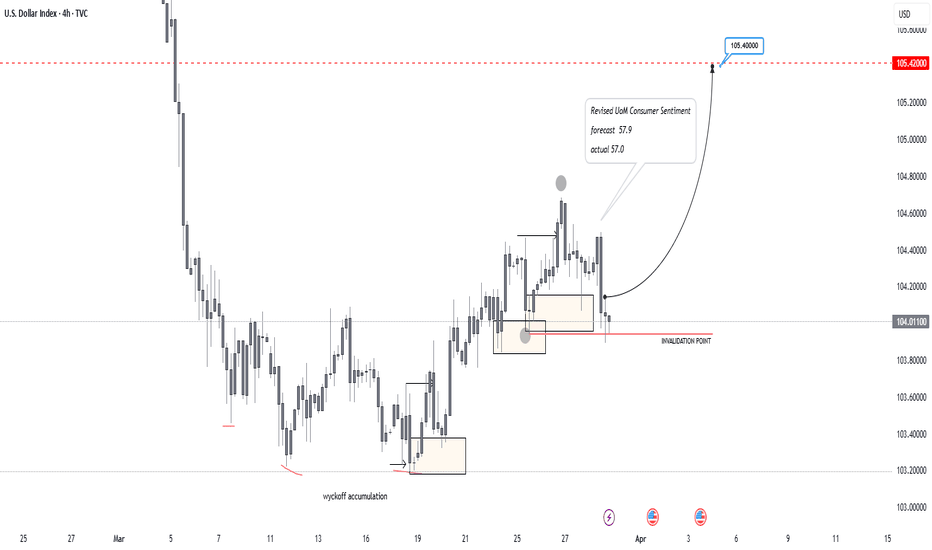

US DOLLAR UPDATE4H demand zone was reached, and price initially reacted strongly with a bullish close. However, buyers lacked momentum, and with fundamentals like Friday’s UoM data coming in lower than forecast, confidence in the economy weakened, leading to a drop.

From a technical standpoint, price will seek lower demand, but for shorts to be confirmed, the invalidation point must be broken, not just spiked. Let’s wait and see how the market unfolds.

Blessings,

T

$DXY IdeaWhen analyzing the weekly DXY chart, we identify the presence of two CRTs: one bullish and one bearish. However, the bearish CRT has a low probability of success due to the candle formation and the fact that the price is still in a discounted region within the range.

Given this, our initial expectation is for the price to drop at the beginning of the week to seek liquidity in the equilibrium region of the daily range, which coincides with the 50% level of the bearish CRT. This movement may act as a correction within the predominant trend, pushing the price up toward the premium region of the weekly range. From that point, we will once again look for selling opportunities, as the market may resume its downward movement.

Based on this analysis, we initially seek selling opportunities down to the equilibrium region. Once this level is reached, we will wait for confirmation of a bullish reversal to look for buying opportunities up to the 50% mark of the bullish CRT.

DXY 1H – Potential Sweep Before Uptrend ContinuationThe Dollar Index recently closed above a previous lower high, signaling a possible bullish trend continuation. However, the recent drop has only seen wicks covering the higher low, suggesting this may just be a liquidity sweep rather than a true bearish reversal.

📊 Key Observations:

✔ Higher Low Sweep: Current price action suggests liquidity is being grabbed before a potential move higher.

✔ Daily Structure: This move aligns with a possible sweep on the D1 timeframe, meaning a bullish reaction could be imminent.

🔎 Next Steps: Watching for bullish confirmation before taking long positions. If price reclaims support, a continuation toward higher levels is likely.