A1MD34 trade ideas

AMD UpdateThose of you that follow my AMD posts, you know that price came into my 1.382 target area @ $95.16 almost two weeks ago. Since then, I have been stating that I would prefer to see another low down to the $85-$87 area, but it is not required for the pattern to be complete. This move off of the 11 March bottom looks like a sloppy 5-wave move. If you know me, you know I instantly start to think of a corrective pattern as impulsive waves are normally decisive and leave little to the imagination.

That being said, a corrective pattern could be pointing to the initial a wave of intermediate (B), or it could be the last wave 4 of c of C of (A). Wave (B) would be pointing to the $160-$190 area, whereas the latter would be pointing to another drop in the $85-$87 range. MACD looks like it needs to drop and RSI shows AMD is overbought. These technicals point lower, but you should be asking yourself: how low? I still plan on buying in if price can make it down to the 1.618. If it doesn't make it to this area, I will remain on the sidelines until I can get a better entry point. Hopefully we can get some more clarity this week.

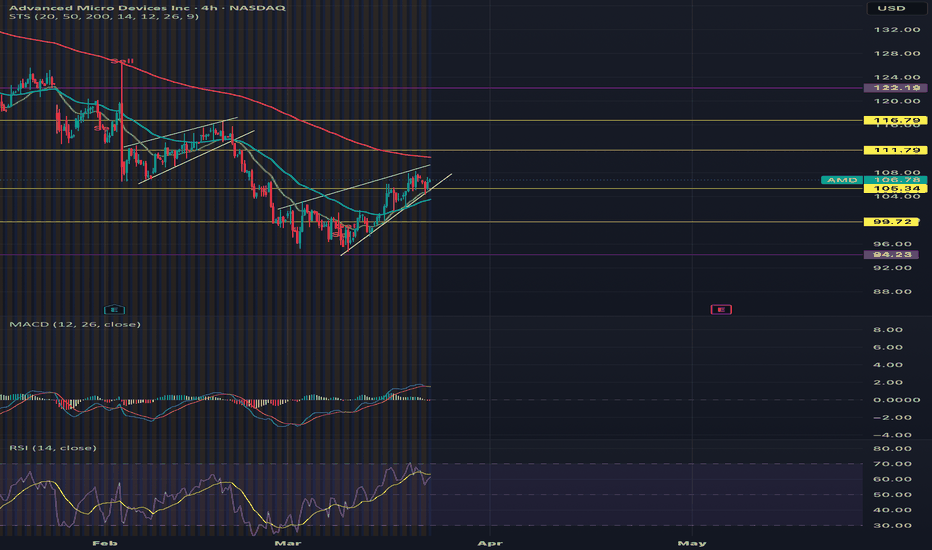

AMD Puts AMD (Advanced Micro Devices) – Powering the Future of AI & Chips

Stock: $106.78 | Ticker: NASDAQ:AMD | Chart: 4H

⚡️ AMD is a global semiconductor leader, designing high-performance CPUs, GPUs, and cutting-edge AI chips powering everything from gaming to data centers. With new AI processors rolling out in 2025, they’re going head-to-head with Nvidia in the AI race.

Chart Breakdown:

This 4H chart shows an ascending wedge pattern under the 200 EMA resistance – a classic bearish setup if momentum fades. Price is consolidating near $106, and a break below $105.34 could trigger a pullback to $99.

However, a breakout above $111.79 would flip momentum, aiming for $116–122.

Bottom Line:

AMD’s fundamentals in AI are 🔥, but this chart screams “decision point.”

Watch the breakout… or the breakdown.

Downtrend is officially broken :)boost and follow for more🔥

its been in a bearish downtrend all year, but it finally head a breakout last week, now look for a push to 111-127 🎯

After 127 the rally may slow down, profit taking and consolidation before we build a base for the next leg up to 150-200 🚀

side note: AMD was really good to me last week, paying 200%+ in call options, it didn't have a crazy upside move either my entries were just perfect, and i had really good exits too. I think when momentum is fully back on this stock the options will payout more than 200% ⚡

current chart request list: NVDA-XYZ-USO-HOLO-ZTS-PLTR-AAPL-SMCI-SPY-MELI-APP-V-SOUN-PLTR

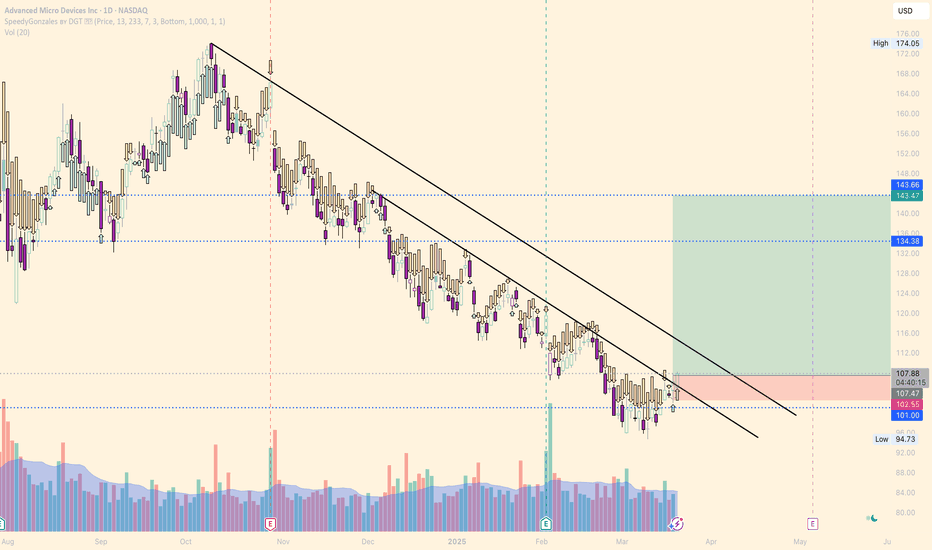

AMD 1st breakout made. Now waiting for the 1day MA50.AMD is trading inside a Channel Down since November 1st 2024 and under a second layer of lower highs since December 4th 2024.

Along with the 1day RSI that just crossed above its own Resistance level, the price crossed above that second layer of lower highs.

This is the first sign of an upcoming bullish breakout but the last Resistance to confirm that is the 1day MA50.

If that breaks, go long and target 144.00.

Follow us, like the idea and leave a comment below!!

Safe Entry ZoneNever Ever Follow stocks let it come.

Always wait confirmation for entry.

the Green 1h Zone is safe entry zone.

We have two scenarios:

One: strong buying volume with reversal Candle.

Two: Fake BreakOut of green Buying Zone.

Both indicate buyers stepping in strongly once showed up at 1h Green Zone

it would be safe entry.

Note: Take Profit Line is Strong Resistance, watch out for any sell pressure at this Line.

Chart on AMD with Fibonacci Retracement, Trendlines, SupportTrendline: Downtrend, connect lower highs and draw a line.

Fibonacci Retracements: High to Low for the period will show where the potential resistance

levels are.

Support Levels: Price held support from previous levels.

For Educational Purposes Only. Not a recommendation to buy or sell.

AMD gaining momentum A relief bounce or a reversal?

If price can close decisively above the trendline, this could trigger a reversal targeting the $133 level first, with potential to reach the $ 143 zone.

Entry price: $107 ish

Stop loss: $102

Target: $133

Risk calculation:

$107 - $102 = $5 per share risk

Reward calculation:

$133 - $107 = $26 per share potential reward

Risk/Reward ratio:

$26 ÷ $5 = 5.2:1

AMD downtrend is almost broken!boost and follow for more 🔥

we are one green day away from finally breaking that local trend resistance, short covering and buying pressure may return if we get the breakout this week!

look for 120s short term, if the major trend resistance breaks then 150-170 comes very quick 🎯 also look at the RSI and what AMD did after it hit this RSI level last time...

ok now im done for today see y'all soon with more ✌️

AMD: Fibonacci Framework (Fractal Analysis RECAP)In this idea, I’d like to share a quick recap about my unconventional approach to understanding the chaos of the market.

Price movements don’t just mirror fundamentals, they also reshape them in continuity. Relating recent fluctuations to historic swings is crucial, because markets operate within a structured, evolving framework where past price proportions subtly wire the future. The interplay between bulls and bears doesn’t unfold randomly — it reflects recurring behavioral cycles encoded in historical patterns. Each swing carries the imprint of collective psychology, liquidity dynamics, and structural forces, which tend to repeat in varying scales. In Fractal Analysis, I recognize 2 key aspects of price dynamics: magnitude (price) and frequency of reversals (time).

For example, capturing the direction of past bullish wave can be used to define boundaries of future bearish waves. In logarithmic scale, the movements exhibit relatively more consistent angle (as percentage-based distance factors in natural growth).

To build structural framework, we need another 2 chart-based frames of reference because having multiple Fibonacci channels layered across cycle creates a collective framework of confluence zones, where price reactions become more meaningful. When several channels align or cluster around the same price levels, those zones gain credibility as potential support/resistance, because independent measurements are pointing to the same structural levels. This is why by analyzing price within a broader historical context, we gain perspective on where current price action fits within the larger market narrative.

AMD short term bullish. Price is expected to have sought its SSL and Receiving nice reaction from Previous Bull POI which was that Bullish Breaker and thus Seeking new Price discovery for short term.

Thus it is very good chance that Price will visit that Bearish Breaker first in next few weeks.

DYOR. This isn't a financial advice. This is just educational and speculative idea.

Your gains or losses are your own responsbility.

If you like this idea, please give it a thumbs up.

AMD- Bullish, Earnings power is there now. Im bullish AMD around these levels.

High growth rates year over year potential.

its trading below the 1000 day moving averages (200 week moving average).

Stock may rise or bounce around for a few months, but historically should do well over the next few years.

Its priced at 20 forward PE, which is cheaper than the Sp500 and most of the large cap stocks.

However, it has a higher growth rate potential expected by analysts, in the 20-30% annual year over year growth range. Each quarter could bring higher valuation as it performs (potentially).

Peter lynch math says we should be willing to pay up to twice the growth rate in PE terms for a good grower. Amd is only trading at 1 x the growth rate.

Do your homework and trade small.

Cheers.

AMD - Advanced Money Destroyer...Not For Long!NASDAQ:AMD

Has been decimated but the DIP BUY BOX holds strong! $85-$100 could lead to an easy 2x!

- Key S/R Zone

- Massive Volume Shelf

- Bearish WCB Breakout will give Bullish Cue

- Lowest RSI since 2022 BOTTOM

A turnaround here could lead to outsized performance in portfolios.

Not financial advice

Amd - Please Look At The Structure!Amd ( NASDAQ:AMD ) is about to retest massive support:

Click chart above to see the detailed analysis👆🏻

For about 5 years Amd has been trading in a decent rising channel formation. That's exactly the reason for why we saw the harsh drop starting in the beginning of 2024. But as we are speaking, Amd is about to retest a massive confluence of support which could lead to a beautiful reversal.

Levels to watch: $100

Keep your long term vision,

Philip (BasicTrading)

AMD: Bottomed and can rally by as much as +140%.AMD is bearish on its 1D technical outlook (RSI = 40.266, MACD = -4.630, ADX = 52.178) but technically appears to be forming a new multi-month bottom after exactly 1 year of downside. The 1D RSI hit the S1 level, which priced the October 10th 2022 bottom. The outcome of that bottom was a +142.42% rally, same as the October 23rd 2023 Low, whose +142.42% rally formed the March 2024 ATH. This time this week's low has come very close to the S1 level, which is the strongest support level on the long term. A new potential +142.42% rally from the current levels would make a marginal ATH (TP = 230) and that's our current target for the end of the year.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

AMD at a Critical Level! Will the Downtrend Continue or Reverse?Market Structure & Key Levels

* AMD is currently trading within a downtrend channel, struggling to break through the resistance zone around $100–$102.

* A key support zone is forming around $95–$96, where buyers have been stepping in.

* The broader trend is bearish, with AMD rejecting from the upper boundary of its trend channel.

Support & Resistance

* Immediate Resistance: $100.25, $103.14, $104.00

* Immediate Support: $95.91, $94.73, $90.00 (PUT Wall)

📊 Indicator Analysis

MACD & Momentum

* MACD is slightly bullish, but the momentum is still weak, suggesting uncertainty.

* If the MACD crosses bullishly with volume, we could see a short-term relief rally toward $100+.

Stochastic RSI

* The Stoch RSI is oversold and curling upward, hinting at potential upside.

* However, without strong volume confirmation, this could be a weak bounce.

📈 GEX & Options Insights

* IVR: 52.9, suggesting moderate implied volatility.

* IVX avg: 56.5, showing that the stock is near average volatility levels.

* GEX Sentiment: Bearish

* PUT Support Wall at $95 (Highest negative NETGEX level).

* CALL Resistance at $102–$105 (Heavy gamma exposure).

* A break below $95 could trigger more downside pressure toward $90.

💡 Trade Scenarios

🟢 Bullish Play (Breakout Above $100)

* Entry: Above $100.25 with strong volume.

* Target: $103.14 → $104.00.

* Stop Loss: $97.50 (Below rejection point).

🔴 Bearish Play (Continuation to Downside)

* Entry: Below $95.50.

* Target: $94.73 → $90.00 (PUT Support Wall).

* Stop Loss: $97 (Above consolidation zone).

Final Thoughts

* Bearish Bias Unless AMD Breaks Above $100–$102.

* Watch for a rejection at resistance or a breakdown of $95 for further downside.

* Implied Volatility suggests a strong move could be coming.

🚨 This analysis is for educational purposes only. Always trade with proper risk management! 🚨

Strong Buying Support for AMDAMD has been in a bearish market for almost a year. Now, the Y downtrend cycle is nearly complete, making it a good place to look for a buying opportunity. In my view, the market will reject at S2 and form a bullish candle. However, if the support doesn't hold, the price may continue downward to complete cycle X. The good indicate to know if market on bullish trend is price can break LH on Daily Time Frame.

Support

S1@105.58, S2@102.44

RSI

b)RSI TF H4 is indicate overbought

c)RSI TF Daily almost touching 30

This is not a buy call. Just sharing Idea, Thanks