Top5 oversold/overbought according to RSI & Anheuser-Busch InbevWelcome back Aspen & Tiger Brands! After some pressure years, they’re both back into “overbought”.

Top 5 Oversold & Overbought currently according to their 14-day RSI’s:

Oversold:

City Lodge Hotels 26

Anheuser Busch Inbev 27

Ascendis Health 28

Nampak 28

PPC 31

Overbought:

Capitec Bank 83

Aspen 75

Tiger Brands 72

Emira Property 70

PSG Group 70

This week I want to spend some time on Anheuser Busch Inbev. What a fall from grace, after some pretty shocking results. Up to end of August ANH was one of the top performing shares on the JSE. But with the recent turn of events, find the trend very much against the share price.

Just before the results was released, the share price broke through the 50-day moving average & found some support at the diagonal support line. Bad results did however not only see the share price break the diagonal support, but also cut through the 200-day moving average like a cold beer on a hot day.

We did however see the share price again find strong support at the horizontal line where ANH found 5 times already this year (at R1155). Should the support hold, could see the share testing the R1200 levels again followed by the 200-day moving average at R1264. This brings us in range with our target price on the company (at around R1300). Read the full report by clicking here: oldoak.co.za

Although the share price finds itself EXTREMELY oversold according to it’s 14-day RSI, the very much downward sloping 50-day moving average isn’t making me feel warm and fussy inside. I don’t currently hold any positions in the company but will monitor it closely (wait for confirmation). Should we see a break below the current horizontal support, will have me monitoring the R1030 levels again, which will place the trend slap-bang back into the parallel channel. This currently would act as my entry point.

ABUD34 trade ideas

ANHEUSER BUSCH INBEV (ANB) SHORTAnheuser Busch InBev is literally printing short as it ticks. Prices just broke out of a bear flag pattern and now is about to do the same thing again. If it works, why change it right? This one will be selling like hot cakes, or rather like Telkom (pun intended).

Sell: At the break of the bear flag pattern.

Target is the bottom of the pattern according to the 90% rule at the 1281.60 price level

Flat beer!This is definitely not a pretty sight. After this mornings profit warning, AB Inbev is taking some serious shots (pun intended).

This positive trendline (support) which started at the beginning of 2019, helped ANH being one of the top-performing FTSE/JSE All Share companies YTD. The support was however broken this week, with today's price movement dropping ANH below the 200-day moving average (R1254.19). Next target is R1158, with a break a close below this levels bringing back the declining parallel channel (next target R1070).

ANH do however find itself in EXTREME oversold position according to it's 14-day RSI, which could help a dead-cat-bounce. I would however caution any long positions before we see some sort of recovery.

$JSEANH Anheuser setting up for a short term buying opportunityAnheuser-Busch Inbev looks to be setting up for a long trading opportunity off a good level of support between R1352.00 - R1362.00. Firstly, this level ties in with the uptrend support level which formed from the lows where the stock bottomed back in January of this year. Secondary level of support is provided by the 89/100 day moving averages (orange/red lines) which provided support on the pullback in July of this year. Thirdly, the level of +- R1352.00 is the lateral level of support above which the stock has consolidated during the last 3 months. Lastly, the RSI indicator has provided solid support for the stock off the 40 level which has held once more.

It is quite evident that the levels between R1352 - R1362 have many different indicators of support which supports a high probability view that the stock could start to lift off current levels.

Look to buy any weakness into the support zone (R1352 - R1362) using a stop loss as a close below R1350.00. Should the stock start to gain momentum, i would look to bank at two respective targets which provided recent resistance on the upside. 1st Target R1440, 2nd Target R1480.

ANH: add to your radar screenDepending on what the rand will do within the next couple of days.

Rounding top pattern might be unfolding (see the black pattern).

Rounding top patterns may form at the end of an extended upward trend and this pattern may indicate a reversal in the long-term price movement.

Wait for further bearish technical confirmation.

ANH - Resistance Held We may derive the following from the Daily ANH chart:

1. Price has respect our resistance level (purple box).

2. Price should in all probability continue to drop further.

3. Monitor price action and look out for further short opportunities.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

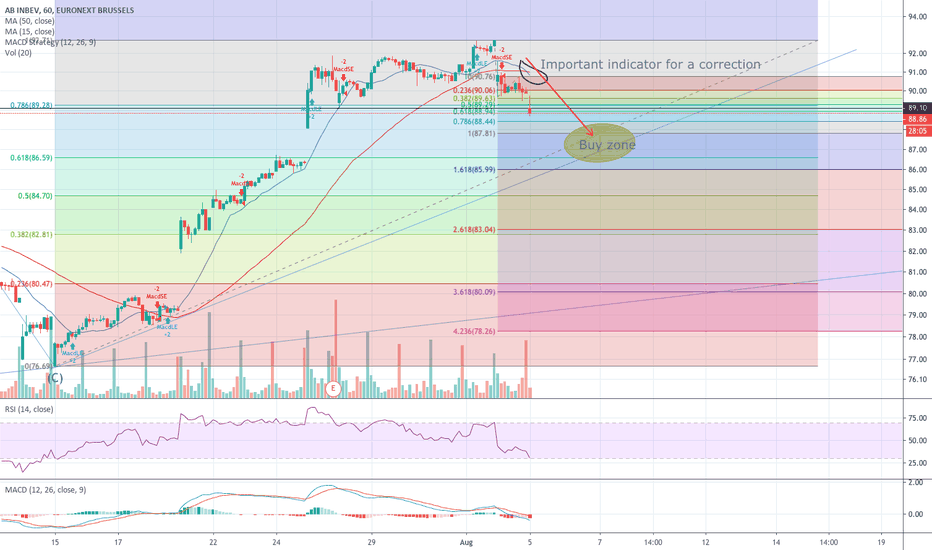

Correction on AB Inbev ongoingthe MA15 and 50 were already strating to go closer together the last 2 weeks and after the red day on the BEL20 index last Friday they finally crossed.

Last time this happened a correction came, so I expect the same to happen now.

Looking at the fibo levels we might go to the 85-86€ level

ANH - Headwind We may derive the following from the Daily ANH chart:

1. Price rocketed up - as analysed (See linked idea).

2. Majority of profit can be taken.

3. A reversal over the next few days is likely.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

BUD technicals and fundamentals look greatFundamentals

Analysts are pricing BUD @$118 (24% above current price!)

New products and hype.

Technicals

OBV has been increasing steadily. But on a longer term, you can see the average volume is now lower than previous years.

BUD is breaking above a weekly resistance 50SMA.

ABI is playing an inception move on usHi all,

this is my first idea. Don't know if it can be of any use to anyone... In case it is, then thanks for liking it ;-)

According to my (maybe amateuristic) analysis I noticed that ABI is playing an inception move on us. It actually formed a nice cup and handle, in the handle of a major cup and handle.

Further more the MA's show that there might be a slight correction towards the 80€ area. Maybe a buying opportunity?

Then it should take off again towards +- 84€ and on a later stage towards the 95€ area