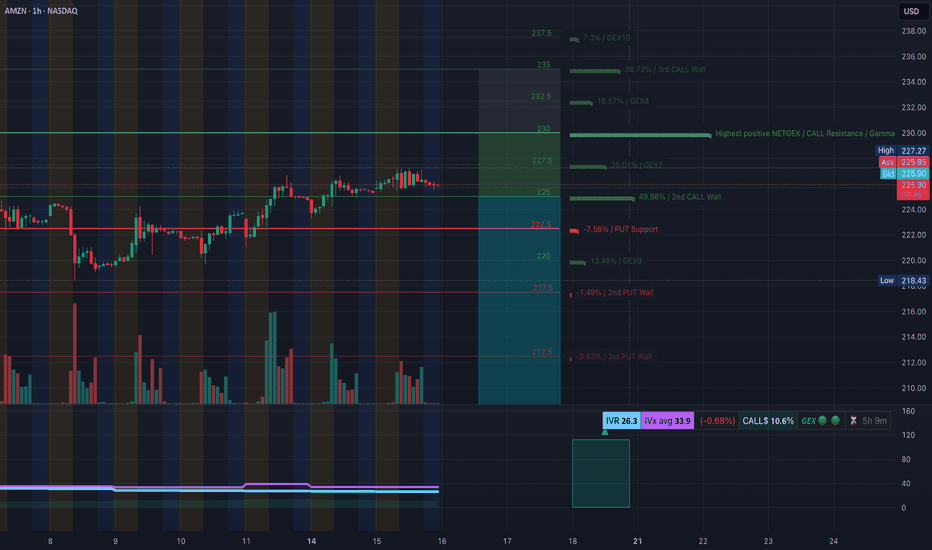

AMZN Near Critical Pivot AMZN Near Critical Pivot – Option Traders, Watch These GEX Levels Carefully!

🧠 GEX Analysis for Options Trading:

Amazon is sitting right below its Gamma Wall at $225, which aligns with the highest positive NETGEX, suggesting a significant resistance zone. There's a clear call wall stack at $227.5 a

Key facts today

Cantor Fitzgerald has maintained an 'Overweight' rating for Amazon (AMZN) and raised its price target from $240.00 to $260.00 per share.

Amazon's market value is currently at $2.4 trillion, positioning it as the fourth most valuable company globally, behind Nvidia, Microsoft, and Apple.

Amazon has teamed up with Vonage to integrate its AI voice agent with the Vonage Voice API, improving real-time communication for users and businesses across multiple platforms.

36,964.71

0.00 BRL

319.40 B BRL

3.44 T BRL

212.33 B

About Amazon.com

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

ISIN

BRAMZOBDR002

FIGI

BBG001XT6PL2

Amazon.com, Inc. is a multinational technology company, which engages in the provision of online retail shopping services. It operates through the following segments: North America, International, and Amazon Web Services (AWS). The North America segment offers retail sale of consumer products, including from sellers, advertising, and subscriptions services through North America-focused online and physical stores. The International segment focuses on retail sale of consumer products, including from sellers, advertising, and subscription services through internationally-focused online stores. The AWS segment is composed of global sales of compute, storage, database, and other services for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

AMZN Sitting on a Key Launchpad – What’s Next? for July 14🧠 GEX Analysis & Option Strategy:

* Gamma Wall / Resistance: $225

* Next Major Call Walls: $227.5 → $230 → $235

* Call Side Dominance: 13.3% Calls, low IVR at 27.4, IVx avg 38.9

* Put Support: $217.5 / $213.5

* GEX Bias: Mildly bullish bias above $225 — price is floating at Gamma Wall.

🟢 Bullish Opt

Amazon I Strong Bullish Outlook Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow

AMAZON STRONG UPTREND|LONG|

✅AMAZON is going up

Now and the stock made a bullish

Breakout of the key horizontal

Level of 220$ and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nat

AMZN Coiled at Key Gamma Level! Trade Setup Inside📊 GEX (Options Sentiment) Analysis – AMZN

* Current Price: $223.20

* Gamma Wall (Call Resistance): $225 – Highest Net GEX, significant resistance zone.

* CALL Walls: Stack from $225 → $230 → $232.5 → $235

→ Suggests upside resistance builds fast; option sellers may try to cap the rally here.

* PUT W

AMZN at a Crossroad! TA for July 16Options & Intraday Trading Setups to Watch This Week 🔍

🧠 GEX Analysis & Options Sentiment (Tanuki)

* GEX Sentiment: Mildly Bullish

* CALLs Volume: 10.6% → Neutral-to-Weak Bullish

* IV Rank (IVR): 26.3 → Low implied volatility rank

* IVx Avg: 33.9 → Neutral options environment

Gamma Walls / Levels t

AMZN Gamma Setups + Trade Plan for July 7📡 GEX-Based Option Trading Analysis

Amazon (AMZN) shows bullish option flow into next week. The GEX map highlights the following:

* Highest Net GEX sits at 225, acting as a strong magnetic price level / resistance zone.

* There’s a Call Wall cluster at 225–230, which could cap short-term upside unle

APPLE: 1st 1D Golden Cross in 2 years just formed.Apple is bullish on its 1D technical outlook (RSI = 67.490, MACD = 1.760, ADX = 17.850) and yesterday it started forming the first 1D Golden Cross in more than 2 years. This signals the extension of the 2nd major bullish wave of the 3 year Channel Up. The previous one made an incredible extensino to

AMAZON Will Keep Growing! Buy!

Hello,Traders!

AMAZON is trading in an

Uptrend and the stock made

A breakout and retest of the

Key horizontal support

Of 218$ and is going up again

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts b

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AMZO34 is featured.