LEV2020-LEZ2020: Spread on Live CattleLEV2020-LEZ2020

Commodity Spread Trading is an advanced way to profit statistically from the differences that occur in the commodity futures market based on Contango or Backwardation situations.

These statistics are offered by online software and allow for amazing performance.

So far we have achieved the highest gains in relation to drawdowns with this way of trading,

Here we enter Short on the Live Cattle Spread buying the October Futures and selling the December Futures.

Happy Trading to All!

BGI1! trade ideas

LEZ2020-LEQ2020 - Spread on Live CattleLEZ2020-LEQ2020

Breakout of the resistance level on this inversion pattern in the Spread between the two futures contracts on Live Cattle.

The parameters respect our strategy and we are approaching the seasonal window that statistically ends on January 29th with 93% of chances to get profit from it.

Cattle to close gap?!The break of the tenkan on the Daily shows we have lost the positive momentum we had generated at the end of October. In fact the momentum was so high at that period that we created a big gap, the close of which is the basis of our trade.Price just couldn't go past the SSA on both the weekly and the monthly creating this slowdown in momentum we intend to capitalise on .We take some off the table around the daily kijun area and the rest on completion of the gap close. The lagging is in check and has no obstacles beneath it.

Entry: 2 small position at 118.100

SL: 120.800 ( safely above the highs)

TP1: 114.650 (daily kijun area)

TP2: 112.925 (completion of gap close)

NB: The whole point of trading is to make a modest return risking as little as possible. Risk management is key!

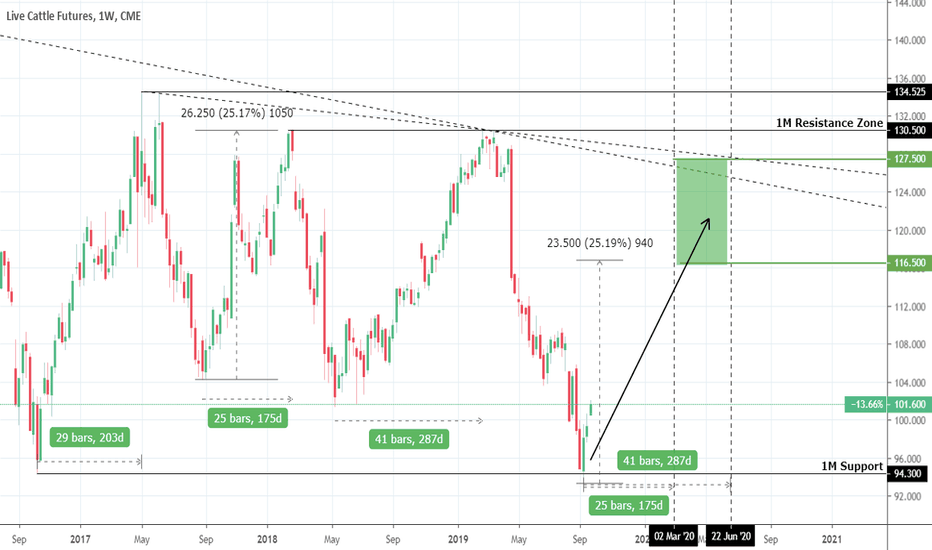

Live Cattle: Strong long term Buy Opportunity.Live Cattle has hit this month the 94.300 1M Support, with the last time we saw these levels being in October 2016. The price appears to be trading within a long term Rectangle within 94.300 and the 130.500 - 134.525 Resistance Zone. The current 3 week rebound on the 1M Support makes LE an automatic long term buy opportunity. We are therefore long at the moment and having calculated all possible scenarios within this Rectangle, we concluded that profit should be taken within 116.500 - 127.500. Take advantage of this opportunity based on your won risk tolerance levels.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Live Cattle Futures? Buying, wait for Sept Candle To CloseLook at 2016,2017 & 2018 monthly chart. What happened in the month of September, yes price action found major support for rest of the year, then was bullish for the rest of the year. I see live cattle finding support this month around yearly S2 pivot point noted on the chart (by the blue arrow). If you buy and sell live cattle futures, would look into buying at this $90 area and up to $110 range, starting in October.

The green area noted under $90 area happened around 10 years ago, when live cattle futures bottomed out, I hope that doesn't happen related to China Tariffs or other sudden agriculture events. With everyone well in life and trading. Keep on Trading on.

Live Cattle buy opportunityI realize there aren't many commodities traders on here, so this is mostly for myself and my own journal.

I see a long opportunity in the Cattle market and hope to see a possible move to at least 110 in the weeks ahead. Cattle has been beaten down recently due a number of reasons. The main reasons I see are tariffs, declining profits due to the increased price of corn, and an emerging trend in preformed vegetable matter aka "beyond meat".

I believe the tariff situation with China should start moving in a positive direction by the end of this month, and also the USMCA trade agreement with Mexico and Canada will almost certainly be ratified, which should increase the exports of US beef. My main reasoning behind this trade is mostly a belief that cattle is now at bargain prices and presenting a buy opportunity.

Target = 110.00

SL = 102.40

Live Cattle (LE) ShortSo, my last analysis on live cattle was April 25th where i talked about the possibility of live cattle breaking support and going further down and it went much further than i thought. In my opinion, I believe live cattle will continue on its trend downwards and will find support at the next support level identified on the chart. Enter and exit at your own risk.

DISCLAIMER

Please note that this chart is an opinion based chart only. Please trade at your own risk

Live Cattle: Cyclical sell opportunity.Live Cattle has been trading within a long term 1M Rectangle (RSI = 45.889, CCI = -24.7510, Highs/Lows = 0.0000) roughly since late 2016. This March the price was rejected exactly on the 1W Resistance (130.500 - 134.525) and in April another Lower High attempt failed. This resulted in a strong downfall which is expected to test again the 1W Support Zone (101.625 - 104.150) before another rebound. We are on a long term sell with TP = 104.250.

See the call of this trade before the strong rejection took place:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

December Live Cattle Head and ShouldersDecember Live Cattle has topped out the last shoulder and has gone to a spinning top. Expect drop Wednesday down to 121.250 at about the 2 day moving average. If it can go below this mark and stay below, then pivot at 120.775 would be the next target. Neckline comes in at about 120. If we see a fall through this target, height of right shoulder comes in at S2, 117. For now this is still a bull market. Expect rejections along the way or a turn back up to higher prices.

April Live Cattle H&SCattle formed a head and shoulders. Has now crept below the neckline. Target is pivot at 126.450. Outside target for right shoulder S1 at 124.150 or my imaginary uptrend line just above. December Cattle also building out H&S, but that market hasn't completed pattern. If it can break pivot then we should see continued selling. Pivot right now has become support.

LIVE CATTLE FUTURES (APR 2019), 1D, CMETrading Signal

Short Position (EP) : 127.4

Stop Loss (SL) : 128.2

Take Profit (TP) : 125.325, 124.025

Description

LEJ2019 formed Double Repo Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (127.4) and place stop after 0.618 level (128.2). Once the position was hit, place take profit before an agreement (125.325) and 124.025

Money Management

Money in portfolio : $1,000,000

Risk Management (0.5%) : $5,000

Position Sizing

$0.025 = +-$10/std-contract

Commission fee = -$5.8/std-contract

EP to SL = $0.8 = -$320

Contract size to open = 15 standard contracts

EP to TP#1 = $2.1 = +$830

EP to TP#2 = $3.4 = +$1,350

Expected Result

Commission Fee = -$87

Loss = -$4,800

Gain#1 = +$6,640

Gain#2 = +$9,450

Total Gain = +$16,090

Risk/Reward Ratio = 3.27

cattle-another global growth storyit appear a trend change is about to happen in the cattle market. in my opinion supply outweighs demand and will soon influence cattle pricing. trend changes are fairly normal may take sometime to correct. tomorrows WASDE and other influencing factors may give traders insight post gov shutdown. current curve is backwardated meaning front month futures are trading at a premium compared to back months. calendars and diagonals are optimal here. remember agriculture and live stock have been flying blind since shutdown effected USDA reporting.

Live Cattle: Long term Sell opportunity.The price was recently rejected on the long term Sell Zone of 127.825 - 134.425. For almost 2 years this belt has been used as a sell point by the market. This is a good long term opportunity to go short and target a price above the 101.625 - 104.250 Buy Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.