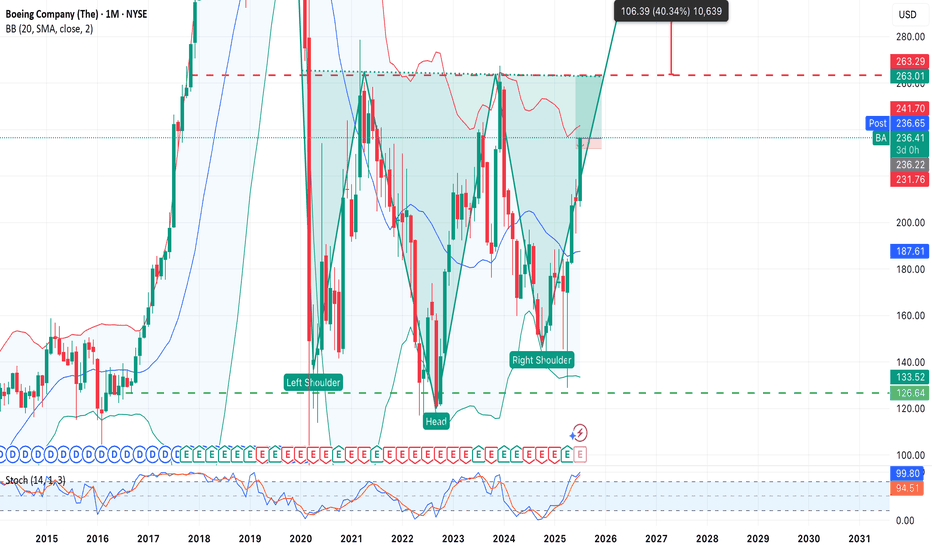

Boeing to $300 - Falling wedge** The year ahead **

On the above 6 day chart price action has corrected over 50% since December 2023. A number of reasons now favour a long position, they include:

1. Price action and RSI resistance breakouts.

2. Support on past resistance.

3. Double bottom on price action (yellow arrows)

4. Fall

Key facts today

Boeing's Q2 cash flow was $227 million, with a net loss of $612 million and adjusted EPS of -1.24. Revenue reached $22.75 billion, and shares rose 2.5% to $242.3.

Boeing achieved its strongest quarterly results since 2023, driven by a surge in plane deliveries, especially the 737 MAX, now produced at the maximum rate of 38 per month.

Boeing workers in St. Louis, about 3,200 strong, rejected a contract offer, prompting Boeing's contingency plan. The stock rose 1.4%, with a seven-day pause before a potential strike.

−0.10 BRL

−63.70 B BRL

358.60 B BRL

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

ISIN

BRBOEIBDR003

FIGI

BBG0025NPMZ5

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), Global Services (BGS), and Boeing Capital (BCC). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. The company was founded by William Edward Boeing on July 15, 1916 and is headquartered in Arlington, VA.

Related stocks

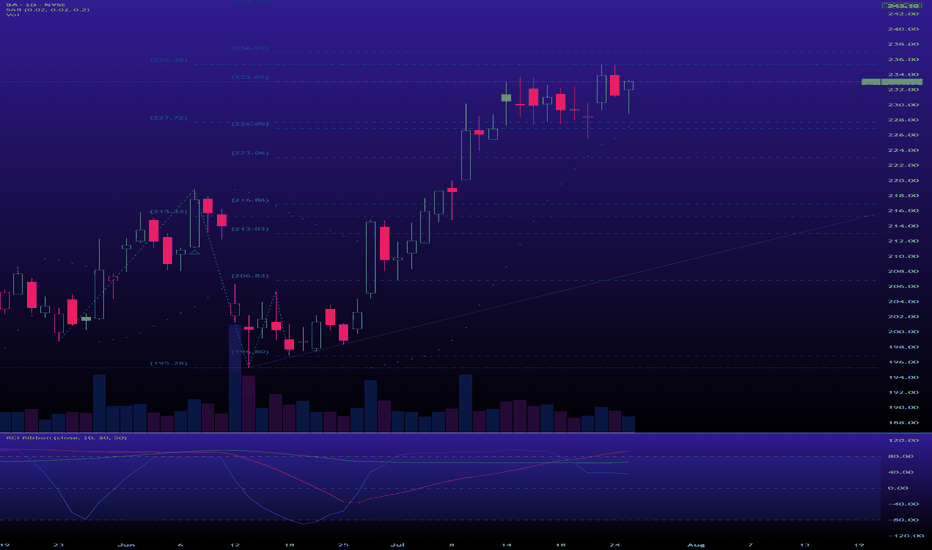

Boeing Wave Analysis – 28 July 2025- Boeing broke the resistance level 232.50

- Likely to rise to resistance level 240.00

Boeing recently broke the resistance level 232.50 (which stopped the previous minor impulse wave 3 in the middle of July, as can be seen below).

The breakout of the resistance level 232.50 continues the active s

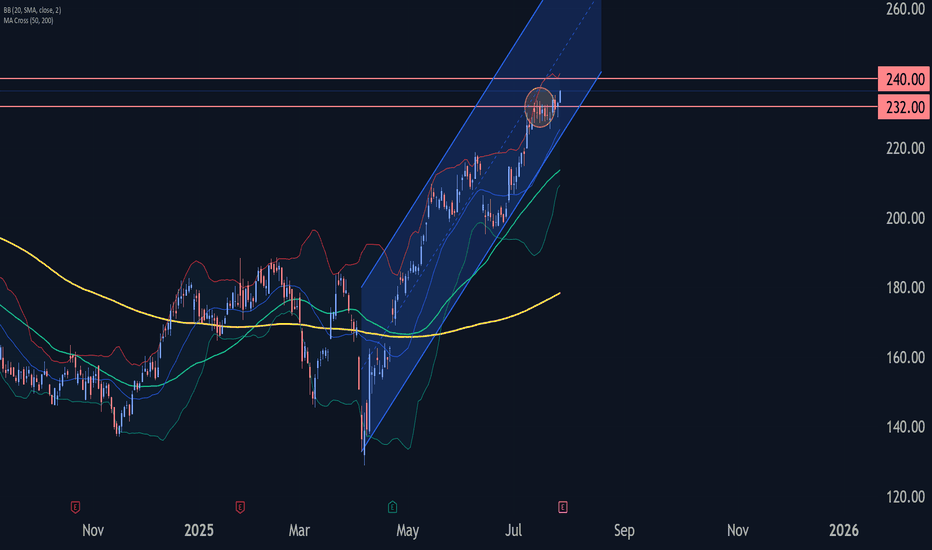

An adventure? Yes. But technically — beautiful. Boeing.Adventure Idea: The Return of Boeing NYSE:BA

An inverted “Head and Shoulders” pattern is forming on the BA (Boeing) chart — one of the most reliable bullish formations in technical analysis. The price is confidently approaching the neckline around $235–241, and a breakout above this level could

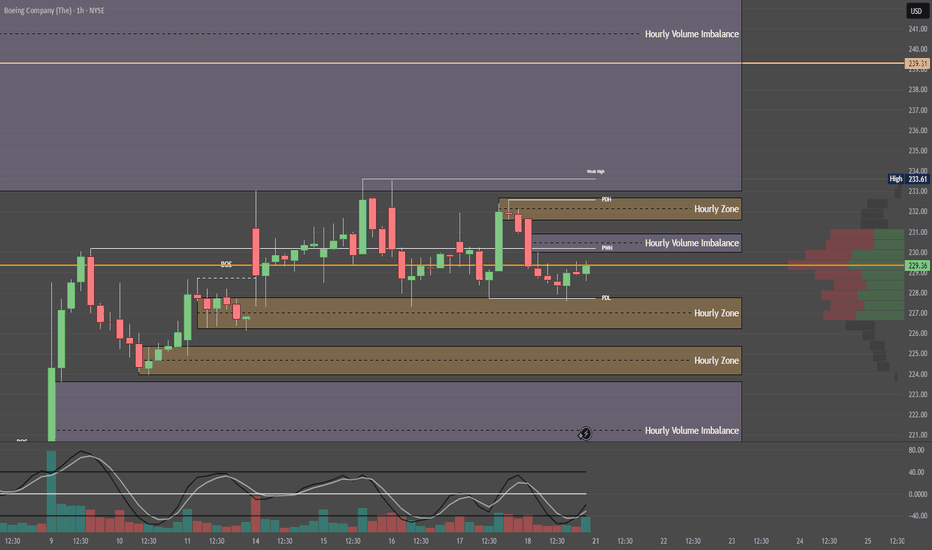

Quantum's BA Weekly Outlook 7/19/25🚀 G.O.D. Flow Certified Trade Blueprint – Boeing (BA)

1. 🧩 Summary Overview

Ticker: BA

Current Price: $229.34

Trade Type: Day Trade / 0–2 Day Swing

System: G.O.D. Flow (Gamma, Orderflow, Dealer Positioning)

2. 🔬 Flow Breakdown

🔵 GEX (Gamma Exposure):

Highest negative GEX at $230 = possible resistan

Long Opportunity: Boeing Could Take Flight Next WeekCurrent Price: $226.84

Direction: LONG

Targets:

- T1 = $233.00

- T2 = $238.00

Stop Levels:

- S1 = $223.00

- S2 = $218.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to i

BA heads up into $230: Strong fib zone might cause a serious dipBA has been flying (lol) from its last crash caused crash.

About to test a signrificant resistance at $229.82-230.73

Expect at least some "orbits" or a pullback from this zone.

.

Previous analysis that caught THE BOTTOM:

==================================================

.

BOEING COMPANY STOCK ENTER INTO BULLISH TREND Boeing Company Stock Enters Bullish Trend on 1-Day Time Frame

The Boeing Company (BA) stock has entered a bullish trend on the 1-day timeframe, signaling potential upward momentum. A key development in this trend is the recent breakout above the critical resistance level of $189.00, which now acts

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US97023BS3

BOEING CO. 16/46Yield to maturity

7.64%

Maturity date

Jun 15, 2046

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

7.52%

Maturity date

Mar 1, 2048

US97023BV6

BOEING CO. 17/47Yield to maturity

7.51%

Maturity date

Mar 1, 2047

BCOC

BOEING CO. 15/45Yield to maturity

7.44%

Maturity date

Mar 1, 2045

BA4798350

Boeing Company 3.825% 01-MAR-2059Yield to maturity

7.38%

Maturity date

Mar 1, 2059

BA4762315

Boeing Company 3.85% 01-NOV-2048Yield to maturity

7.26%

Maturity date

Nov 1, 2048

BA4866210

Boeing Company 3.95% 01-AUG-2059Yield to maturity

7.14%

Maturity date

Aug 1, 2059

BA4829131

Boeing Company 3.9% 01-MAY-2049Yield to maturity

7.11%

Maturity date

May 1, 2049

BA4866209

Boeing Company 3.75% 01-FEB-2050Yield to maturity

7.10%

Maturity date

Feb 1, 2050

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.86%

Maturity date

May 1, 2064

BA4798349

Boeing Company 3.5% 01-MAR-2039Yield to maturity

6.57%

Maturity date

Mar 1, 2039

See all BOEI34 bonds

Curated watchlists where BOEI34 is featured.