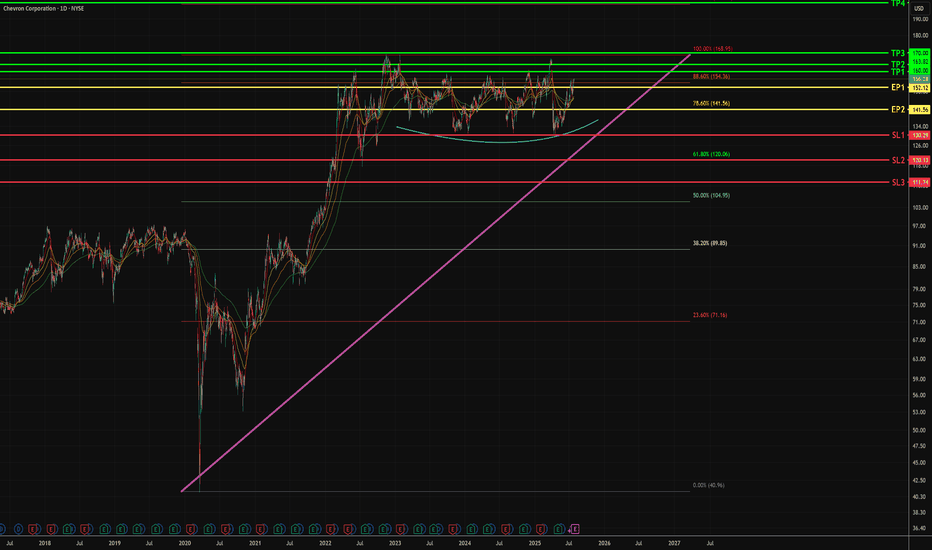

CVX - Potential Swing Upside - Mid TermTimeline - now to 3 months

1. Bullish flag pattern sustained, form during Oct 2021.

2. Rounding bottom above 1D resistance at $130

- Last close is above Fib 88.6% - $154.36

- In the 2 days, weak selling pressure is noticed.

3. More attempts to break 88.6% Fib level opposed to $130 support line

Key facts today

Chevron appointed John Hess to its board after the FTC lifted a prior block due to his OPEC talks. This follows Chevron's acquisition of Hess, outbidding Exxon for Guyana assets.

Chevron faces challenges due to tensions between the oil sector and the Trump administration's biofuel policies, with producers worried about high costs from current regulations.

Chevron has completed a $450 million transaction, transferring full ownership of Block A-18 in the Malaysia–Thailand Joint Development Area to PTT Exploration and Production (PTTEP).

17,753.06

0.00 BRL

95.21 B BRL

1.04 T BRL

About Chevron Corporation

Sector

Industry

CEO

Michael K. Wirth

Website

Headquarters

Houston

Founded

1879

ISIN

BRCHVXBDR008

FIGI

BBG001XT6JG2

Chevron Corp. engages in the provision of administrative, financial management, and technology support for energy and chemical operations. It operates through the Upstream and Downstream segments. The Upstream segment consists of the exploration, development, and production of crude oil and natural gas, the liquefaction, transportation, and regasification associated with liquefied natural gas, the transporting of crude oil by major international oil export pipelines, the processing, transporting, storage, and marketing of natural gas, and a gas-to-liquids plant. The Downstream segment consists of the refining of crude oil into petroleum products, the marketing of crude oil and refined products, the transporting of crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car, and the manufacturing and marketing of commodity petrochemicals and plastics for industrial uses and fuel & lubricant additives. The company was founded on September 10, 1879 and is headquartered in Houston, TX.

Related stocks

CVX Trade Setup — Catch the Bounce + Dividend PlayChevron ( NYSE:CVX ) is setting up for a potential bounce from strong support around $134.96 (S2 level). The trade aligns with both technical and fundamental tailwinds:

🟢 Technical Setup:

Holding just above S2, showing signs of base formation.

Clear risk/reward box:

Entry: ~$135

Target: $150.05 →

CVX – Waiting for Pullback to 0.382 Before Targeting Gap FillsChevron (CVX) recently broke structure to the upside after holding a 1D demand zone near $136.

I'm now watching for a pullback toward the 0.382 retracement (~$141.80) of the recent impulse. This level aligns with the breakout area and offers a potential continuation setup.

🎯 Trade Setup:

Bias: Lon

Bullish Outlook: Key Levels Signal Upside PotentialTargets:

- T1 = $140.50

- T2 = $144.00

Stop Levels:

- S1 = $134.50

- S2 = $133.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The

CVX demand zone!OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

Chevron: The Chart’s Reaching a Critical PointChevron is starting to look very interesting again — but let’s be clear from the start: Chevron, like every oil giant, lives and dies by the price of oil. If oil rips higher or collapses due to global politics, supply shocks, or economic chaos, Chevron NYSE:CVX follows. No exceptions.

That said

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CHVX34 is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks