Key facts today

DaVita's adjusted earnings per share (EPS) for Q2 CY2025 reached $2.95, exceeding analyst expectations of $2.75 by 7.3%, and marking an increase from $2.59 in the same quarter of the previous year.

DaVita Inc has an average rating of 'hold' with 1 'strong buy,' 8 'hold,' and 1 'sell.' The 12-month price target is $160.50, suggesting a 12.4% upside from $140.52.

DaVita faced rising patient care costs, operational disruptions from hurricanes, and a ransomware attack in April, resulting in a 10% increase in general and administrative expenses.

14,271.43

0.06 BRL

5.05 B BRL

69.09 B BRL

About DaVita Inc.

Sector

Industry

CEO

Javier J. Rodriguez

Website

Headquarters

Denver

Founded

1994

ISIN

BRDVAIBDR002

FIGI

BBG00P14JWQ5

DaVita, Inc. engages in the provision of medical care services. It operates through the following two segments: US Dialysis and Related Lab Services, and Other-Ancillary Services and Strategic Initiatives. The US Dialysis and Related Lab Services segment offers kidney dialysis services in the United States for patients suffering from chronic kidney failure. The Other-Ancillary Services and Strategic Initiatives segment consist primarily of pharmacy services, disease management services, vascular access services, clinical research programs, physician services, direct primary care, end stage renal disease seamless care organizations, and comprehensive care. The company was founded in 1994 and is headquartered in Denver, CO.

Related stocks

DVA DaVita Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DVA DaVita prior to the earnings report this week,

I would consider purchasing the 175usd strike price Puts with

an expiration date of 2025-2-21,

for a premium of approximately $8.45.

If these options prove to be profitable prior to the earnings

THC Tenet Healthcare Corp Financial

- Company has grown fast.

- Outperforming the market in general.

- Good outlook for the coming time.

Techinical

- Good risk-reward setup.

- Sector is in favor by many investors.

- Other stocks in the sector are just like this stock outperforming the market and I think this will co

DVA DaVita Inc (Long) Financial

- Company shows great results.

- Company passed the Hanhart fundamental growth test.

- Earnings + outlook + 10%.

- Growth outlook is one of the bests in these times.

Marco

- Company seems to perform well in most market conditions that are coming up.

Techincal

- Company is outpe

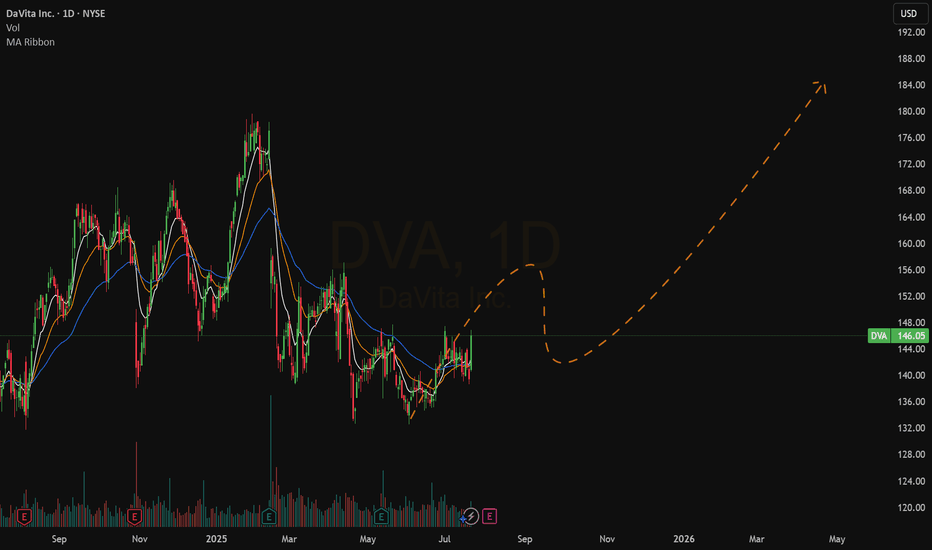

DaVita Inc. DaVita Inc. (NYSE: DVA) currently sits at a pivotal point, poised for potential growth. The RSI (14) is neutral at 43.97, indicating neither an overbought nor oversold condition. This neutrality often precedes a directional move, making DVA a prime candidate for a strategic entry.

The stock closed

DaVita (DVA) AnalysisLeading Dialysis Service Provider:

DaVita NYSE:DVA stands as a top kidney dialysis service provider in the U.S., demonstrating strong resilience post-COVID-19. CEO Javier Rodriguez emphasized the company's strengthened position and continued investments in staff and systems.

Expansive Market Pote

DVA LONG 041824I understand there may be some noise in the market regarding weight loss drugs, as such it has created a bit of a rift in prices of healthcare services relating to patient diets, lifestyles and procedures, could also be COVID lag/residue etc.

At this time however the Senior Living sector is expecte

DaVita (DVA) Stock Spike on Hope for Chronic Kidney Disease CureDaVita ( NYSE:DVA ) stock witnessed a significant surge as Novo Nordisk (NVO) unveiled promising results from its weight-loss drug study, offering newfound hope for patients battling chronic kidney disease. The groundbreaking findings have ignited investor optimism and reshaped the landscape for dia

A 80% edge - Mostly unused. Why?The Medianline/Pitchfork Tool provides a high probability (~80%) to reach the Centerline from any parallel line.

That means, if you can figure out how to buy as low as possible, or short as high as possible, your trade works out ~80% of time.

Why would one not use this edge?

Ask me questions, I

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

DVA6082365

DaVita Inc. 6.75% 15-JUL-2033Yield to maturity

6.47%

Maturity date

Jul 15, 2033

DVA5876396

DaVita Inc. 6.875% 01-SEP-2032Yield to maturity

6.20%

Maturity date

Sep 1, 2032

DVA5026985

DaVita Inc. 3.75% 15-FEB-2031Yield to maturity

6.04%

Maturity date

Feb 15, 2031

DVA4994310

DaVita Inc. 4.625% 01-JUN-2030Yield to maturity

5.82%

Maturity date

Jun 1, 2030

See all DVAI34 bonds