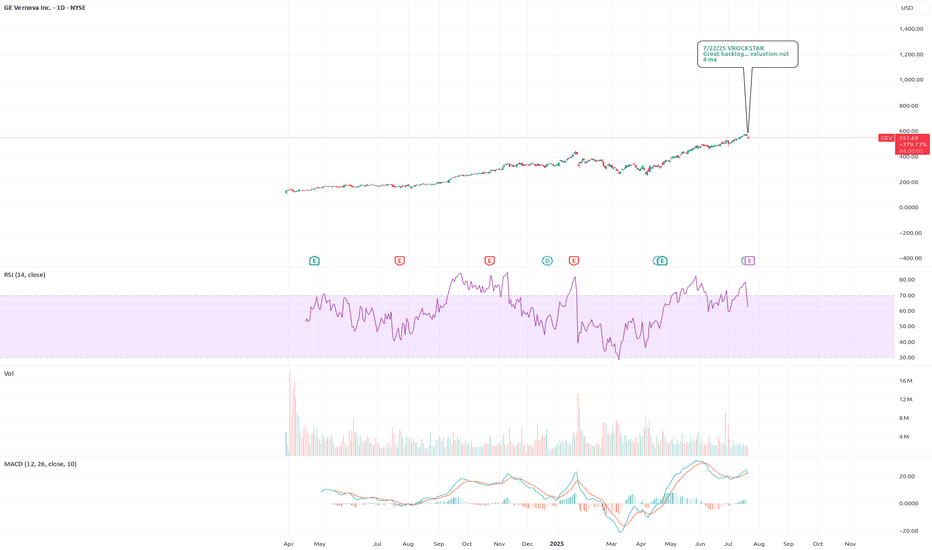

7/22/25 - $gev - Great backlog... valuation not 4 me7/22/25 :: VROCKSTAR :: NYSE:GEV

Great backlog... valuation not 4 me

- literally demand for as long as the eye can see

- is that worth 2% fcf yield? probably

- 50x next year PE? probably

- i'd dip buy this. but honestly i think results/ comms are +ve and stock all else equal goes higher. i just d

154,500.000

0.001 BRL

8.37 B BRL

188.38 B BRL

About GE Vernova Inc.

Sector

Industry

CEO

Scott L. Strazik

Website

Headquarters

Cambridge

Founded

2021

ISIN

BRG2EVBDR003

FIGI

BBG01PHM44W8

GE Vernova, Inc. is a electric power industry. Its products and services generate, transfer, orchestrate, convert, and store electricity. The firm operates through the following segments: Power, Wind and Electrification. The Power segment includes design, manufacture, and servicing of gas, nuclear, hydro, and steam technologies, providing a critical foundation of dispatchable, flexible, stable, and reliable power. The Wind segment includes wind generation technologies, inclusive of onshore and offshore wind turbines and blades. The Electrification segment includes grid solutions, power conversion, electrification software, and solar and storage solutions technologies required for the transmission, distribution, conversion, storage, and orchestration of electricity from point of generation to point of consumption. The Company was founded November 09, 2021 and is headquartered in Cambridge, Massachusetts.

Related stocks

GE Vernova Inc. (GEV) – Powering the Global Energy TransitionCompany Overview:

GE Vernova NYSE:GEV is becoming a cornerstone of the global clean energy shift, providing advanced power generation, transmission, and renewable energy technologies that are now mission-critical for national energy strategies.

Key Catalysts:

Explosive Electrification Growth ⚡

GE Vernova, Inc. - A Leading Electric Power IndustryGE Vernova, Inc. is a company making waves in the electric power industry. Here's a brief overview:

* Founded on November 09, 2021

* Headquartered in Cambridge, Massachusetts

* Segments:

1. **Power**: Designs, manufactures, and services gas, nuclear, hydro, and steam technologies for dispatchable,

1/28/2025 GEV longHello traders,

I noticed a bullish signal on GEV, as well as across energy and chip stocks today. Yesterday’s market breakdown, caused by DeepSeek, led to panic selling and significantly impacted these sectors. However, the diversified AI model will likely expand the overall market opportunity, mea

GEV Strong In A Weak Tape And Setting Up A Pullback BuyI drew a couple lines to show what I'd like to see over the next couple trading sessions. Not only would that be a pullback to the top of a long base but it would be a pullback to the 20sma. As it turns up from there could be a good opportunity for a low risk pullback buy entry.

The market might ke

326 is a very solid area of support on the sidewayIf you look closely at the sideway movement, it has already begun, even though the indicators have started to sell off. It could pose the question of whether a retracement of around 1.5% may be warranted or if a full correction occurs at this time where the second foundation of support stands.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

75VG

GE CAPITAL UK FUNDING UNLIMITED CO 8% GTD SNR EMTN 14/01/2039Yield to maturity

5.66%

Maturity date

Jan 14, 2039

92VF

GE CAPITAL UK FUNDING UNLIMITED CO 5.875% GTD SNR EMTN 18/01/33Yield to maturity

4.88%

Maturity date

Jan 18, 2033

71HP

GE CAPITAL UK FUNDING UNLIMITED CO 6.25% GTD SNR EMTN 05/05/2038Yield to maturity

3.17%

Maturity date

May 5, 2038

See all G2EV34 bonds