GEOO34 trade ideas

General Electric Buy SignalThe Trading Chaos Expert has identified me that the price has formed a bullish divergent squat bar on the daily chart of General Electric shares. This signal, reliable as it is, is supported by Elliott wave structure, which is marked on the selected chart. Going long using pending levels that are marked on the chart.

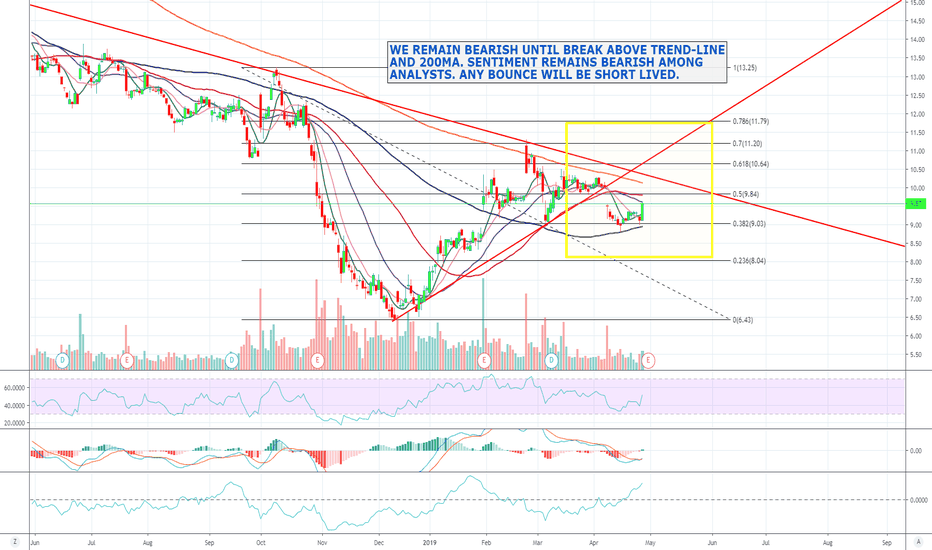

Conditional long200 EMA acting strongish price over the last few weeks have made many systemic attempts to break this but the bears have denied the bulls, however it is heartening to a cluster of supports due to some rangebound behavior. Supports at 9.80 where ema 50 sits and then another support at around 8.80-9 which was the april 15th low and closing price respectively. If 10.40-10.50 breaks decisively our first target will will be between 11.29-11.70 where 11.20 was the swing high made on 25th Feb which was coincidentally a rejection of the 200 ema resistance, 11.70 is a crucial level as well as it was the closing price on oct 24th 2018 which was one candle before the relentless downtrend began

GE share prices bounced back with supporting volumeGE shares have breached 10.26 resistance price line in today's session and now attempts to push through 10.39.

A break above 10.39 could see share prices continue to 10.61

GE share prices could head down to retest 10.00 support price line if it fails to hold above 10.26

$GE $9.50 Does not mean it's good value, still room to fall. Stephen Tusa is regarded as somewhat of a god in the GE analyst community. In 2016 he projected the fall in GE then priced at $30 . Since then he has been pretty flawless in his analysis and his opinion is that GE is still overvalued, his price target of $6 is becoming more and more realistic. Until he changes his views it is very difficult to see how the stock can rally as his track record is so good.

GE Bullish to $12+General Electric Co. (NYSE: GE) is expected to report its first-quarter results early on Tuesday. Overall, analysts anticipate earnings of $0.09 per share, as well as $27.05 billion in revenue. Shares traded at $9.57 on Friday’s close. The consensus price target is $12.61. The stock has a 52-week trading range of $6.40 to $14.99.

Off Technicals we see it finally breaking back above a major weekly trendline and using it as support.

Head and Shoulder pattern on the lower time frame and currently on a major reversal zone with multiple confluence showing bullish.

Mind you - Still SUPER new to technical analysis but sharing this for improvement and to hopefully bounce ideas off of traders and students alike.

let me know what y'all think :)