GOOG - Possible Break OutHello Everyone,

Happy Sunday to All.

I would like to make a quick Analyse on GOOG. When i was scanning the stocks,i reliazed that this could be a possible breakout and could be a opportunity to buy.

This looks like a breakout and i am expecting to Re-test trend line which price level 175 $.

Then first target is 190-192 which is approx %8 - 10 above from 175.

If it will restest and hit the 175 , this could be good entry point.

If not then first target is 190-192 which is approx %5 above current price level.

Long Term , of course Google is Google no doubt to jump in every price points :)

For me, short term i would wait 175 and put my order to that price , then wait for next moves.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday and good start a Week

GOGL35 trade ideas

Alphabet (GOOGL) Stock Approaches $200 Ahead of Earnings ReleaseAlphabet (GOOGL) Stock Approaches $200 Ahead of Earnings Release

According to the Alphabet (GOOGL) stock chart, the share price rose by more than 2.5% yesterday. Notably:

→ the price reached its highest level since early February 2025;

→ the stock ranked among the top 10 performers in the S&P 500 by the end of the day.

The positive sentiment is driven by expectations surrounding the upcoming quarterly earnings report, scheduled for release tomorrow, 23 July.

What to Know Ahead of Alphabet’s (GOOGL) Earnings Release

According to media reports, Wall Street analysts forecast Alphabet’s Q2 revenue to grow by approximately 11% year-on-year, with expected earnings per share (EPS) of around $2.17 — up from $1.89 a year earlier. Notably, the company has consistently outperformed estimates for nine consecutive quarters, setting a positive tone ahead of the announcement.

Despite the optimism, investors are closely monitoring two key areas:

→ Cloud computing competition , where Google Cloud contends with Microsoft Azure and Amazon AWS;

→ Growing competition in the search sector , linked to the rise of AI-based platforms such as ChatGPT.

In response, Alphabet is significantly increasing its capital expenditure on AI infrastructure, planning to spend around $75 billion in 2025. These investments are aimed at both defending its core search business and advancing the Gemini AI model, while also strengthening Google Cloud’s market position.

Technical Analysis of Alphabet (GOOGL) Stock

Since April, GOOGL price fluctuations have formed an ascending channel (marked in blue).

From a bullish perspective:

→ the June resistance level at $180 has been breached and may soon act as support;

→ previous bearish reversals (marked with red arrows) failed to gain momentum, suggesting sustained demand is pushing the price higher.

From a bearish standpoint, the price is approaching:

→ the psychological level of $200, which has acted as a major resistance since late 2024;

→ this barrier may be reinforced by a bearish gap formed in early February.

Strong results from the previous quarter, combined with optimistic forward guidance from Alphabet’s management, could provide bulls with the confidence needed to challenge the $200 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Silicon Valley Shaken by China’s Free AI OffensiveSilicon Valley Shaken by China’s Free AI Offensive

By Ion Jauregui – Analyst at ActivTrades

Artificial intelligence is undergoing its first major geopolitical fracture. While OpenAI strengthens its infrastructure by renting servers from Google Cloud, China’s advance with free generative models threatens to redefine the balance of power in the sector. Names like Qwen, InternLM, Yi, Baichuan, ChatGLM, or Ernie Bot (from Baidu), as well as initiatives backed by Tencent, Alibaba or iFlytek, are emerging strongly. Many of these open-source models already match — and in some tasks outperform — DeepSeek and compete with giants like GPT-4. A new global chessboard is being drawn with direct consequences for Alphabet, owner of Gemini and the same cloud service now supporting its main rival.

Google’s parent company has once again bared its teeth. Alphabet published second-quarter 2025 results that comfortably beat market expectations. Revenues are rising, profitability is solid, and its financial strength allows it to buy back shares at a dizzying pace. But behind all the shine, one shadow remains: its bet on artificial intelligence, Gemini, still hasn’t taken off compared to ChatGPT — and now faces a tsunami of free AI coming from China.

China’s Free AI Offensive: Intelligence for All (Without Paying)

The latest developments unveiled by Beijing are setting off alarms in Silicon Valley. Models like InternLM2, Qwen2, and Yi are not only distributed freely but show results equivalent or superior to paid models in key natural language tasks. Trained with massive corpora and backed directly or indirectly by the state, these AIs are designed to scale in universities, startups, and local companies, replacing Western software at no cost and with open licenses. The open-source ecosystem, combined with a local (albeit limited) chip market, allows China to reduce dependence on the West while exporting influence to emerging markets like Central Asia, Africa, or Latin America.

Xi Jinping Hits the Brakes… or Does He?

Since Xi Jinping’s speech calling for “moderation” in public investment in sectors like AI or electric vehicles, the message seems more like an attempt to control bubbles than halt progress. The president was clear: “Not the entire country should be building cars or processing data.” With irony, he labeled local governors as “three-pat officials”: one on the head to get the idea, one on the chest to sell it, and one on the backside to run when it blows up. Elegantly Brutal Comment. Behind the humor lies a serious backdrop: inflated bubbles, centers without qualified staff or functioning chips, and falsified sales data. This isn’t surprising given China’s price wars in the auto sector and shady practices inflating sales through vehicles insured before actual purchase, which has triggered a wave of new regulations and controls. This war has spread to AI, with centers being built without skilled personnel or working chips. According to Xi, unchecked growth is not worth it if it means excessive corporate and state debt.

OpenAI Rents Google Servers: Strategic Move or Dependence?

In an unexpected twist, OpenAI has started using Google Cloud infrastructure. The paradox is clear: Google, a direct rival with Gemini, is now supporting the race leader. The move seems pragmatic: OpenAI needs scale, and Google has one of the world’s most powerful cloud networks. This could translate into meaningful revenue for Alphabet, at the cost of ceding leadership perception in AI.

From a strategic standpoint, integrating into OpenAI’s service ecosystem could win Alphabet a long-term technological and economic victory by boosting cloud revenues and indirectly funding Gemini.

Alphabet Analysis (GOOGL)

🤖 Gemini, the Eternal Contender?

The paradox is clear: by using Google Cloud — one of the world’s most powerful cloud services — OpenAI generates income for Alphabet. Meanwhile, Alphabet still struggles to differentiate itself in generative artificial intelligence. Gemini continues searching for its place. Despite being one of Alphabet’s boldest bets, its progress has been slow and adoption lukewarm, and it hasn’t yet delivered significant returns on its own. Gemini has yet to achieve massive direct monetization. While integrations with Google Workspace — Gmail, Docs, and the Android ecosystem — are gaining visibility, user perception is still dominated by OpenAI. And now, with the emergence of free Chinese AIs, Gemini may be pushed aside even in markets where Alphabet aimed to lead digital transformation, like India, South America, or parts of Eastern Europe.

This alliance with OpenAI may have a mixed impact: positive on revenues, but negative for perceptions of technological leadership. Meanwhile, the market is watching open-source models like Qwen2, InternLM2, and Yi from China — all free — gain traction in sectors once reserved for the West. In the short term, this may seem like a trade-off, but from a strategic viewpoint, it could be one of Alphabet’s key long-term business moves. Alphabet has historically invested in competitors and made key acquisitions to reinforce its ecosystem — this could be one of those strategic bets, helping to fund Gemini’s path toward long-term tech leadership. Especially considering that in Q1, it increased R&D spending — particularly in AI and quantum computing — and that the cloud business must sustain its operating profitability (which grew 25% in Q1), this move could provide essential capital for this critical business vertical. Alphabet posted $33.8 billion in Q1 revenue, with total operating margins around 28%. AI as a future lever: Gemini 2.5 Pro and AI Overviews, already with 1.5 billion monthly users, could be catalysts accelerating multiple products.

A (Nearly) Perfect Quarter

Alphabet posted $93.84 billion in revenue in Q2 2025, a year-on-year growth of +10.7%. Net income reached $26.5 billion, with estimated EPS at $2.18. Operating margins improved to 34% (up from 32.4% in Q2 2024), reflecting more efficient management, while other Big Tech players have opted for cuts. One key standout was Google Cloud, which grew over 25% YoY ($12–13.1B), consolidating its profitability and strengthening its role as Alphabet’s second-largest revenue stream behind advertising.

Is Advertising Still the Engine?

Ad revenues rose by a solid +8.5%, reaching nearly $67 billion, with YouTube and Google Search leading the recovery (~$52–53B). Alphabet shows that even in disruptive times, its model continues generating cash.

Regulatory Risks

Growing antitrust pressure (Chrome, search case) with upcoming decisions could impact its business model and valuation.

Massive Buyback and Strong Cash Position

Alphabet isn’t just earning — it’s returning value to shareholders. The company announced a $70 billion share buyback, showing confidence in its future. Its cash position remains one of the strongest in the sector.

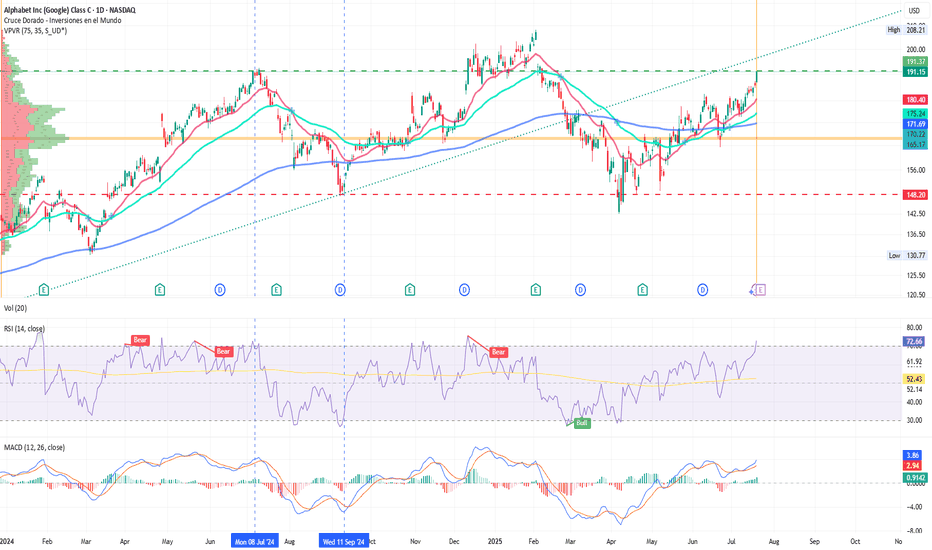

Technical Analysis (Updated)

Yesterday’s closing price was $191.37, within the consolidation zone from early 2025 that took the stock to its all-time high of $208.21. The upward channel seems to be testing a strong resistance zone, and the RSI is showing overbought conditions at 72.66%. The golden cross identified on June 30 remains intact. The strong trading zone around the point of control at $166.67 appears to act as support for the recent rally, indicating a positive bias. Key supports lie around the 200-day moving average ($172.9) and the 50-day moving average ($168). A convincing close above $194–195 may lead to further gains, while losing the $172.9–168 zone could suggest a correction due to high speculation or partial institutional sell-offs.

Conclusion: Train Wreck or Calculated Strategy?

The dominance of artificial intelligence is no longer just a game between American giants. China has entered the arena with a radical strategy: offering free, functional models to the world. The emergence of these state-backed models will force Silicon Valley to respond through moves like this one. Alphabet finds itself at a crossroads. Its financial strength and cloud business give it tactical advantages — even while renting infrastructure to its rivals — although this may dilute its presence as a developer. Still, its big AI bet appears to be advancing more slowly than many hoped. Alphabet’s strategy of participating in its rival’s business could be seen as weakness… or as a long-term masterstroke. Everything will depend on whether Gemini can reach the level of sophistication, adoption, and monetization that its ambition promises. Until then, the global AI landscape has become more complex, more competitive… and more Eastern.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

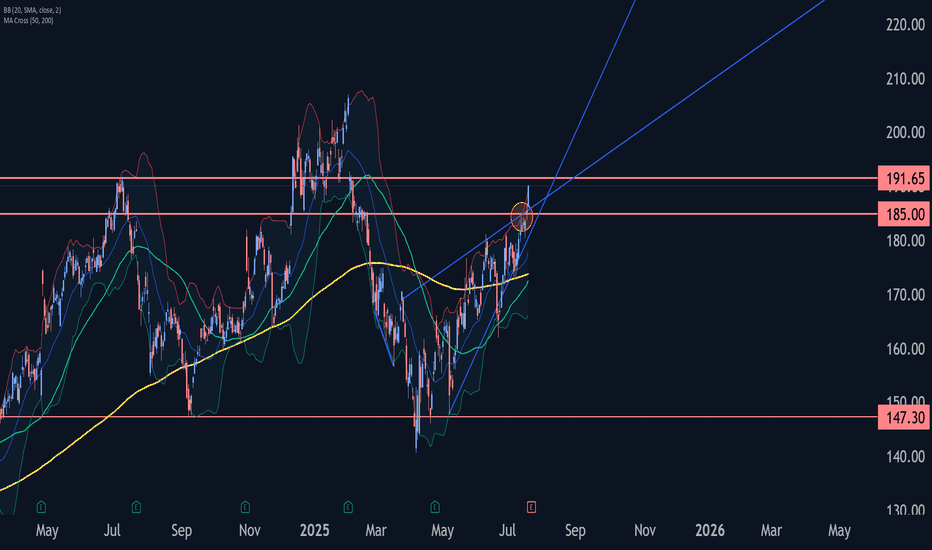

Google Wave Analysis – 21 July 2025

- Google broke resistance zone

- Likely to rise to resistance 191.65

Google recently broke the resistance zone between the resistance level 185.00 and the upper trendline of the daily Rising Wedge from the start of May.

The breakout of this resistance zone accelerated the active impulse wave C of the intermediate ABC correction (2) from the start of April.

Given the clear daily uptrend, Google can be expected to rise further to the next resistance 191.65 (target price for the completion of the active impulse wave C).

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, there is a chance that we will see new all time highs soon.

📝Levels to watch:

$200

🙏🏻#LONGTERMVISION

Philip - Swing Trader

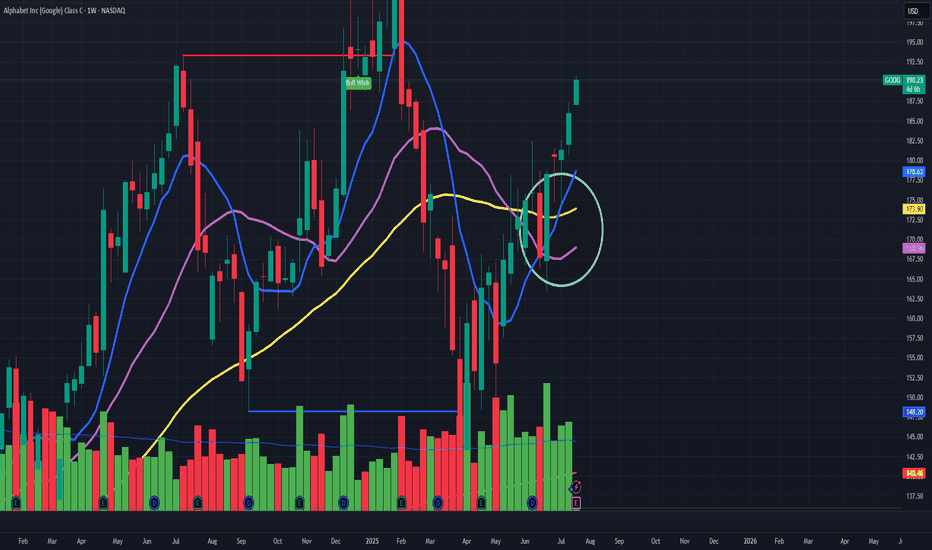

With price near $190 and strong volume, $200+ looks imminent.🔥 NASDAQ:GOOGL Weekly Chart Signals a Golden Cross

Alphabet’s (GOOG)9-week MA is crossing the 20 and 50-week MA—classic bullish setup. With price near $190 and strong volume, $200+ looks imminent.

💡 Why It’s Climbing:

- AI breakthroughs (Gemini, DeepMind)

- Google Cloud gaining traction

- Big tech rotation + investor flow

📈 Golden crosses like this often lead to multi-month rallies. GOOG’s chart is flashing green.

Earnings Incoming: July 23, 2025 (After Market Close)

Alphabet (GOOG) is set to report Q2 earnings this week, and expectations are high:

- EPS Forecast: $2.14 per share, up 13% YoY

- Revenue Estimate: $79.2B, an 11% increase from last year

- Key Drivers: AI momentum (Gemini, DeepMind), Google Cloud growth, and strong YouTube ad performance

💡 With a golden cross forming and earnings likely to show double-digit growth, GOOG could get the catalyst it needs to break past $200.

"These 3 power signals boost the 3-step rocket booster strategy"Am lubosi forex and i would like to welcome you.This is where i share with you technical analysis strategies.

I started trading in 2017 and learning about it has not been easy.My hope for you is that this channel will shape your trading journey and help you

Find a path to making money on your own terms.

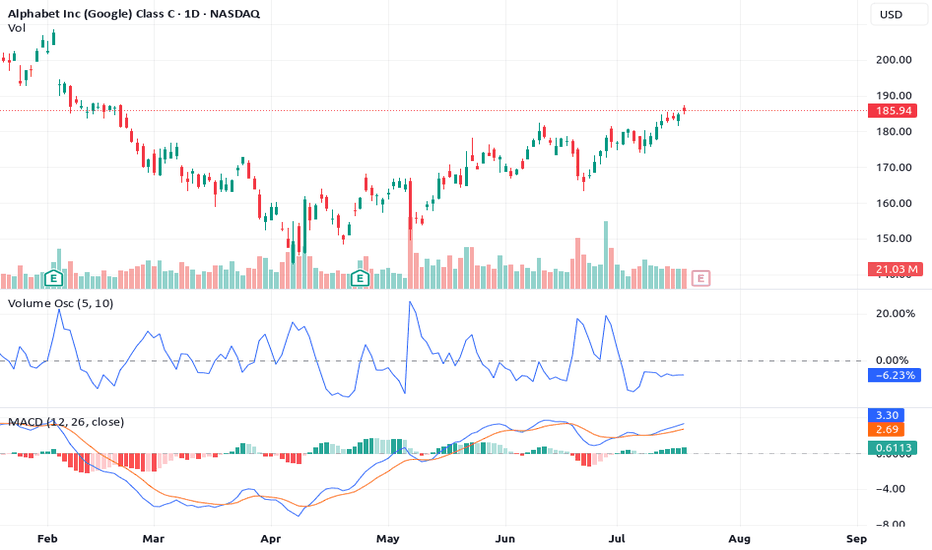

In this video am showing you the rocket booster strategy

using 3 indicators and catalysts as follows:

1-Volume Oscillator

2-MACD Indicator

3-Earnings Report Catalyst

These 3 power signals boost

the 3-step rocket booster strategy

Watch this video

to learn more

Disclaimer:Trading is risky please use a simulation trading account before you trade with real money

also learn risk management and profit taking strategies.

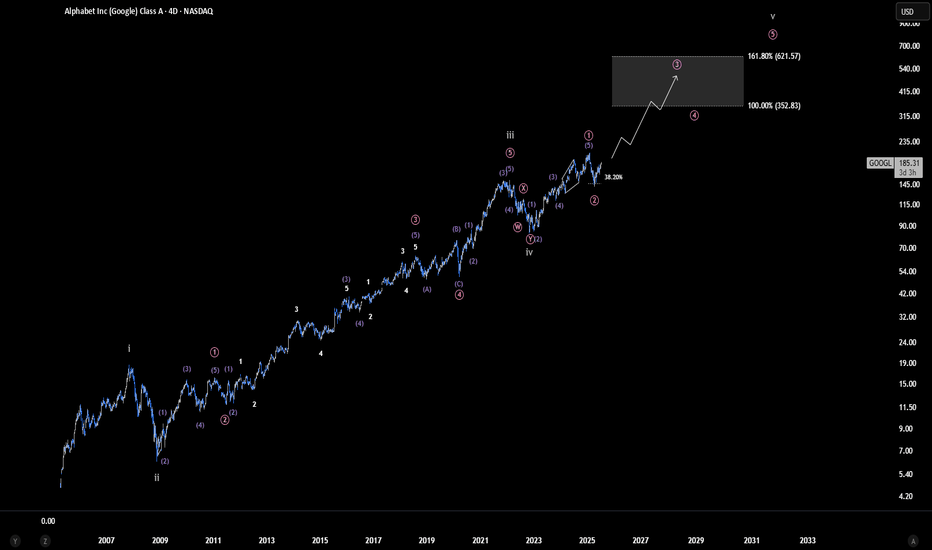

Alphabet (Google) - Ready to Surge Again? | Ew analysisWe appear to be in the final wave of a major bull run that began all the way back in 2005. If this count unfolds as expected, Google could potentially rally toward the $350–$620 range or even higher representing a gain of over 200% from current levels. This would mark the completion of the fifth and final wave before a major long-term correction sets in.

That said, it's important to stay cautious. A sustained break below the current gray wave 5 would invalidate this scenario and suggest that the long-standing bull cycle may already have come to an end.

Analyzing GOOGL's Path: Breakouts and Critical Support• Strong Upward Trendline : The chart clearly displays an ascending trendline (light blue) from early April, indicating a robust bullish trend. The price has consistently found support at or near this line, reinforcing its significance as a key technical level.

• Recent Breakout and Potential Retest : The price has recently broken above a notable resistance zone around the $181-$183 mark (highlighted in green). The dotted white lines suggest a potential retest of this newly formed support level before a continuation of the upward movement, a common pattern following a breakout.

• Identified Price Targets Ahead : Two distinct target zones are identified above the current price: the $181 to $183 range as the "1st Target" (already reached/broken out of), and a higher "2nd Target" between $191 to $193. These represent areas where upward momentum might face resistance or profit-taking.

• Critical Support Zone for Drop Scenarios : In the event of a price drop, the chart indicates a critical support zone from $171 to $173. This area aligns with the ascending trendline, making it a crucial level to watch for potential bounces if the price pulls back.

• Confirmed Retested Support Below : Further down, the chart highlights a retested support zone between $161 and $163. The repeated testing and holding of this level affirm its strength as a reliable base for the price in the longer term.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

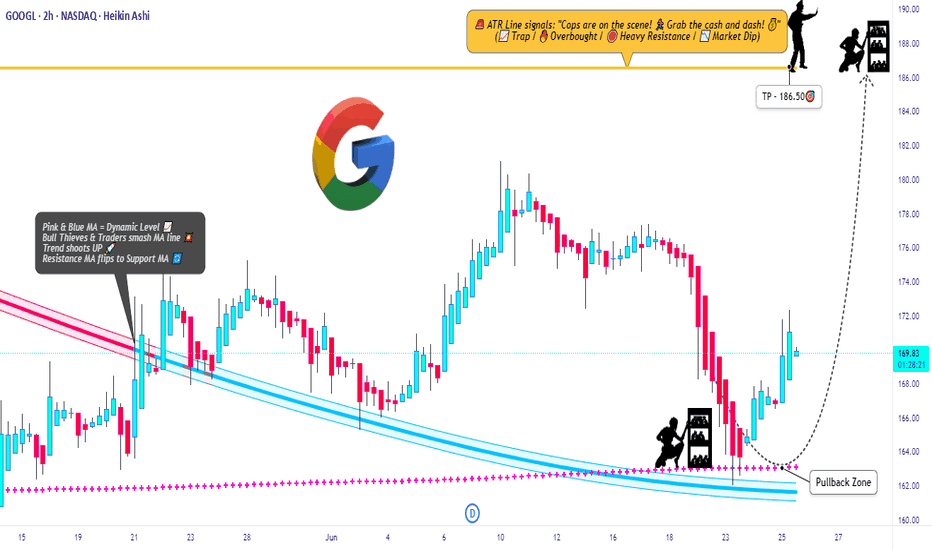

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based on sharp technical intel and subtle fundamental whispers, the setup is clear: the bulls have cracked the code, and it’s time to grab our loot.

🟢 🎯 ENTRY POINT - THE LOOT ZONE

"The vault is wide open!"

Snatch your bullish entry anywhere on the chart, but the pros will place limit buys on recent pullbacks (15m/30m zones), either on swing lows or highs. The pullback is your door in — don’t miss it!

🛑 STOP LOSS - ESCAPE ROUTE

Set the Thief SL at the recent 2H swing low (162.00).

But remember, each robber’s risk appetite is unique — adjust your SL based on your size, cash, and courage.

🎯 TARGET - GETAWAY MONEY

💼 Main Target: 186.50

Or if heat rises early, vanish with your gains before the full score hits. Disappear like a ghost — profit first, questions later!

🧲 FOR SCALPERS – THE QUICK GRAB

Only ride the long wave — shorting is off-limits in this mission.

If your wallet is loaded, dive in. If not, join the swing crew.

Use trailing SL to protect your cash stack 💰.

📈 THE SETUP – WHY THIS RAID WORKS

The GOOGL Market is bursting with bullish energy — a classic Red Zone robbery moment.

Overbought tension, fakeouts, trend shifts — exactly where we love to strike! Consolidation and reversals = opportunity for the brave.

📣 TRADING ALERT - NEWS AHEAD!

🚨 Avoid entries during news releases – they trigger alarms!

Use trailing SL to lock in your stash, especially during high-volatility windows.

🔍 TIPS FROM THE THIEF’S DESK

Stay updated with the latest whispers — from fundamentals to geopolitical noise, COT positioning to sentiment swings. The market changes faster than a thief on the run — so adapt fast!

💖 Show some love: 💥Hit that Boost Button💥

Let’s fuel this robbery plan with more power and precision.

Every day in the market is a new heist — let’s win like thieves, not sheep. 🏆💪🤝❤️🚀

I'll be back soon with another masterplan...

📡 Stay sharp, stay hidden — and always aim for the vault. 🤑🐱👤🎯

$GOOGL $GOOG AI Signals a Volatile Expansion 🔍 Technical Overview (Daily TF)

GOOGL is currently trading at $180.19, breaking upward inside a well-defined bullish channel, hugging equilibrium levels after consolidating just below the $184 resistance zone. This setup reflects classic Smart Money reaccumulation behavior:

🟩 Current Structure: CHoCH → BOS confirmed on higher lows

📊 Equilibrium: Mid-channel value alignment; strong price efficiency with low imbalance

🟧 Premium Zone: $202.81–208 marked for liquidity sweep (target zone)

🔴 Strong Highs: Not yet swept; draw on liquidity to the upside likely

Key price levels:

Resistance zone: $184.00–208.00

Support cluster: $172.00–168.00

Discount Block (Demand): $144.00–132.00

🤖 VolanX AI Models Forecast (as of July 12)

📌 Model 1 – Smart Money AI Trading Suite

LSTM Forecast: +9.0% gain expected over next 14 days

Target: $196.34

Market Condition: Overbought (No order blocks currently)

Volatility: 26.4%

Volume Shift: -15.5% (suggesting short-term supply exhaustion)

📌 Model 2 – WaverVanir DSS Platform

Sentiment Score: 78 (bullish bias)

15-Day Prediction: $182.34 (+1.2%)

30-Day Prediction: $184.36 (+2.3%)

📈 Note: The DSS is projecting slower upside in comparison to the Smart Money AI suite. This divergence suggests that while short-term price may rise, the major move could depend on external catalysts.

🌍 Macro & Catalyst Outlook

NASDAQ Tech Momentum: Q2 earnings in July will be a key macro driver

Yields & Dollar Index: Softening DXY supports tech; watch 10Y real yield inversion

AI Sector Beta: GOOGL is lagging NVDA/MSFT but may play catch-up into August

CPI/Inflation Watch: If inflation readings cool, it may trigger flows into mega-cap tech

Fed Policy Risk: September dot-plot shift could trigger volatility (Fed pivot vs sticky inflation)

🧠 WaverVanir DSS Conclusion:

📌 Bias: Bullish-to-Neutral

📌 Trade Zone: Watching for breakout above $184 to trigger sweep toward $196–202

📌 Invalidation: Break below $168 invalidates bullish structure; targets $144 liquidity pool

📌 Strategy: Standby mode; entry requires confirmation of volume breakout above range high.

📢 WaverVanir Insight:

"Smart Money has shown its hand — compression is a prelude to expansion. We're monitoring confluence between AI signal alignment and SMC structures. $196 target remains valid unless CHoCH flips bearish with volume."

#WaverVanir #VolanX #SmartMoneyConcepts #GOOGL #AITrading #InstitutionalFlow #LSTM #VolumeProfile #TradingView #MacroAnalysis #StockForecast #Alphabet #MarketForecast

GOOG Wave B

Bullish price action from the last couple of months has been unconvincing, and this looks more like a wave B correction.

A break of the black ascending channel would be a trigger for wave C.

It would be interesting to see a reversal pattern in smaller timeframes if price touches the gray supply zone.

Google: Upcoming TopWe locate Google in turquoise wave 2 (of a downward impulse). In more detail, we see the stock developing a complex - - - pattern and expect turquoise wave 2 to conclude imminently with wave . All the while, the price should maintain a safe distance from resistance at $209.28. Looking ahead to turquoise wave 3, we anticipate sell-offs down into our magenta Target Zone between $123.92 and $98, before wave 4 likely triggers a temporary rebound up to the $138.35 level. Ultimately, the entire turquoise downward impulse should bottom out again in the magenta zone, which would also mark the completion of waves (C) in magenta and in green. Since a new larger upward phase should begin afterward, the magenta zone presents an opportunity to establish long positions. However, if Google were to break above the $209.28 resistance next, we would have to expect a new high for magenta wave alt.(B) —which would only temporarily postpone the anticipated sell-off though (probability: 24%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

GOOGLE Count changed, Bullish outlook.I have adjusted NASDAQ:GOOG NASDAQ:GOOGL Elliot wave count with a wave 1 completing a leading diagonal backed up by a deep wave 2 correction into High Volume Node support (HVN). We potentially have another 1-2 with fast drop and recovery to the S1 daily pivot which would make long term outlook extra bullish by extending target.

Wave 3 is underway with a target of the all time hime high HVN for wave 5. The next resistance HVN is $191.

Price above the daily pivot and is continuing upwards after testing as support.

Analysis is invalidated below $162 swing low.

Safe trading

This Looks So Bullish (I See A Cup And Handle. What do you see?)Pattern Identified: Cup and Handle

From the chart of Alphabet Inc. (GOOGL), the most prominent and likely bullish pattern is a Cup and Handle formation:

Cup Formation:

The price declines sharply around February–April 2025.

It then forms a rounded bottom.

Recovers back to the previous resistance near $180 in June–July.

Handle Formation:

A short pullback (forming a small downward-sloping consolidation).

Followed by a breakout around $180.55 (current price).

Price Target Calculation:

Formula:

Target Price = Breakout Level+(Cup Height)

Breakout Level: ~$180

Cup Bottom: ~$145

Cup Height: 180 - 145 = $35

Target Price = 180+35 = 215

GOOG LongMarket Structure Breakdown

Initial Break of Structure (BOS) – Bearish Phase

A significant bearish BOS occurred after a liquidity sweep above the prior high. This marked the temporary dominance of sellers, driving price downward.

Change of Character (ChoCh) – Sentiment Shift

Following the bearish leg, price printed a sharp recovery and broke above internal lower highs, signaling a Change of Character. This is the first indication of buyers regaining control.

Bullish BOS – Confirmation of Uptrend

The bullish BOS validated the upward structural transition, establishing new higher highs and higher lows. This confirms that institutional order flow has shifted bullishly.

🔹 Liquidity Dynamics

The liquidity sweep at the recent low (marked with a red dot) is a critical manipulation event, removing weak longs before institutions accumulate.

The current price action is printing a re-accumulation range, where price is likely to dip into key zones to trap breakout sellers.

Multiple liquidity pockets (green shaded regions) below serve as potential inducement zones. These areas may be revisited to gather liquidity before the next leg higher.

Final target is projected near the higher time frame sell zone around the $186–188 level, where substantial resting liquidity likely exists from previous swing highs.

🔹 Risk Management Considerations

Entry Zones: Look for confirmation-based entries within the liquidity trap zones, avoiding premature positioning at highs.

Stop-Loss: Place invalidation levels below engineered sweep zones to prevent getting caught in liquidity grabs.

Scaling Strategy: A tiered entry model can be effective here — initiating partial entries at the first trap and scaling in on deeper retracements.

Targeting: Conservative traders can aim for the internal high; aggressive positioning could seek full mitigation of the higher time frame zone.