24,616.67

0.00 BRL

81.20 B BRL

874.80 B BRL

About Home Depot, Inc. (The)

Sector

Industry

CEO

Edward P. Decker

Website

Headquarters

Atlanta

Founded

1978

ISIN

BRHOMEBDR002

FIGI

BBG002Q24GK0

The Home Depot, Inc. engages in the sale of building materials and home improvement products. Its products include building materials, home improvement products, lawn and garden products and decor products. The firm operates through the following geographical segments: U.S., Canada and Mexico. It offers home improvement installation services, and tool and rental equipment. The company was founded by Bernard Marcus, Arthur M. Blank, Kenneth Gerald Langone and Pat Farrah on June 29, 1978 and is headquartered at Atlanta, GA.

Related stocks

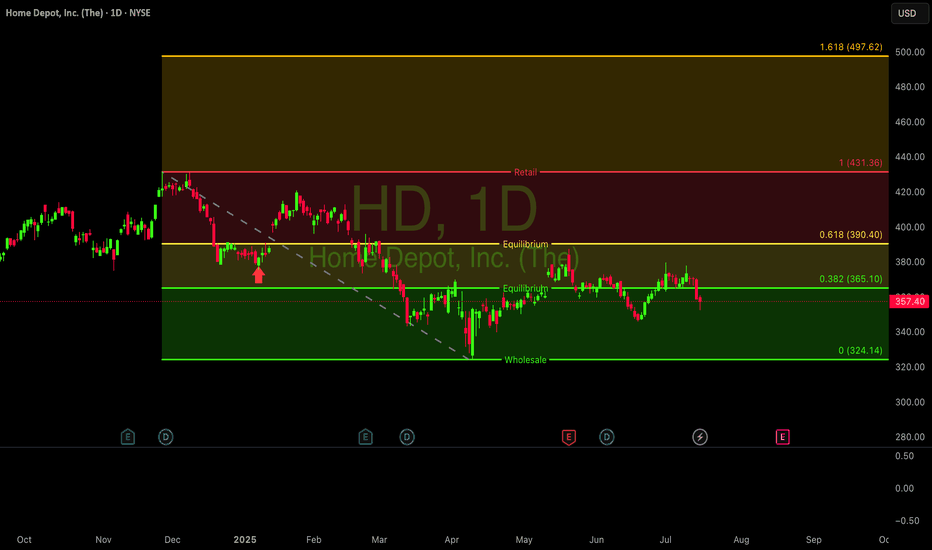

$HD - Cookie long hold this is bread and butterNYSE:HD hold a bullish position could see over $505 long term... <3

NYSE:HD breaking out with conviction! Up 5.2% this week on increasing volume. 12 analysts maintain BUY ratings with targets up to $455 (23% upside). Technical pattern shows higher lows since April. Strong revenue growth despite

Check 350.47 support (HA-MS indicator interpretation method)

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(HD 1D chart)

Can the HA-MS indicator be applied to stock charts?!!!

The conclusion is that it can be applied to all charts.

However, since the stock marke

Home Depot Wave Analysis – 18 June 2025

- Home Depot broke support zone

- Likely to fall to support level at 340.00

Home Depot recently broke the support zone located between the support level 352.00 (low of wave A from April) and the 61.8% Fibonacci correction of the ABC correction (2) from April.

The breakout of this support zone acc

Long Setup: Home Depot ($HD) | Bullish Continuation Above Cloud 📈 Technical Setup:

Home Depot ( NYSE:HD ) is setting up for a potential bullish continuation after retesting the top of the Ichimoku Cloud and holding key support.

Ichimoku Cloud: Price is consolidating above the Kumo, with the Conversion Line (Tenkan) and Base Line (Kijun) flatlining — signaling p

Home Depot – Pattern Suggests C Wave Toward $315 from $367 LevelHome Depot appears to be inside a pattern that fits either an Ending Diagonal or Skewed Triangle structure. From the $367 area, a potential C wave may begin targeting the $315 zone.

Investors should be cautious, as diagonal or skewed triangle formations often involve significant uncertainty. The wh

Home Depot Stock Chart Fibonacci Analysis 060325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 372/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

HD BULLISH POTENTIALHere's a professional and engaging English version of your summary, ideal for a social media or blog post:

---

🔨 Home Depot (HD) — Is the Bottom In?

Home Depot, often considered the U.S. equivalent of IKEA in the home improvement sector, just posted **strong Q4 2024 earnings**, signaling potenti

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US437076CG5

HOME DEPOT 21/51Yield to maturity

7.32%

Maturity date

Mar 15, 2051

US437076CK6

HOME DEPOT 21/51Yield to maturity

7.08%

Maturity date

Sep 15, 2051

HD4933111

Home Depot, Inc. 3.125% 15-DEC-2049Yield to maturity

6.62%

Maturity date

Dec 15, 2049

HD4401003

Home Depot, Inc. 3.5% 15-SEP-2056Yield to maturity

6.52%

Maturity date

Sep 15, 2056

HD4971789

Home Depot, Inc. 3.35% 15-APR-2050Yield to maturity

6.45%

Maturity date

Apr 15, 2050

HD5386726

Home Depot, Inc. 3.625% 15-APR-2052Yield to maturity

6.43%

Maturity date

Apr 15, 2052

US437076BS0

HOME DEPOT 17/47Yield to maturity

6.23%

Maturity date

Jun 15, 2047

US437076BX9

HOME DEPOT 18/48Yield to maturity

5.98%

Maturity date

Dec 6, 2048

HD4253641

Home Depot, Inc. 4.25% 01-APR-2046Yield to maturity

5.96%

Maturity date

Apr 1, 2046

HD4134022

Home Depot, Inc. 4.4% 15-MAR-2045Yield to maturity

5.92%

Maturity date

Mar 15, 2045

HD5475098

Home Depot, Inc. 4.95% 15-SEP-2052Yield to maturity

5.87%

Maturity date

Sep 15, 2052

See all HOME34 bonds

Curated watchlists where HOME34 is featured.