Home Depot Potential for Bearish Drop | 28th February 2023Looking at the H4 chart, my overall bias for HD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market.

Looking for a sell entry at 311.69, where the overlap resistance and 38.2% Fibonacci line is. Stop loss will be at 331.31 where the overlap resistance and 78.6% Fibonacci line are. Take profit will be at 279.90, where the overlap support and 78.6% Fibonacci line is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website

HOME34 trade ideas

Home Depot Potential for Bearish Drop | 28th February 2023Looking at the H4 chart, my overall bias for HD is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell entry at 311.69, where the overlap resistance and 38.2% Fibonacci line is. Stop loss will be at 331.31 where the overlap resistance and 78.6% Fibonacci line are. Take profit will be at 279.90, where the overlap support and 78.6% Fibonacci line is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website

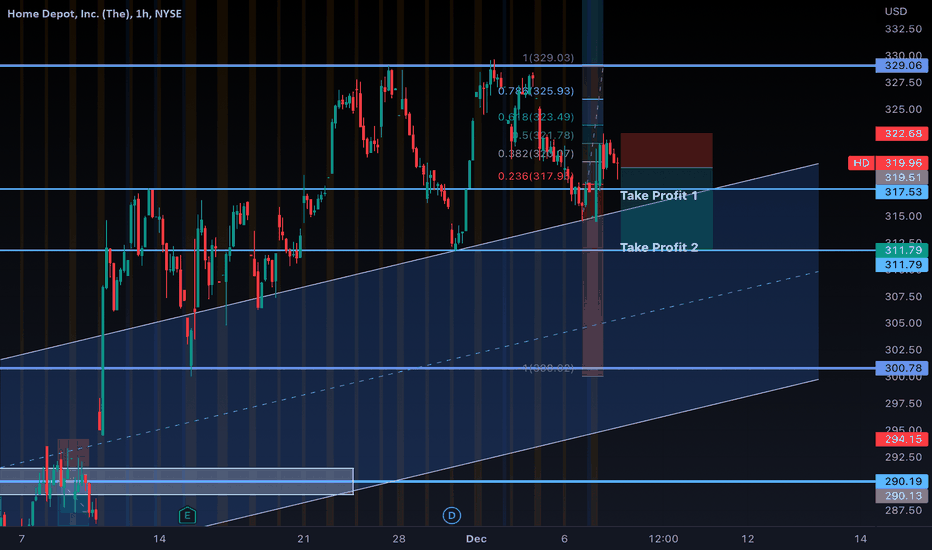

Home Depot looking strong prior to earnings releaseHome Depot, Inc. (The) (symbol ‘HD’) shares made around 13% in profits since the beginning of Q4 2022. The share price made a very strong bullish run and then entered a slightly bearish trading channel. The company’s earnings report for the fiscal quarter ending January 2023 is set to be released on Tuesday 21st of February, before market open. The consensus EPS for Q1 is $3,26 compared to Q1 2022’s $3,21.

‘Home Depot looks “healthy” financial-wise with a dividend yield of 2.40% and a payout ratio of 44,30% this shows that the company is giving out a relatively good amount of dividends to its investors while retaining most of its earnings to reinvest in the company to maximize growth, The current ratio of the company is over 100% which means that they are in the financial position to repay the short term-liabilities should the need arise.’ said Antreas Themistokleous at Exness.

Based on technical analysis the share price bounced on a major technical support which consists of the 38.2% of the daily Fibonacci retracement level and the bullish trendline which is valid since late October 2022.

If the following sessions close above the current level we might see the next level of resistance laying around the $325.50 area which is the 23.6% of the daily Fibonacci level. The fact that the 50 day moving average is trading well above the 100 day moving average and the Stochastic oscillator near the extreme oversold levels further support this possible continuation to the upside.

In the event that the price resumes the downward movement of the last week then the first point of support might be seen around $306 price area which consists of the lower band of the Bollinger bands, the 100 day moving average and the 50% of the Fibonacci.

Rising WedgePrice is trying to fall from a Bearish Rising Wedge today.

Looks like a bearish W pattern, an alternative bat has completed and price is turning down. Most, not all harmonic patterns that look like a crooked W are called bearish only meaning they reverse down as a rule at the end of the 4th leg up, but there is an opportunity to go long on the last leg of that W as long as you get out in time. Crooked M patterns are called bullish as they reverse at the end of the 4th leg which is. But even with a Bullish M pattern, if you recognize the pattern, one can short the last leg down as long as you recognize that price may reverse at the end of that 4th leg down.

I have the .886 and the 1.113 marked as this may be a Bat but too soon to tell. Support is sometimes found at the hump of the W.

Thrusting candle right this second that can change by close. A thrusting candle is considered a continuation of the current trend and should not reach the half way mark of the prior candle.

Price is hanging on the .382 of the trend up since the Covid low.

Strong stock/Short interest is around 2.41%.

Earnings 2-21 and there is a mixture of analyst opinions on earnings with more negative opinions than positive ones.

Caution as I see some chartists whom I respect calling this a cup so I could be wrong. I just do not see a rounded bottom. No one is always right I guess.

No recommendation.

When you're at the end of your rope, tie a knot and hold on!

Home Depot dips continue to attract.Home Depot Inc - 30d expiry - We look to Buy at 312.12 (stop at 298.22)

The stock is currently outperforming in its sector.

This stock has seen good sales growth.

Bespoke support is located at 312. 307 has been pivotal.

The primary trend remains bullish.

We look to buy dips.

Our profit targets will be 346.86 and 349.86

Resistance: 324 / 330 / 335

Support: 312 / 307 / 300

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Reasons for $HD puts before earningsPrice is unlikely to rise over 340 before earnings on 21 Feb. It may stay under 330. There is plenty of time for swing puts, for price to move back down in range (gray box) 328-280. The purple band shows upper supply zone.

1- 5ema < 12ema < 20sma

2- bearish reversal open

3- long red candle closed below recent rangebound days

4- RSI below 50

5- stochastic %D moving down

Home Depot Tries to Get Constructive Before CPIFew sectors are more sensitive to interest rates (and therefore inflation) than housing. With the major consumer price index due on Thursday, it’s a good time to consider industry heavyweight Home Depot.

First, the home-improvement chain rallied after the last two CPI reports were lower than feared. Will it react similarly to another positive number?

Next, you have the tight consolidation zone between roughly $310 and $322. Notice how prices attempted to break free of this range on Wednesday.

Third, the bounce followed a test of the 50-day simple moving average (SMA). That same moving average had a potential “golden cross” above the 200-day SMA about a month ago.

Finally, this chart includes our 2 MA Ratio custom script. It keeps the default settings of the 8- and 21-day exponential moving averages (EMAs). The most recent rally pulled the fast EMA above the slow EMA, a potential sign of short-term direction turning more positive.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

HD: RECTANGLE PATTERN AND FULL TECHNICAL ANALYSISHD ( HOME DEPOT ):

Consumer Cyclical - Home Improvement Retail.

Home Depot is included in the Down Jones Industrial Average.

My technical analysis on the stock:

The current downtrend took the stock 37% of its all time high of January 2022.

On June 23, HD initiated a strong bounce to $333 off the $265 level.

On August 17, HD initiated a huge drop back to 265, to bounce back again to the 330 zone where we currently are.

The stock is currently down 22% off its all time high.

Is this a buy?

No one knows, but let's look at technical analysis to help us make a decision.

As we see from the chart, the 265-269 zone is acting as a strong support while the 328-333 zone is acting as a strong resistance.

All of the above has created a nice range in the shape of a rectangle.

A rectangle is formed when the price is confined to moving between the two horizontal levels, creating a rectangle.

The pattern can indicate a few things:

- that the downtrend has paused and the stock is now consolidating before a continuation down. So back at the bottom of the rectangle and break down.

- that the downtrend has stopped and we're looking at a change of trend. Kind of bottoming pattern. So basically it can keep ranging for a while and break to the upside OR break to the upside in the next few days.

The rectangle ends when there is a breakout, and the price moves out of the rectangle.

Considering the above there are several ways to trade it:

1. If you think the price will keep consolidating within the range, you can short the stock at the top of the range . Your target is the bottom of the rectangle, with a stop just above the rectangle.

2. if you have a more bullish view, you can wait for a breakout off the rectangle and go long the stock , with a stop below the top line of the rectangle. All targets are mentioned on the chart (blue lines). Rectangle ultimate target being $400.

I'm leaning slightly bullish here because moving averages have started to rise, and I like the triple bottom, but who knows. Whatever your opinion is, best is to manage your risk.

Trade safe.

C+H into H+S as left shoulder is the top right side of the CupThis particular formation is something I seldom experience in my daily chart readings, but when it arises tends to guarantee a profit given this entry. First time I ever saw this I questioned, can two patterns be combined? I would have to agree. Proper confirmed entry would be at 328, as soon as I witnessed the potential first indication of a reversal of trend, a lower high in a previous uptrend. Another thing that added conviction was the appearance of larger than the other wicks in the formation of the H+S specifically that right shoulder. I entered Friday in this situation because of the conviction I had in regard to experiencing this formation previously. 5 min time frame is my preference for day trades. Hope this helps.

RectanglePrice has not broken the resistance line of the rectangle.

Rising wedges noted on daily and hourly. The bottom trendline of the wedge has not been broken.

Price is above the wedge

Rising wedges interrupt supply and demand and are known to be bearish in the end. This pattern is not valid unless bottom line is broken. It can be a long term pattern sometimes.

Possible W pattern also noted inside this rectangle.

No recommendation.

Possible Short at a good entry level.

Price is above the .382 of the trend up.

HD - could it break up soon?HD had been building a base for the past 9 months, forming a double bottom. It began to break above the 200 days moving average on 10th November and had sustain above this MA since.

Currently it looks close to attempting a break above a neckline @ 327. However with still much uncertainty and volatility in the market, it is safer to long the breakup with a test-sized position. Any pullback to retest the neckline could be a safer place to increase position size if the neckline proves to be a new support and trailing stops should be in place.

There is a chance the market could continue to whipsaw sideways for a while more until more economic data comes in.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Take care and Good Luck!

If earnings beat is baked into price, then $HD goes downJust because last time price sold down after earnings, does not mean it will happen again.

What I see is that price is trying to close above upper downtrend line but 20sma is still below 200sma. Also yesterday price opened at the line and dropped. 316-318 should hold as resistance for a pullback into yellow oval.

The 30m chart leans bullish for now, because 20ma and price are over 200ma. Thus I am suggesting a counter-trend swing trade. Buy fewer contracts and be comfortable to hold. Trade design uses 30m chart, which shows downside targets of 305, 300, 200sma (296-295).

When you enter close to resistance/supply, then stop losses are close to buy price. This is one reason I enjoy counter-trend trades. Even better, put contracts cost relatively less when they are bought before the downtrend momentum begins (IV is lower).

My trade: I bought 11/25 305P for 3.42 when stock was ~315.70.