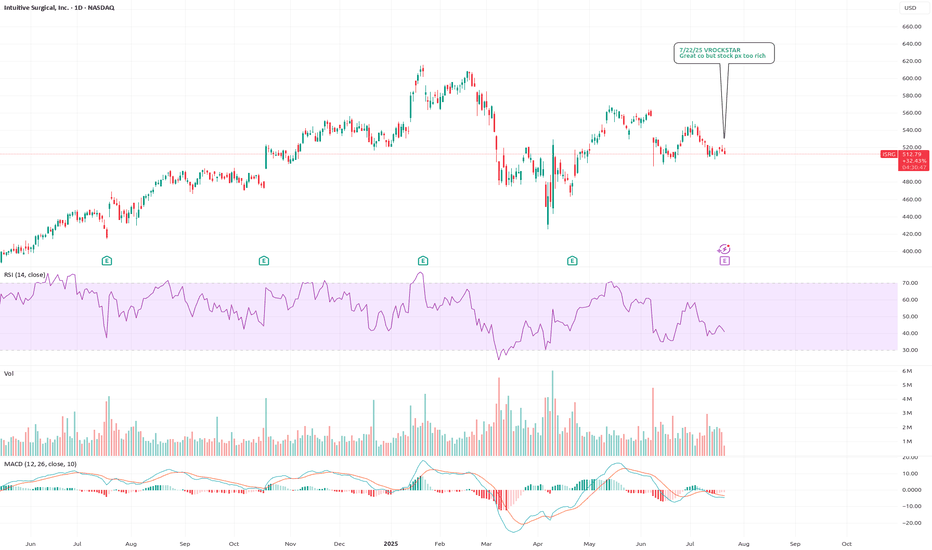

7/22/25 - $isrg - Great co but stock px too rich7/22/25 :: VROCKSTAR :: NASDAQ:ISRG

Great co but stock px too rich

- high multiples forgivable given rare leadership role

- "robotics and AI in high value healthcare industry"

- the valuation and growth aren't necessarily "too" expensive like memes pltr, cvna, sym, joby, qubt, qbts, rgti etc. etc

64,785.71

0.00 BRL

12.52 B BRL

45.03 B BRL

About Intuitive Surgical, Inc.

Sector

Industry

CEO

David J. Rosa

Website

Headquarters

Sunnyvale

Founded

1995

ISIN

BRI1SRBDR001

FIGI

BBG00RHFMBF3

Intuitive Surgical, Inc. engages in the provision of robotic-assisted surgical solutions and invasive care through a comprehensive ecosystem of products and services. Its products include Da Vinci Surgical and Ion Endoluminal systems. The company was founded by Frederic H. Moll, John Gordon Freund, and Robert G. Younge in November 1995 and is headquartered in Sunnyvale, CA.

Related stocks

Technically Intuitive Surgical looks like it has found supportBecause I don't know much about the healthcare industry I have been avoiding it thus far. However I have done some research on Intuitive Surgical and was surprised to learn about what they do. The company is a mix between technology and healthcare, there's nobody to compete with them either which wa

ISRG Daily Chart: Anticipating a Bounce from Key Demand Zone Overview:

ISRG has been in a recovery phase since its lows in early April, establishing an upward trend. However, after hitting significant resistance in May, the stock has entered a corrective pullback. This chart outlines a potential long setup, waiting for a strategic entry at a confluent demand

Køb af Intuitive SurgicalAbout the Company:

Intuitive Surgical Inc. is an American company that is a global leader in robotic-assisted surgery. They are best known for their da Vinci Surgical System, which enables surgeons to perform minimally invasive operations with high precision.

Business Model:

Intuitive Surgical p

ISRG in Buy ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's

ISRG: Back to a Key Zone, Great Risk/Reward EntryISRG just dropped into the same area where it consolidated from August to October before making its run toward all-time highs. You can wait for a close above the 200 EMA, but I’ve been waiting for this one for a long time—so I’m starting to work my way in.

Let’s see if the magic is still here and if

Intuitive Surgical (ISRG): Techno-Fundie PullbackFundamentals:

**I want to own a piece of a company comparable to CFLT (Confluent). And it turns out that Intuitive Surgical (ISRG) is the right one.

Technicals:

Daily chart pullback back into support. I am putting a tentative stop loss at 500 and a target at 700. Then, hold when it reaches there

Intuitive Surgical (ISRG) LongIntuitive Surgical Inc. (ISRG), is the pioneer behind the revolutionary da Vinci Surgical Systems, is transforming the landscape of minimally invasive surgery. With its cutting-edge robotic platforms, ISRG enables precision, efficiency, and enhanced patient outcomes, making it a leader in the medica

Speculative Madness: The Market’s Bubble Stocks Some stocks areSpeculative Madness: The Market’s Bubble Stocks

Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears.

Here’s my list of bubble stocks that scream unsustainable pricing:

SBUX, T, PLTR, BMY, PYPL, NFLX

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.