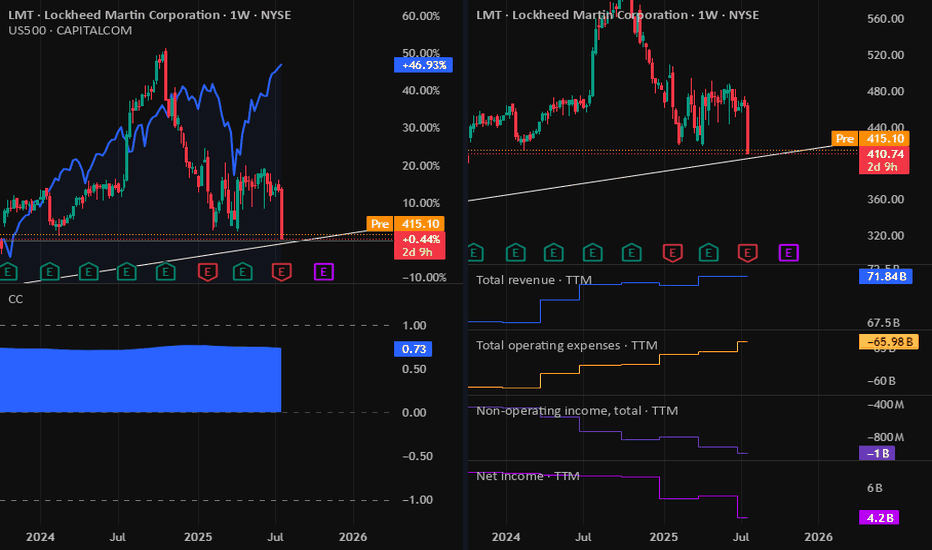

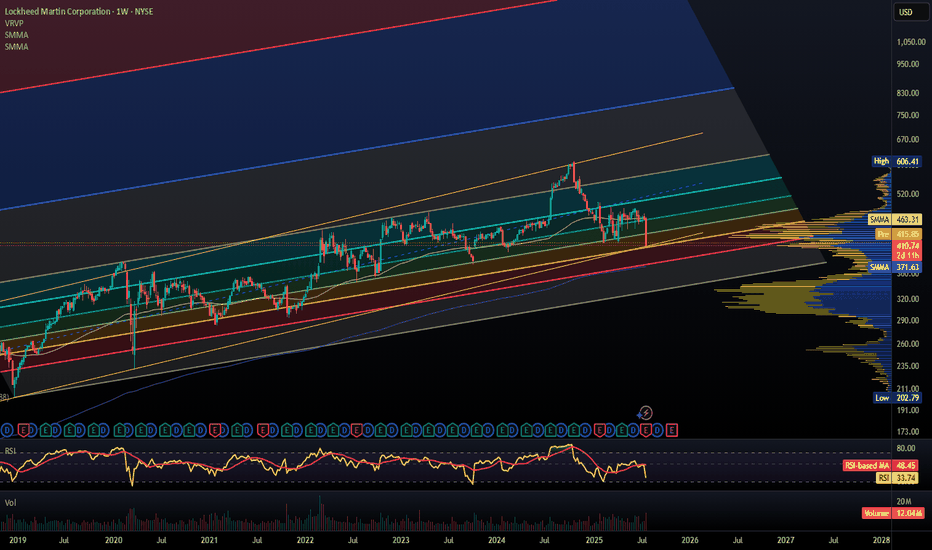

Lockheed Martin Stock in Bullish Trend - Key Levels to watchLockheed Martin (LMT) Stock in Strong Bullish Trend - Key Levels to Watch

Lockheed Martin's (LMT) stock is currently exhibiting a well-defined bullish trend, trading near a recent higher low that may serve as a crucial support level for the next upward move. The defense giant continues to benefit f

Key facts today

Lockheed Martin faces class action lawsuits over alleged securities fraud, claiming false statements on internal controls and risk management, following a stock price decline after Q2 2025 results.

On July 22, 2025, Lockheed Martin reported a $1.6 billion drop in Q2 earnings due to losses in its Aeronautics Classified, Canadian Maritime Helicopter, and Turkish Utility Helicopter programs.

23,236.35

0.10 BRL

28.77 B BRL

382.99 B BRL

About Lockheed Martin Corporation

Sector

Industry

CEO

James D. Taiclet

Website

Headquarters

Bethesda

Founded

1912

ISIN

BRLMTBBDR009

FIGI

BBG002V12WP8

Lockheed Martin Corp. is a global security and aerospace company, which engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services. It operates through the following business segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. The Aeronautics segment researches, designs, develops, manufactures, integrates, sustains, supports, and upgrades advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles, and related technologies. The MFC segment is involved in air and missile defense systems, tactical missiles and air-to-ground precision strike weapon systems, logistics, fire control systems, mission operations support, readiness, engineering support and integration services, manned and unmanned ground vehicles, and energy management solutions. The RMS segment designs, manufactures, services, and supports various military and commercial helicopters, surface ships, sea and land-based missile defense systems, radar systems, sea and air-based mission and combat systems, command and control mission solutions, cyber solutions, and simulation and training solutions. The Space segment includes the production of satellites, space transportation systems, and strategic, advanced strike, and defensive systems. The company was founded in 1995 and is headquartered in Bethesda, MD.

Related stocks

LMT: Lookheed Martin Dropped on Earnings 23-07-2025The dividends now is around 3% which is good for a strong company like Lookheed Martin. But as we are seeing a drop in company profits & Equity, and the stock price is near to a support level, we have to monitor the stock for the next few days or weeks. If all is ok, I will consider buying it.

Discl

Lockheed Martin (LMT) Stock in Strong Bullish TrendLockheed Martin (LMT) Stock in Strong Bullish Trend - Key Levels to Watch

Lockheed Martin's (LMT) stock is currently exhibiting a well-defined bullish trend, trading near a recent higher low that may serve as a crucial support level for the next upward move. The defense giant continues to benefit f

LMT – Long Setup IdeaLMT – Long Setup

Current: \$463.01 | Premarket: \$464.01 (+0.22%)

---

📊 Why I’m Eyeing the Long:

✅ Strong base at \$450–460 – buyers defending this level hard for months. Solid floor.

✅ Premarket green after red day = possible bounce play incoming.

✅ Deutsche Bank PT \$472 – not huge, but con

Buy Idea: LMT @ around $480This war is really happening right now between Israel, Iran, and the United States.

Because of this, countries are spending more money on weapons, defense systems and military gear.

The U.S. and its friends are about to increase their defense budgets and Lockheed Martin is one of the biggest co

U.S. – Iran Tensions: How Geopolitics Could Rattle the MarketsRising tensions between the United States and Iran are once again casting a shadow over global markets. From oil prices to defense contractors and transport stocks, this situation has the potential to ignite volatility across several key sectors.

🔍 What Traders Should Watch:

Oil & Energy Stocks – I

What happens when war whispers... and Wall Street listens? 🦅🔥

"🌍 📉📈

Lockheed Martin ( NYSE:LMT ) just pierced through a tightening triangle 🔺— like a fighter jet breaking the sound barrier ✈️💥

Coincidence? 🤔 Or is this price action a signal of something brewing behind the scenes? 🕵️♂️

⚔️ Global tension is rising.

💰 Defense budgets are booming.

And NY

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LMT4988881

Lockheed Martin Corporation 2.8% 15-JUN-2050Yield to maturity

6.90%

Maturity date

Jun 15, 2050

LMT4549067

Lockheed Martin Corporation 4.09% 15-SEP-2052Yield to maturity

6.27%

Maturity date

Sep 15, 2052

LMT5402220

Lockheed Martin Corporation 4.3% 15-JUN-2062Yield to maturity

6.25%

Maturity date

Jun 15, 2062

LOMA

LOCKHEED MARTIN 2045Yield to maturity

6.19%

Maturity date

Mar 1, 2045

LMT5402219

Lockheed Martin Corporation 4.15% 15-JUN-2053Yield to maturity

6.19%

Maturity date

Jun 15, 2053

LMT5741406

Lockheed Martin Corporation 5.2% 15-FEB-2064Yield to maturity

5.95%

Maturity date

Feb 15, 2064

LMT4002344

Lockheed Martin Corporation 4.07% 15-DEC-2042Yield to maturity

5.95%

Maturity date

Dec 15, 2042

US539830BL2

LOCKHEED MARTIN 15/46Yield to maturity

5.90%

Maturity date

May 15, 2046

LMT5592253

Lockheed Martin Corporation 5.2% 15-FEB-2055Yield to maturity

5.76%

Maturity date

Feb 15, 2055

LMT5492512

Lockheed Martin Corporation 5.9% 15-NOV-2063Yield to maturity

5.68%

Maturity date

Nov 15, 2063

LMT5492511

Lockheed Martin Corporation 5.7% 15-NOV-2054Yield to maturity

5.62%

Maturity date

Nov 15, 2054

See all LMTB34 bonds

Curated watchlists where LMTB34 is featured.