$MO breaking out! Altria showing strong momentum as it challenges the $60 resistance with higher lows since April. Williams Alligator confirming bullish trend with all three lines aligned. Solid 7%+ dividend yield while we ride this uptrend. Higher highs coming with strong support at $53.50. #Bullish #Dividends #TechnicalBreakout

MOOO34 trade ideas

Altria Group (MO) – Rising Inside Ending Diagonal, Possible BaseAltria (MO) is advancing within a rising ending diagonal structure. After completing wave 5 of wave C, price is currently moving upward within the wedge.

Although there is no contact yet with the lower diagonal boundary, a third test remains structurally possible. Such formations often invite a final pullback to the base before resolution. This scenario remains valid while price stays within the diagonal.

If a third test occurs, the lower boundary becomes a key decision point. A bounce would confirm diagonal strength, while a breakdown may target $50 and potentially the long-term trendline near $45.

There is no confirmation of weakness at this time. However, the pattern’s nature warrants preparedness for a potential revisit to the wedge base.

Structure: Ending Diagonal

Status: Price rising inside the wedge

Scenario: Possible third test of base (not yet tested)

Levels to watch: $50 (consolidation), $45 (trendline)

OptionsMastery: A break and retest on MO!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

OptionsMastery: Immediate buy on MO!?🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Everyone’s scared of booze stocks… Why I’m still buyingThis analysis is provided by Eden Bradfeld at BlackBull Research.

One of the things I find interesting is that a lot of people say “why do you like booze stocks so much Eden” and yet many of these same people are at the pub, or buying En primeur from Glengarry Wines. The short answer is — I like stocks that trade at multi-year lows with a predictable product. There is a fairly hysterical article in the FT wondering “Is alcohol the new tobacco?” To which I say, well, tobacco companies are absolute cash machines. The best performing stock in the S&P, of all time, to the best of my knowledge, is Altria.

I know investing in tobacco is not fashionable (and yet, how many people do you see on the street vaping?). I know it goes against “ESG” and the scolds at public health slap you on the hand and say “gosh that is very bad for you!”. But the truth is that tobacco does generate tremendous profits — the net income margin for British American Tobacco is 39.1%. For those in the back, that’s for every $1 you sell, you make 39.1 cents of profit. There’s very few businesses with such fantastic operating margins — Visa’s net income margin is 56%. If I owned only one stock forever, I guess it’d probably be Visa.

My point is — waving your hands about and saying “oh no! Tobacco!” belies the economics of it. The tobacco companies are doing very well, thank you very much. It will come as no surprise that cigarette smoking has been replaced by vaping. To paraphrase Oscar Wilde, news of nicotine’s demise has been greatly exaggerated.

This is not saying to invest in tobacco stocks, but my point is that human habits don’t change. They merely evolve, but the song remains the same.

To be fair — alcohol consumption is declining. But it isn’t declining at a rate that calls for any kind of alarm. Most of the companies I follow — Brown Forman, Diageo, Constellation, etc, reported largely flat sales. It’s also instructive to look to history.

In other words — alcohol consumption has largely normalised in the last few decades. There’s still cause for worry — I think wine is one area of concern, and Cognac is another — both industries need to think about how they introduce younger drinkers to their product. This is why I largely shy away from wine (and why Constellation is selling their wine portfolio). “Evergreens” like Guinness (a Diageo brand) and Jack Daniel’s (a Brown-Forman brand) are predictable.

Once again — a bunch of ratios for ya’ll:

Brown-Forman: 18x fwd earnings

Pernod: 12x fwd earnings

Constellation Brands: 13.25x fwd earnings

And so on… these stocks trade like they are discount retailers in biddlybunk Ohio. They are not. There’s the issue. There’s where value lies. Cigarettes never went away; they became vapes. In my opinion, I don’t see booze going away anytime soon either.

$MO Rally - Base - Rally Breakout say no to this stuff ( word substitute)

About Altria Group, Inc.

Altria Group, Inc. is a leading US-based holding company in the tobacco industry. Here's a brief overview:

* Founded in 1919

* Headquartered in Richmond, VA

* Operates through three main segments:

+ Smokeable Products: cigarettes, machine-made large cigars, and pipe tobacco

+ Oral Tobacco Products: MST, snus, and oral nicotine pouches

+ All Other: NJOY, Helix ROW, and the IQOS System heated tobacco business

As a major player in the US tobacco market, Altria Group, Inc. has a long history of innovation and growth.

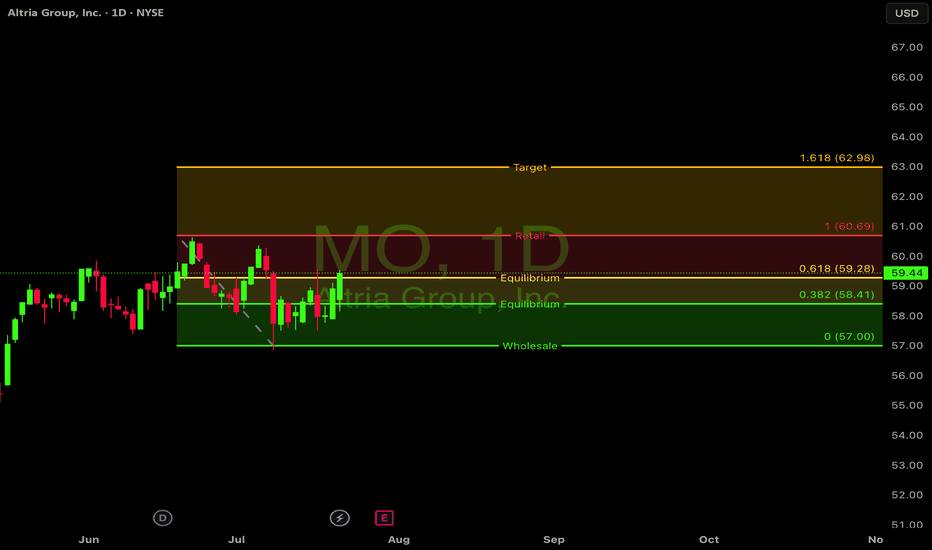

Altria $MO to $57+ if They Beat Earnings on ThursdayAltria NYSE:MO is trading at a P/E ratio of 9 right now, which is pretty crazy. Tech sectors overall are also showing signs of extreme uncertainty, which furthers the fundamental argument for value stocks like NYSE:MO and NYSE:PM as they approach earnings. 🔥🛡💎

If Altria provides a solid report on Thursday morning (pre-market), then I think this inverse head and shoulders pattern can take the stock back up to $57-$58 in the week(s) that follow. 💸📈🎯

NYSE:MO rallied +10% as a result of its last earnings report on October 31st. I see no reason it can't happen again! As we always say at WAVE$ Cap, history does tend to rhyme. 😮💨🏆

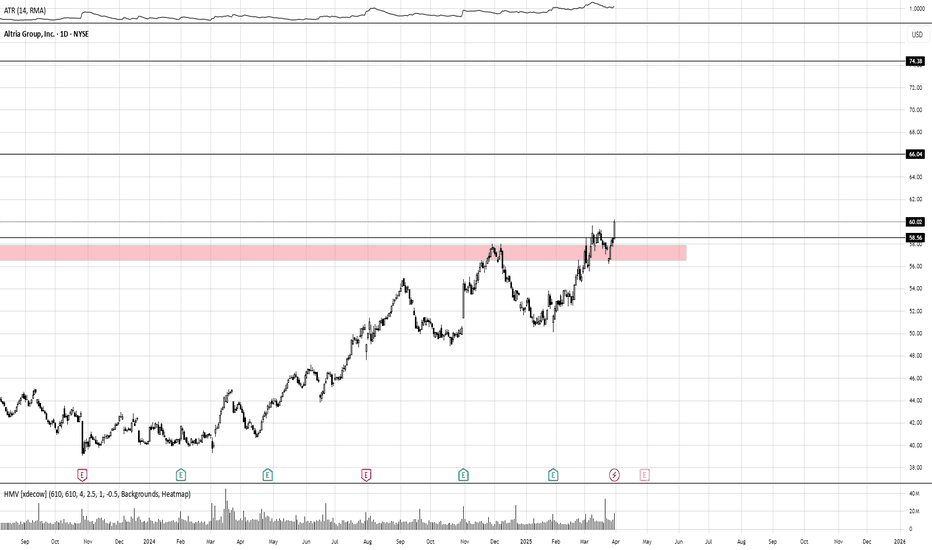

$MO Double D Bottom BreakoutHere on NYSE:MO we can see a very clearly defined double bottom on the Quarterly chart with the current quarter candle pushing into and above the breakout zone.

Quarterly CCI is also firmly broken out into positive momentum sure to keep those milky double d bottoms producing sweet sweet buttermilk all the way up to our 75$ Price target.

Get some baby!

Buying MO should be your only M.OTop 3 Technical Reasons MO Will Rise

Breakout from Support: MO recently bounced off its $41 support level, a floor it has respected for months. Buyers are clearly showing up to the party, and the stock looks ready to grind higher.

Strong Relative Strength: The stock’s RSI has climbed out of oversold territory and is now trending upwards. This signals that momentum is finally shifting in favor of the bulls.

Golden Cross Setup: The 50-day moving average is curling upwards toward the 200-day, hinting at a potential golden cross. This classic bullish signal tends to lure technical traders like moths to a flame.

Top 3 Fundamental Reasons MO Will Rise

Dividend Magnet: With a fat dividend yield north of 8%, Altria attracts income-focused investors like flies to honey. As rates stabilize, the stock’s high payout looks increasingly attractive compared to bonds.

Resilient Revenue: Despite ongoing regulatory challenges, Altria continues to rake in cash thanks to its pricing power in cigarettes. Add its strategic investments in alternatives like smokeless tobacco and cannabis, and you’ve got a company diversifying for the future.

Recession-Proof Demand: Let’s face it—people don’t stop smoking when times get tough. If anything, vice products tend to hold up better during economic uncertainty, making Altria a steady defensive play.

Potential Paths to Profit

Lowest Risk: Buy shares outright, sit back, and collect dividends while the stock aims for $45–$46.

Options Play: Sell cash-secured puts at the $42 strike to either pocket premium or get assigned shares at a discount.

Covered Call Combo: Own shares and sell January $45 calls to generate additional income while capping upside around 10%.

Disclaimer: We are not a brokerage or investment firm. We do not offer financial advice or investment advice and/or signals. This is not certified financial education. We offer access to the daily thought process of an individual and his experiences. We do not offer refunds. All sales are final.

Altria Group ($MO) Pushing Higher with Cup & Handle BreakoutNYSE:MO is showing strength after breaking out of a Cup & Handle pattern, aiming for a target near $70, a potential 27.8% upside.

Cup & Handle Breakout – Recent breakout points to a target near $70, supporting a bullish outlook.

Channeling Upward – Moving within a strong ascending channel, providing structure for the uptrend.

SMA 150 Support – The 150-day SMA sits below, adding stability to the trend.

Volume and CCI – Volume at 1.28M shows solid interest, while the overbought CCI hints at potential short-term resistance.

Key Support – Strong support around $54.55, close to the 52-week high, reinforces a solid base.

If NYSE:MO holds its momentum within the channel, that $70 target could be within reach, although it may retest support at $54.55 first.

MO oversold - Long at 51.72Buying as long as it stays oversold and sell each lot as it becomes overbought and profitable.

I'll post details later but system is 23-1* in the last 12 months on this ticker. Not huge average gains, but if the Fed cut is bigger than expected, its 8% dividend is a safe haven. Nice uptrend too.

Not investment advice - just edutainment.

TREND OF MARLBOROI shared it from my phone before, so the graphic was not clear. This time I am posting it more clearly from the computer. Reverse shoulder head and shoulders pattern worked on Marlboro. Bullish confirmation was also received from the neck area. Formation target $50.94

No need for indicators at all

MO services smokers who always need another LONGMO moves on the 2H like a large caps and seems to have upside in its current trend up.

I am targeting recent pivot highs and an overall trade of 10% . I will look at call options as well.

MO has two minor earnings beats in a row after a miss. Albiet minor fundamental momentum,

I will take it as a sign that MO will do well. Its business model is keeping smokers content

and being competitive with its margins to prevent demand destruction.

The Rocket Booster Strategy In 3 StepsNow when you are looking at this stock I want you to understand

that this type of strategy is good for investment purposes only

This means you are not allowed to use margin

To trade these types of stocks.

Otherwise, you will lose your money to trading commissions

and market volatility

So instead you can use the rocket booster strategy to take advantage

of this market move

You may think to yourself

"What is the rocket booster strategy?"

The Rocket Booster Strategy In 3 Steps:

Step 1 - The 50 Day moving average has to cross above the 200 Day Moving Average

Step 2 - The 200-Day Moving Average has to be below the 50-Day Moving Average.

Step 3 - The price should be above both the 50 Day moving average and the 200 Day Moving Average.

If you follow these steps then you will see the buying signal as shown in this chart above

Rocket boost its content to learn more.

Disclaimer: This is not financial advice please do your own research before you buy or sell anything

Bullish Patterns on [MO] stock + 9.59% Dividend Yield (Wyckoff) The cumulative volume of the "Wyckoff/Weis Wave" shows an interesting accumulation of a solid company. After the recent declines, we can see a clear basis for the price rebound. The Wyckoff Wave Volume Indicator shows the distribution of buying and selling wave forces. From the current impression, we can conclude that sellers are losing strength and we see more and more active buyers. I expect an upward movement in the coming weeks. Additionally, it is a company with solid foundations that also pays a dividend of 9.59%

Altria: Down the hatch! 🍺The price of Altria is still struggling to break below the $40.35 support level. We expect the price to dip below this support and reach the magenta Target Zone between $38.52 and $37.39. Only here do we expect the end of wave-(b) and thus the transition into the last sub-wave of the turquoise wave B

ALTRIA Stock Chart Fibonacci Analysis 020124 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 42.2/61.80%

Chart time frame : D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Altria Group Inc (MO): Navigating Challenges & Driving Growth

In the ever-evolving landscape of the tobacco industry, Altria Group Inc (NYSE: NYSE:MO ) stands as a resilient force, weathering challenges and steering towards growth. The recently released 2023 financial results and 2024 guidance provide a comprehensive insight into the company's strategic moves, financial performance, and its commitment to shareholder value.

Challenges and Resilience:

Altria (NYSE: NYSE:MO ) faced a challenging year in 2023, with a 2.4% decrease in net revenues, reflecting the industry-wide struggle against stricter regulations and evolving consumer preferences. The decline in shipment volumes of traditional cigarettes by 9.9% highlights the ongoing shift away from conventional tobacco products. However, amidst these challenges, Altria (NYSE: NYSE:MO ) demonstrated resilience by achieving a 2.3% growth in adjusted diluted EPS, reaching $4.95. This growth is a testament to the company's ability to adapt to changing market dynamics and capitalize on opportunities in the smoke-free and alternative nicotine products segment.

Strategic Investments and Diversification:

Altria's (NYSE: NYSE:MO ) strategic investments have played a crucial role in its resilience. With a 10% stake in Anheuser-Busch InBev and a 42% interest in Cronos Group, the world's largest brewer and a leading player in the cannabis market, respectively, Altria has diversified its portfolio beyond traditional tobacco. The recent acquisition of Njoy Holdings further exemplifies the company's commitment to staying at the forefront of evolving consumer preferences.

Smoke-Free Initiatives:

Amidst declining cigarette shipments, Altria's (NYSE: NYSE:MO ) focus on smoke-free alternatives has become increasingly evident. The report highlights the company's investment in NJOY vapes and its on! nicotine pouches. Despite a 32.8% growth in on! nicotine pouches shipment volumes, the company faces the challenge of a shifting customer base towards newer nicotine consumption methods. Altria's (NYSE: NYSE:MO ) dedication to innovation and adapting to evolving consumer habits positions it well in the face of increasing competition from alternatives like vapes.

Financial Outlook and Shareholder Value:

Despite a slight decline in quarterly net revenues in its smokable products division and challenging economic conditions leading to some customers migrating to cheaper brands, Altria (NYSE: NYSE:MO ) remains confident in its financial outlook. The announcement of a new $1 billion share repurchase program underscores the company's confidence in its financial stability and its commitment to delivering value to shareholders.

Conclusion:

Altria Group Inc's (NYSE: NYSE:MO ) 2023 performance showcases a company navigating a dynamic market with strategic foresight. The growth in adjusted diluted EPS, coupled with strategic investments and a commitment to smoke-free alternatives, positions Altria (NYSE: NYSE:MO ) as a key player in the tobacco industry's transformation.