ORCL34 trade ideas

$ORCL - Consolidation for Breakout Imminent ORCL is going up... or down :) I prefer to buy this stock so I'm waiting for a strong breakout of the descending TL with my entry on the chart. My 1 year price target is at $65 if that lower TL holds.

If you found this to be insightful or helpful, please show appreciation by hitting that like button. If you want more ideas I invite you to follow as well! I try to be here for all of my followers with any questions they might have. Feel free to shoot me a DM or comment below to start a conversation!

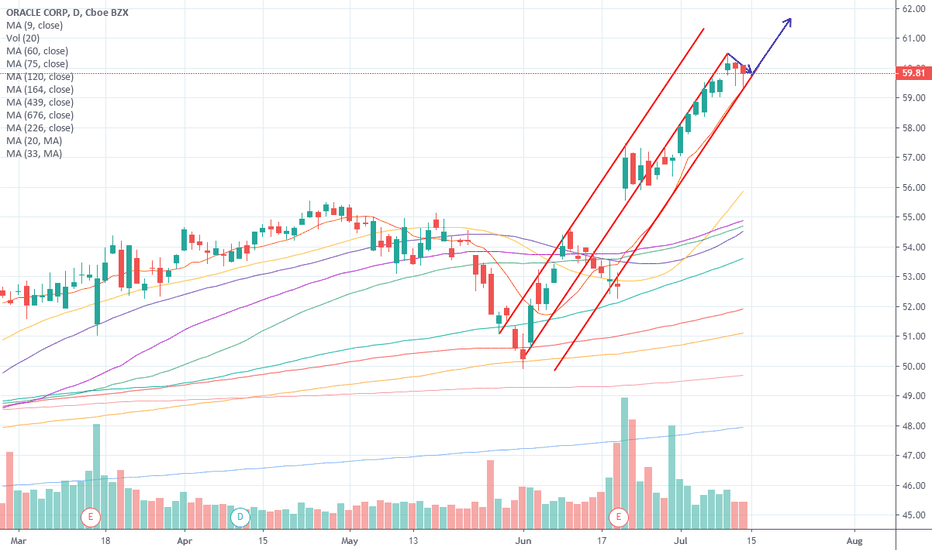

$ORCL Trade setup for OracleEntry level $57.4 = Target price $61.63 = Stop loss $55.73

Oracle Corp. engages in the provision of products and services that address all aspects of corporate information technology environments. It operates through the following business segments: Cloud and License, Hardware, and Services. The Cloud and License segment markets, sells, and delivers applications, platform, and infrastructure technologies. The Hardware segment provides hardware products and hardware-related software products including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management and other hardware related software, and related hardware support. The Services segment offers consulting, advanced support, and education services. The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner and Edward A. Oates on June 16, 1977 and is headquartered in Redwood City, CA.

ORCL - A Bullish Future?The stock has created a symmetrical triangle pattern since the beginning of June. Also mixed into this pattern is an earnings gap halfway through the month. The price has continued to trade within this gap range but the consolidation has led to the stock price moving out of the triangle pattern. The recent pullback, while remaining in the gap zone, is now testing the previous triangle resistance line as support. The stock is also exiting an oversold position.

I have two Fibonacci Extension levels targeted. The 61.8% & 100% levels are noted by the dashed green lines should the bullish move continue.

$ORCL On way to challenge all time highs.Entry level above the 100ma @ $55.60 = Target price $60.00.

Rising 200 & 50 Ma's are rising and the stock has bounced off them as per usual.

Buy-side volume increasing.

RSI in strong uptrend.

Stochastic has reset and moving higher.

MACD looks set to reverse away from zero line, while histogram ticks higher.

It reads like Amazon!I think we are headed for a red week or 2 in the US markets. Oracle broke both Kijun and Tenkan in the past two weeks on the Weekly. I would expect a 3rd red candle here. On the Monthly it broke the Tenkan giving an alert for bullish momentum lost,this is reminiscent of Amazon on the monthly as well. The 1st price target is the monthly Kijun which is weekly SSB. The 2nd target is a monthly flat Tenkan area below the Kijun.

Entry: 2 small position @54.17

SL: 56.46

TP1: 51.39

TP2:47.97

NB: If you dont manage your risk it will manage you!!

ORCL technicals at resistance level with earningsTechnical Analysis

On June 20th, we started and important channel, and we are back at this level at $55.5

Since this date, we have a slight RSI upward trend, with an even bigger OBV uptrend.

Fibonacci retracement level at 50%

Important dates

Earnings will be announced Thursday September 12th, after the close.

Daily ORCL stock price trend forecasts analysis.12-JUL

Investing position: In Rising section of high profit & low risk

S&D strength Trend: In the midst of an adjustment trend of downward direction box pattern price flow marked by limited rises and downward fluctuations.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

Forecast D+1 Candlestick Color : GREEN Candlestick

%D+1 Range forecast: 0.5% (HIGH) ~ -0.6% (LOW), 0.1% (CLOSE)

%AVG in case of rising: 1.1% (HIGH) ~ -0.4% (LOW), 0.8% (CLOSE)

%AVG in case of falling: 0.5% (HIGH) ~ -1.0% (LOW), -0.4% (CLOSE)