PEPsico is looking to pop up further NASDAQ:PEP had a strong gap up, and with the latest completion of the cup and handle, it is clear that the upside is likely coming back. Bullish engulfing candle was seen as a strong contender for continued upside. My guess is with the positive momentum, the stock is likely to break above the downt

24,709.52

0.00 BRL

51.63 B BRL

495.17 B BRL

About PepsiCo, Inc.

Sector

Industry

CEO

Ramon Luis Laguarta

Website

Headquarters

Purchase

Founded

1965

ISIN

BRPEPBBDR005

FIGI

BBG0025NPJN5

PepsiCo, Inc. engages in the manufacture, marketing, distribution, and sale of beverages, food, and snacks. It operates through the following business segments: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), PepsiCo Beverages North America (PBNA), Latin America (LatAm), Europe, Africa, Middle East, and South Asia (AMESA), and Asia Pacific, Australia and New Zealand, and China Region (APAC). The FLNA segment consists of branded convenient food businesses in the United States and Canada. The QFNA segment includes cereals, rice, and pasta under the Quaker, Pearl Milling Company, Quaker Chewy, Cap'n Crunch, Life, and Rice-A-Roni brands. The PBNA segment is composed of beverage concentrates, fountain syrups, and finished goods under various beverage brands such as Pepsi, Gatorade, Mountain Dew, Diet Pepsi, Aquafina, Diet Mountain Dew, Sierra Mist, and Mug. The LatAm segment covers beverage, food, and snack businesses in the Latin American region. The Europe segment offers beverage, food, and snack goods in Europe and Sub-Saharan Africa regions. The AMESA segment deals with all beverage and convenient food businesses in Africa, the Middle East, and South Asia. The APAC segment refers to all business operations in the Asia Pacific, Australia and New Zealand, and China region. The company was founded by Donald M. Kendall, Sr. and Herman W. Lay in 1965 and is headquartered in Purchase, NY.

Related stocks

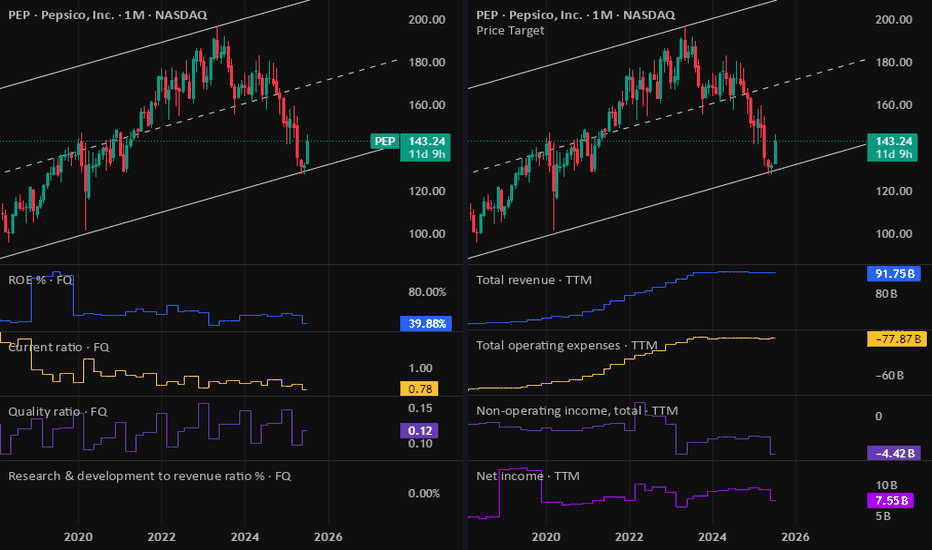

PEP: PepsiCo Earnings resultsIts looks like PEP is a buy now. Just want to double check on future sales growth as it is stable for a while. Lower stock price made the dividend very attractive since PEP is a defensive stock.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

PepsiCo (PEP) Stock Rallies 7.4% Following Earnings ReportPepsiCo (PEP) Stock Rallies 7.4% Following Earnings Report – What Comes Next?

Yesterday, PepsiCo Inc. (PEP) released its quarterly earnings report, which significantly exceeded market expectations:

→ Earnings per share (EPS) came in at $2.12, surpassing the forecast of $2.02.

→ Gross revenue reach

PEP is in the Wyckoff Accumulation phaseThis Week (July 8 - 12):

Support: The recent consolidation shelf around $130.00 is the first line of defense. The absolute low and our line in the sand is the Selling Climax low at $127.60.

Resistance: The 20-week moving average at $138.30 is the immediate ceiling it needs to break through.

Next

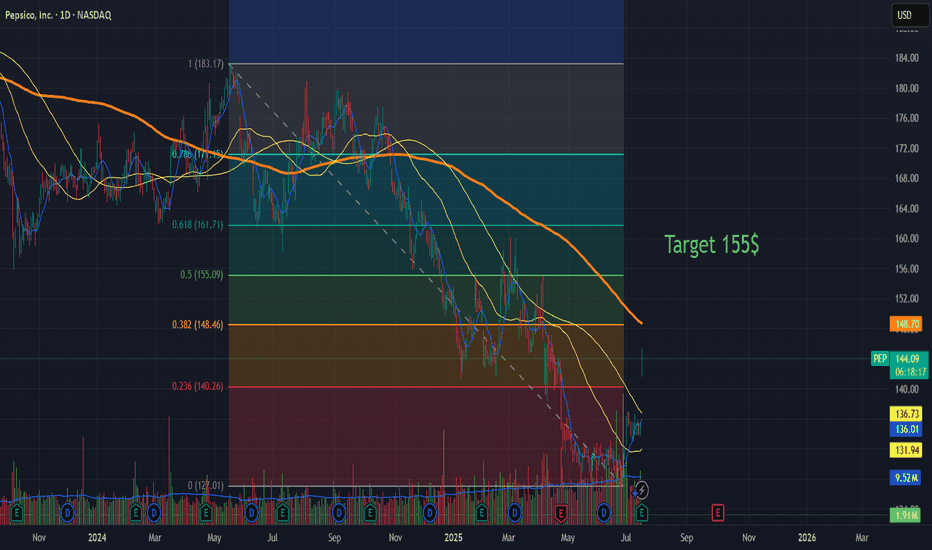

PEP Long-Term Buy Opportunityhi Traders,

The chart presents a compelling long-term buying opportunity for PepsiCo (PEP). The price is currently sitting in the identified "buy zone", a historically reliable area for accumulation. If we experience further dips, it’s still considered a buying opportunity all the way down to the 2

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US713448FG8

PEPSICO 21/51Yield to maturity

6.69%

Maturity date

Oct 21, 2051

PEP4895343

PepsiCo, Inc. 2.875% 15-OCT-2049Yield to maturity

6.52%

Maturity date

Oct 15, 2049

PEP4864210

PepsiCo, Inc. 3.375% 29-JUL-2049Yield to maturity

6.24%

Maturity date

Jul 29, 2049

US713448FF0

PEPSICO 21/41Yield to maturity

6.24%

Maturity date

Oct 21, 2041

US713448DP0

PEPSICO INC. 16/46Yield to maturity

6.19%

Maturity date

Oct 6, 2046

PEP4968014

PepsiCo, Inc. 3.625% 19-MAR-2050Yield to maturity

6.19%

Maturity date

Mar 19, 2050

PEP4968015

PepsiCo, Inc. 3.875% 19-MAR-2060Yield to maturity

6.17%

Maturity date

Mar 19, 2060

PEPS

PEPSICO INC. 17/47Yield to maturity

5.97%

Maturity date

May 2, 2047

PEP3887895

PepsiCo, Inc. 3.6% 13-AUG-2042Yield to maturity

5.96%

Maturity date

Aug 13, 2042

PEP5447005

PepsiCo, Inc. 4.2% 18-JUL-2052Yield to maturity

5.93%

Maturity date

Jul 18, 2052

PEPB

PEPSICO INC. 12/42Yield to maturity

5.76%

Maturity date

Mar 5, 2042

See all PEPB34 bonds