Key facts today

Petroleo Brasileiro SA (PETR3) cut natural gas prices to distributors by 14% from August 1, driven by lower oil prices and a stronger Brazilian real. Prices have dropped 32% since December 2022.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.73 BRL

36.61 B BRL

490.83 B BRL

3.70 B

About PETROBRAS ON N2

Sector

Industry

CEO

Magda Chambriard

Website

Headquarters

Rio de Janeiro

Founded

1953

ISIN

BRPETRACNOR9

FIGI

BBG000BFTBL4

Petroleo Brasileiro SA Petrobras is a Brazil-based integrated oil and gas company. The Company's activities are divided into five business segments: Exploration and Production (E&P), which focuses on the exploration, development and production of crude oil, natural gas liquid (NGL) and natural gas in Brazil and abroad; Refining, Transportation and Marketing, which mainly covers the refining, logistics, transport and trading of crude oil and oil products, export of ethanol, as well as extraction and processing of shale; Gas and Power, which includes transportation and trading of LNG and natural gas, as well as generation and sale of electricity; Distribution, which sells oil products through own retail network and wholesale channels, and Biofuels, which includes the production of biodiesel and its co-products, as well as ethanol-related activities. The Company operates in the Americas, Africa, Asia and Europe.

Related stocks

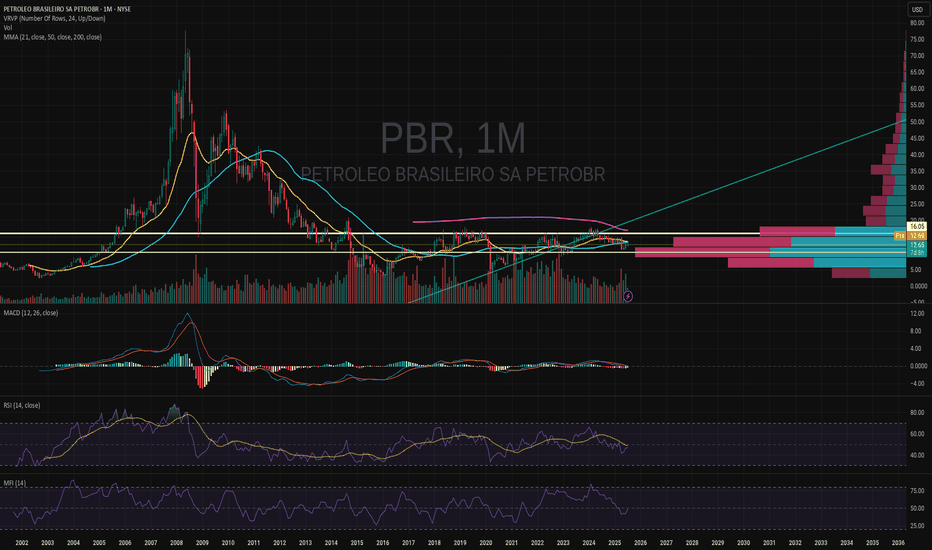

PBR Trading Strategy

This concise plan outlines key entry points and profit targets for trading PBR. Follow the strategy to capture upward moves while managing risk effectively.

Entry Points:

• 14.5: Initial entry

• 13.7: Add on a pullback

• 12.7: Further averaging down if needed

Profit Targets:

• 16.0: Take partial

PBR.A goes up from here.PBR and PBR.A is set up to retake the previous highs as Oil continues its rise. Shocks to global supply are imminent. New discoveries give the company plenty of room to continue to increase production and global share well into the future. Political risk baked in. Max pain 12.50-11.50. Stop set at 1

PBR - Petrobras Oil and Gas, BrazilPetrobras is a major Brazilian oil and gas company, founded in 1953 and headquartered in Rio de Janeiro. It focuses on exploring, producing, refining, transporting, and selling oil and gas. As one of the world’s largest energy companies, Petrobras is a key player in the industry.

The company’s main

$PBR Bullish Sentiment (Gap Fill)Reasons for Bullish Sentiment:

- Daily inside candle; currently in the middle of daily broadening formations

- Potential upside movement as the MACD line (blue) is quickly approaching the signal line (orange) indicating of bullish sentiment.

- RSI at 45 (can go down to under 30 but there is a highe

PBR Back from Earnings DumpBrazil's largest oil producer just announced another huge dividend of 0.339. Ex-div June 12, payment Sep 26. That's 18.76%!

Price action is reversing off support of 14.96 and HMA crossed over bullish. We've seen this before back in March from another earnings dump and it recovered nicely.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US76716XAB82

RioOilFinTrust 6,75% 06/01/2027Yield to maturity

14.67%

Maturity date

Jan 6, 2027

USU76673AB55

RioOilFinTrust 6,75% 06/01/2027Yield to maturity

12.21%

Maturity date

Jan 6, 2027

US71647NBJ7

PETROBR.G.F. 21/51Yield to maturity

8.19%

Maturity date

Jun 10, 2051

5P0E

PETROBRAS GBL FIN.15/2115Yield to maturity

7.83%

Maturity date

Jun 5, 2115

US71647NBG3

PETROBR.G.F. 20/50Yield to maturity

7.72%

Maturity date

Jun 3, 2050

US71647NAA7

PETROBRAS GBL FIN. 13/43Yield to maturity

7.57%

Maturity date

May 20, 2043

PTRB4808419

Petrobras Global Finance BV 6.9% 19-MAR-2049Yield to maturity

7.52%

Maturity date

Mar 19, 2049

US71647NAK5

PETROBRAS GBL FIN. 14/44Yield to maturity

7.11%

Maturity date

Mar 17, 2044

US71645WAS0

PETROBRAS GLOBAL FI.11/41Yield to maturity

6.99%

Maturity date

Jan 27, 2041

XS0982711474

PetrobrGlobaFin 6,625% 16/01/2034Yield to maturity

6.99%

Maturity date

Jan 16, 2034

US71647NBF50

PetrobrGlobaFin 5,093% 15/01/2030 Rule 144AYield to maturity

6.87%

Maturity date

Jan 15, 2030

See all PETR3 bonds

Curated watchlists where PETR3 is featured.

Political stocks: The corridors of power

15 No. of Symbols

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of PETR3 is 35.02 BRL — it has decreased by −0.06% in the past 24 hours. Watch PETROBRAS ON N2 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMFBOVESPA exchange PETROBRAS ON N2 stocks are traded under the ticker PETR3.

PETR3 stock has risen by 3.98% compared to the previous week, the month change is a 2.85% rise, over the last year PETROBRAS ON N2 has showed a −0.25% decrease.

We've gathered analysts' opinions on PETROBRAS ON N2 future price: according to them, PETR3 price has a max estimate of 46.00 BRL and a min estimate of 34.00 BRL. Watch PETR3 chart and read a more detailed PETROBRAS ON N2 stock forecast: see what analysts think of PETROBRAS ON N2 and suggest that you do with its stocks.

PETR3 reached its all-time high on Feb 21, 2025 with the price of 40.56 BRL, and its all-time low was 0.61 BRL and was reached on Jan 31, 2000. View more price dynamics on PETR3 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PETR3 stock is 3.16% volatile and has beta coefficient of 0.95. Track PETROBRAS ON N2 stock price on the chart and check out the list of the most volatile stocks — is PETROBRAS ON N2 there?

Today PETROBRAS ON N2 has the market capitalization of 446.16 B, it has decreased by −3.66% over the last week.

Yes, you can track PETROBRAS ON N2 financials in yearly and quarterly reports right on TradingView.

PETROBRAS ON N2 is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

PETR3 earnings for the last quarter are 2.67 BRL per share, whereas the estimation was 2.60 BRL resulting in a 2.57% surprise. The estimated earnings for the next quarter are 1.61 BRL per share. See more details about PETROBRAS ON N2 earnings.

PETROBRAS ON N2 revenue for the last quarter amounts to 118.60 B BRL, despite the estimated figure of 124.28 B BRL. In the next quarter, revenue is expected to reach 115.11 B BRL.

PETR3 net income for the last quarter is 35.21 B BRL, while the quarter before that showed −17.04 B BRL of net income which accounts for 306.58% change. Track more PETROBRAS ON N2 financial stats to get the full picture.

PETROBRAS ON N2 dividend yield was 10.66% in 2024, and payout ratio reached 148.05%. The year before the numbers were 14.02% and 57.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 29, 2025, the company has 49.19 K employees. See our rating of the largest employees — is PETROBRAS ON N2 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PETROBRAS ON N2 EBITDA is 216.01 B BRL, and current EBITDA margin is 43.84%. See more stats in PETROBRAS ON N2 financial statements.

Like other stocks, PETR3 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PETROBRAS ON N2 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PETROBRAS ON N2 technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PETROBRAS ON N2 stock shows the buy signal. See more of PETROBRAS ON N2 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.