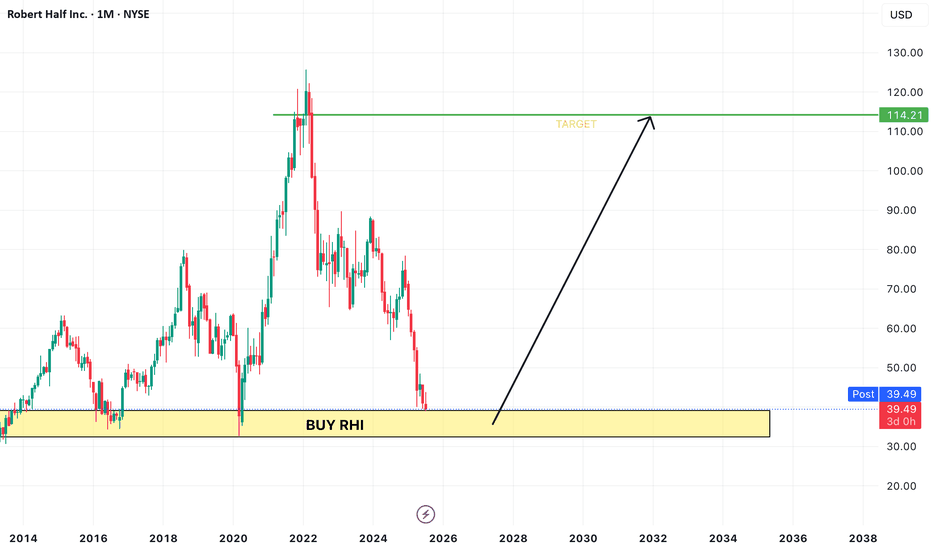

Robert Half | RHI | Long at $37.58Robert Half NYSE:RHI is a company that provides talent solutions and business consulting services in the US and internationally. It's a cyclical stock. Currently, the price has entered my "crash" simple moving average zone ($37-$33) and has historical bounced from this area. This doesn't mean the

22,494.00

0.01 BRL

1.36 B BRL

31.25 B BRL

About Robert Half Inc.

Sector

Industry

CEO

Michael Keith Waddell

Website

Headquarters

Menlo Park

Founded

1948

ISIN

BRR1HIBDR002

FIGI

BBG00RHFNJT0

Robert Half, Inc. engages in the provision of talent solutions and business consulting services. It operates through the following segments: Contract Talent Solutions, Permanent Placement Talent Solutions, and Protiviti. The Contract Talent Solutions segment refers to the fields of finance and accounting, technology, marketing and creative, legal, and administrative and customer support. The Permanent Placement Talent Solutions segment focuses on accounting, finance, tax, and accounting operations personnel. The Protiviti segment solves problems in finance, technology, operations, data, digital, legal, human resources, governance, risk, and internal audit. The company was founded by Robert Half in 1948 and is headquartered in Menlo Park, CA.

Related stocks

White Collar job sentiment has been plunging since 2022Robert Half has been around for quite sometime...I look at this chart as a sentiment indicator for "white collar workers". While white collar workers and the American middle class are not synonymous you could say that many people in the middle class are employed as white collar workers so it is a c

RHI to $68My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zones at bottom of channels (period 100 52 & 26)

Stochastic Momentum Ind

5/30/24 - $rhi - detailed thinking: i'd remain greedier to buy.5/30/24 - vrockstar - NYSE:RHI - doing a follow up comment here given the stock now at 52wk lows and was flagged to me by a friend to take a look.

1) my valuation comments vs. the 4/25/24 comment don't change much. you're looking at a situation where it's a matter of where bottom EPS is and what

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.