R2BL34 trade ideas

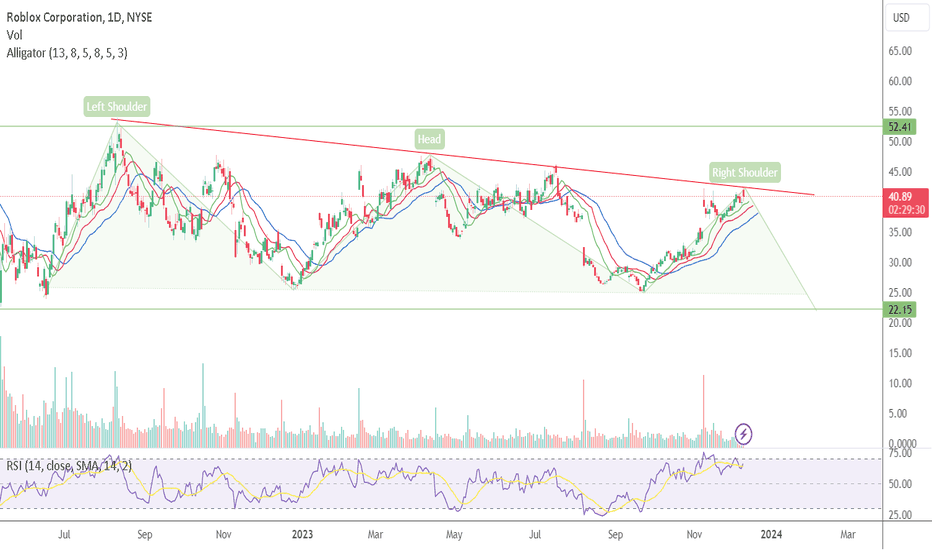

RBLX Roblox Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the 35usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $4.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Roblox (NYSE: RBLX) RRoblox is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator of some favorable trends underneath the surface for RBLX in the report.

Price Momentum

RBLX is trading in the middle of its 52-week range and below its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some downward momentum. This is a buy opportunity for the stock.

$RBLX Revenue Stagnation is a Serious RiskAfter releasing disappointing Q2 earnings, Roblox (NYSE: RBLX) plummeted by as much as 34% reaching new 52-week lows. While the stock has rebounded since by 37%, this rebound may be short-lived as the gaming platform’s Q3 earnings are right around the corner on November 8th pre-market. Analysts are estimating the company to report $829.8 million in bookings while posting an EPS of -$0.495. While the model used in this article forecasts the company to beat the bookings estimate, it projects it to report a wider loss due to the constant growth of its R&D costs. Moreover, the gaming platform is showing signs of struggling to monetize its daily average users (DAU) due to its declining bookings per DAU, a trend the model expects to persist in Q3. With the stock seemingly trading at a premium compared to other players in the gaming industry, taking a short position in RBLX stock may be lucrative ahead of its earnings.

RBLX Fundamentals

Q3 Forecast

In order to forecast RBLX’s revenue, we have to forecast its DAUs first. With that in mind, the company’s DAUs have historically increased in the year’s second half compared to the first half. As such, we can forecast its Q3 DAU to be more than 72.1 million based on the average QoQ growth rate of 10.17% from Q2 to Q3 in 2020, 2021, and 2022.

Quarter DAUs QoQ Growth

Q2 20 33,400,000

Q3 20 36,200,000 8.38%

Q2 21 43,200,000

Q3 21 47,300,000 9.49%

Q2 22 52,200,000

Q3 22 58,800,000 12.64%

Q2 23 65,500,000

Q3 23 72,163,021 10.17%

After forecasting Roblox’s Q3 DAUs, we can now calculate its revenue per user to find its revenue projection. Since Q1 2021, the company’s revenue per DAU has been ranging between $9 – $11. Therefore, we can use the average revenue per user over that period of $10.22 to reach a revenue projection of $737.3 million.

Quarter DAU Revenue Revenue/DAU

Q1 21 42,100,000 $386,976,000 $9.19

Q2 21 43,200,000 $454,100,000 $10.51

Q3 21 47,300,000 $509,336,000 $10.77

Q4 21 49,500,000 $568,769,000 $11.49

Q1 22 54,100,000 $537,134,000 $9.93

Q2 22 52,200,000 $591,207,000 $11.33

Q3 22 58,800,000 $517,707,000 $8.80

Q4 22 58,800,000 $579,004,000 $9.85

Q1 23 66,100,000 $655,344,000 $9.91

Q2 23 65,500,000 $680,766,000 $10.39

Q3 23 72,163,021 $737,329,905 $10.22

Using the same method we can also project Roblox’s bookings in Q3 which is the metric the company mainly focuses on. After pandemic restrictions started to be lifted in 2022, Roblox’s bookings per DAU declined substantially as life returned to normal – declining from $15.56 in Q4 2021 to $11.67 in Q1 2022. Since then, bookings per DAU have roamed around $12 except in Q4 2022 where the gaming platform reported record bookings.

Based on this, we can use the average bookings per DAU since Q1 2022 except Q4 2022 since it is an outlier. In this way, the company’s bookings per DAU can be estimated to be $11.9 which amounts to bookings of $858.5 million, more than analysts’ estimate of $829.85 million by 3.4%.

Quarter DAU Bookings Bookings/DAU

Q1 22 54,100,000 $631,200,000 $11.67

Q2 22 52,200,000 $639,900,000 $12.26

Q3 22 58,800,000 $701,700,000 $11.93

Q4 22 58,800,000 $899,400,000 $15.30

Q1 23 66,100,000 $773,800,000 $11.71

Q2 23 65,500,000 $780,700,000 $11.92

Q3 23 72,163,021 $858,525,857 $11.90

However, an alarming sign could be bookings per DAU stagnating YoY as this shows that the company is unable to monetize its DAU base. As a result, its revenues could stagnate even with DAUs increasing.

A reason behind this could be management’s attempts to add more DAUs from higher age groups. However, that comes at the expense of younger DAUs which make up most of the gaming platform’s DAUs.

Through this projected bookings per DAU metric, we can forecast Roblox’s operating costs based on their percentage of bookings. But first, we’ll forecast the company’s cost of revenue and developer exchange fees.

Roblox’s gross margin averaged 74.51% from Q1 2020 until Q4 2022.

Quarter Revenue CoR Gross Margin

Q1 20 $161,570,000 $41,793,000 74.13%

Q2 20 $200,392,000 $53,669,000 73.22%

Q3 20 $251,914,000 $65,818,000 73.87%

Q4 20 $310,009,000 $78,618,000 74.64%

Q1 21 $386,976,000 $97,937,000 74.69%

Q2 21 $454,100,000 $116,930,000 74.25%

Q3 21 $509,336,000 $130,015,000 74.47%

Q4 21 $568,769,000 $151,988,000 73.28%

Q1 22 $537,134,000 $135,632,000 74.75%

Q2 22 $591,207,000 $143,157,000 75.79%

Q3 22 $517,707,000 $126,437,000 75.58%

Q4 22 $579,004,000 $142,432,000 75.40%

After that, its gross margin improved to an average of 76.51% in Q1 and Q2 2023 due to more bookings being processed through credit cards and prepaid cards which has a positive impact on its margins, per management in the Q1 earnings release. Therefore, we can forecast its gross margin in Q3 to be near that 76.51% figure. In this way, a projection for Roblox’s Q3 cost of revenue could be $173.1 million.

Quarter Revenue CoR Gross Margin

Q1 23 $655,344,000 $151,841,000 76.83%

Q2 23 $680,766,000 $162,029,000 76.20%

Q3 23 $737,329,905 $173,164,312 76.51%

As for DEF, the company expected this expense to amount to $800 million in 2023 in the Q2 earnings call, and so far, it has incurred $348.2 million in the first half of the year, which means that it expects to incur $451.7 million for the rest of the year. With that in mind, Roblox has historically seen its DEF increase in Q3 and Q4, with the bulk of any given year’s total reported in Q4. Over the last 3 years, the company reported 31.15% of its total DEF in Q4. As such, we can project its DEF to be $202.5 million in Q3 and $249.2 million in Q4 based on management’s forecast.

Quarter Dev Ex Fees % of Total

Q1 20 $44,499,000 13.54%

Q2 20 $85,052,000 25.87%

Q3 20 $85,475,000 26.00%

Q4 20 $113,714,000 34.59%

2020 Total $328,740,000 100.00%

Q1 21 $118,938,000 22.09%

Q2 21 $129,714,000 24.10%

Q3 21 $129,952,000 24.14%

Q4 21 $159,717,000 29.67%

2021 Total $538,321,000 100.00%

Q1 22 $147,122,000 23.58%

Q2 22 $143,148,000 22.95%

Q3 22 $151,470,000 24.28%

Q4 22 $182,115,000 29.19%

2022 Total $623,855,000 100.00%

Q1 23 $182,440,000 22.81%

Q2 23 $165,843,000 20.73%

Q3 23 $202,511,096 25.31%

Q4 23 $249,205,904 31.15%

2023 Total $800,000,000 100.00%

With cost of revenue and DEF out of the way, we can now forecast the rest of Roblox’s operating costs based on their percentage of bookings. First, infrastructure and trust & safety expenses have ranged between 22% – 28% of bookings since Q1 2022. In this way, we can calculate an average of 25.42% of bookings which results in an IST projection of $218.2 million, representing a 14.26% increase YoY. This is in line with management’s expectations in the Q2 earnings call of bookings growth outpacing IST in Q3 since bookings, according to the model, would increase 22.35% YoY.

Quarter ITS % of Bookings

Q1 22 $141,355,000 22.39%

Q2 22 $158,235,000 24.73%

Q3 22 $190,986,000 27.22%

Q4 22 $198,505,000 22.07%

Q1 23 $211,044,000 27.27%

Q2 23 $225,039,000 28.83%

Q3 23 $218,223,202 25.42%

Looking at Roblox’s G&A and marketing costs, we can find that they represent 11.27% and 3.62% on average of bookings since Q1 2020. That said, the average for G&A doesn’t take into account Q2, Q3, and Q4 2020 since the pandemic impacted them due to work from home policy which has led to lower costs. Based on these projected figures, we can forecast G&A cost to be $96.7 million in Q3, while marketing costs can be projected to be $31.1 million.

Quarter G&A % of Bookings Marketing % of Bookings

Q1 20 $30,558,000 12.24% $15,657,000 6.27%

Q2 20 $18,707,000 3.79% $13,908,000 2.81%

Q3 20 $16,168,000 3.26% $12,858,000 2.59%

Q4 20 $31,908,000 4.97% $15,961,000 2.48%

Q1 21 $94,375,000 14.47% $20,002,000 3.07%

Q2 21 $97,678,000 14.68% $18,990,000 2.85%

Q3 21 $51,584,000 8.09% $19,599,000 3.07%

Q4 21 $59,383,000 7.71% $27,772,000 3.61%

Q1 22 $57,772,000 9.15% $29,102,000 4.61%

Q2 22 $78,676,000 12.30% $26,501,000 4.14%

Q3 22 $81,165,000 11.57% $32,105,000 4.58%

Q4 22 $79,704,000 8.86% $29,740,000 3.31%

Q1 23 $97,574,000 12.61% $26,755,000 3.46%

Q2 23 $96,197,000 12.32% $30,328,000 3.88%

Q3 23 $96,775,599 11.27% $31,113,688 3.62%

As for R&D cost, it has been growing sequentially since Q3 2020. The company expects it to continue increasing this year due to increased headcount to develop new features and improve its overall product, according to its Q2 earnings report. That being said, Roblox plans to slow its headcount rate in 2024 through the end of 2025.

Based on this, we can estimate the R&D cost to amount to $367.7 million based on an average sequential growth rate of 16.62% since Q1 2020, representing 42.83% of the projected bookings.

Quarter R&D QoQ Growth % of Bookings

Q1 20 $49,409,000 19.80%

Q2 20 $40,249,000 -18.54% 8.14%

Q3 20 $51,708,000 28.47% 10.41%

Q4 20 $60,067,000 16.17% 9.35%

Q1 21 $96,644,000 60.89% 14.82%

Q2 21 $124,748,000 29.08% 18.75%

Q3 21 $138,245,000 10.82% 21.68%

Q4 21 $173,570,000 25.55% 22.54%

Q1 22 $177,762,000 2.42% 28.16%

Q2 22 $211,757,000 19.12% 33.09%

Q3 22 $235,551,000 11.24% 33.57%

Q4 22 $248,407,000 5.46% 27.62%

Q1 23 $275,537,000 10.92% 35.61%

Q2 23 $315,319,000 14.44% 40.39%

Q3 23 $367,719,031 16.62% 42.83%

Based on the projections above, Roblox is projected to report an operating loss of $352.1 million.

Revenue $737,329,905

CoR $173,164,312

DEF $202,511,096

ITS $218,223,202

R&D $367,719,031

G&A $96,775,599

Marketing $31,113,688

Operating Loss -$352,177,023

For interest income, we can the average amount of Q1 and Q2 2023 since the company turned most of its cash balance into short and long-term investments. As such, we can estimate interest income to be $32.9 million in Q3. As for interest expense, it has averaged around $10 million per quarter since Q1 2022, which we can use for the Q3 projection. This leaves other income which can be projected to be $484.5 thousand based on the average amount since Q1 2022.

Quarter Interest Income Interest Expense Other Income

Q1 22 $245,000 $9,999,000 -$379,000

Q2 22 $4,197,000 $9,891,000 -$3,051,000

Q3 22 $12,764,000 $10,005,000 -$4,302,000

Q4 22 $21,636,000 $10,008,000 $1,988,000

Q1 23 $31,082,000 $10,012,000 -$440,000

Q2 23 $34,764,000 $10,129,000 $3,277,000

Q3 23 $32,923,000 $10,007,333 -$484,500

Meanwhile, the average income tax provision since Q1 2020 is $432 thousand, which is the figure we’re using in the model.

Quarter Provision for (Benefit from) Income Tax

Q1 20 $1,000

Q2 20 $5,000

Q3 20 $19,000

Q4 20 ($6,681,000)

Q1 21 $2,000

Q2 21 $20,000

Q3 21 ($998,000)

Q4 21 $656,000

Q1 22 $2,000

Q2 22 ($278,000)

Q3 22 $352,000

Q4 22 $3,476,000

Q1 23 $276,000

Q2 23 ($1,236,000)

Q3 23 $432,000

Based on the projections for Roblox’s Q3 income statement, we can expect the gaming platform to report a net loss of $330.17 million or an EPS of -$0.58, which is wider than analysts’ estimate of -$0.495.

Revenue $737,329,905

CoR $173,164,312

DEF $202,511,096

ITS $218,223,202

R&D $367,719,031

G&A $96,775,599

Marketing $31,113,688

Operating Loss ($352,177,023)

Interest Income $32,923,000

Interest Expense $10,007,333

Other Income -$484,500

Loss Before Tax ($329,745,856)

Income Tax $432,000

Net Loss ($330,177,856)

OS 566,683,861

EPS ($0.58)

Valuation

Since Roblox isn’t profitable, we can use its forward P/S ratio to find a fair value for its shares. Currently, the company is competing with Take-Two Interactive Software, Inc. (NASDAQ: TTWO) and Electronic Arts Inc. (NASDAQ: EA) in the gaming sector. With that in mind, Roblox has the highest forward P/S among its competitors, despite both companies being profitable and generating free cash flow.

Meanwhile, the sector median forward P/S is 1.08, indicating that Roblox is overvalued by 447.2%. However, a better figure benchmark ratio to use could be the average forward P/S of both EA and Take-Two which is 4.49. As such, we can reach a price target of $22.4, implying a 34% downside from current levels.

Upside Risks

Despite Roblox’s bearish fundamentals, there’s a risk to consider. While the platform’s bookings per DAU have been declining YoY, there’s a chance this trend is broken after its launch on PlayStation on October 10th. As is, its debut week on PlayStation was extremely successful as it ranked 3rd in the percentage of PlayStation players that played it at least once, according to Circana’s video game industry analyst Mat Picatella. Moreover, the title reached more than 10 million downloads during its debut week, per Axios’ Stephen Totilo.

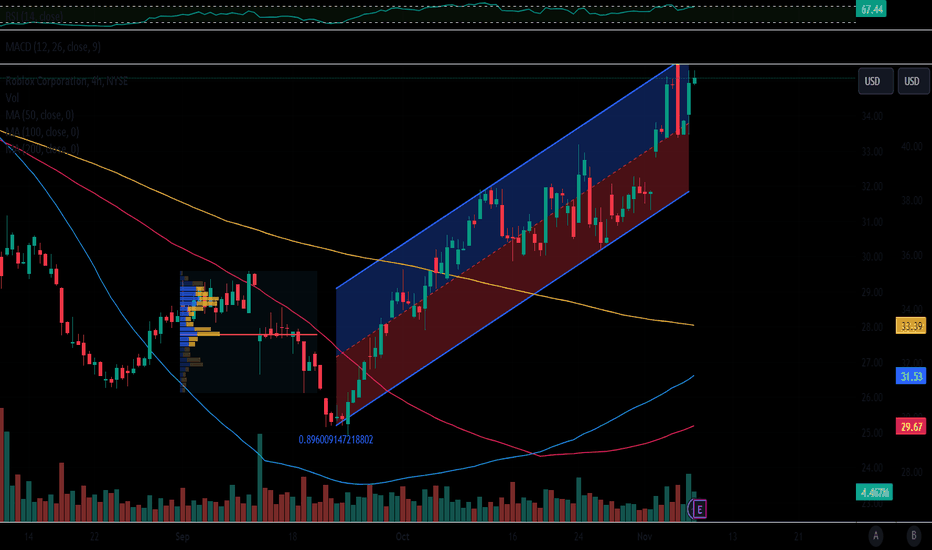

Technical Analysis

On the hourly chart, RBLX stock is in a neutral trend as it is trading in a sideways channel between $29.6 and $34. Looking at the indicators, the stock is above the 200 and 50 MAs which is a bullish sign. However, it recently failed to break resistance and broke through the 21 MA to the downside. Meanwhile, the RSI is neutral at 54 and the MACD is bearish.

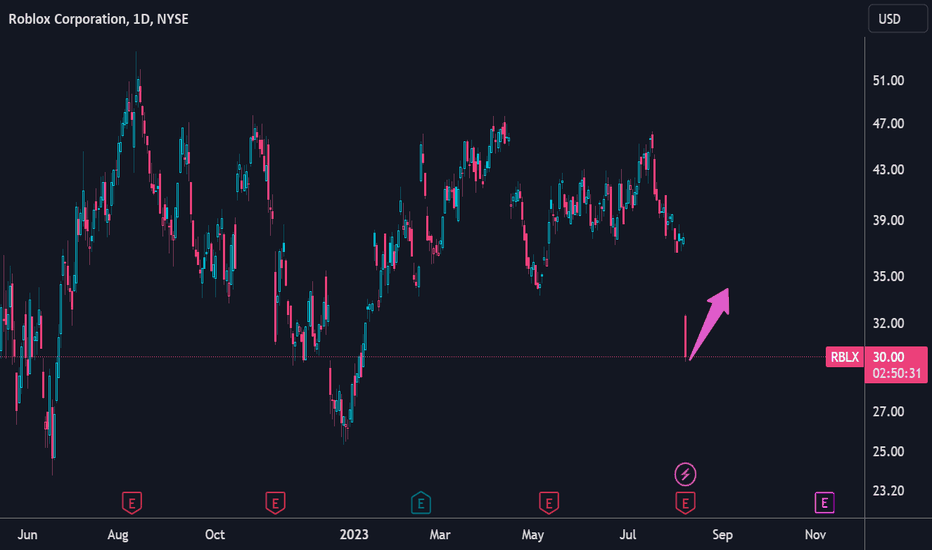

As for the fundamentals, RBLX’s upcoming Q3 earnings on November 8th will be a major catalyst for the stock. Given that the model forecasts the company to post a wider loss than expected along with declining bookings per DAU, its stock may fall and reach a level near the $22.41 price target. Since the stock failed to break resistance, investors could find the price range between $34 and $32 ideal for a short position.

RBLX Forecast

In summary, taking a short position in RBLX stock ahead of its Q3 earnings on November 8th may be a profitable decision as it is expected to post a wider loss than estimates, despite slightly beating analysts’ bookings estimate. Moreover, the model forecasts another decline in bookings per DAU in Q3 which is a sign that the company is struggling to monetize its growing DAUs. Meanwhile, the stock appears to be trading at a premium compared to its peers based on its forward P/S ratio. All of these factors could lead RBLX stock to fall in the near term and reach a level near the $22.41 price target.

RBLX covered callI have LONG term shares in my son Gabes' account that I will be selling a covered call on.

IF it gets called away here, it will be profitable.

I do not mind waiting around for that to happen or not. If after earnings I can buy to close this sold call for less than .10.

Just being very paytient on this position for him.

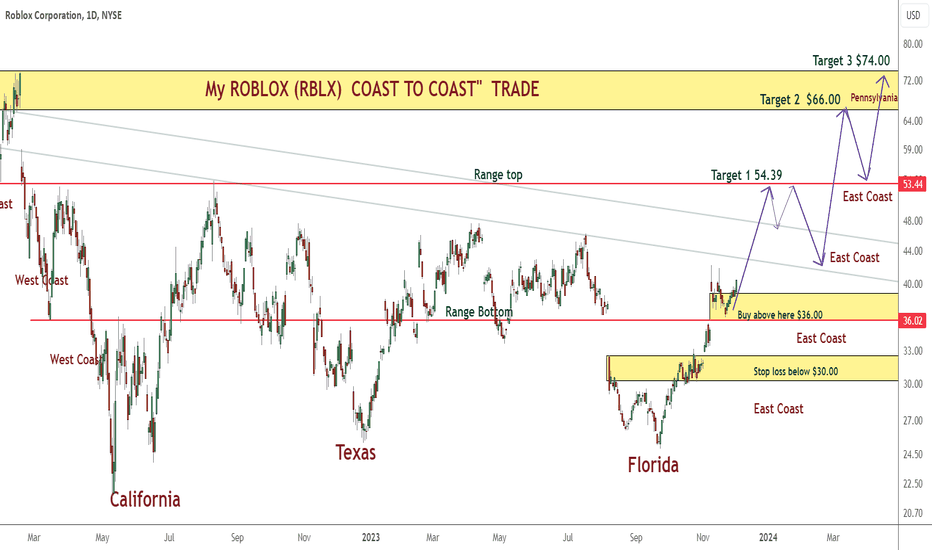

RBLX PLAY on gaming - No pun intendedSolid breakout above $35 Would be great for RBLX

Would wait until that point to enter any positions.

Entry: $35.10

Target 1: $45.90 (33% Gain)

Target 2: $74:20 (105% Gain)

Target 3: $94.80 (174% Gain) Long term - < 1 year target timing.

Roblox Corporation is an American video game developer based in San Mateo, California. Founded in 2004 by David Baszucki and Erik Cassel, the company is the developer of Roblox, which was released in 2006. As of December 31, 2022, the company employs over 2,100 people.

Bullish on RBLX.

As you can see here on the 15-minute chart we are in a channel. I drew this channel on the hourly time frame. We have recently formed a double bottom on the daily chart and we had a massive green day today. I am looking for a breakout and retest on the resistance-turned-support bounce with high-volume calls. As always thank you for reading my analysis.

My levels to manage my RBLX long-term positionCopy & Paste from WSJ:

For the June-ended quarter, Roblox said revenue rose 15% to $680.8 million for the quarter while total costs rose 30% to $994.8 million. Daily users, hours of engagement and other key metrics were up from a year ago but net bookings and adjusted profit came in below Wall Street analysts’ expectations.

The results disappointed investors, though, partly because Roblox doesn’t provide financial projections.

“This is a company that’s hard to model,” Benchmark analyst Mike Hickey said. “It could’ve been a great quarter if they guided the Street.”

Still, the market reaction seems “a bit extreme,” said Roth MKM analyst Eric Handler. “We’re talking a 1% bookings miss and $10 million Ebitda miss off a very low number. That shouldn’t be worth billions of dollars of value destruction.”

Roblox isn’t a traditional videogame company. Unlike its peers, all of its games and other interactive content is made by its own users with tools the company provides for free. Its large and growing creator community ranges from hobbyists to professional studios, and they can earn revenue by selling virtual goods, advertising or both.

RBLX catch the falling knife +10%Roblox Corporation is an American video game developer based in San Mateo, California. Founded in 2004 by David Baszucki and Erik Cassel, the company is the developer of Roblox, which was released in 2006. As of December 31, 2022, the company employs over 2,100 people.