33,133.33

0.01 BRL

14.46 B BRL

124.52 B BRL

About Sherwin-Williams Company (The)

Sector

Industry

CEO

Heidi G. Petz

Website

Headquarters

Cleveland

Founded

1866

ISIN

BRS1HWBDR002

FIGI

BBG00RHG3903

The Sherwin-Williams Co. engages in the development, manufacture, distribution, and sale of paint and coatings. It operates through the following segments: Paint Stores Group, Consumer Brands Group, Performance Coatings Group, and Administrative. The Paint Stores Group segment caters to the needs of architectural and industrial paint contractors and do-it-yourself homeowners. The Consumer Brands Group segment manufactures and distributes a broad portfolio of branded and private-label architectural paint, stains, varnishes and other industrial products. The Performance Coatings Group segment develops and sells industrial coatings for wood finishing and general industrial applications. The Administrative segment refers to the administrative expenses and assets of the company’s new global headquarters and research and development center, both currently under construction. The company was founded by Henry Sherwin and Edward Williams in 1866 and is headquartered in Cleveland, OH.

Related stocks

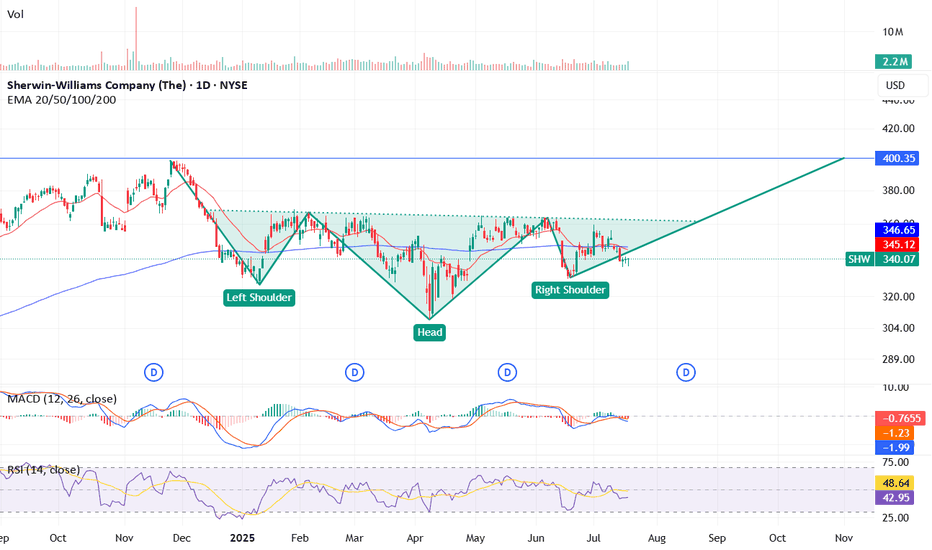

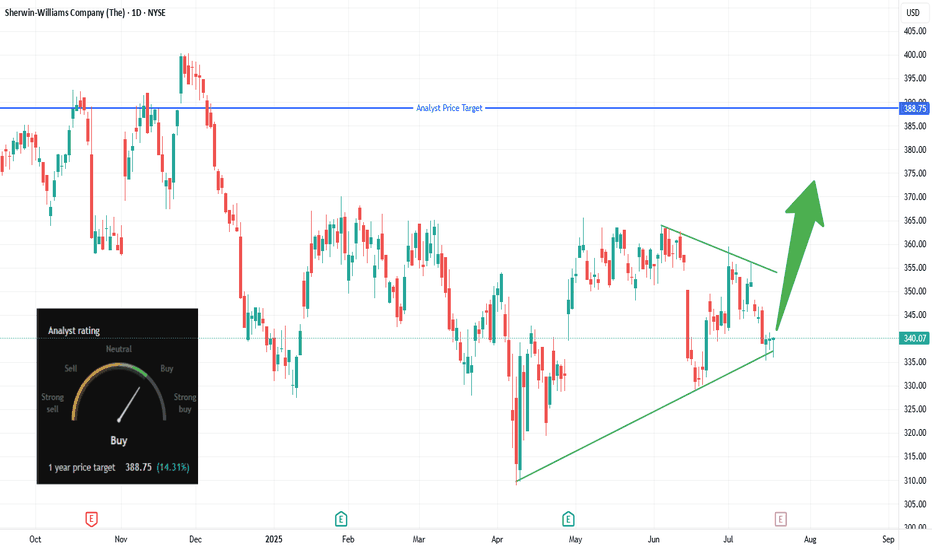

SHW Bulls Ready to Paint the Tape Green?📋 Trade Summary

Setup: Price bouncing off ascending trendline support in a tightening triangle pattern.

Entry: Market buy at ~$340

Stop-loss: Below channel support at $327.74

Targets:

Initial: $355 (trendline break)

Main: $388.75 (analyst price target)

Risk/Reward

Sherwin-Williams Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sherwin-Williams Stock Quote

- Double Formation

* (Target Entry Or Gap Fill)) At 770.00 USD | Completed Survey

* ((No Trade)) On Reversed Settings | Subdivision 1

- Triple Formation

Sherwin Williams, you will always need paintNYSE:SHW looks good here, pushing agains multi year horizontal resistance

* ER out of the way,

* weekly bull flag break here, need to confirm the weekly close,

can buy leaps or debit spreads, half size here and add on weekly confirmation.... not financial advice ;D

Sherwin-Williams | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Sherwin-Williams

- Double Formation

* 270.00 USD | Support Area | Subdivision 1

* Neckline | Uptrend Bias

- Triple Formation

* Flag Structure | Continuation Area Attempt | Subdivisio

SHW Multi-Time-Frame Squeeze SHW has a history of making outsized moves on the back of Daily Squeeze action. In the recent past, it has moved in "harmonic" 50+ point surges. If the next daily squeeze fires long, I look for it to run up to it's prior high at $354. If it behaves like it did last quarter, this could happen on t

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SHW5459736

Sherwin-Williams Company 4.25% 08-AUG-2025Yield to maturity

119.05%

Maturity date

Aug 8, 2025

See all S1HW34 bonds