S1NP34 trade ideas

Inverse Head and Shoulders Already Completed Toward a New ATHThe price has completed the formation of an inverse head and shoulders pattern, with the final breakout occurring last week.

Volume confirms the validity of the pattern.

The distance from the head to the neckline projects a target toward a new all-time high (ATH).

As often happens after a breakout, a retest of the neckline may occur, which could present a good entry or accumulation opportunity

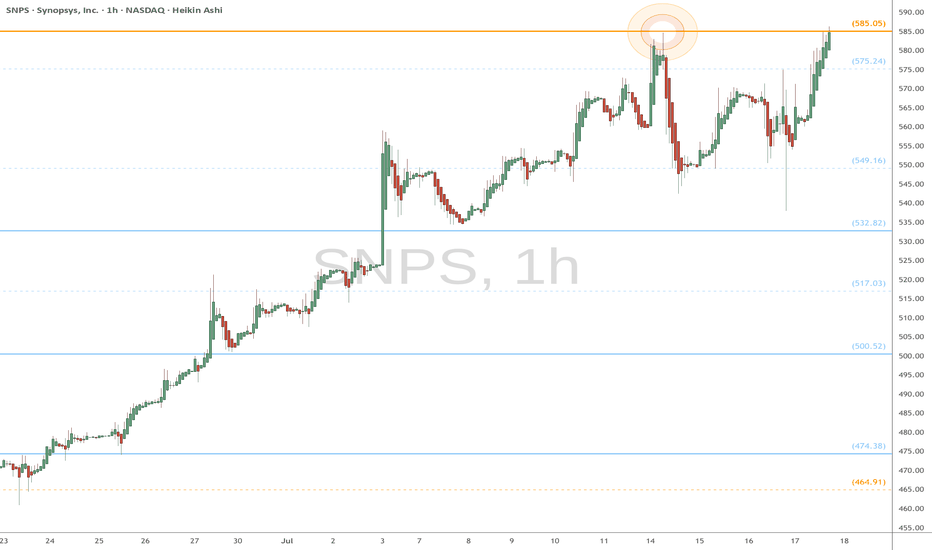

SNPS – Dangerous Correction Wave Nearing Completion?The wave structure marked in red often indicates a corrective move. While it appears impulsive at first glance, such formations typically end with a strong candle in the direction of the trend, followed by a full retracement.

This rally is likely not a new bullish impulse but a complex correction within a broader downtrend. Volume remains relatively muted compared to previous sell-offs, reinforcing the corrective nature of the current wave.

Due to the structure's unreliability and tendency to reverse sharply, this is a highly dangerous zone to enter a long. However, for experienced traders, a minimal long position with a trailing stop may be considered for a final push toward the resistance zone around $590.

A failure to break that zone with volume will likely lead to a rapid decline back to previous lows around $400 or even $360.

SNPS Trading Plan: Anticipating a Break Above SMA 150 at 535.73NASDAQ:SNPS

Currently, the price of SNPS is 520.70, which is slightly below the 150 SMA (527.81). The suggested entry point is 535.73, positioned above the SMA 150 to confirm a potential upward trend.

Entry Strategy:

Wait for the price to break above 535.73 to signal confirmation of strength and momentum.

Verify that the SMA 150 remains in an upward trend or shows signs of reversing upward.

Stop Loss:

Set the stop loss at 519.9, just below the SMA 150, to protect against significant downside.

Target:

Identify potential resistance levels above 535.73 to define profit-taking zones.

Alerts:

Place an alert on TradingView at 535.73 to get notified when the price breaks the entry point.

Note:

This plan also aims to identify a potential upward reversal in the trend of the SMA 150, ensuring the stock aligns with a strong bullish movement.

Stock Of The Day / 05.12.2024 / SNPS12.05.2024 / NASDAQ:SNPS

Fundamentals. Negative catalyst after earnings report and weak 2025 forecast.

Technical analysis.

Daily chart: nearest potential support level is 515.00 formed by the nearest break in the trend.

Premarket: Gap Down on moderate volume.

Trading session: The price forms a pronounced tightening to the level 532.00 against the initial downward movement, after a non-pullback decline from the opening of the session. We are considering a short deal in continuation of the initial movement.

Trading scenario: pullback along the trend (false tighten) to the level 532.00

Entry: 529.30 breakdown of the trend line of the tightening structure.

Stop: 532.27 above the held level 532.00

Exit: Close part of the position on 520.56 after an unsuccessful attempt to update lower low. Close the rest when exiting upward from the consolidation.

Risk Reward: 1/3

SNPS Breakout Potential to the UpsideNASDAQ:SNPS has been range-bound since 2023 and is finally showing technical patterns that reveal Dark Pool hidden accumulation, pro trader nudges, and the potential for HFTs to gap and run the stock upward.

This stock is setting up to challenge the all-time high. Often in the current Moderately Up-trending Market Condition, HFTs will gap the stock over the resistance level.

So keep the stock on a watchlist to look for pro trader nudges or resting-day candles that indicate the pros are attempting to trigger HFTs to gap the stock up. IF the HFTs gap the stock, then pro traders will take profits immediately, selling into the foray of retail traders chasing the gap. The goal is to enter before a potential gap. The stock may not gap. However, the pattern is indicative of more HFT activity.

Synopsys Inc. Growth Expectations Ahead of the Quarterly ResultKey arguments in support of the idea.

▪ Expectation of a robust quarterly report.

▪ Attractive entry price and favorable valuation levels based on key multiples.

Investment Thesis

Synopsys, Inc. (SNPS) is the largest computer-aided design (CAD) company in the electronics design industry. Its flagship product, Design Compiler, is a widely recognized logic circuit synthesis tool. The Company offers a comprehensive range of additional products for the design of specialized integrated circuits, including solutions for logic synthesis, behavioral synthesis, element tracing, static timing analysis, formal verification, hardware description language (HDL) simulation (SystemC, SystemVerilog/Verilog, VHDL), and circuit simulation. Synopsys primarily serves customers in the semiconductor and electronics industries. The Company operates through two key segments: Design Automation, which accounts for approximately 69% of total revenue through the first nine months of fiscal year 2024, and Design Intellectual Property (IP), contributing 31%. Founded in 1986, Synopsys is headquartered in Sunnyvale, California.

Expectation of a robust quarterly report. We anticipate that the Company will report results for the current quarter that surpass consensus expectations. Demand for electronic design automation (EDA) solutions remains consistently strong, bolstered by Synopsys’ successful performance in the July quarter and a positive investor outlook for the ongoing period. The Company has reaffirmed its revenue growth guidance of 15% for FY2024 and expects improvements in operating margins. The strategic importance of EDA investments in executing customers' technology plans makes this sector relatively resilient to cuts in capital expenditures. Additionally, the adoption of new AI-based tools, such as ASO.AI and VSO.AI, is gaining momentum and contributing positively to Synopsys’ growth. Furthermore, The Company announced the acquisition of Ansys earlier this year, with the deal expected to close in the first half of 2025. This strategic move will enable Synopsys to provide a comprehensive solution for systematic chip design and integrated chip analysis, expanding its product line and enhancing its competitive position. Consequently, we foresee additional near-term upside for SNPS stock.

Attractive entry price and favorable valuation levels based on key multiples. The stock is currently trading at a discount relative to key multiples when compared to one of its main competitors and the industry average. For instance, Synopsys has an EV/EBITDA ratio of 29.5x for the next 12 months, which is favorable compared to Cadence Design Systems (CDNS) at 34.5x and the peer average of 31.3x. Additionally, the Company’s next 12-month P/E ratio stands at 38.4x, significantly lower than Cadence’s 44.7x and the industry average of 46.7x. This pricing presents an attractive entry point for investors and indicates strong upside potential for the stock.

The target price for the shares is $605, the rating is Buy. We recommend setting a stop loss at $425.

Synopsys Inc. (SNPS) - Waiting for an Entry PointSynopsys Inc. (SNPS) - Waiting for an Entry Point NASDAQ:SNPS

The stock is approaching a potential entry point around $559.31, above the trendline it tends to respect. The entry will be executed with stop loss management in place. It's important to monitor the developments and stay updated accordingly.

Strong technical buy signal for Synopsys (SNPS)Technical Analysis of Synopsys Inc. (ticker on Nasdaq: SNPS):

Synopsys (SNPS) shows strong development within both a long-term and short-term rising trend.

A new strong technical buy signal has now been triggered for Synopsys after breaking through a very important technical resistance level around USD 600.00.

There should now be significant technical support for the stock around the USD 600.00 level.

There has been a 'classic' test of the support level here now around USD 600.00, and now the share seems ready for further growth within both the short-term and long-term rising trend.

There is little technical resistance for further upside before around the USD 750.00 level, and up towards the upper trend line of the uptrend.

Based on the technical picture for the share, the potential is assessed to be around USD 750.00 in 1-3 months' time.

What could potentially change the currently very positive technical picture for the Synopsys share would be if the share were to have an established break below USD 590.00.

SNPS Cup N Handle Retracement TestHello everybody thank you for watching my video on this cup and handle setup the price had broken out over the resistance line on the 17th of June and started to retrace all the way up until today so we should see some respect of the support line for a possible entry. if that does not hold tomorrow and it goes lower I will cancel the trade idea and look elsewhere for opportunity.

Let me know if you need to know anything else!

Synopsys Posts Financial Results for Q2 Fiscal Year 2024Synopsys ( NASDAQ:SNPS ) has raised its annual revenue and profit forecast due to the robust demand for its software to design advanced chips driving artificial intelligence applications. The AI boom has boosted investments in custom design of chips as tech firms race to dominate the lucrative technology with new innovations, triggering demand for companies such as Synopsys. Chief Executive Sassine Ghazi said demand for the company's core products remained strong, with revenue from them expected to grow 15% this year as customers design their own chips for AI and other purposes. Semiconductor firms continue to invest in research and design and turn to the company's AI-powered electronic design automation suite, Synopsys.ai, in a bid to ace and improve complex chip designs.

Synopsys ( NASDAQ:SNPS ) now expects annual adjusted earnings per share between $12.90 and $12.98 from its earlier forecast of $12.86 and $12.94. The company updated its annual expectations on its investor day in March, excluding its software integrity (SIG) unit. Earlier this month, the company said it would sell the SIG unit to a private-equity group led by Clearlake Capital and Francisco Partners in a $2.1 billion deal.

Synopsys ( NASDAQ:SNPS ) forecast third-quarter revenue between $1.51 billion and $1.54 billion, below analysts' average estimate of $1.60 billion, according to LSEG data. Revenue in the second-quarter ended April 30 rose about 15% to $1.45 billion, but fell short of estimates of $1.53 billion. Excluding items, it earned $3.00 per share, beating estimates of $2.95 per share.

In January, Synopsys ( NASDAQ:SNPS ), which partners with chipmakers including Taiwan Semiconductor Manufacturing Co, Intel (INTC.O), and Samsung Electronics, said it would buy Ansys (ANSS.O) in a $35 billion cash-and-stock deal. Separately, Ansys said on Wednesday that its stockholders approved its proposed acquisition by Synopsys.

Synopsys ( NASDAQ:SNPS ) reported Q2 financial results for the second quarter of fiscal year 2024, with quarterly revenue of $1.455 billion, up approximately 15% year over year and at the high-end of guidance. Quarterly GAAP earnings per diluted share of $1.92; non-GAAP earnings per diluted share of $3.00, up approximately 26% year over year1 and exceeding guidance.

Synopsys' strong Q2 results were driven by its team's relentless focus on execution, leading technology that is mission-critical to customers, and resilient business model. The company is again raising its full-year targets for revenue and non-GAAP EPS, based on strong execution and continued business momentum.

Technical Outlook

Synopsys ( NASDAQ:SNPS ) stock closed Thursday's trading session with a Relative Strength Index (RSI) of 60.27 which is slightly overbought. The stock has been on a rising trend since the fall of November, 2023 consecutively rising to new highs.

Navigating the Chip Maze: Should You Invest in Synopsys?Navigating the Chip Maze: Should You Invest in Synopsys?

Synopsys, a titan in the Electronic Design Automation (EDA) landscape, offers intriguing prospects for investors curious about the semiconductor industry. But before diving in, let's unpack the company, analyze its potential, and explore options – with a strong disclaimer: trading is inherently risky and not suitable for everyone.

Synopsys: Powering the Chip Revolution

Founded in 1986, Synopsys has carved a niche by providing essential tools and services for chip design and verification. Imagine them as the architects and inspectors of the tiny brains powering our devices. Their clients? Tech giants like Apple, Intel, and Samsung, relying on Synopsys for efficient, secure chip development.

Products and Services:

EDA Tools: The bread and butter – software enabling chip design, simulation, and verification.

Silicon IP: Pre-designed building blocks, saving chipmakers time and money.

Software Security and Quality: Tools to identify and fix vulnerabilities in software, crucial in an increasingly interconnected world.

Financials and Performance:

Revenue: $5.3 billion (FY 2023)

Net Income: $1.2 billion (FY 2023)

Ratings: Leader in Gartner's Magic Quadrant for EDA, "100 Best Companies to Work For" by Fortune

So, Buy, Sell, or Hold?

This is where things get tricky. Analysing publicly available information can't guarantee future performance. Several factors could influence Synopsys' stock price:

Overall Semiconductor Market: A booming market benefits Synopsys, but downturns can impact sales.

Technological Advancements: Staying ahead of the curve in EDA is crucial, and continuous innovation is key.

Competition: Other EDA players like Cadence Design Systems pose constant competition.

Options Trading: A Calculated Gamble?

Remember, options involve significant risks. Buying call options bets on a stock price increase, while put options profit from a decrease. With expirations ranging from 1-12 months, you choose your timeframe and risk tolerance. However, options decay in value over time, and misjudgment can lead to substantial losses.

The Verdict: Do Your Research, Proceed with Caution

Synopsys is a prominent player in a growing industry, but the decision to invest ultimately rests on your individual financial goals and risk appetite. Conduct thorough research, understand the risks involved, and never invest more than you can afford to lose. Consider seeking professional financial advice before making any investment decisions.

Risk Warning

Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses.

Risk Warning: Trading is Not for Everyone

It's essential to emphasize that trading stocks and options carries inherent risks. Market volatility, unpredictable events, and human error can lead to significant losses. Therefore, it's crucial to undertake thorough research, understand the underlying risks, and only invest funds that can be comfortably afforded to lose.

------------------------------------

Rating: STRONG BUY

Risk Disclaimer!

The article information and the data is for general information use only, not advice!

---------------------------------------------------------------------

Risk Warning Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses. Risk Disclaimer! General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss!

SNPSSynopsys, Inc. is an American electronic design automation company headquartered in Sunnyvale, California, that focuses on silicon design and verification, silicon intellectual property and software security and quality. Synopsys supplies tools and services to the semiconductor design and manufacturing industry

Synopsys Pulls BackSynopsys has pulled back after hitting new highs, and trend followers may take notice.

The first pattern on today’s chart is the four-month consolidation pattern between May and early October. SNPS was mostly trapped below $465 during that time. But it broke out on October 6 and is now pulling back to that level. Has old resistance become new support?

Second is the series of higher weekly lows during the period of consolidation. Those could reflect lurking buyers willing to step in.

Next, a rising trendline has taken shape since mid-August. Prices have also pulled back near that potential support.

Finally, the provider of semiconductor-design software seems to be in a secular uptrend. It broke out to record highs in May, despite the broader market remaining below the peak of early 2022. This could make trend followers anticipate continued momentum, especially with barely two months left in the year.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .