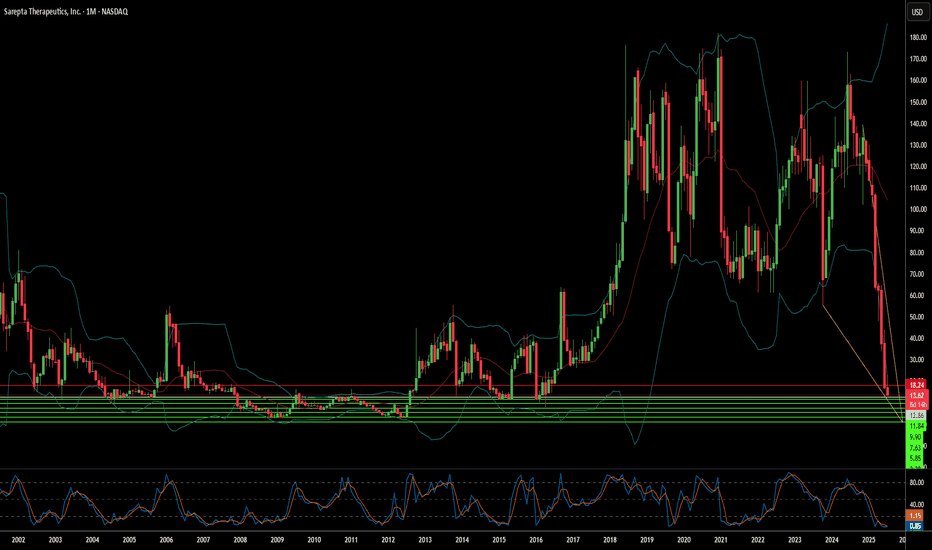

Sarepta $SRPT clears $20 then it's a quick move to $35. This stock has been beaten down on what is now unfounded FDA drama. A bottoming pattern is in place, Pro-Blue Osc is quickly moving up and volume shelf will act as a launch pad. Clear $20 and $35 comes quick for a fantastic trade. Longer term this can get back to triple digits.

S1RP34 trade ideas

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

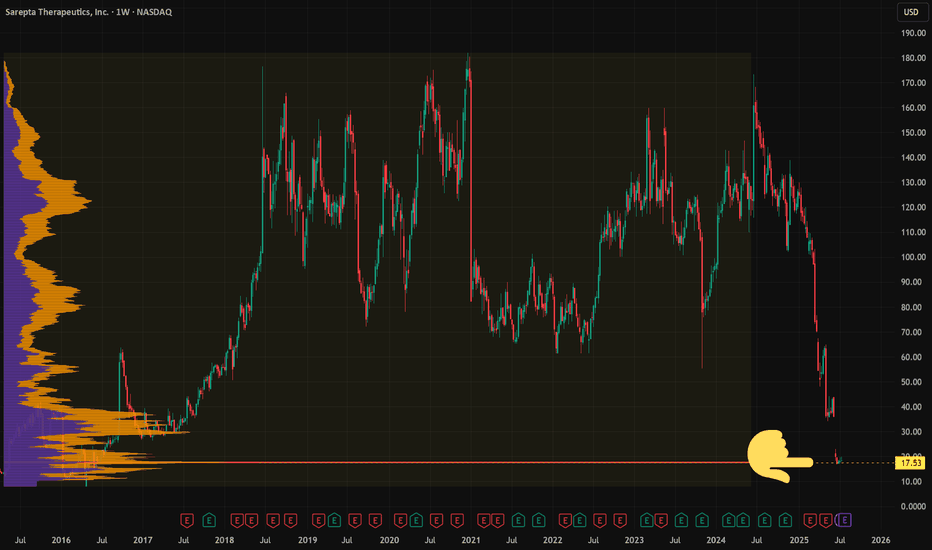

I'm scared of this stock and I'm buyingWall St. has already written the obituary on NASDAQ:SRPT —but that’s exactly why I’m stepping in.

Back in 2020 (link below) I traded a setup from a Spike at 50% Retracement up to its prior ATH near $170, cashed out, dodged the drug-trial IV grenade. I saw 50% of market cap evaporate in a gap. Scared me, made me even more appreciative of risk.

This year alone? Three separate -27% to -50% drawdowns. Yikes is right… and capitulation smells like opportunity.

Risk management: I’m sizing the trade as if it can drop another -50%. If I’m wrong, pain is survivable. If the market over-shot, upside is asymmetric. Whoever’s left is either hedged or numb—perfect soil for a rebound.

Process: 🗑️ Find the trash → Measure the multi-year Volume Profile → Size for worst case → Buy when everyone tells you it's wrong → Hold for return to form

SRPT LongSarepta Therapeutics

Focused on the development of precision genetic medicines to treat rare neuromuscular

and central nervous system diseases

investorrelations.sarepta.com

Major leader in treatment

- Duchenne muscular dystrophy (Duchenne) and limb-girdle muscular dystrophies (LGMDs)

- Explore perespective produts in Gene therapy and editing

Fundamentals:

- Growing Revenue and EPS

- Trading at historical low PE

- Far below market consensus $148

Technicals

- Near low 200VWAP extension 30% discount

SRPT Sarepta Therapeutics Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SRPT Sarepta Therapeuticsprior to the earnings report this week,

I would consider purchasing the 120usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $9.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SRPT Sarepta Therapeutics Potential Buyout SoonIf you haven`t bought SRPT here:

Then you need to know that there is a Massive catalyst coming!

Sarepta Therapeutics is going to announce Duchenne muscular dystrophy Phase 3 data for its SRP-9001-301 - (EMBARK) by mid November.

This week institutions bought calls worth more than $10Mil that SRPT Sarepta Therapeutics will trade above $135 by November 17.

Some even bought the $210 strike price!

They also have a big partnership with the giant Roche Holding AG (RHHBY).

I think SRPT Sarepta Therapeutics is well positioned for a potential takeover soon!

Looking forward to read your opinion about it.

SRPT strong supportSRPT is at a very strong support at the moment and entries can be made now if fundamentals of the company are strong

Entry @ CMP or 107 to 100

SL @ 97

TP 1 @ 120

TP 2 @ 132

This is when we are expecting that it will bounce back up from the strong support of 105

104-106 range (Strong Support)

Its trading in a range and entries is good for people who believe its a fundamentally strong company

SRPT (Sarepta) is Bull to at least 72.81Prediction: SRPT (Sarepta) is Bull to at least 72.81

Reasons:

A good/decent Bull Pattern has emerged (Before closing) that is pointing upwards, and the Trends momentum is strong enough to push through the current resistance and reach the next resistance point of 72.81. And also, the main index for small biotech XBI is also showing bull signs.

As you can see on the chart, the Alligator Mouth has a decent strength, and so does the MA (53.33%), The Oscillators is Neutral (slightly bearish) but the momentum was good, so it is to be expected. Before post/pre market data it had a Sell signal (-27.27%) but with the post/pre market it improved to Neutral (-9.09%) which is a good sign. Also, Volume Flow is on an increasing trend thus giving SRPT more fuel to pump.

And finally, the volatility squeeze is not enough for the stock to collapse/reverse so all in all the signs are pointing to bull.

Bollinger Band SqueezeSRPT looks like she will pop soon. The bollinger bands are contracted and are squeezing the keltner channel for a classic bollinger band squeeze.

It is not a given which way this will pop, could go up or down..but a move is coming.

There are pocket pivots under price

Short is a bit over 9%. Negative volume is high on SRPT.

Keltner Channels are volatility-based envelopes set above and below an exponential moving average. This indicator is similar to Bollinger Bands, which use the standard deviation to set the bands. Instead of using the standard deviation, Keltner Channels use the Average True Range (ATR) to set channel distance.

No recommendation

Bottom FishingSome of the biotech industry seems to be recovering after most suffering a long hard fall.

SRPT gapped down, way down, did the dead cat bounce dance and regained a bit only to form a symmetrical triangle that broke to the downside. Then a descending triangle and has fallen down from each triangle the designated amount but could fall further. The low during these scenarios was 68.04 which is less than the 3 year low. Some support noted at 67.04.

The dead cat bounce is an event pattern as a rule, be it bad earnings or bad news related. Price makes a dramatic drop in a daily swoop down averaging 15 to 30%. Price bounces up, then resumes the downtrend. Biotech is among the top contenders to have a drop down of this magnitude. The semiconductor industry, internet stocks and alternative energy are all on the list among of those more likely to gap down significantly. Utilities, housegold goods and the defense sectors are among those least likely to gap down to this extent.

The bollinger bands are contracting, so a move one way or the other is to be expected.

No recommendation.

Being a bottom dweller can be time consuming )o: Some stocks gap down and can actually be a good buy, and it will improve the odds if the gap down day candle ends as a doji or a bullish candle. Utilities rarely gap down to this extreme, but not to say they do not ever do it. Homebuilders are among those that can gap down like this, but this sector is more likely to recover without further decline than other sectors according to statistics.

SRPT Long Breakaway Gap

Hook Reversal

Price Crossed SMA13

RSI divergence

Williams %R Crossed -80

Entry 74

Stop 67

Target 100

I am not a PRO trader. I trade option to test my trading plan with small cost.

The max Risk of each plan is less than 1% of my account.

If you like this idea, please use SIM/Demo account to try it.

SRPT - Long This is a stock ive lost on before - so be warned

However, it seems so oversold and if price pushes lower I will likely re-enter, the stock has a strong pipeline of goods and has had some good news recently (Amondys 45 FDA approval) which hasnt really been reflected in the stock price.

RSI is touching oversold

Average Analyst price target is still $130

Price at multi year lows

I think taking multiple small positions is the way to play this, to scale in, and allow for protection from the continuation of the sell off in the short term