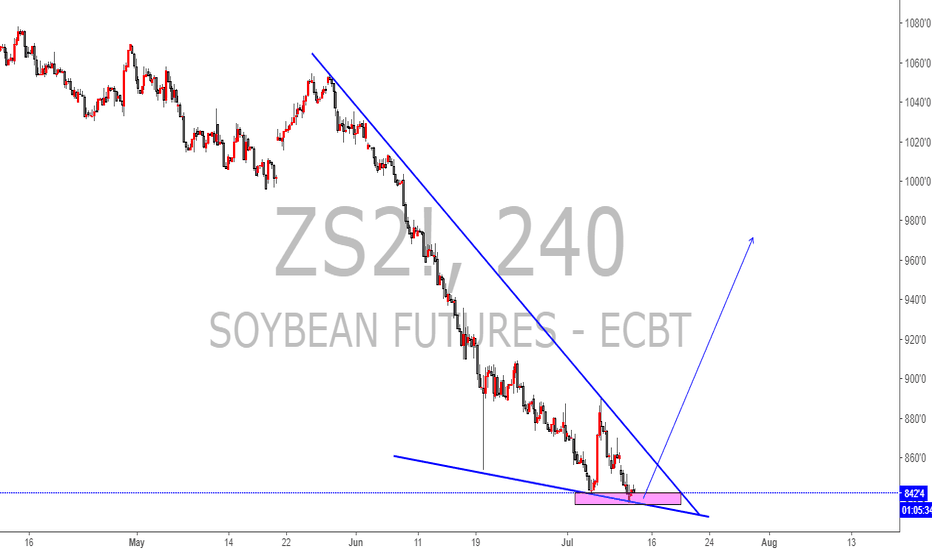

SJC1! trade ideas

Soybean futures Nov 2018 (1D) Trading Signal

Long Position (EP) : 849.5

Stop Loss (SL) : 840.5

Take Profit (TP) : 881.25, 888.25

Description

ZSX2018 formed Double Repo Buy at 1d time frame. Trade setup with Buy Stop at 0.382 Level (849.5) and place stop after 0.618 level (840.5). Once the position was hit, place take profit before an agreement (881.25) and 888.25

Money Management

Money in portfolio : $49000

Risk Management (2%) : $980

Position Sizing

$0.25 = +-$12.5 (Standard)

Commission fee = -$2.82/contract (Standard)

EP to SL = $9 = -$450/contract (STD)

Contract size to open = 2 standard contracts

EP to TP#1 = $31.75 = +$1587.5 (STD)

EP to TP#2 = $38.75 = +$1937.5 (STD)

Expected Result

Commission Fee = -$11.28

Loss = -$900

Gain#1 = +$1587.5

Gain#2 = +$1937.5

Total Gain = +$3525

Risk/Reward Ratio = 3.87

Soybeans will go upIt was long time never this low. In 2008 when the market collapsed it was just a bit shorter.

In my opinion it will go up safely until 1000 mark because market love that kind of full numbers.

Risk to Reward is excellent also the market did a retrace from the bottom level indicating that the buyers are now in control.

Soybeans /ZS - Short Premium - Short straddle into high IVRSoybeans are offering a short premium opportunity as price perhaps starts making a bit of a floor. I have sold a straddle at 840 w/ 45 DTE for a maximum profit of $2500. A few things made this an attractive trade such as the high implied volatility and price having reached a key support level where I hope price stays buoyed while I run out the clock and collect options premium. The high implied volatility has allowed me to sell a straddle that has a break even range of $100 or greater than 10% of the total value of the underlying which makes me feel comfortable with the risk/reward of this trade.

Soybean Future NOV18 (1d)Trading Signal

Long Position (EP) : 847

Stop Loss (SL) : 839

Take Profit (TP) : 864.75, 882.25

Description

ZSX2018 formed Double Repo Buy at 1d time frame. Trade setup with Buy Limit at 0.382 Level (847) and place stop after 0.618 level (839). Once the position was hit, place take profit before an agreement (864.75) and 882.25

Money Management

Money in portfolio : $133,000

Risk Management (1%) : $1,330

Position Sizing

$0.25 = +-$12.5 (Standard)

Commission fee = -$1.67/contract (Standard)

EP to SL = $8 = -$400/contract (STD)

Contract size to open = 3 standard contracts

EP to TP#1 = $17.75 = +$887.5 (STD)

EP to TP#2 = $35.25 = +$1,762.5 (STD)

Expected Result

Commission Fee = -$10.02

Loss = -$1200

Gain#1 = +$1,775

Gain#2 = +$1,762.5

Total Gain = +$3,537.5

Risk/Reward Ratio = 2.92

the Grain complex is getting madly crushed in the last month... ....multi years low for many... extremely oversold across the complex!

JUST A TRADE TO KEEP AN EYE ON...

I am not an expert in these ones, but the trade war has potential for more destruction,

even, there is important votes for Trump midterm in it (farmers)... any surprise can come up from the hat!

...but we also entering the new crop season.

With this crazy weather hitting across the continent,

dead cat bounces very possible,

I would trade with options, no futures yet... too dangerous still!

Wait for a divergence or a breakout to play it... nothing lined up for the moment,

just keep an eye on it

ZN or Soybean Future Long Train soon...Watching soybean futures now, with a bullish bais at this time. Looks like, if you look left on daily chart (a double or triple botton) is happening now. June is a cyclical time with Soybean from being bearish to going bullish for next month or two. Also, look left, specially on daily charts for support and resistance.

Soybeans running out of RSI - Bull ButterflyAugust Soybeans is nearing S3 at 966'2 and almost depleted RSI. This will give us a double bottom and a Bull Butterfly. This market could jump up then continue down into the 954 area and 935, although 935 might be a long shot. We might get a W bottom or sideways channelling down here.

Soybean Meal Head and ShouldersSeptember Soybean Meal has created an H&S. Market is now at the neckline and waiting to see if it breaks. Minimal drop would be to S2 at 364.3. Minimal shoulder height would put it at S3 at 353.5. Large sells for this formation came in at the 20 day MA at 378.1. There is also a support line coming in at 357 so this may be a launching area for an upward move. The other issue is an RSI support line that is almost reached. This tracks back several months. To make this H&S successful that line will have to be breached.