The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately t

0.000 BRL

2.12 B BRL

13.18 B BRL

About The Trade Desk, Inc.

Sector

Industry

CEO

Jeffrey Terry Green

Website

Headquarters

Ventura

Founded

2009

ISIN

BRT2TDBDR004

FIGI

BBG00ZVXKLL3

The Trade Desk, Inc. engages in the provision of a self-service and cloud-based ad-buying platform. It operates through the United States and International geographical segments. The firm offers omnichannel advertising, audience targeting, solutions for identity, application programming interface (API), custom, and programmatic, measurement and optimization. The company was founded by Jeffrey Terry Green and David Pickles in November 2009 and is headquartered in Ventura, CA.

Related stocks

TTD is giving a second chance A few days ago, we mentioned that NASDAQ:TTD could have reached a great buying level around the $44 area. After a recent rally, we’re now seeing a typical bullish continuation pattern. If the flag breaks to the upside, you’ll have a new opportunity to join the upward move.

Once again, a tight sto

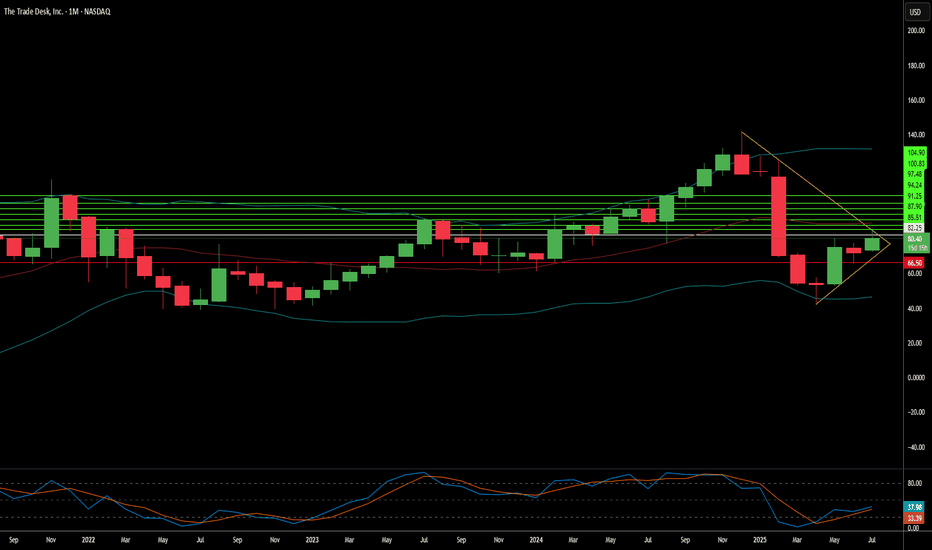

$TTD | Smart Money Accumulation or Just a Dead Cat Bounce?WaverVanir International LLC Analysis

🧠 Weekly Chart | Smart Money Concepts (SMC) | June 25, 2025

After a dramatic markdown, The Trade Desk (TTD) has bounced sharply off a major strong low / demand zone (~$40–$45). We’re currently trading near $69.80, building bullish momentum toward the equilibriu

TTD Swing Trade Plan – 2025-06-06🐻 TTD Swing Trade Plan – 2025-06-06

Bias: Moderately Bearish

Timeframe: 5–7 trading days

Catalysts: Weak daily trend, below EMAs, oversold conditions may delay move

Trade Type: Naked put option

🧠 Model Summary Table

Model Bias Strategy Strike Premium Target(s) Stop-Loss Confidence

Grok Moderately B

Long on $TTD ; It should test 75-80 range- Many good news have come for NASDAQ:TTD in the last 2 weeks and one of that is Judge ruling against Google Ad business which might lead to relaxed rules by Google which will help other advertisers expand their TAM

- Netflix ads should allow DSPs like NASDAQ:TTD to get more investment dollars

$TTD Breakout After Earnings | Gapped Up w/ Volume Surge📊 Summary for TradingView Post:

NASDAQ:TTD exploded +11% post-earnings, gapping above key resistance and closing strong with massive volume.

Price cleared multiple supply zones with conviction, now sitting above $79 with eyes on $82.74 and $86.43.

Buyers showed up heavy. This is no random push—str

$TTD stock has been in a steady uptrend!📊 The Trade Desk ( NASDAQ:TTD ) – Stock Analysis

🔍 Fundamental Analysis

1. Company Overview:

Name: The Trade Desk Inc.

Ticker: TTD

Sector: Technology / Advertising

Business Model: The Trade Desk is a leading demand-side platform (DSP) for digital ad buyers, enabling programmatic advertising acro

TTD eyes on $54.xx: Major Resistance to be flipped to SupportTTD dumped even before tariffs but trying to recover.

Now testing a major resistance zone at $54.21-54.34

If rejected then watch next support zone $51.26-51.43

Previous Analysis that called the top:

================================================

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought TTD before the recent rally:

Now analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 55usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $6.7

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where T2TD34 is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks