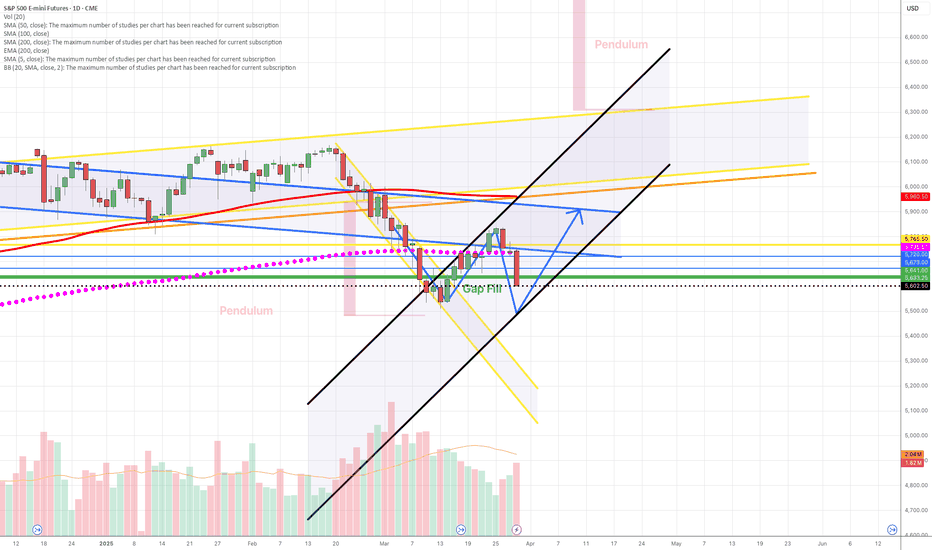

ES UpdateLooks like they turned the algos on so here's the 3hr chart update.

Just because they turned the algos on doesn't mean good news for the bulls, ES MFI is almost overbought, I expect it to get there at market open. 7am right now.

So basically I'm expecting the market to fill the down gap then drop again.

Don;t expect any more updates today, I'm going to work now.

WSP1! trade ideas

ES1 2025-03-31 SPOOZ 15minOBHello everyone, I hope you won, stayed out, or learned something form the market today 😂.

Today was a easy grab.

Drawdown: 17. Tics

TP: 111. Tics Grabbed (out of 438)

Spooz Open Manipulation,

Broke near high,

Retraced to 15min Order Block,

TP Hit at 3 equal Highs (volume).

If you found this inciteful, join our group discussion! (link in bio)

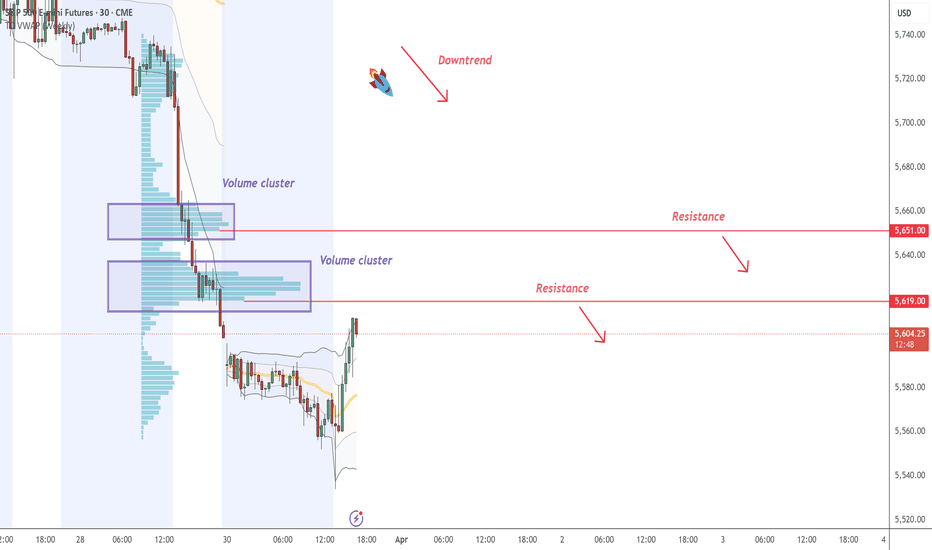

ES - Day Trading Analysis With Volume ProfileOn ES , it's nice to see a strong sell-off from the price of 5619 and 5651. It's also encouraging to observe a strong volume area where a lot of contracts are accumulated.

I believe that sellers from this area will defend their short positions. When the price returns to this area, strong sellers will push the market down again.

Downtrend and Volume cluster are the main reasons for my decision to go short on this trade.

Happy trading,

Dale

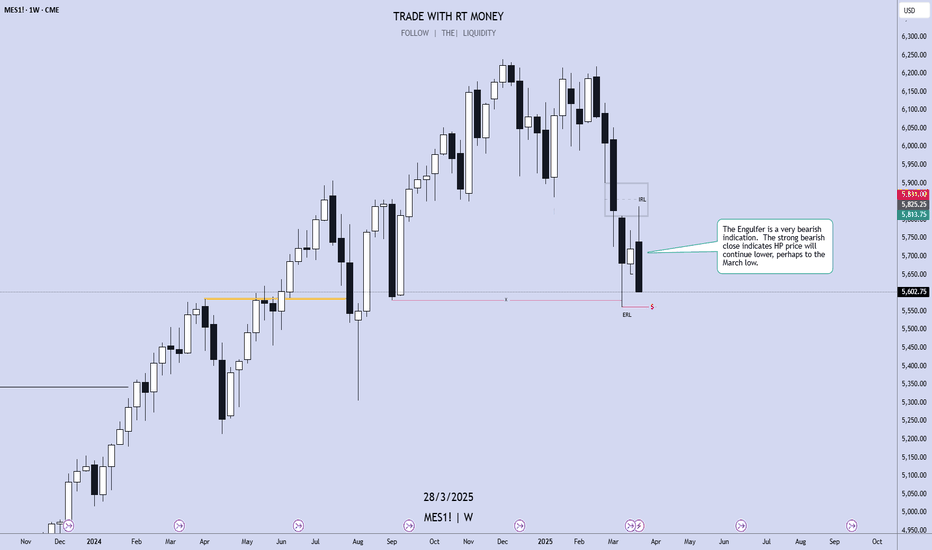

Liberation, Altercation or Doom? ES Futures weekly planCME_MINI:ES1!

Quick Update

The upcoming week is poised to be critical for financial markets as President Donald Trump's so-called "Liberation Day" on April 2 approaches. On this date, the administration plans to implement new tariffs aimed at reducing the U.S. trade deficit by imposing reciprocal duties on imports from various countries.

As April 2 looms, the full impact of these tariffs remains uncertain, leaving markets and investors in a state of heightened anticipation.

We may get clarity on the tariff situation on April 2, 2025.

Universal tariff announcement of categories of imports may clarify US administration’s maximum tariff escalation approach.

A phased out and unclear tariff approach may keep markets in limbo.

Economic Calendar

Keep an eye on the data docket, NFP and other key releases are due this week.

Tuesday, Apri 1, 2025 : ISM Manufacturing PMI, JOLTS Job Openings

Wednesday April 2, 2025 : ADP Employment Change, Factory Orders MoM

Thursday April 3, 2025 : Balance of Trade, Imports, Exports, ISM Services PMI, Initial Jobless Claims

Friday, April 4, 2025 : Non-Farm Payrolls, Unemployment rate, Average Hourly Earnings MoM,Average Hourly Earnings YoY, Fed Chair Powell Speech

Key Levels to Watch:

Yearly Open 2025 : 6001.25

Key Resistance : 5850- 5860

LVN : 5770 -5760

Neutral Zone : 5705-5720

Key LIS Mid Range 2024 : 5626.50

2024-YTD mCVAL : 5381

2022 CVAH : 5349.75

August 5th, 2024 Low : 5306.75

Scenario 1: Bold but Strategic Tariffs (Effective Use of Tariff to reduce trade deficit and raise revenue) : In this scenario, we may see relief rally in ES futures, price reclaiming 2024 mid-range with a move higher towards key resistance level.

Scenario 2: Maximum pressure, maximum tariff (All out trade war) : In this scenario, we anticipate a sell-off with major support levels, such as 2024- YTD mCVAL, 2022 CVAH and August 5th, 2024 low as immediate downside targets.

Scenario 3: Further delays in Tariff policy (A negotiating tool, with looming uncertainty) : In this scenario, sellers remain in control and uncertainty persists, while we anticipate that rallies may be sold, market price action may remain choppy and range bound.

Weekly Market Forecast: SELL THE INDICES!In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures for the week of March 31st - April 4th.

The equity markets took a bearish turn last week. This is likely to continue for the upcoming week.

Monday is the end of March. Tuesday brings a new week and new opportunities. April 2nd brings... potentially market flipping volatility. The day the Trump tariffs are implemented.

Be careful. Let the market give you direction, and then get involved.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

No where to go but up....What a mess! As you can see from the 240 minute chart, things are indeed ugly. But, isn't it strange that we made all time highs just a month or so ago? Look at the Magic 7 stocks and find one that doesn't look buyable here. All the bearish sentiment in the world cannot stop the flood of FOMO money that will attract to the negative look of the chart to the first clear sign of a trend reversal. I don't care about the rest of the world, I am going to try and buy this somewhere between where we are and an absolute bottom in the 5500's.

bearflag broke downno rate cuts but im still balling

we already tested that gap (rectangle) so a second attempt will probably close it.

that will throw us well below the year to date value range

so im looking at it as a potential bottom.

if this gap fails to hold im looking at the previous range for help and the previous value area high to turn support (classic what was once resistance is now support)

on the shorter timeframe i anticipate 5485 to act as support a small bounce can make it look like a head and shoulders pattern for the bearflag target if there's any bullish play

note this is not a trade i will take unless the data and reaction at the level will look bullish.

so make sure you know we can straight up nuke on monday. (eyes on BTC during this weekend)

anyone who saw my posts before i talked about how we need to rotate back to value thats exactly what happened.

previous range value area high was left untested, retesting it is quite the possibility. (theres a gap right above it )

ES/SPY Possible Enhancement On Idea.As per usually channel lines are nice but common price action includes big pushes past them and then reclaiming them. This provides great opportunities for big money to run the stops, scoop of the shares, paint a big wick and keep trucking. It's how the game is played and provides no real ability as to where to count on a bottom or to put stops. Non the less the channel lines provide an idea as to where to see signs of traction or of course a top for further bull traps or sell offs. Personally I think peak tariffs fears are near and at some point the market will accept them and move on.

ES Bull Unicorn Trade ReviewDaily bias: Bullish due to the 1hr NWOG that was created on Friday

Trade info:

- Price trades down into 1hr +NWOG

- Creates a 5min bull unicorn model

- I enter as price trades back down into the breaker block (BB) and target +2r profit

- Hits my +2r TP perfectly and falls back down

Let me know if this trade review helps and if you want more trade reviews.

SHORT ON ES?This could be a short rade idea for swing trade.

Las week price invalidate long ideas and the structure remain bearish.

Depending on how we open on Sunday, and with NFP week ahead, I would see ha Monday price will dive quick again, or retrace a little and offer short second half of he week.

They Shut Down the AlgosYou can see in the chart that during the initial Feb/March drop that the algos were still running, and we'd see at least a small bounce when MFI/RSI got oversold, however you can see that they shut the algos down yesterday, MFI totally flatlined for 2 days which is something that did not happen on the initial drop.

So basically, there's no point for me to plot 3 hr charts until they turn the algos back on. I will post when that happens.

Made a bunch of mistakes this week, but managed to break even daytrading XLF puts twice today. XLF was lagging the market a bit which made it easier to trade.

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$537.50

Sleep: 8 hour, Overall health: Energized

As mentioned in our trade recap video yesterday, today was suppose to be really bearish and go down more,

However, the inflation report ended up being really bad and that just crashed the market all day.

I was expecting to see some bounces here and there along the way but it was just straight drill with no buyers in sight.

Daily Trade Recap based on VX Algo System

8:24 AM Market Structure flipped bearish on VX Algo X3! Look to STR at 1 min MOB or resistance.

11:10 AM VXAlgo NQ 10M Buy Signal

3:36 PM VXAlgo NQ 48M Buy Signal

S&P 500 Futures Potential Short OpportunitiesThe S&P 500 futures index has retraced approximately half its previous losses from a steep sell-off that began at 6148. After rejection at 5818, prices now hover precariously above critical Support at 5732.

Immediate Support Test: Failure at 5732 would trigger additional bearish pressure toward the next support levels at 5649 and 5566.

Bullish Reversal Potential: Only a decisive close above 5818 would suggest a more constructive outlook, which currently appears improbable amid elevated VIX levels.