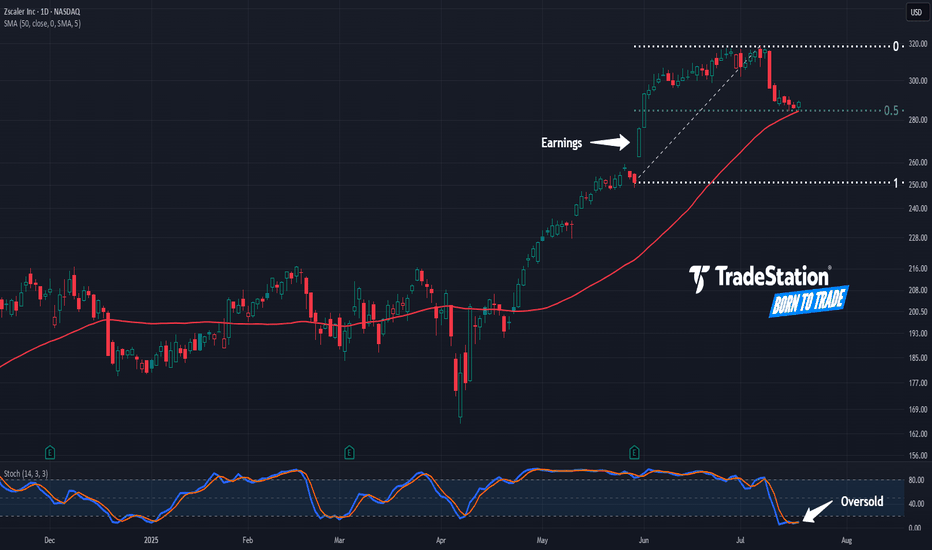

Zscaler May Be OversoldZscaler recently climbed to a three-year high, and now it’s pulled back.

The first pattern on today’s chart is the May 30 gap after earnings and revenue beat estimates. That may reflect positive fundamentals.

Second, the cybersecurity stock has retraced half the move following results. Stabilizing here may confirm direction is pointing higher.

Third, prices are trying to stabilize near the rising 50-day simple moving average.

Fourth, stochastics have dipped to an oversold condition.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Z2SC34 trade ideas

ZS is starting the early sign of the Wyckoff distribution phaseMarkup (Phase E) that has been going on for months. But look closer. The momentum is getting tired. The daily chart is where the truth comes out. After that magnificent run, the price has stalled and started moving sideways for a month.

Entry Level: Initiate a trade if ZS rallies to the $325 - $327 area and fails to hold its gains.

Price Target: The ultimate target is the start of the markdown phase, with an initial price objective around $250.

Stop Loss: A confirmed weekly close above $335 would indicate the distribution pattern has failed and you should exit the trade.

ZS - Breakout Confirmed — Now What?Zscaler has broken out of a year-long ceiling with volume and momentum — as long as it holds above $275, the trend has shifted bullish and targets $310+ are now in play.

1. Structural Breakout

That resistance zone capped price for over a year — multiple failed attempts, including the November–December 2023 top. This breakout is significant, and invalidates the bear case that this zone would hold again. ZS has now entered open-air territory — next real resistance isn’t until $310–320 (based on prior highs from 2021–2022).

2. RSI & MACD Still Hot – But Not Crashing

RSI is cooling slightly from extreme overbought (still ~79), but hasn't broken down — momentum remains bullish. MACD still trending higher, although it's stretched — but no bearish crossover yet. As long as price consolidates above the breakout zone, these indicators can reset without breaking the trend.

3. Volume Validates the Move

The breakout came on surging volume — a textbook confirmation signal. This is not a weak breakout or bull trap; this is buyers forcing a regime change. Institutions were clearly active.

The Playbook from Here:

🟢 Bull Case (Primary Scenario)

Price holds above $275–280 on any retest → confirms breakout

RSI cools into the 60s without sharp reversal

MACD slowly resets while price trends sideways/up

Target = $310–320 next resistance zone (late 2021 levels)

🔴 Bear Case (Only If)

Fails back below $275 on volume → false breakout

RSI breaks sharply below 60 and MACD crosses down hard

This would put $250–257 back in play as a retracement target

Zscaler Inc. (ZS) – Multi-Year Breakout with Target at $700📅 1D Chart | Smart Money Concepts | Fibonacci Extensions | Volume Profile

Price: $301.19 | Volume: 1.59M

ZS has officially broken through its prior consolidation structure and is now trading firmly in premium territory. With the 0.786 Fib level at $298.27 now reclaimed, momentum traders are eyeing a run toward higher extensions.

🔍 Key Technical Zones:

✅ Breakout Confirmed: Structure shifted after reclaiming $250–$275

🟨 Premium Zone Begins: $300+

📈 Major Fib Extensions:

1.236: $444.89

1.618: $569.36

2.0: $693.82

🟡 Suggested Exit Zone: ~$696–700 (historical extension confluence)

🧠 Smart Money Context:

Clean Break of Structure (BOS) after a long accumulation phase

Volume supports breakout behavior

Weekly CHoCH + BOS align with institutional positioning

Little resistance until the $440–700 range based on past structure gaps

💡 Trade Plan (Probabilistic):

Upside Continuation (70%): Strong bullish conviction, targeting $444 then $569

Pullback Re-entry (30%): Retest of breakout near $270–$298 may offer a second-chance entry

🛡 Risk Management:

Entry: Current levels or on pullback to $298

TP1: $444

TP2: $569

TP3: $696–700 (consider reducing exposure)

SL: Close below $280 (invalidates breakout thesis)

📌 Conclusion:

ZS is in an extended markup phase. As long as macro conditions remain favorable, a long ride toward $700 is technically plausible. Watch volume and institutional behavior closely as we climb into uncharted premium zones.

#ZS #Zscaler #BreakoutStocks #Fibonacci #SmartMoneyConcepts #TechnicalAnalysis #PremiumZone #TradingView #EquityMomentum

Attempting a break above the resistance NASDAQ:ZS is looking at a potential break to the upside after the stock has crossed above all ichimoku indicators. Additionally, long-term MACD is showing a constant steady flow of upside momentum. Beside that, mid-term stochastic has rebounded above the 20-oversold line with %K and %D crosses, rising up in the process.

$270 Target by June 20thThe Cyber Security space is one I anticipate to gain a lot of traction this year due to current economic environment. NASDAQ:CRWD Is already trading at a premium even though the market has had a downturn recently. NASDAQ:ZS is the only ticker comparable to it in terms of fundamental strength. I see institutional buying ramping up as more good news come out over the coming weeks. I like June 20, 2025 EXP Calls at $270 Strike for a play. Ideally would want to exit one week prior to expiry as I see it blowing past this target.

Zscaler: BalancedZS has seen buyers and sellers largely balancing each other recently, preventing any significant moves in either direction. As a result, we continue to place the stock in a corrective rally as part of the magenta wave , with its high anticipated above the $259.61 resistance. However, if the price falls below the $153.70 support, the ongoing corrective structure will extend further, with the turquoise wave alt.X establishing a new low. This alternative scenario carries a 35% probability.

ZS - the trade from the upper part of the envelopeSHORT:

- the price hit resistance and broke through the upper part of the envelope. which indicates the weakening of the bulls

- the price moves inside the expanding channel

- on 4h TF it is clearly visible that the RSI and the stochastic are about to reverse

- on 4h TF divergence in osmosis is clearly visible

$ZS: Zscaler – Cloud Security Titan or Overhyped Hype Train?(1/9)

Good afternoon, folks! ☀️ NASDAQ:ZS : Zscaler – Cloud Security Titan or Overhyped Hype Train?

With NASDAQ:ZS soaring after smashing earnings, is this cybersecurity champ locking down profits or just riding a digital wave? Let’s crack the code! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: Up post-earnings, exact $ TBD 💰

• Recent Results: Q1 2025 earnings beat estimates, per X buzz 📏

• Sector Trend: Cloud security demand surging 🌟

It’s a hot streak in a hotter market! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: Strong, based on 151.62M shares 🏆

• Operations: Leader in Zero Trust security ⏰

• Trend: posts hail robust growth, per Mar 6 chatter 🎯

Solid, shielding the digital frontier! 🌍

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Win: Q1 2025 topped forecasts, guidance raised 🔄

• Cloud Security: Demand spikes amid cyber threats 🌐

• Market Reaction: Stock jumped📋

Thriving, as hackers keep the world on edge! 💡

(5/9) – RISKS IN FOCUS ⚠️

• Valuation: High P/E could spook investors 🔍

• Competition: Crowded field with CrowdStrike, Palo Alto 📉

• Macro Shifts: Economic dips might slow spending ❄️

Watch out, risks lurk in the shadows! 🕵️

(6/9) – SWOT: STRENGTHS 💪

• Earnings Beat: Q1 2025 growth shines 🥇

• Market Lead: Zero Trust pioneer 📊

• Demand: Cloud security’s red-hot 🔧

Locked and loaded for the cyber age! 🔒

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High valuation, competition pressures 📉

• Opportunities: Rising cyber threats fuel expansion 📈

Can it secure the bag or get hacked by rivals? 🤔

(8/9) – 📢Zscaler’s riding high post-earnings—your call? 🗳️

• Bullish: $250+ by summer, cyber’s king 🐂

• Neutral: Holding steady, risks loom ⚖️

• Bearish: $180 drop, hype fades 🐻

Vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Zscaler’s Q1 2025 earnings pop signals strength 📈, but high stakes mean volatility’s a shadow friend 🌫️. Dips? That’s our DCA jackpot 💰. Buy low, soar high! Treasure or trap?

ZS - breakout of daily trendline and backtest heldZScaler has broken out of the daily trendline and back-tested the trendline yesterday and held it. Todays price action is also nice watching it holding it above the 205 level

As long as it holds 205 level on a daily closing basis, I believe we will see 215/220 prior to Earnings which are due in another 3 weeks.

SL - < 205 on DCB basis

T1 - 215

T2 - 220

Zscaler Poised for Massive BreakoutZscaler's appears to be situation for a breakout from a massive multi-year consolidation triangle. It's P/S ratio is 4x less than its peak while revenue has increase dramatically. Profitability is coming with net margins being within a few points of positive earnings (used to be -38%). ZS had never missed a single earnings projection and the future looks like continued growth as businesses continue to invest heavily in cybersecurity.

This is eyeing the $400 level with a P/S of 25. The previous peak will act like a magnet once the breakout is complete. But it likely won't stop there. Steady revenue growth and profitability should push this to $600+ over the next 3 years.

Zscaler (ZS): Liquidity Below $154—A Drop Imminent?Zscaler is becoming interesting again, not only due to its earnings call yesterday but also because it has formed a strong sell-side liquidity below $154.

After a period of sideways movement, we anticipate a sell-off to take out the liquidity below, most likely wicking into the $151-$122 area. If this plays out, it should conclude the wave C and wave (2).

We did not believe the earnings report will have a decisive impact, but it still could provide one last push into the $220-$237 range before the expected drop to wave (2).

At this point, we are not placing any limit orders but have set alerts to monitor the development of this scenario closely.

Zscaler Earnings BREAKOUT Inbound? 67% UpsideEarnings Monday: Zscaler - NASDAQ:ZS 💻

A huge name within the cybersecurity space, this growth beast is reporting earnings on Monday and has beaten earning projections over 24x in a row! They clearly know how to play the game that is Wall Street. Will the streak continue?

-Cup with handle forming as we speak. $265 is the BO area. 📏$445 - 67% Upside

-Bull Flag breakout with successful retest.📏$300

-H5 Indicator is Green

-Williams Consolidation Box is thriving

-Launching off AVP Shelf

The sector is red hot with MEH quarters from the Cybersecurity leaders in NASDAQ:CRWD NASDAQ:PANW so if Zscaler can come in and knock some socks off then they will fly to $300 faster than you can say "What is a Zscaler?"

NFA #CyberSecurity