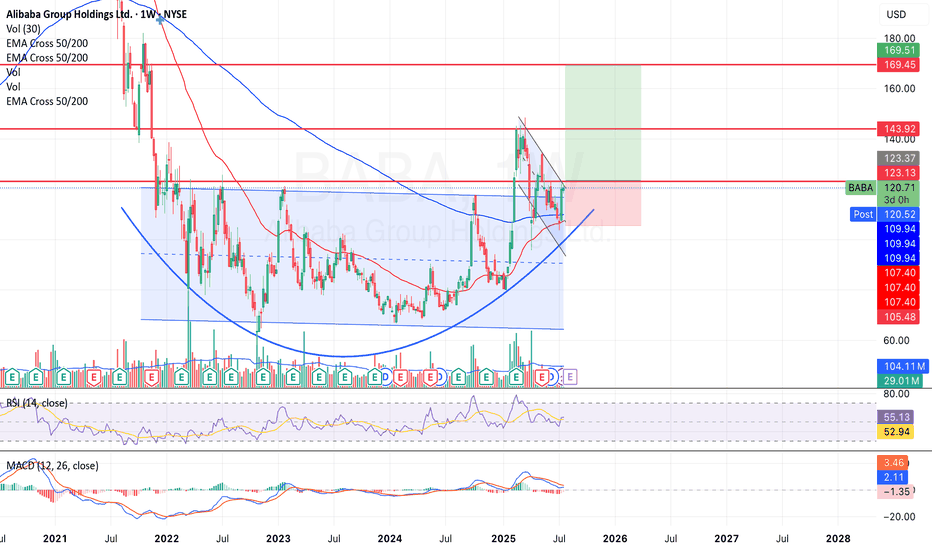

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour j

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

19.65 MXN

367.96 B MXN

2.83 T MXN

16.56 B

About Alibaba Group Holdings Ltd.

Sector

Industry

CEO

Yong Ming Eddie Wu

Website

Headquarters

Hangzhou

Founded

1999

FIGI

BBG012PPB6J5

Alibaba Group Holding Ltd. engages in providing technology infrastructure and marketing reach. It operates through the following business segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others segments. The Core Commerce segment consists of platforms operating in retail and wholesale. The China Commerce segment includes China commerce retail and wholesale businesses. The International Commerce segment focuses on international commerce retail and wholesale businesses. The Local Consumer Services segment is involved in To-Home businesses, which include Ele.me, local services and delivery platform, and Taoxianda, and To-Destination segment businesses which include Amap, the provider of mobile digital map, navigation and real-time traffic information, and restaurant and local services guide platform. The Cainiao segment has Cainiao Network and offers domestic and international one-stop-shop logistics services and supply chain management solution. The Cloud segment includes Alibaba Cloud and DingTalk. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China.

Related stocks

Much needed break for $BABA on the horizonI took a much needed break but not as long as NYSE:BABA has taken since 2021; swinging between ~$70 and ~$120 over the past six years.

I strongly suspect that this might have something to do with Jack Ma's speech in late 2024 that made him go 'missing' from public view

- www.wired.com .

The s

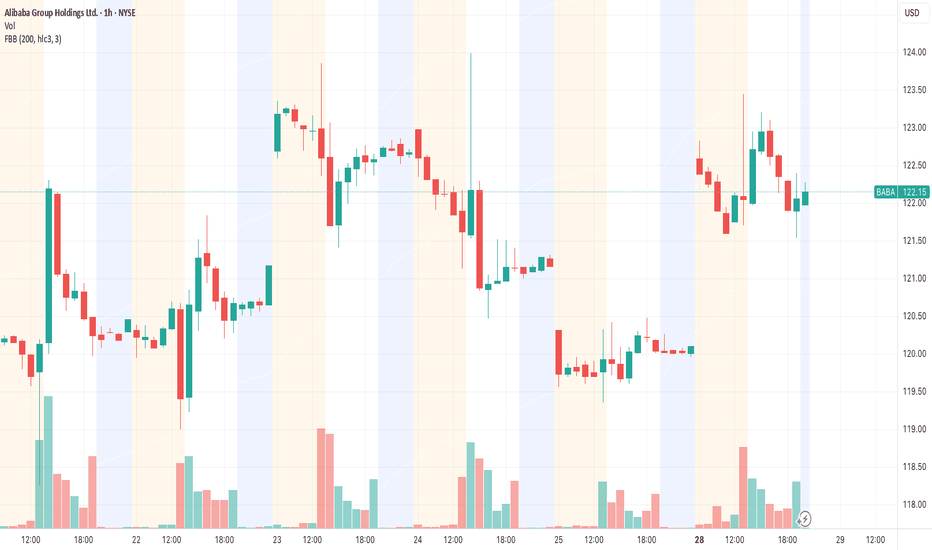

BABA looks ready to drop.It’s been hitting the $125 wall since May and just can’t break it. This last bounce? Weak volume. No real buyers stepping in. RSI is already stretched and there’s no accumulation from big players.

If it loses $120 with conviction, we might see $110 or lower.

And let’s be real — China’s still strug

BABA | Long | Strong AI & Seasonality Tailwinds (July 2025)BABA | Long | Strong AI & Seasonality Tailwinds (Aug 2025)

1️⃣ Quick Insight: Alibaba is showing strong AI-driven momentum, healthy fundamentals, and positive seasonality patterns. August–December tends to be bullish, and the stock is already holding up well despite recent dips.

2️⃣ Trade Paramete

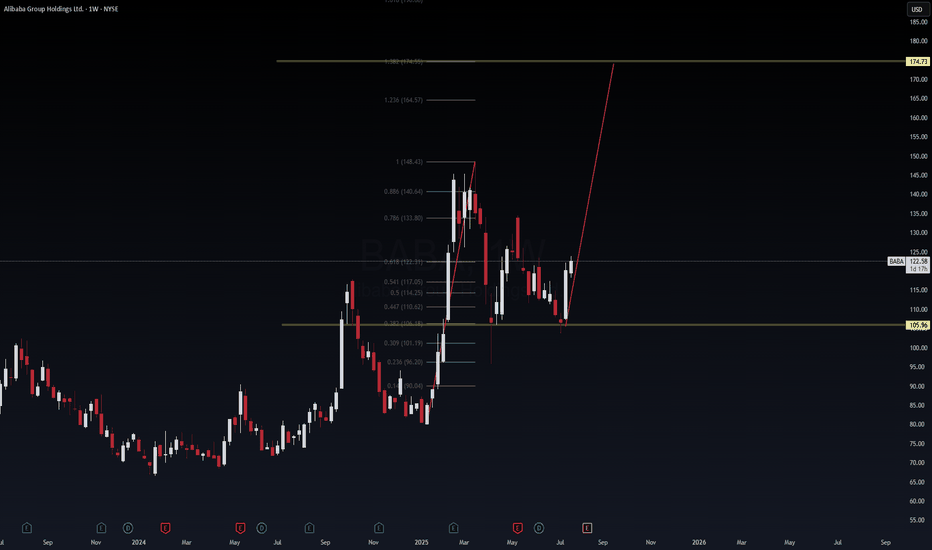

Long $BABA - NYSE:BABA is testing 200 SMA

- NYSE:BABA moves are explodes higher then cools then retest support then explodes higher than the last high. It's called trading with higher wavelength

-> Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $9

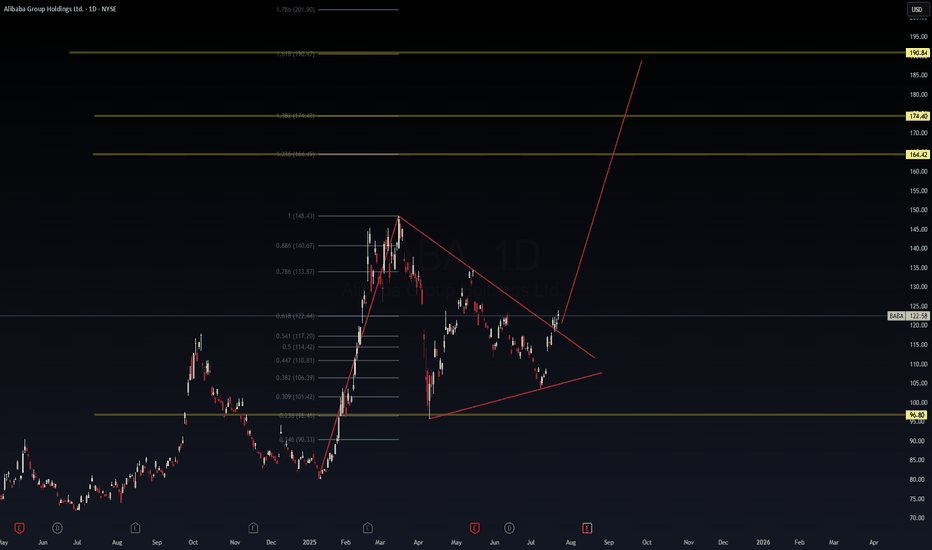

$BABA Breakout Imminent – Triangle Compression Ending, Fib .....📈 NYSE:BABA Breakout Imminent – Triangle Compression Ending, Fib Confluence Targets Set

After weeks of coiling inside a converging triangle, Alibaba ( NYSE:BABA ) just broke above the downtrend line with conviction. The structure and Fibonacci extensions point toward an explosive leg up—possibly

BABA | Weekly VolanX Setup📈 BABA | Weekly VolanX Setup

WaverVanir International LLC | July 24, 2025

Alibaba is bouncing off a key institutional demand zone at 105.96, reclaiming the .382 Fibonacci level with strong bullish conviction. This weekly structure sets the stage for a macro Fibonacci extension run toward 174.73 — a

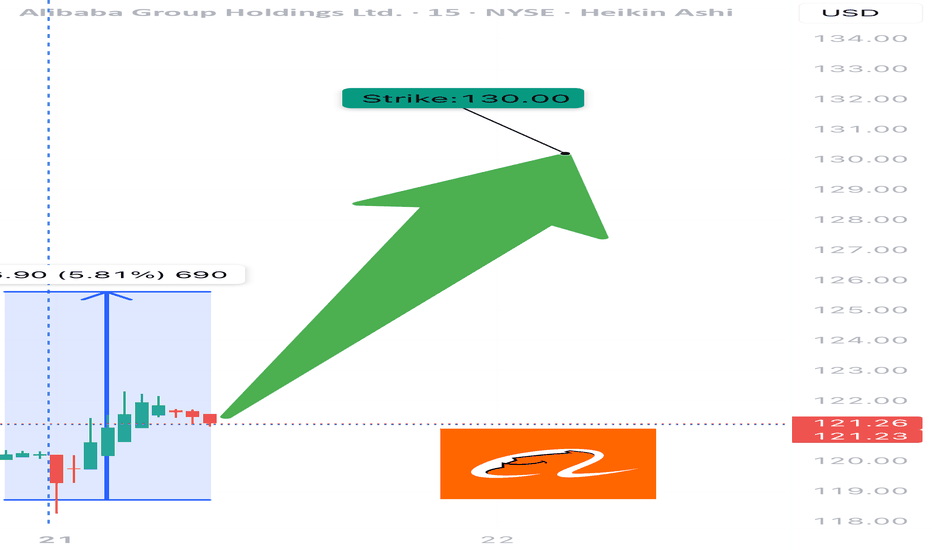

BABA WEEKLY TRADE IDEA – JULY 21, 2025

🐉 NYSE:BABA WEEKLY TRADE IDEA – JULY 21, 2025 🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Lo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 9988/N is featured.

Frequently Asked Questions

The current price of 9988/N is 290.56 MXN — it hasn't changed in the past 24 hours. Watch ALIBABA GROUP HOLDING LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange ALIBABA GROUP HOLDING LTD stocks are traded under the ticker 9988/N.

9988/N stock hasn't changed in a week, the last month showed zero change in price, over the last year ALIBABA GROUP HOLDING LTD has showed a 61.42% increase.

We've gathered analysts' opinions on ALIBABA GROUP HOLDING LTD future price: according to them, 9988/N price has a max estimate of 416.77 MXN and a min estimate of 252.60 MXN. Watch 9988/N chart and read a more detailed ALIBABA GROUP HOLDING LTD stock forecast: see what analysts think of ALIBABA GROUP HOLDING LTD and suggest that you do with its stocks.

9988/N reached its all-time high on Oct 27, 2021 with the price of 454.57 MXN, and its all-time low was 175.00 MXN and was reached on May 17, 2024. View more price dynamics on 9988/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

9988/N stock is 0.00% volatile and has beta coefficient of 1.59. Track ALIBABA GROUP HOLDING LTD stock price on the chart and check out the list of the most volatile stocks — is ALIBABA GROUP HOLDING LTD there?

Today ALIBABA GROUP HOLDING LTD has the market capitalization of 5.03 T, it has increased by 10.83% over the last week.

Yes, you can track ALIBABA GROUP HOLDING LTD financials in yearly and quarterly reports right on TradingView.

ALIBABA GROUP HOLDING LTD is going to release the next earnings report on Aug 14, 2025. Keep track of upcoming events with our Earnings Calendar.

9988/N earnings for the last quarter are 4.46 MXN per share, whereas the estimation was 4.38 MXN resulting in a 1.69% surprise. The estimated earnings for the next quarter are 5.08 MXN per share. See more details about ALIBABA GROUP HOLDING LTD earnings.

ALIBABA GROUP HOLDING LTD revenue for the last quarter amounts to 673.68 B MXN, despite the estimated figure of 674.24 B MXN. In the next quarter, revenue is expected to reach 664.99 B MXN.

9988/N net income for the last quarter is 34.85 B MXN, while the quarter before that showed 142.01 B MXN of net income which accounts for −75.46% change. Track more ALIBABA GROUP HOLDING LTD financial stats to get the full picture.

ALIBABA GROUP HOLDING LTD dividend yield was 0.80% in 2024, and payout ratio reached 13.85%. The year before the numbers were 1.39% and 22.64% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 124.32 K employees. See our rating of the largest employees — is ALIBABA GROUP HOLDING LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ALIBABA GROUP HOLDING LTD EBITDA is 517.14 B MXN, and current EBITDA margin is 17.78%. See more stats in ALIBABA GROUP HOLDING LTD financial statements.

Like other stocks, 9988/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALIBABA GROUP HOLDING LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ALIBABA GROUP HOLDING LTD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ALIBABA GROUP HOLDING LTD stock shows the buy signal. See more of ALIBABA GROUP HOLDING LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.