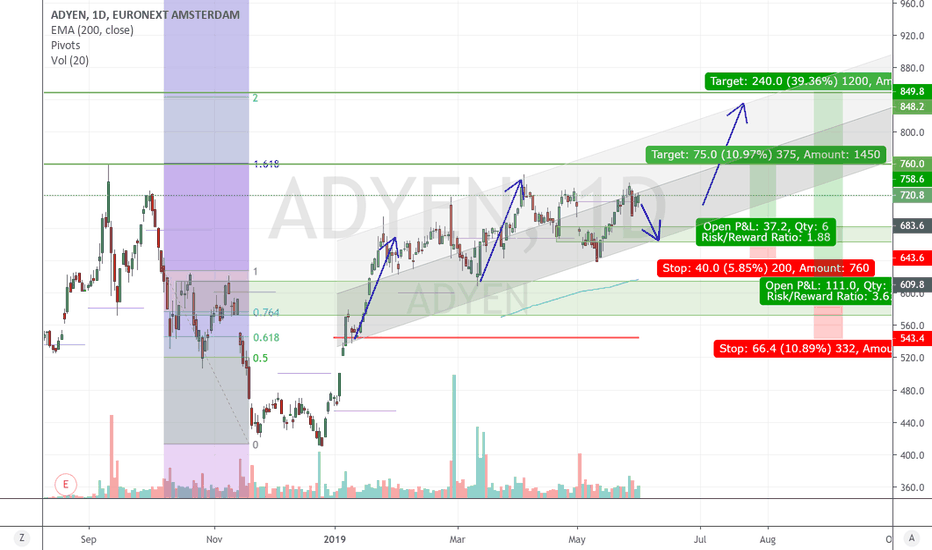

ADYEN/N trade ideas

Stocks Better then AMZN: PDD, HFG, ADYEN, SHOP, 3690My list of stocks wich i hold in may-june and enjoyed their perfomance:

On-line retail platforms and covid gainers

PDD (Pinduoduo)

HFG (Hello Fresh)

ADYEN (Adyen)

SHOP (Shopify)

3690 (Meituan Dianping)

Adyen have a great potencial to go up, and all of this companies have a great potencial next 3 years.

I reccomend to buy warrants for 2022-2023 year.

Time to sell ADYEN, perhaps rebuy aroud EUR 875,-ADYEN has been on an impressive run since approximately EUR 700,-.

The channel it formed has recently been broken and a head and shoulders pattern seems to be forming. So for me it's time to sell and look for potential buying opportunities.

There are several smaller supports close by, but the first one with slightly more history is around 870-900. This number interestingly coincides with the target of the head and shoulders (top H&S - bottom H&S= 175 --> bottom 1050-175= EUR 875,-).

And it doesn't end there, because if we take the fib retrace for the last upward channel I mentioned earlier, the 0.618 fib is at 878, exactly in that same area of support.

The H&S officially comes into play once the neckline (orange) is broken.

Huge Bull Flag - Q2 better than expected resultsAdyen is a payment provider comparable to SQUARE, but in Europe.

Recently it has won huge clients from Paypal (i.e. Ebay).

The Company is trading still under-valued compared to SQUARE.

- Revenue growth is double 70%+ vs. 44% of SQUARE

- Profitability is great 7%+ vs. -1.5%

Still up-side potential, but also in bottom of current range. So definitely a good buy-in moment just after the recent release of Q2 results where they have beaten expectations.

Adyen - ShortAdyen lost a huge customer, Uber. Uber will handle payments itself and has received a license from De Nederlandsche Bank (DNB) for handling all electronic payments.

I think Adyen has gone too far and is ready for a huge correction.

First price target: € 550

Second price target: € 400 - € 470

ADYEN WILL GROW IN THE FUTURE 2018 to 2022this can be a great opportunity to step in into shares now. Adyen will continue to grow for years to come and become a player of paypal. In the future how I have made the graph will take something higher or slightly lower, but always remember WIN IS PROFIT !!!!!

ADYEN Long FTWThe Entry

The break of $600 a key resistance point as a nice whole number and as the Fibs 0.61 point

ADL has been gradually rising and RSI is nicely at a 53%

Will look to enter 1 hour after London opens today

The R/R so far looks like a 1:1.5 ratio

The Situation

With the close of Oct, money seems to be flowing back in the the markets

Midterms are over and it seems like the increased in democrats splitting congress will make radical policy changes less likely. Thus giving some certainly to investors

Adyen also recently announced that it has entered Canada and this aligns nicely with the rising Cannabis industry situated in Canada.

Issues/Risks

The risk that this rally is short term, if the price retreats to $553.9 breaking the Fib 0.786 point then we are certain. This is an estimated 9.2% Risk

To be safe I will be leveraging 5k Margin across the full trade and will enter at 50% first, once the price breaks the fib 0.382 point I’ll enter the remaining 50%

ADYEN new stock on EURONEXTTesting a new method here, I'm trying to predict future resistance areas without price history (new stock). I'm very curious how it's going to play out.

Company Profile:

Adyen is a technology company offering a single integrated platform that facilitates frictionless payments for merchants across channels and geographies.

Source: Cofisem - Last Update: 08 Jun 2018

Trading currency EUR

Shares outstanding 29,445,458

Instrument Type: Stock

Market: Euronext Amsterdam

www.euronext.com

Adyen pennant forming, ugly IPOBrand new IPO stock EURONEXT:ADYEN is forming a pennant. It can go either way from this point so do only trade it after a breakout. I'm not planning to trade Adyen in the near term because there are big risks involved:

Newly listed stocks can do wild things, so use a tight stop loss.

The free float of this stock is very low. All shares are allocated to institutional investors at the time of subscription. They had to sign a contract which states that they want to hold the shares for several years. Only a small part of the shares can be freely traded (<15%). The price can therefore go up but also go down quickly.

If I were a value investor I would definitely not trade this stock because of the low free float. I think that private investors, in particular, are now pushing up the price and will get trapped with expensive shares.

Disclaimer: this reading is intended to explain the risks and high valuation involved with this stock. This is absolutely no investment advice.

General information: Adyen is a global payment company that allows businesses to accept e-commerce, mobile, and point-of-sale payments. Adyen has more than 5,000 customers and is listed on the stock exchange Euronext.