ALGN trade ideas

Long term short as CadYard got into the market GET IT DESIGNED

cadyard is your tool to communicate with your dental designers. Enjoy the UNLIMITED FREE upload and storage for intra-oral STL, meshmixer files, BlueBioSky files. There is no need for you to learn or buy any dental designing software. In cadyard, you will be able to find dental designer from all over the world . Deliver to your patient an affordable 3D dentistry. To get started, You just need to have an intra-oral scanner or a desktop scanner to get started.

ca.cadyard.com

Align Tech Trade setupEntry level $290 = target price $318 = Stop loss $281

Some very bullish price action has taken place recently, a major downtrend break and golden moving average cross

is hugely significant.

Indicators are very bullish and have a lot of room to run higher.

P/E ratio 58

Company profile

Align Technology, Inc. engages in the manufacture, design, and marketing of global medical devices. It operates through the Clear Aligner, and Scanner and Services segments. The Clear Aligner segment consists of invisalign full, teen and assist products, and vivera retainers along with training and ancillary products for treating malocclusion. The Scanner and Services segment comprises of intraoral scanning systems and additional services available with the intraoral scanners that provide digital alternatives to the traditional cast models. The company was founded by Zia Chishti, Brian Freyburger and Kelsey Wirth in March 1997 and is headquartered in San Jose, CA.

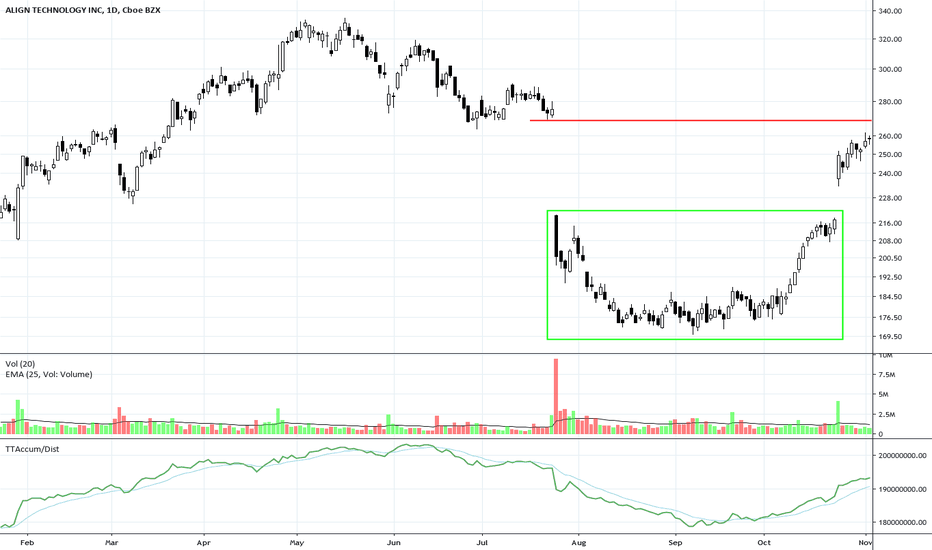

$ALGN Risky Long bet on Align Technology, bottom feeders believeTechnically the stock has formed a fantastic base since the selloff, possibly earnings could ignite a rally.

Indicators are high but room to run.

MA's are providing great support and all in upward trajectory.

Market expectations are low.

Smiledirectclub has been a disaster since IPO, maybe not that big of competition afterall.

Align offers a professional tried and tested service, unlike SDC.

China is a huge market that is still relatively untapped.

Average analysts price target $256 | Overweight= Considerable upside

P/E ratio still high at 44 once forgiven but not in current market.

Company profile

Align Technology, Inc. engages in the manufacture, design, and marketing of global medical devices. It operates through the Clear Aligner, and Scanner and Services segments. The Clear Aligner segment consists of invisalign full, teen and assist products, and vivera retainers along with training and ancillary products for treating malocclusion. The Scanner and Services segment comprises of intraoral scanning systems and additional services available with the intraoral scanners that provide digital alternatives to the traditional cast models. The company was founded by Zia Chishti, Brian Freyburger and Kelsey Wirth in March 1997 and is headquartered in San Jose, CA.

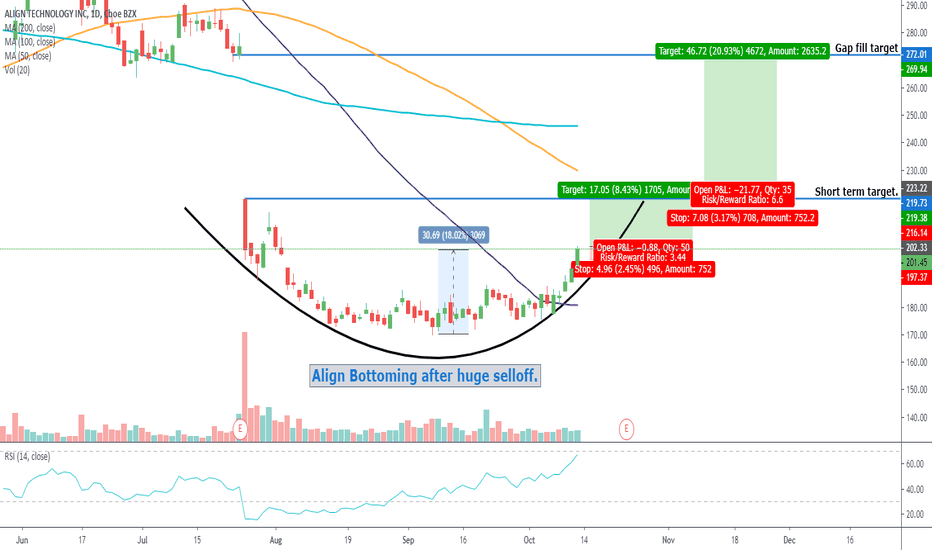

$ALGN Reversal well under way in Align technology.Entry level $202.33 = Target price $219.38 = Stop loss $197.37

Longer term price target $270 which fills the post earnings gap.

Fears over the exposure to the Chinese market and competition from NASDAQ:SDC lead to a capitulation in the stock price throughout 2019.

We believe that the SDC competition is not as significant as believed and as for the China issue the days to follow will determine what the near term future will be.

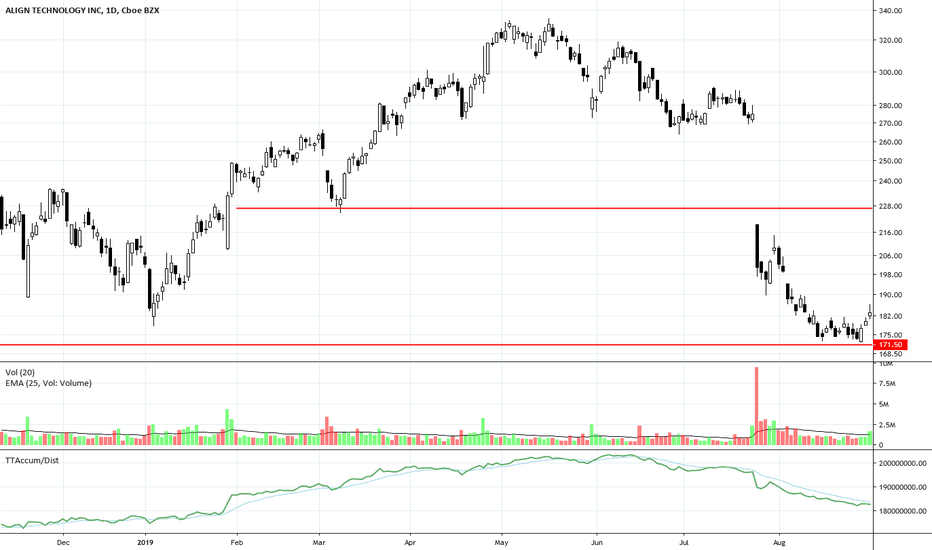

ALGN at Long-Term Support LevelALGN gapped down at the end of July on weak earnings news. It has now collapsed to a strong long-term support level. The final capitulation by Smaller Funds managers has ended. The consistency of the candlestick pattern with closely aligned lows and an early Shift of Sentiment™ pattern on the Balance of Power Indicator reveals some Dark Pool Quiet Rotation™ at this level.