ANET new positionStarted a feeler position in ANET today with 110 shares. Sold a low delta covered call and added a CSP on the monthly a bit lower. I believe this will be the range of interest here. I wanted to slowly diversify a bit away from small caps as I have made a lot on the risk account the last two years. Arista is heavily positioned to benefit from energy, cloud, and Ai expansion and it has some of the best growth financials I have ever seen.

My plan:

Repeat covered calls at a lower delta to capture share appreciation.

Buy 100 more shares if it gets closer to 100 and continue to sell CSP

ANET trade ideas

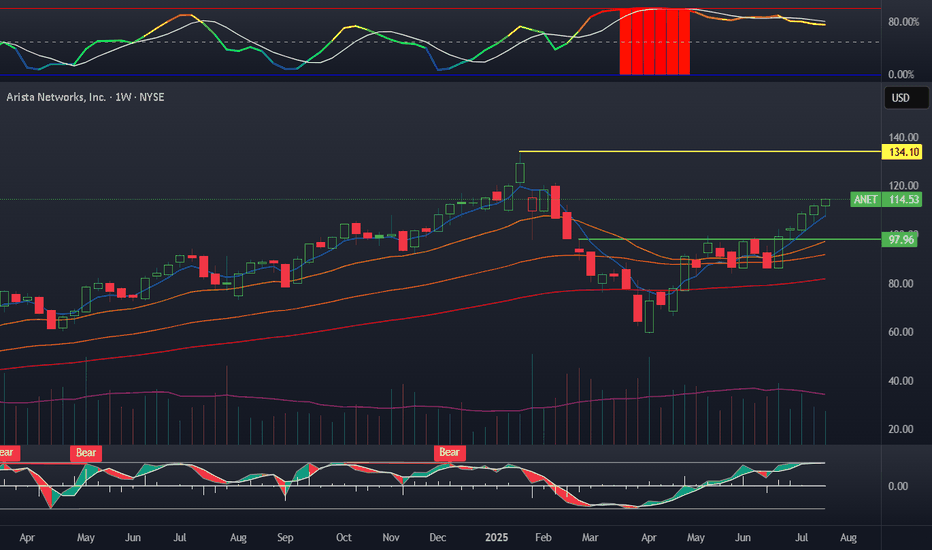

Arista Networks (ANET)_Cloud Fabric for AINYSE:ANET Price has respected the support line around $94–97, which was previously a breakout zone and now serves as a solid foundation for a potential upward move. Volume Profile shows strong interest in this range, confirming its importance.

Technical view:

• Rebound from support at $94.36 (July 2)

• Rounded base pattern in formation

• Stochastic oscillator is entering overbought zone – early caution, but momentum still bullish

• Upside potential to $128–130 if breakout continues

Fundamentals:

• Arista benefits from AI-driven infrastructure demand

• Strong revenue growth and margins, especially in cloud networking

• Partnering with Microsoft and Meta for high-speed data center solutions

• Low debt, healthy cash reserves – stable balance sheet

📌 Watch zone: $97–101

Break and hold above $102 could confirm bullish continuation.

What’s your take – are we setting up for a breakout or due for a pause?

Arista is the market leader in data center switching platformsArista Networks demonstrates strong financial performance, a solid growth outlook, and innovative product development, particularly in AI and cloud networking. While valuation models offer mixed signals, the company's fundamentals and strategic positioning make it a compelling consideration for investors interested in the networking and cloud infrastructure sector. Ken Griffin at Citadel Advisors sold 1.5 million shares of Nvidia, cutting his exposure 50%. He also added 108,000 shares of Arista, increasing his stake 17%.

Israel Englander at Millennium Management sold 740,500 shares of Nvidia, trimming his stake 7%. He also purchased 979,600 shares of Arista, increasing his position 43%.

Paul Tudor Jones of Tudor Investment sold 209,000 shares of Nvidia, reducing his exposure 24%. He also purchased 213,800 shares of Arista, opening a new position.

3 Reasons Arista Networks Could Soon Rally SignificantlyIn 2023, we covered Arista Networks NYSE:ANET , calling it part of the internet’s "bedrock" but rating it a Hold due to valuation concerns. Since then, ANET has outperformed the S&P 500, proving our call wrong.

Recently, ANET’s stock has dipped alongside broader market declines. However, we believe the selloff presents a buying opportunity, given ANET’s strong positioning in AI and cloud growth. Here’s why:

1. Strong Growth Drivers

ANET’s revenue comes from three segments: Core (65%), Cognitive Adjacencies (18%), and Cognitive Network (17%). Its hardware (Ethernet switches, routers) and software (EOS) are critical for hyperscalers (48% of revenue), enterprises (35%), and providers (17%). With AI and cloud capex surging, ANET is well-positioned for sustained demand.

2. Best-in-Class Margins

ANET’s net margins have nearly doubled since 2020, reaching ~42% TTM. Operating leverage allows revenue growth to flow efficiently to the bottom line. While R&D spending must remain competitive, ANET’s high-margin business supports strong earnings.

3. Attractive Valuation

Despite premium multiples (14x sales, 35x earnings), ANET trades near 5-year lows relative to historical trends. If growth (projected ~20%) and margins hold, a re-rating toward its average P/E (~40x) could drive shares toward $100+.

Risks

- Customer concentration (Meta + Microsoft = 35% of revenue).

- Margin pressure if R&D spending lags.

- Multiple compression in a weak market.

Verdict: Buy

ANET’s growth, margins, and valuation make it compelling. While risks exist, the upside outweighs them.

Good luck out there!

Arista Networks (NYSE: $ANET): Positive Outlook Amid AI Growth Arista Networks Inc. (NYSE: ANET) closed the latest trading session at $68.67, gaining 1.48% on the day. The stock has recently experienced a steep decline from its 52-week high near $134, yet it remains a key player in the edge computing space. As of Q4 2024, 78 hedge funds held positions in Arista, signaling strong institutional interest.

The company’s infrastructure supports edge computing by delivering ultra-fast, programmable switches and routers. These tools are vital for real-time data management in environments such as data centers and IoT systems. With the growing demand for AI-driven workloads at the network edge, Arista’s technology is well-placed to support this shift.

In 2024, Arista recorded $7 billion in revenue, marking a 19.45% increase from the previous year. Its net income rose by 36.3% to $2.85 billion. In Q4 alone, revenue jumped by 25.3% year-over-year to $1.93 billion. To enhance AI workload management, Arista launched the EOS Smart AI Suite with Cluster Load Balancing, a solution aimed at improving system efficiency under large-scale processing demands.

The edge computing market is on track to grow significantly, with global spending expected to reach $261 billion in 2025. This trend is supported by broader interest in Internet of Things (IoT) and AI technologies. Analysts predict this spending will climb to $380 billion by 2028.

Technical Analysis

Arista's price action shows it tested a key support zone at around $60, with the 200-day moving average at $65.95. The stock previously attempted to rebound above resistance at $77 but failed, forming a bearish setup. Current RSI stands at 31.16, suggesting the stock is close to oversold reading.

If it holds above the $60 support, a potential bounce could target $77, followed by $90 and above, aligning with the 100-day moving average. A break below $65 could open a path toward $60 or lower. Volume has been heavy during the downtrend, indicating strong selling pressure.

Arista Networks Raises 2025 Revenue Forecast to $8.2BArista Networks, Inc. (NYSE: NYSE:ANET ) has increased its 2025 revenue outlook to $8.2 billion, marking a 17% year-over-year growth rate. This revision is driven by robust demand from Tier 1 hyperscalers and Tier 2 cloud providers adopting Ethernet-based solutions. For Q1 2025, the company expects revenue between $1.93 billion and $1.97 billion, with a gross margin around 63% and operating margin of 44%.

Arista specializes in data-driven networking solutions for cloud, data center, campus, and routing infrastructures. Although it lagged in AI revenue growth initially, the company now benefits from broader AI and cloud integration. UBS has given the stock a Buy rating, targeting a price of $115. At market close on April 17, 2025, ANET traded at $71.20, reflecting a 0.93% decline for the day. Volume reached 8.57 million shares.

Meanwhile, market sentiment remains cautious due to new trade tariffs imposed by the Trump administration. These policies, particularly against Chinese imports, have disrupted global supply chains and triggered inflationary pressure. As a result, hedge funds reduced risk exposure ahead of the announcement. Market research from IDC warns that prolonged tariffs could impact the IT sector’s recovery and limit hardware availability.

Technical Analysis

On the 3-day chart, ANET has dropped below the key support-turned-resistance level around $77. The price currently sits around the 200-day moving average, acting as a crucial short-term support zone. The current 50-day moving average stands at $98.45, while the 100-day and 200-day moving averages are $87.99 and $65.96, respectively.

The chart outlines two possible scenarios: a breakout above $77 could send the price toward the $88 level; otherwise, a rejection here may pull the price back to the $60 support range. Volume spikes indicate active participation near current levels.

ARISTA NETWORKS ($ANET) ZAPS Q4—AI & CLOUD FUEL SURGEARISTA NETWORKS ( NYSE:ANET ) ZAPS Q4—AI & CLOUD FUEL SURGE

(1/9)

Good evening, TradingView! Arista Networks ( NYSE:ANET ) is buzzing—$ 7B in 2024 revenue, up 19.5% 📈🔥. Q4 shines with AI and cloud demand—let’s unpack this tech titan! 🚀

(2/9) – REVENUE RUSH

• 2024 Haul: $ 7B—19.5% jump from $ 5.86B 💥

• Q4 Take: $ 1.93B—25.3% up, beats $ 1.9B 📊

• EPS: $ 0.65—tops $ 0.57, up 25%

NYSE:ANET ’s humming—cloud’s got juice!

(3/9) – BIG PLAYS

• Q1 ‘25 Guide: 1.93 − 1.97B—above $ 1.907B 🌍

• Stock Split: 4-for-1—shares for all! 🚗

• AI Ties: Meta, NVIDIA deals spark buzz 🌟

NYSE:ANET ’s wiring the future—full throttle!

(4/9) – SECTOR SNAP

• P/E: ~54—premium vs. Cisco’s 17 📈

• Growth: 19.5% smokes sector’s 7%

• Edge: 70-80% Microsoft share—kingpin 🌍

NYSE:ANET ’s hot—value or stretch?

(5/9) – RISKS IN VIEW

• Clients: Microsoft, Meta—big eggs, one basket ⚠️

• Comp: Cisco bites back—AI race heats 🏛️

• Economy: Capex cuts could sting 📉

High flyer—can it dodge the turbulence?

(6/9) – SWOT: STRENGTHS

• AI Lead: $ 750M ‘25 target—cloud king 🌟

• Margins: 64.6%—profit punch 🔍

• Cash: 95% flow jump, no debt 🚦

NYSE:ANET ’s a lean, mean machine!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Client lean, high P/E 💸

• Opportunities: AI clusters, enterprise zip 🌍

Can NYSE:ANET zap past the risks?

(8/9) – NYSE:ANET ’s Q4 buzz—what’s your vibe?

1️⃣ Bullish—AI keeps it soaring.

2️⃣ Neutral—Growth’s solid, risks linger.

3️⃣ Bearish—Premium fades fast.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:ANET ’s $ 1.93B Q4 and AI deals spark zing—$ 7B year shines 🌍. Premium P/E, but growth rules—champ or chase?

Arista Networks Dips 4% Premarket Despite Strong Q4 FinancialsArista Networks (NASDAQ: NYSE:ANET ) saw a 4% dip in premarket trading despite delivering better-than-expected revenue and earnings in its latest quarterly report. The stock's recent movement raises questions about market sentiment and potential buying opportunities.

Strong Revenue and Earnings Growth

Arista Networks, a leader in cloud networking, reported a fourth-quarter revenue of $1.93 billion, reflecting a 7% year-over-year increase. This beat analyst estimates and demonstrated the company’s ability to sustain growth even amid economic uncertainty.

Net earnings surged to $830.1 million (65 cents per share), compared to $664.3 million (52 cents per share) in the prior year. These strong financials reflect Arista’s continued dominance in the cloud networking industry, particularly as it pushes further into AI-driven initiatives.

Additionally, Arista Networks provided an optimistic forecast for the first quarter of 2024, expecting revenue between $1.93 billion and $1.97 billion, surpassing analysts' expectations. This suggests that despite short-term price volatility, the company’s long-term growth remains intact.

Market Sentiment and Analyst Ratings

Despite the positive earnings report, NYSE:ANET faced early selling pressure. However, analysts remain bullish on the stock, with an average "Buy" rating from 15 analysts. The 12-month price forecast stands at $108.38, representing a slight downside of -3.12% from the latest price, indicating that the market might already be factoring in Arista’s growth potential.

Technical Analysis

From a technical perspective, NYSE:ANET ’s premarket drop of 4.11% has placed its Relative Strength Index (RSI) at 47, signaling that the stock is approaching oversold territory but not yet at extreme levels.

Currently, the stock is trading above key moving averages (MA), suggesting that the broader uptrend remains intact. However, the dip brings NYSE:ANET close to its one-month low, a temporary support level that traders should watch closely. If selling pressure continues, a break below this level could lead to further downside.

That said, this retracement could also be a strategic move to sweep liquidity and attract demand for a potential rebound. Investors should watch for price stabilization and confirmation of renewed buying interest before making any decisive moves.

Conclusion

Despite the early sell-off, Arista Networks’ strong fundamentals, growing revenue, and positive long-term outlook position it as a solid investment choice. The recent dip may be an opportunity for traders to capitalize on a short-term pullback before the stock resumes its upward trajectory. As always, monitoring key technical levels and broader market trends will be crucial in assessing NYSE:ANET ’s next move.

2/18/25 - $anet - Not obvious, sidelines2/18/25 :: VROCKSTAR :: NYSE:ANET

Not obvious, sidelines

- in this tape where we're mooning big beats/ gains (those have been software-related consumer and tend to be growing >25%) and shooting others (lower-growth w/ unclear outlooks) gives low visibility for how mkt will trade NYSE:ANET eps

- on one hand, this stock has defn outperformed it's NASDAQ:QQQ comp. no reason to believe anything's changed. >3.5 bn fcf on 131 bn EV by no means expensive for a moat like this and growing nearly 20%. i think that's the main point.

- on the other hand, any whack guide or indication of uncertainty or delays etc. send this thing down 10-15% easily.

- so on what looks like a +10/-10% sort of move (i should check implied vol, but this is what i'd guess), and not necessarily faster growing or more moat-y with better valuation than my tech dawgs NYSE:TSM and $uber... i am seeing less and less reasons to play this EPS season than i typically do and more reason to just sit and sip on that sweet mint tea.

good luck to holders. i'd be a dip buyer here on an outsized down move, but probably just sit sidelines otherwise. buy zone is sub $100.

V

Continuing Correction Arista Net. ANETGoing off the technical picture, there is a general alignment from at least 5 different perspectives. The indicators I use look at the market from may different ways, deriving data from volumes, volatility, stochastics, momentum and simple stats like sigma deviations on the previous. Many cases do not offer a discernible Elliott count or a harmonic, but these are very useful when they are discernible.

ANET Arista Networks Options Ahead of EarningsIf you haven`t bought ANET before the rally:

Now analyzing the options chain and the chart patterns of ANET Arista Networks prior to the earnings report this week,

I would consider purchasing the 100usd strike price Puts with

an expiration date of 2025-2-21,

for a premium of approximately $2.92.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$ANET : A steady compounder under the shadows of $AVGOToday we dive into the world of stocks where we look at a little know cos. called Arista Networks $ANET. NYSE:ANET since its IPO almost 10 years ago has given a 2000% return to its investors. The next generation Networking cos with virtualized network platform on specialized designed chips and advanced Ethernet switches with low latency used in Cloud Data centers .

NYSE:ANET weekly chart looks amazing with higher high and higher lows. Recently most cloud networking stocks like NASDAQ:ALAB and NASDAQ:AVGO have been consolidating. NYSE:ANET is @ 100 Day SMA which is currently at $ 106. NYSE:ANET consolidation around 100 Day SMA is always a great buying opportunity.

Long NYSE:ANET @ 100-Day SMA.

Arista Into EarningsANET is still suffering from the NVDA sell off (I would argue completely irrational panic). It's currently ranging right in the middle of major support and major resistance. So it's tricky because we're so far above support, but also lots of room to recover losses. My bet into earnings is Arista breaks above resistance at $141. Arista is trading just under 20X revenue and they have amazing profit margins and sustained growth. The broader Nasdaq Computer Index IXCO is very close to breaking out of this long range it's been so it seems like a fair bet that ANET jumps to the upside along with everything else.

Good Luck!

ANET Analysis: Preparing for a Breakout or Pullback?As of December 8, 2024, ANET is trading at $109.00. Here’s an in-depth analysis and trading strategy for this tech leader.

1. Fundamental Analysis: Leveraging Network Technology Growth

* Forward P/E Ratio: 25.3, suggesting a fair valuation for a high-growth technology stock with strong fundamentals.

* Expected EPS Growth: Projected 18.5% 5-year EPS growth, driven by demand in cloud infrastructure and data networking.

* Expected Revenue Growth: Expected revenue CAGR of 15% over the next five years, supported by market share expansion in enterprise data centers.

* Net Margins: 34.2%, indicating excellent operational efficiency and dominance in high-margin segments like cloud networking.

Fundamental Rating: 9/10

Arista Networks stands out as a well-managed company with exceptional profitability and consistent revenue growth in a high-demand industry.

2. Technical Analysis: Key Price Levels and Market Dynamics

Support and Resistance Levels:

* Immediate Resistance: $110.74 (current high and key breakout level).

* First Support: $108.25 (current consolidation zone).

* Major Support: $96.00 (historical demand area and near the 50-day EMA).

Indicators:

* MACD: Bullish crossover with strong upward momentum, signaling potential continuation.

* Bollinger Bands: ANET is trading near the upper band, indicating overbought conditions and possible short-term consolidation.

* Moving Averages:

* 20-day EMA: Positioned at $103.80, providing dynamic support.

* 50-day EMA: Positioned at $96.00, marking critical support for a deeper retracement.

Liquidity Zones & Order Blocks:

* Liquidity Zone: Between $108 and $110, where the price is consolidating before a potential breakout.

* Order Block: $90 to $96, highlighting strong historical buying interest and accumulation.

3. Trading Plan: Playbook for Scalping and Swing Trades

Scalping Setup:

* Entry: Buy near $108 on a pullback or break above $110.75 with strong volume.

* Target: $112 to $115 for short-term profit.

* Stop-Loss: $107 (below immediate support).

Swing Trading Setup:

* Entry: Accumulate near $96 for a medium-term play or wait for a breakout above $110.75 for confirmation.

* Target: $120 for swing trade gains.

* Stop-Loss: $94 (below major support and 50-day EMA).

4. Where ANET Might Be Headed Next

ANET is showing strong bullish momentum with solid fundamental and technical setups. A breakout above $110.74 could signal a rally toward $115-$120, while a failure to hold above $108 may lead to a retest of $96. Given its growth potential, ANET remains a strong candidate for both scalping and swing trades.

5. Disclaimer

This analysis is for informational purposes only and not financial advice. Please consult your financial advisor or conduct your own research before trading.

CROSSING death cross on numerous indicators 340s in sightThe stochastics show a death cross formulating on the daily and numerous other indicators. It jumped with volatility and more than usual volume; I did declare that it may come down for a correction at some point before I expected it to break through 400, like a cannon. Still a firm supporter of bearish mode and stance.