MORE CONFIRMATION NEEDED FOR BOMBARDIER LONG======PRICE TARGET $1.68=======.

======ENTRY LEVEL $1.65========.

COMPANY PROFILE

Bombardier, Inc. manufactures planes and trains. It operates through the following segments: Business Aircraft; Commercial Aircraft; Aerostructures and Engineering Services; and Transportation. The Business Aircraft segment designs, manufactures and provides aftermarket support for three families of business jets, spanning from the light to large categories. The Commercial Aircraft segment designs and manufactures a portfolio of commercial aircrafts. The Aerostructures and Engineering Services segment designs and manufactures major aircraft structural components such as engine nacelles, fuselages and wings and provides aftermarket component repair and overhaul as well as other engineering services for both internal and external clients. The Transportation segment offers product range and services to the rail industry and covers the full spectrum of rail solutions such as complete trains to subsystems, services, system integration, signaling, and e-mobility solutions. The company was founded on June 19, 1902 and is headquartered in Montreal, Canada.

BBDB/N trade ideas

BBD.B false break of support $2.00 Trapping Go Long $1.75Gap up Monday Morning,

A test of Resistance $2.15

A bounce off and back down to test Support $2.00

Support fails and signals continued down trend

Downtrend also fails and traps those who short at break of support.

Price heads long @ $1.75 Start of long term uptrend Monthly Chart time frame Entry on the D1 chart.

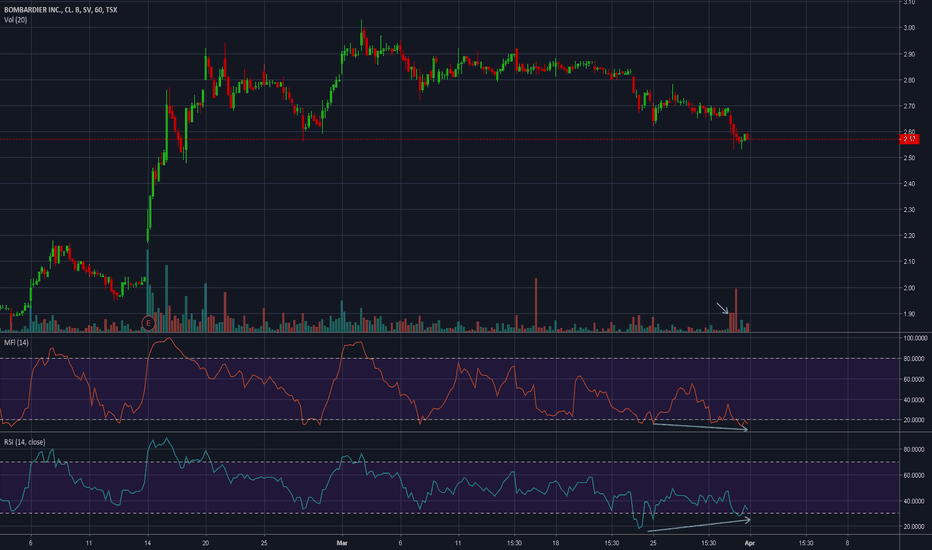

BBD.B - Triangle pattern breaching downtrend. Neutral Bullish.BBD.B - Neutral bullish here. Triangle pattern upside being testing while breaking moderate resistance. RSI looks healthy and room to run. Gap overhead. Would like to see some more volume come in however I find it bullish at the moment while mindful of possible false breakout.

Bombardier : out of day RSI (20) without the usual Vol Boost Les Affaires gave a analysis of BBD.A last friday witch i agree on

www.lesaffaires.com

It's gonna go back at 5,50$ at some point.

For now we can expect a under 2$ drop before heading to that point.

My guest is that focus on the market is elsewhere and people could see Bombardier like something with more potential then any tech stock now.

So we may be out of that RSI low (day 20)

and we didn't yet see that 2 consecutive volume in the green with second one higher

normaly after a RSI drop we see that and a price move up of about 10%.

my guest is that we're gonna see that 2,15-2,20 resistence becoming a 2,60 soon.

BOMBARDIER LOOKS READY FOR A BOUNCE OVER THE NEAR TERM Over the last 3 years, Bombardier Relative Strength (14) has hit a peak of at least 70 **AFTER** hitting a low of 31 or lower. This chart shows roughly the relationship between share price & RSI as well as the "behavior" of these technical tools through the last 7 times this scenario has occurred.

dead cat bounceMost would be looking to short here due to the breakdown and apparent short term consolidation happening under the critical price line.

However parabolic move down plus RSI extremely overextended tells me were in for a possible sharp incline. risky and volatile so relatively tight stops here.