CLSK trade ideas

CLSK / 4hAs expected, #CleanSpark continued to rise 4.5% on the last subdivision of the leading diagonal wave i(circled). So now, an advance of 15% lies ahead.

According to the prior NASDAQ:CLSK 's analysis, the overlapping waves that started to arise in early April all have expanded upward in a leading diagonal as the first wave of the ongoing Minor degree wave C (a countertrend rally).

Trend Analysis >> The leading diagonal pattern in Minute degree initially is aligned with the trend in a larger degree upward >> Minor degree impulsive wave C should be underway.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

CLSK / 4hAs anticipated, #CleanSpark has continued to rise 6% today on the last subdivision of the diagonal wave i(circled).

According to the prior NASDAQ:CLSK analysis, the overlapping waves that started to arise in early April all have expanded upward in a leading diagonal as the first wave of the ongoing Minor degree wave C (a countertrend rally).

Trend Analysis >> The leading diagonal pattern in Minute degree should initially be aligned with the trend in a larger degree upward >> Minor degree impulsive wave C should be underway.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

CLSK / 4hThe price has risen by 8% today, as expected. #CleanSpark might continue to advance >> 25% on the last subdivision of the diagonal wave i(circled).

According to the prior NASDAQ:CLSK 's analysis, the overlapping waves which started to arise in early April, may all be expanded in a leading diagonal as the first wave of the ongoing Minor degree wave C (countertrend rally).

Trend Analysis >> The leading diagonal pattern initially is aligned with the trend in a larger degree upward.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

CLSK / 4hThe rising waves that started in early April may all considered in a leading diagonal as a first wave of the ongoing Minor degree wave C(countertrend rally). So, an impulsive 5th wave of the diagonal pattern would likely lie ahead.

NASDAQ:CLSK >> 34% advance, as illustrated in this 4h-frame.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

CLSK / 4h#CleanSpark rising by 36% in three straight weeks and its wave structure (in a five-wave sequence) quite well would suggest that entire correction in Minor degree wave B could have ended at the early April low >> 6.46, which was very close to the anticipated Fib-target >> 6.27.

Technically, the trend of Minor degree should have turned upward.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

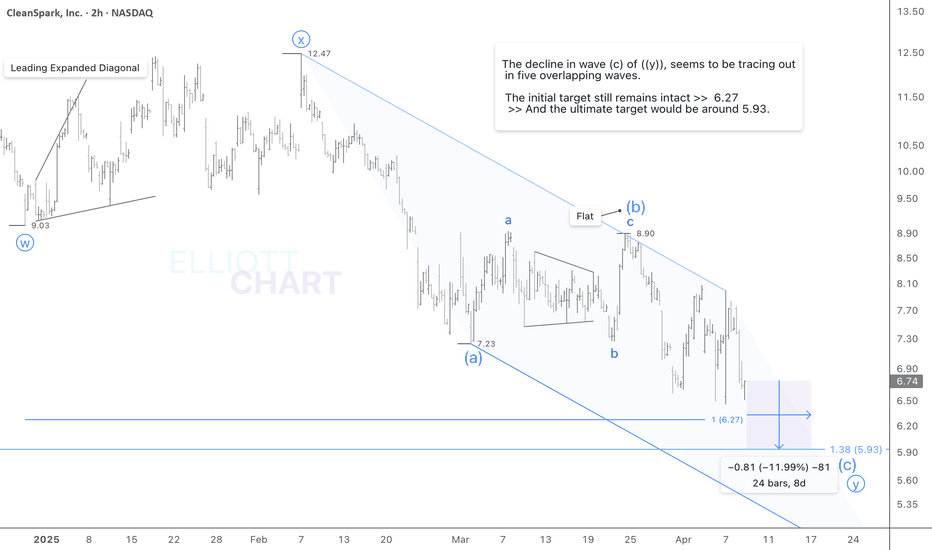

CLSK / 4h#CleanSpark has worked slightly higher in a couple of days, and its analysis in this frame has not changed so far. Over the next week, the current decline of wave y might trace out a three-wave sequence thoroughly like the prior subdivisions (w & x).

The initial target remains intact >> 6.27

>> And the ultimate target would be around 5.93.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

CLSK / 3h#CleanSpark has developed the price volatilities in overlapping waves since the late-March high (8.90), so all would be well considered as a three-wave sequence in , which its subdivisions of w and x should be over, and y has begun its way down.

Further decline of wave y (estimated >> 18%) lies ahead in a couple of weeks.

The initial target remains intact >> 6.27

>> And the ultimate target would be around 5.93.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

CLSK / 4h#CleanSpark has worked slightly higher (3.73%), so the countertrend rally in wave x would have remained in a very late stage.

The ultimate decline (estimated >> 28%) in wave y lies ahead

towards the anticipated Fib-targets and against the late-March high at 8.90.

The initial target remains intact >> 6.27

>> And the ultimate target would be around 5.93.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 2hThe ongoing overlapping waves in NASDAQ:CLSK have revealed a three-wave sequence in both waves w and x so far. An ultimate decline in wave y may have started Wednesday towards the anticipated Fib-targets.

The initial target remains intact >> 6.27

>> And the ultimate target would be around 5.93.

$CLSK / 2hThe price volatilities in NASDAQ:CLSK have revealed overlapping waves which seem to have inclined towards the expected targets and might be framed in an ending diagonal as wave(c) of ((y)).

The Fib-expansion targets remain intact >> 6.27 >> 5.93

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 2hThe price volatility in NASDAQ:CLSK has revealed overlapping waves, which would incline to achieve new lows towards the expected targets that remain intact yet.

Hence, further decline lies ahead to trace out the ongoing wave (c) in a thorough five-wave sequence.

The Initial Target >> 6.27

The Ultimate Target >> 5.93

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 4hThe price volatility in NASDAQ:CLSK last week revealed overlapping waves, which would be inclined to achieve new lows towards the expected targets that remain intact yet.

Hence, further decline should likely lie ahead to trace out the ongoing wave (c) in a thorough five-wave sequence.

The Initial Target >> 6.27

The Ultimate Target >> 5.92

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 4h#CleanSpark rising by 21% in two straight days and its wave structure quite well would suggest that the correction in Minor degree wave B could have ended at Monday's 6.59 low, though its target >> 6.27 remained intact.

Technically, the trend of Minor degree should have turned upward.

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 4hNASDAQ:CLSK started the week with continuing the anticipated decline by 6.54%.

The ongoing wave (c) might be searching for its extreme-low around converging the Fibonacci levels >> 1.38 & 1(on the channel).

So, further decline likely by 10% is expected in this week.

Eventually All Waves Settle!! #CleanSpark might well conclude the entire correction in Minor degree wave B which remains in very late stage, over just few coming days. Hence, the trend reversal soon lies ahead!

The initial target still remains intact >> 6.27

Ultimate Target >> 5.92

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 4hThe short-term bearish stance remains intact towards the initial target at 6.27.

And as expected, NASDAQ:CLSK continued to decline by 10% in two straight days.

Further decline by 24% would likely lie ahead just over couple of the weeks!

Eventually All Waves Settle!! #CleanSpark might well conclude the entire correction as Minor degree wave B around converging the Fibonacci levels ( level 1.38 where wave B would retrace to 1.38 of the expanding diagonal wave A and level 1 on the Fib channel ), and the ongoing downtrend as well.

The initial target remains intact >> 6.27

Ultimate Target >> 5.92

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 4hThe short-term bearish stance remains intact towards the initial target at 6.27. And as expected, NASDAQ:CLSK continued to decline by 7% today. So, further decline by 25% would likely lie ahead just over couple of the weeks!

Eventually, CleanSpark might well conclude the entire correction in its Minor degree wave B around converging the Fibonacci levels ( level 1.38 where wave B would retrace to 1.38 of the expanding diagonal wave A and level 1 on the Fib channel ), and its downtrend as well.

The initial target remains intact >> 6.27

Ultimate Target >> 5.92

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 2hThe expected decline by 30% in wave (c) of ((y)) may have started its way down today, and it would be tracing out in a five-wave sequence over couple of weeks ahead.

NASDAQ:CLSK 's initial target remains intact >> 6.27

>> The ultimate target would be around 5.92.

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hEventually All Waves Settle!!

CleanSpark might well conclude the entire correction in its wave B, on converging the Fibonacci levels ( level 1.38 where wave B would retrace to 1.38 of the expanding diagonal wave A and level 1 on the Fib channel ).

So, further decline by 30% would likely lie ahead over couple of the weeks.

NASDAQ:CLSK 's initial target remains intact >> 6.27

The Ultimate Target >> 5.92

#CryptoStocks #CLSK #BTCMining #BTC