COREWEAVE INC stock forum

Before the IPO, CoreWeave’s insiders monetized their stakes through two major tender offers, allowing them to secure hundreds of millions in cash without relinquishing control.

2023 Tender Offer

Price: $309.86 per share

Total Shares Sold: ~2.07 million for ~$643 million

Key Details: Fidelity snapped up roughly 1 million shares for $310 million.

Founders’ Sales:

• Michael Intrator sold 354,931 shares for $110 million.

• Brian Venturo sold 231,126 shares for $72 million.

• Brannin McBee sold 172,368 shares for $53 million.

procurefyi.substack.com/p/coreweaves-s-1-is-finally-here-ais

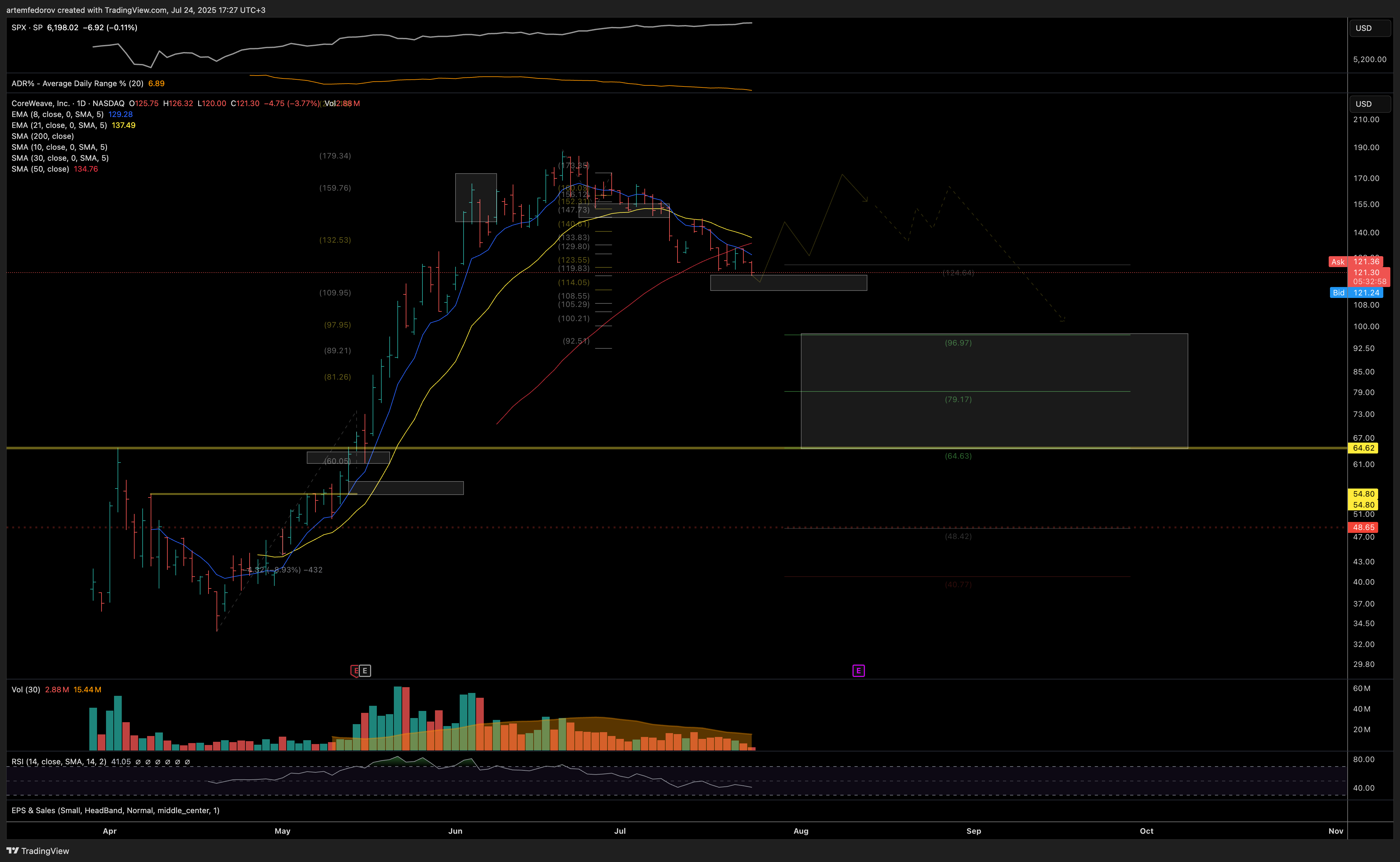

That said, the impulsive decline from the June top suggests this bounce may just be a lower high before a deeper move into macro support at 95 or lower.

Chart: tradingview.com/x/BDPCDYKO/