CVS trade ideas

CVS Long IdeaShould have posted this sooner, but have been shot down several times this year when getting constructive on this name

-CVS may finally be ready to break out

-The stocks been stuck for most of 2018; falling backwards each time it's attempted a run, usually due to some headline (Amazon getting in the space for example)

-Strong earnings and fundamental story; cyclically resilient business

- Still trading at less than half its historical PE

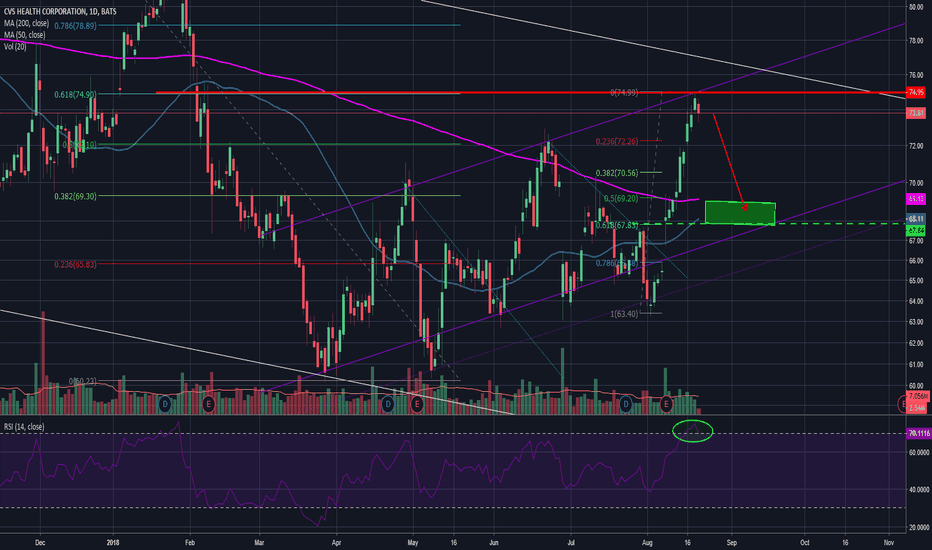

CVS Bounced Nicely Off Support, Potential To Rise Further! CVS bounced off its support at 63.28 (76.4% Fibonacci retracement, 100% Fibonacci extension x2, multiple swing low support) where it could potentially rise up to its resistance at 67.58 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing high resistance).

Stochastic (89, 5, 3) bounced off its support at 3.6% where a corresponding rise could occur.

CVS long following bottoming out, monthly bullish divergenceCVS has formed a descending triangle and daily appears to be closing above the upper triangle (break out). We have a monthly bull div on the RSI. A forming daily wedge will provide good stop for our trade. R:R lies in longing at break out confirmation.

$CVS Long-term Chart Bearish$CVS showing a bearish gravestone doji on the daily to remain trapped in what looks like a descending triangle pattern forming. Ideally would like to see another red candle tomorrow for confirmation.

Targeting 5-10% downside in the near term. If $60 support fails, could see 15-20% downside before next ER.