DraftKings & Evolution: Riding the Wave of Gambling GrowthNASDAQ:DKNG OMXSTO:EVO

The North American online gambling sector is experiencing a surge, with companies like DraftKings and Evolution emerging as standout performers. In the past month, Evolution’s stock rose an impressive 15%, while DraftKings continues to show strong potential in the sports betting arena. As legal licenses expand across U.S. states, this industry is poised for significant growth, outpacing traditional benchmarks like the S&P 500.

Market Momentum and Company Highlights

The online gambling market in North America is in a growth phase, largely due to the legalization of sports betting and casino operations. Evolution, a leader in online casino services, saw its stock climb to $41 as of June, with a market capitalization of $20.5 billion. Evolution's growth reflects the sector’s broader upward trend, bolstered by both stock appreciation and dividend payouts. DraftKings, meanwhile, dominates the sports betting space and is positioned as a future industry leader, capitalizing on the increasing availability of legal betting licenses.

The sector’s potential is fueled by untapped markets. Not all U.S. states have legalized gambling, meaning new licenses could significantly expand the user base. Analysts project a compound annual growth rate (CAGR) of 16.7% over the next 10–15 years, far exceeding the S&P 500’s historical average of 9.8% (or 6% adjusted for inflation since 1926). So, according to this growth trajectory, both companies could outperform broader market indices in the long term (by the way, we talked a lot about Evolution here):

Financial Performance and SBC Challenges

Despite their promise, both companies face financial challenges that investors should consider. DraftKings is currently unprofitable, with a net loss of $151 million over the last 12 months. The company is impacted by a substantial share-based compensation (SBC) expense of $550 million. SBC involves offering employees stock options or shares instead of cash to boost motivation. Such expense is recorded in profit and loss (P&L) statements as a "paper expense" without actual cash outflow. CrowdStrike is a similar case; excluding SBC would have turned a $400 million loss into a profit.

For DraftKings, this SBC-related drag has contributed to a recent dip in earnings per share. But the company is narrowing its losses, with accelerating revenue growth. Analysts anticipate a shift to positive net profit by late 2025 or early 2026, thanks to market share expansion. Evolution is also affected by SBC but benefits from a more established position, which supports its recent 15% stock gain and dividend payments.

Investment Appeal and Sector Dynamics

The growth potential of DraftKings and Evolution hinges on the evolving acceptance of gambling in North America. DraftKings is poised to lead in sports betting, while Evolution is set to dominate online casinos. The specialization reflects a market where younger generations are embracing regulated betting as a social activity. Let’s take as a little example two friends placing $2–3 bets on a game while watching at a bar. This cultural shift, coupled with legal expansions, underpins the sector’s robust outlook.

However, gambling’s stigma remains a consideration. Critics liken it to vices like alcohol or tobacco, but the industry counters that it targets controlled, recreational use rather than fostering addiction. With modern education and awareness—parents discussing gambling with children—the market is adapting to promote responsible engagement too, which may support long-term investment potential well.

Risks and Opportunities

Investing in DraftKings and Evolution carries risks, particularly the high SBC costs that inflate reported losses. Yet, this is offset by rapid revenue growth and a shrinking loss margin. The sector’s exclusion from major indices like the S&P 500 TVC:SPX limits institutional investment, making it a niche play for private investors or family offices. Isolation like this could drive outsized returns as demand grows from savvy individuals seeking undervalued opportunities.

Over the next decade, the 16.7% CAGR suggests significant upside. DraftKings’ leadership in sports betting and Evolution’s casino dominance position them to outpace the S&P 500. For investors willing to navigate SBC-related volatility and societal perceptions, these stocks offer a compelling long-term bet.

A Niche Opportunity Worth Watching

DraftKings and Evolution represent a dynamic corner of the North American market, with growth rates that dwarf traditional indices. While SBC challenges and limited institutional backing pose hurdles, their revenue momentum and expanding legal landscape signal strong potential. As of Evolution and DraftKings showing similar promise, these stocks are worth considering for those seeking high-growth, niche investments. Proceed with due diligence, as the sector’s evolution will continue to shape its financial story.

DKNG1 trade ideas

SniperYos INTC 5/19 Weekly OutlookNASDAQ:INTC - Falling Wedge Breakout Setup Intel (INTC) has broken out of a falling wedge pattern, reclaiming key Fibonacci levels with rising volume and bullish EMA alignment. A strong bounce from support signals a potential move higher.

Key Levels Resistance: $21.50 → $23.00 → $24.15 → $25.25 → $26.35 → $27.55 Support: $21.00 → $20.50 → $20.42 → $17.65

Technical Setup

Falling wedge breakout with successful retest. Price reclaiming 0.618 Fib ($21.26) and pushing higher. 1.618 Fib extension aligns with longer-term target at $27.71.

Indicators

Price trading above 9/21/50 EMAs = bullish short-term structure.

TTM Squeeze histogram turning green = building bullish momentum.

Volume rising during breakout = confirmation from buyers.

Trade Plan

Bullish: Hold above $21.50 confirms breakout strength.

Targets: $23.00 → $24.15 → $25.25 → $27.55

Bearish: Break below $21.00 could signal weakness.

Watch support: $20.50 → $20.42 → $17.65

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the rally:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $1.43.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Draftkings Stock Chart Fibonacci Analysis 050725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 33/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Strong Upside PotentialOn the 4-hour chart, price action remains bullish: buyers continue to step in at progressively higher levels, and the 10, 20 and 50-period EMAs are all aligned upwards, confirming positive momentum within an established uptrend. A discounted cash-flow valuation also suggests the shares are currently undervalued, and several analysts have maintained “buy” ratings for long-term investors. I’m using the rising trendline as my stop-loss reference.

However, there are a few risks to consider. Earnings are scheduled for tomorrow, and even the strongest momentum can reverse on an earnings surprise. Insider selling by the CLO ahead of the report adds another red flag.

Nevertheless, with high risk often comes high reward—this setup could appeal both to short-term traders looking for a breakout play and to long-term investors seeking high-growth names.

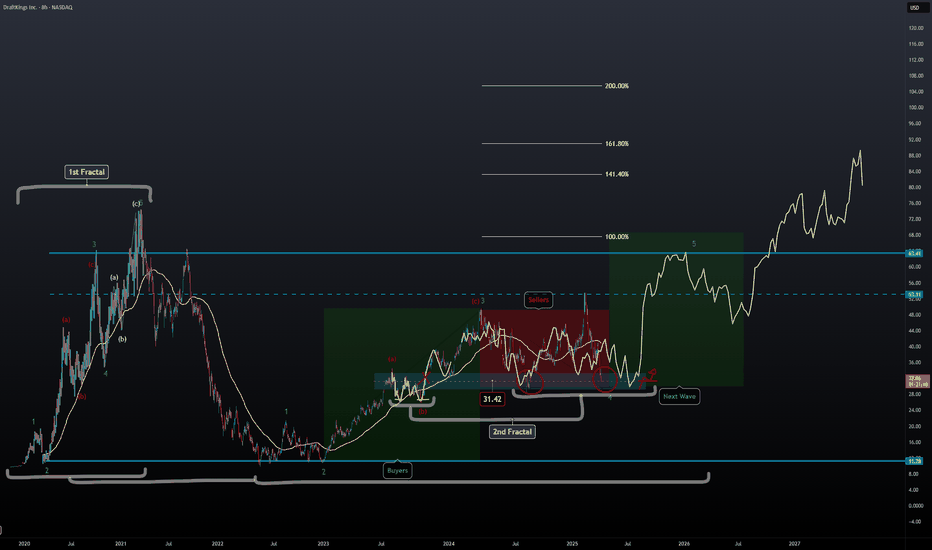

DKNG Update | Second Fractal | Extended TargetsPrice action looks very similar to the '23 Q3 play where we saw a double bottom move taking off from $26 - $49 which is also the ABC move that carried the 3rd impulse wave of the original fractal.

We're still in correction wave 4 and are about to start wave 5 shortly from now to July.

It's possible we could see price action higher than $74 based on the new fractal overlay and with the help of the fib extension.

DKNG 1W – Technical and Fundamental AnalysisDKNG shares have broken a rising wedge on the weekly chart, reinforcing a bearish signal. The price is testing the $35.29 level after failing to hold above $36.88. A breakdown below $31.74 could accelerate a decline toward $28.67 and $14.89. RSI indicates weakening bullish momentum, MACD shows a bearish crossover, and EMA 50 and EMA 200 confirm a long-term uptrend but signal correction risks.

Fundamentally, DraftKings remains a leader in online gambling, but its stock is sensitive to Fed rate decisions and macroeconomic conditions. The upcoming earnings report could also impact price action. Correlation with the Nasdaq and S&P 500 increases its dependence on overall market sentiment.

A confirmed break below $31.74 could lead to further downside toward $28.67 and $14.89. If the price holds above $35.29, a recovery toward $36.88 is possible.

DKNG Update | Crash AheadOne of the best fractal overlays I've seen with some Elliott Waves to go with it.

Price is still in a uptrend but with growing sellers It'll come to an end similar to the last fractal.

During the 3rd wave in the last pattern price experienced its first pullback at (B), and its second at correction wave 4 and the third after the last wave before we witnessed the last push in buyers.

This current cycle price is in a similar stage with a swing low at (b) meaning that we could see another run-up towards major resistance ($63).

This would be the final blow-off-top in general markets. TVC:RUT is already showing signs of weakness which works well with this TA example.

When the time is right I'll do another TA for the downfall. For now I'm bullish but for the horizon I'm very bearish.

DKNG | Back to $10Seeing how price action is weakening over time I could say that bears are looking to take over

Would like to see buyers pushup to local resistance to only selloff once again as we head towards $30 in which we will see a pullback trigger occur.

When the time is right we'll asses price action again to see if we get a straight drop or a full retracement back to ~40.

$DKNG makes a Peg gap and pulls back into great support buy area🚨 NASDAQ:DKNG Just Formed a Perfect Peg Gap—Is This the Buy Zone?

DraftKings ( NASDAQ:DKNG ) just made a Peg gap and is now pulling back into a strong support zone—creating what could be a prime buying opportunity for sharp-eyed traders. 👀

Here’s what’s setting up:

✅ Peg Gap Formation: A bullish signal indicating momentum is still in play.

✅ Pullback to Key Support: Price is settling into a high-confluence buy area.

✅ Potential Bounce Setup: Risk/reward looks 🔥 for a move higher.

Why does this matter?

Because when stocks pull back into solid support after a breakout gap, it often sets up the next leg higher. With sports betting continuing to grow and NASDAQ:DKNG maintaining bullish fundamentals, this could be the perfect moment to jump in before the next rally.

🎯 Watch for confirmation near support—this could move fast. 🚀

DKNG DraftKings Options Ahead of EarningsIf you haven`t bought DKNG before the previuos earnings:

Now analyzing the options chain and the chart patterns of DKNG DraftKings prior to the earnings report this week,

I would consider purchasing the 45usd strike price Calls with

an expiration date of 2025-2-14,

for a premium of approximately $2.24.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DKNG: A Time to BuyGoing into the superbowl DKNG rallies historically. We saw a big pullback yesterday due to headline out of Maryland, this same thing happened in 2021 with New York. It rebounded. I still like this name long.

I've attached the stats in a google sheet below for all those interested:

docs.google.com

$DKNG : Is the reversal near?NASDAQ:DKNG hit the second target and has since pulled back. It is currently sitting on the combined support of the 50DMA, 200DMA, and VWAP. With the golden cross momentum, I think it could bounce from here.

If it fails, I believe the worst-case scenario is a checkback to the trendline and lower VWAP support around $38 to $37.

I am long.

As always, I share my opinions and trades. I'm not suggesting that anyone follow my trades. You do you.