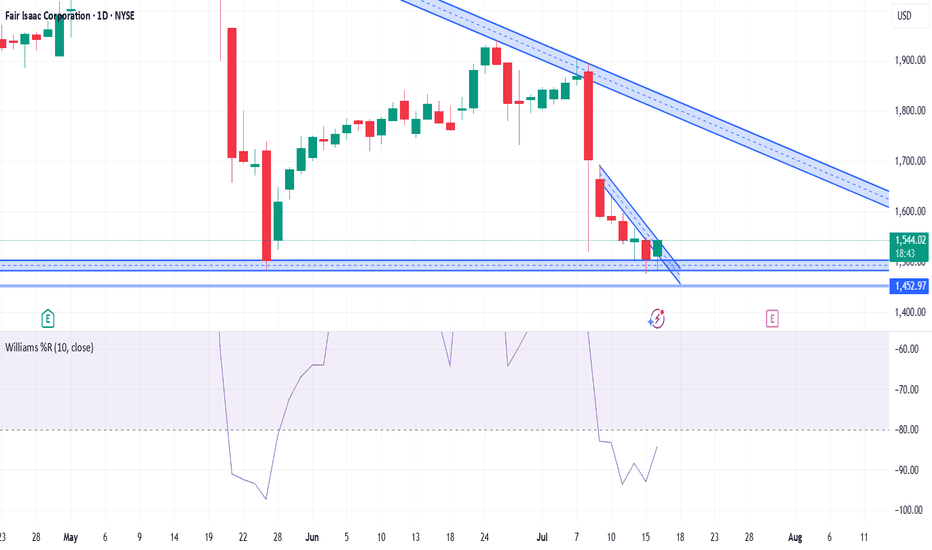

7/30/25 - $fico - Probs a buy7/30/25 :: VROCKSTAR :: NYSE:FICO

Probs a buy

- not really my cup of cottage cheese

- but these growth/ mgns and strong fcf generation (2.5% fwd) speak for themselves

- look at $LC... people are handing out debt to whichever person wants to finance their NYSE:CMG burrito with installments

- har

Key facts today

Fair Isaac Corporation (FICO) will raise prices for its mortgage credit-score metric, with an eight-fold increase in five years. CEO Lansing emphasized FICO's competitive edge in lending.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

486.75 MXN

10.10 B MXN

33.84 B MXN

23.35 M

About Fair Isaac Corporation

Sector

Industry

CEO

William J. Lansing

Website

Headquarters

Bozeman

Founded

1956

FIGI

BBG00SL5L3Y6

Fair Isaac Corp. engages in the provision of decision management solutions. It operates through the Software and Scores segments. The Software segment includes pre-configured analytic and decision management solutions designed for a specific type of business need or process. The Scores segment focuses on business-to-business scoring solutions and services, business-to-consumer scoring solutions and services including myFICO solutions for consumers and associated professional services. The company was founded by Bill Fair and Earl Isaac in 1956 and is headquartered in San Jose, CA.

Related stocks

FICO's Monopoly: Cracks in the Credit Kingdom?For decades, Fair Isaac Corporation (FICO) has maintained an unparalleled grip on the American credit system. Its FICO score became the de facto standard for assessing creditworthiness, underpinning virtually every mortgage, loan, and credit card. This dominance was cemented by a highly profitable b

Looking to get into ficoThis may take awhile to play out because i think this correction will be very choppy. But I have alerts/buys setup to but at $1300. Fundamentally and technically this seems like a good area to buy into this high quality business. Green horizontals are my levels of interest, i'd like to see these hol

Fair Isaac at fair value?The chart suggests we topped out in Wave 5, now we’re in the wave C of a corrective move. Great company, but trading above its fair value. I wouldn’t touch this stock until the correction is over and we find a base. There’s levels of support below, so keep an eye out on this one if you want to go lo

$FICOFICO has formed a textbook double bottom, signaling a bullish reversal. The stock surged ~18% from the pattern’s low (~$1,600) to the breakout above the neckline (~$1,910). Simple TA suggests a total move of ~36% from the bottom, targeting ~$2,300. With the breakout confirmed and FICO halfway throug

About to curve on the MACD but still has major support at 280sThe MACD is already positioned to start curving the stochastic, and the RSI is way oversold but can run flat daily along with a DT on the RSI, with no confirmation on other indicators or oscillators. This is headed towards filling a gap beginning at the 1980 mark, but I wouldn't be surprised to see

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FICO4629230

Fair Isaac Corporation 5.25% 15-MAY-2026Yield to maturity

5.87%

Maturity date

May 15, 2026

FICO6073309

Fair Isaac Corporation 6.0% 15-MAY-2033Yield to maturity

5.81%

Maturity date

May 15, 2033

FICO4921195

Fair Isaac Corporation 4.0% 15-JUN-2028Yield to maturity

5.30%

Maturity date

Jun 15, 2028

See all FICO1 bonds

Curated watchlists where FICO1 is featured.

Frequently Asked Questions

The current price of FICO1 is 26,190.00 MXN — it has decreased by −8.44% in the past 24 hours. Watch FAIR ISAAC CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange FAIR ISAAC CORP stocks are traded under the ticker FICO1.

FICO1 stock has fallen by −8.44% compared to the previous week, the month change is a −23.85% fall, over the last year FAIR ISAAC CORP has showed a −13.67% decrease.

We've gathered analysts' opinions on FAIR ISAAC CORP future price: according to them, FICO1 price has a max estimate of 43,445.41 MXN and a min estimate of 15,867.02 MXN. Watch FICO1 chart and read a more detailed FAIR ISAAC CORP stock forecast: see what analysts think of FAIR ISAAC CORP and suggest that you do with its stocks.

FICO1 reached its all-time high on Nov 26, 2024 with the price of 49,324.15 MXN, and its all-time low was 7,655.76 MXN and was reached on Nov 29, 2021. View more price dynamics on FICO1 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FICO1 stock is 9.22% volatile and has beta coefficient of 1.26. Track FAIR ISAAC CORP stock price on the chart and check out the list of the most volatile stocks — is FAIR ISAAC CORP there?

Today FAIR ISAAC CORP has the market capitalization of 626.20 B, it has decreased by −2.50% over the last week.

Yes, you can track FAIR ISAAC CORP financials in yearly and quarterly reports right on TradingView.

FAIR ISAAC CORP is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

FICO1 earnings for the last quarter are 160.76 MXN per share, whereas the estimation was 145.06 MXN resulting in a 10.82% surprise. The estimated earnings for the next quarter are 138.86 MXN per share. See more details about FAIR ISAAC CORP earnings.

FAIR ISAAC CORP revenue for the last quarter amounts to 10.06 B MXN, despite the estimated figure of 9.67 B MXN. In the next quarter, revenue is expected to reach 9.67 B MXN.

FICO1 net income for the last quarter is 3.41 B MXN, while the quarter before that showed 3.33 B MXN of net income which accounts for 2.36% change. Track more FAIR ISAAC CORP financial stats to get the full picture.

No, FICO1 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 3.59 K employees. See our rating of the largest employees — is FAIR ISAAC CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. FAIR ISAAC CORP EBITDA is 16.88 B MXN, and current EBITDA margin is 43.52%. See more stats in FAIR ISAAC CORP financial statements.

Like other stocks, FICO1 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade FAIR ISAAC CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So FAIR ISAAC CORP technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating FAIR ISAAC CORP stock shows the sell signal. See more of FAIR ISAAC CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.