GGAL/N trade ideas

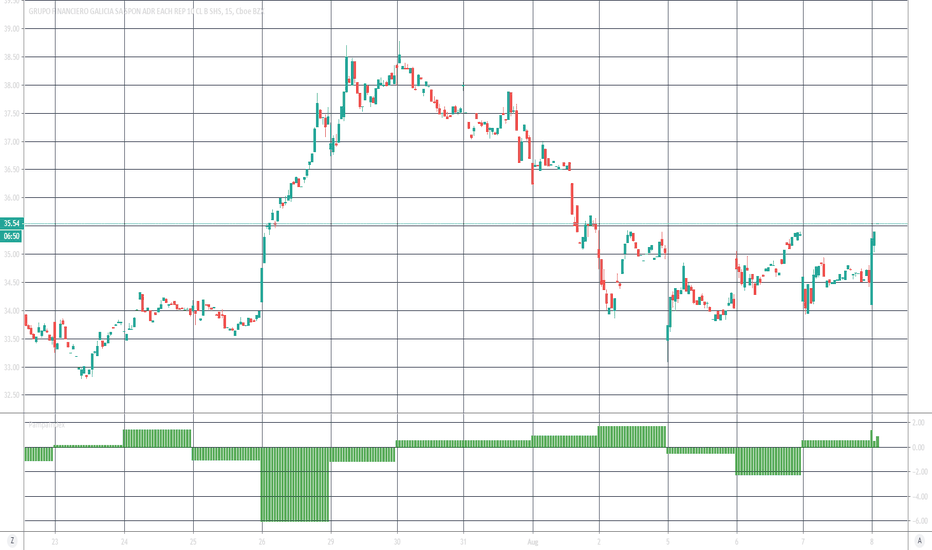

Why GGAL is ready to recoverGGAL took a big hit to its stock price back in August after the Argentinian peso plunged and Argentina raised interest rates to 60%. Investors feared that would hurt GGAL's earnings, though I've seen no evidence that it has. Now the situation has stabilized, with the peso flat against the dollar for the last few months and interest rates gradually coming down. Rates currently sit at 50%.

This should be good news for GGAL, which now has a 9.7/10 average analyst rating. Analysts have been greatly raising GGAL's earnings forecasts. GGAL currently trades at an astonishingly low multiple, even as its huge dividend raise this year should have it trading at a much higher multiple than it has in the past. All signs appear to be good for this stock, and I will be closely watching its earnings report in February to see what the impact of interest rate volatility has been.

Open Straddle OCT 18 2020Open Straddle at following

OCT 18 2020 $12.50 Call @ $1.20

OCT 18 2020 $10 PUT @ $.90

Actually, believe that this has only one direction to go (down) as folks are trying to get in on what they perceive as value play.

Currently is divergent as well but due relative historic lack of volatility I think getting the options at a discount. Could be in position to profit both ways given the time horizon. But in long term I don't see much upside

Quien manda en el precio de GGAL?Muchas veces nos preguntamos "quien manda" en el precio de las acciones argentinas que tienen ADR. ¿Se mueve según la negociación del ADR y la la acción responde en Argentina? ¿Se mueve en Argentina y el ADR responde?

El otro tema es ¿con qué dolar? Especialmente después del cepo los argentinos aprendimos a no confiar en la cotización de FX a la hora de convertir precios.

Este básico chart NASDAQ:GGAL*FX:USDARS/10 que el valor hipotético en pesos del ADR tiene mucho que ver, definiendo resistencias y price action. Especialmente interesante es la vela del lunes 12/8 donde después de toda la volatilidad el precio de la acción en pesos queda igual que a la apertura