$HIMS TANYSE:HIMS on the Daily Chart still with an ascending triangle - with resistance at $72-$70 - is still being respected with price touching the top trendline, with weakening volume, an evening star which is suggesting trend exhaustion from the rally from the 23rd June, succeeding the 30% drop from the head and shoulders pattern.

On the 15m Chart, you can see a bull flag and pennant form which broke down with confluence from MACD and RSI showing downside pressure. forming a bear pennant. However, both indicators are now flashing bullish divergence — price action is printing lower lows, while RSI and MACD are printing higher lows.

Premarket has broken above above the pennant, confirming the divergence.

HIMS trade ideas

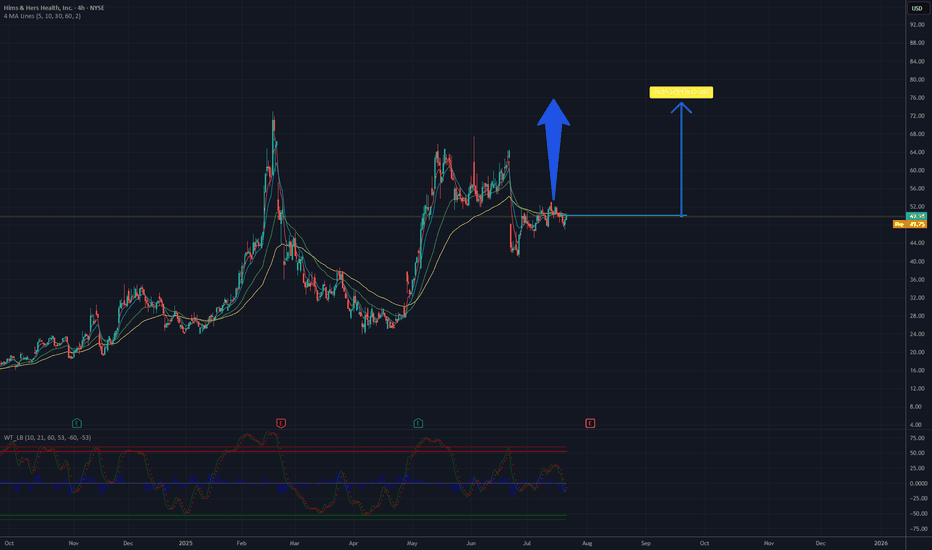

Is it a time for HIMS? Potential 50%,target 75USD.The company has announced plans to introduce comprehensive at-home lab tests, leveraging the acquisition of Trybe Labs, which could enhance service personalization and attract new customers. Additionally, expansion into markets such as Canada and Europe (through the acquisition of Zava) opens new revenue growth opportunities. The company demonstrates continuous financial improvement, including record profitability and a 111% revenue increase since reaching its ATH (All-Time High) in February 2025, which builds investor confidence.

The chart analysis of Hims & Hers Health, Inc. (NYSE: HIMS) indicates a clear upward trend in the recent period. The current price is approximately 49.38 USD. Based on historical data and visible momentum, there is potential for a growth of about 50%, which could bring the price to around 75 USD. Key support is located around 45 USD, while resistance may be tested in the 55-60 USD range before further upward movement. It is recommended to monitor volume and key technical levels to confirm the continuation of the trend.

Potential TP: 75 $

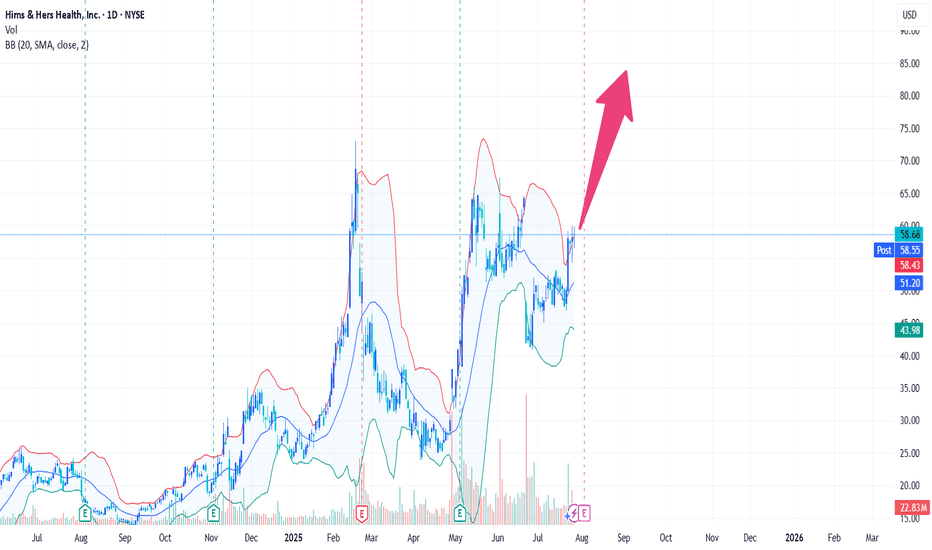

HIMS & HER - Uptrend to continueHIMS & HER NYSE:HIMS is looking at a strong bullish continuation after the stock broke above both the symmetrical triangle and the bearish gap. Resistance at 67.57 has been tested multiple times and is likely to be weakened. Hence, they are likely to break higher.

Furthermore, the stock has shown strong momentum returning after long-term MACD histogram has turned positive and stochastic oscillator crossed above the 50-line and rose, indicating momentum in the mid-term is back in action.

Directional movement index continues to show strong bullish strength.

Strategy:

Buy spot @ 65.53 or buy stop above 67.57. Bull limit @ 49.32 in the event of a correction.

Target 1: 96.93 (1 month est)

Target 2: 110.88 (3-6 month est)

Hims taking some off here I hope i'm wrong, but i took off about 50% of my position. I'm bearish short term, healthcare stocks just getting wrecked left and right. I'd add back in the green horizontals if tested in the 36-32 range. The Hims position has run up a little too much in size than I'm comfortable with, happy to take some off here. Good luck to everyone playing earnings.

$HIMS - stock going for gap fill plus key resistance level. HIMS - Stock on the way to gap fill to $62.96. calls added in the group. Stock has been failing to hold after breaking $65 level. ON high watch if that level breaks for a move to the upside. Company to report earnings next week. Could see a move towards $65 pre earnings.

8/5/25 - $hims - Shouldn't be green.8/5/25 :: VROCKSTAR :: NYSE:HIMS

Shouldn't be green.

- this is a trading man's game stock at the moment

- but fundamentally, as a grow stock in a heady market, you can't be missing here and leaving wide gaps in guidance for hope

- so yeah. i think seeing this thing go red to green is, frankly, surprising and makes me wonder how much liquidity needed to be grabbed on both sides of this thing

- but i'd also believe we need to find a lower low (in the 40s before i'd consider owning it again).

- gl to the bulls. i've only been in your camp - as you can see - on this chart over the last year/year and a half

- but no way i'm owning this thing at this valuation. not a short. but a clear "avoid" at best in my book.

be safe out there. don't let the blinders allow you to not manage size (e.g. trimming) is my friendly nudge

V

HIMS WEEKLY TRADE IDEA (7/29/25)*

**💊 HIMS WEEKLY TRADE IDEA (7/29/25)**

**🔥 Bullish Flow + Rising RSI + Institutional Volume**

**📈 Trade Setup**

• **Stock**: \ NYSE:HIMS

• **Direction**: CALL (LONG)

• **Strike**: \$64.00

• **Entry**: \$0.92

• **Target**: \$1.38

• **Stop**: \$0.46

• **Size**: 2 contracts

• **Expiry**: Aug 1, 2025 (3DTE)

• **Confidence**: 80%

• **Entry Timing**: Market Open

---

**🧠 Why This Trade?**

✅ **Call/Put Ratio = 1.37** → Bullish sentiment

✅ **RSI Daily: 65.2 / Weekly: 61.3** → Momentum building

✅ **1.8x Weekly Volume Surge** → Institutional accumulation

✅ **\$64C OI = 2,616** → High liquidity + interest

⚠️ **Gamma Risk + Fast Decay** → Time-sensitive play

---

**🎯 Strategy**

→ Play the momentum spike into expiry

→ Exit quickly on profit target or 50% stop

**#OptionsTrading #HIMS #SwingTrade #EarningsPlay #TradingViewSetup #FlowTrade**

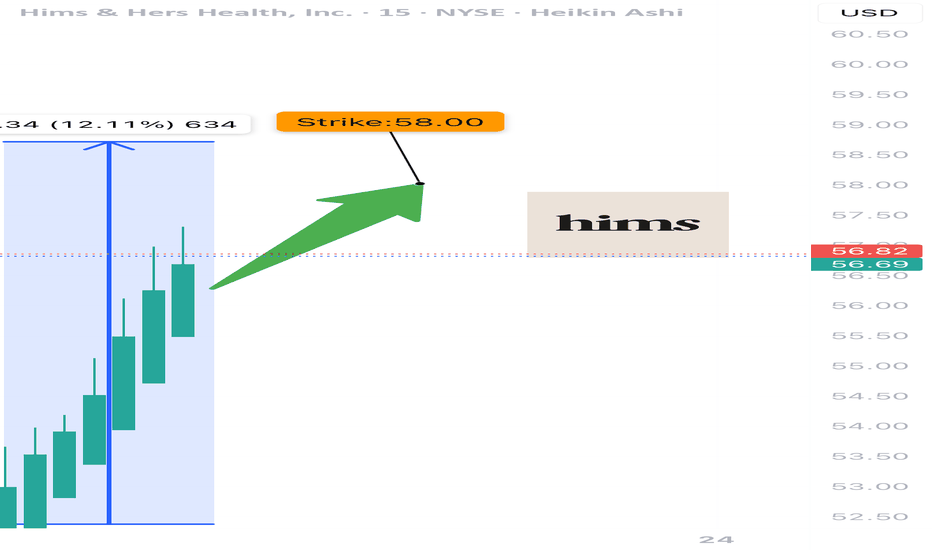

HIMS WEEKLY BULLISH PLAY — 07/23/2025

🩺 HIMS WEEKLY BULLISH PLAY — 07/23/2025

📈 Momentum Up, Flow Bullish, Time Tight — Let’s Ride It

⸻

🔍 MARKET SNAPSHOT

5-model AI consensus = ✅ BULLISH

Why?

• 📈 Weekly RSI = 58.2 (Rising) — Clear momentum

• ⚖️ Call/Put Ratio = 1.63 — Big call volume (45K+)

• 📉 Volume = 0.9x — ⚠️ Slight institutional hesitation

• 🌪️ VIX = 16.0 — Low volatility = smoother execution

⸻

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "HIMS",

"direction": "CALL",

"strike": 58.00,

"entry_price": 0.86,

"profit_target": 1.72,

"stop_loss": 0.43,

"expiry": "2025-07-25",

"confidence": 75%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 58 CALL

💵 Entry 0.86

🎯 Profit Target 1.72 (+100%)

🛑 Stop Loss 0.43 (tight risk)

📅 Expiry July 25 (2DTE)

⚡ Confidence 75%

📈 Size Suggestion Risk 2–3% of capital

⚠️ Key Risks Low volume + high gamma exposure

⸻

🧠 MODEL TAKEAWAYS

✅ RSI and momentum are clearly aligned upward

✅ Call flow = bullish commitment

⚠️ Volume is light → watch for momentum stalls

⚠️ Gamma risk = manage tight, exit fast

⸻

💬 Drop a 🧠 if you’re tracking

📈 Drop a 💥 if you’re in this call

🛎️ Trade tight — expiration Friday, HIMS is moving on momentum not mass

#HIMS #OptionsTrading #CallOptions #BullishPlay #MomentumTrade #ZeroDTE #GammaScalp #AITrading #HealthcareStocks

Grok Bets Big on HIMS $60 Calls

**HIMS \$60C in Play! Mixed Models, But Grok Goes Bullish 💥 \ **

---

### 🧠 TradingView-Ready Caption:

**HIMS Weekly Trade Alert 🚨 | Aug 8 Expiry**

> While most models stay cautious, **Grok/xAI pulls the trigger** on a bullish call. Weekly RSI rising, volume weak but stable. Entry at market open, eyeing that \$60 breakout.

📈 **Trade Setup:**

* **Instrument:** \ NYSE:HIMS

* **Direction:** CALL (Bullish)

* **Strike:** \$60.00

* **Expiry:** Aug 8, 2025

* **Entry Price:** \$7.00

* **Target:** \$8.00

* **Stop Loss:** \$3.50

* **Confidence:** 65%

🧊 Risk: Gamma decay with 3 DTE, mixed signals across models.

🔥 Reward: Only Grok model signals upside — the contrarian bet.

---

### 🏷️ Suggested Tags:

`#HIMS #OptionsTrading #CallOption #HIMS60C #TradingSetup #StockMarket #TechnicalAnalysis #GrokAI #WeeklyTrade #BullishPlay #TradingView #RSI #GammaRisk #EventRisk #SPY #AIModels`

Hims new momentum zoneHims hit my new momentum zone perfectly on the dump. I had this drawn after the initial down leg, hoping the daily gap would fill to the downside. We see a nice hard stop at the buy zone, the stock could easily slide down to 47, but we are seeing strong action from buyers here. Now if only NVO would announce a lawsuit to get the party going.

My plan:

I am overexposed to hims and have a lot of shares in covered calls and I will likely follow the weekly chart but not play it unless we get a massive dump where I will buy LEAPs.

[$HIMS] Beautiful wellness trade - Plan changed overnightNYSE:HIMS

The plan was too SHORT (BEAR CALL SPREADs) NYSE:HIMS @66.0 USD.

Outside regular trading hours it dumped and spiked back from 55.0 USD up to 62.0 USD.

-> technical pattern 3 White Soldiers

Short Story Long: I went long at 55.0 USD (Cash Secured Puts) seeing a strong support at this key level.

>no good trade

>we will see

Absolutely, not to be recommended to copy!

No financial advice.

Neowave Structural Outlook – Complex Correction: W–X–Y–X–ZThis analysis interprets the ongoing structure as a Complex Correction in the form of a W–X–Y–X–Z pattern. Here's a breakdown of the logic behind the wave labeling and key observations:

Overall Structural Summary:

W wave (M1–M5): Though M1 is labeled as ":5", a closer examination of its internal structure reveals corrective characteristics. Therefore, the entire M1–M5 segment is best interpreted as a complex corrective structure, possibly a double three or flat.

X wave 1 (M6–M8): A clear Zigzag, fulfilling the requirements for a valid X. All relevant time and price criteria are met, forming a neat connector after W.

Y wave (M9–M13):

M9–M10: A Zigzag formation.

M11–M12–M13: M12 serves as an x-wave, and M13 unfolds as a simple corrective move in three waves, completing the Y wave. Though M13 is a single-leg visually, the internal structure confirms a three-part move.

The Y wave is longer in both time and complexity, appropriate for its position in the sequence.

X wave 2 (M14): Despite appearing as a short single move, it satisfies the X criteria in the context of the ongoing correction. The small size is acceptable as per rule allowances for connectors in Z formations.

Z wave (M15–ongoing):

M15–M17: Another Zigzag, forming the first leg of Z.

M18: Likely the X connector within Z.

M19: Assumed to be the beginning of the final leg of Z. The structure from here forward will determine whether Z completes as a triangle, zigzag, or another combination.

Supporting Rule Applications:

Several Neowave rules were cross-verified:

- Rule 2a and 5a were referenced to validate corrections that exceed the 61.8% retracement and duration benchmarks.

- Rule 7c and 4 supported impulse invalidations and corrections involving running structures.

Time symmetry across connectors and leg duration was considered to maintain wave consistency.

Visual Channels:

All W, Y, and Z legs are progressing within clearly defined channels.

The Z leg is currently within a steep rising channel. If Z completes as a non-triangular formation, a reversal might follow.

Conclusion & Risk Notes:

This structure, though corrective in nature, contains strong upward segments — especially within Z — making it tradable for bullish swings.

Given that Z is the final leg, caution is warranted. Once Z completes (especially if M19 develops into a three-wave structure), the larger correction may terminate, potentially leading to a larger trend reversal.

Position management (e.g., scaling out or using stop-losses) is advised as the structure evolves.

My buy view for Hims & Hers stock. My buy view for Hims & Hers stock.

Overall, I believe this asset is still in a bullish direction. I remember hoping into accummulating this stock when it dropped from $64 to $41 at the open of market on 23/6/2025 which I sold off when it hit $50.

However, I still hold a strong buy bias with my entry and exit showing on my chart (analysis).

Please trade with care as I still look forward to $64 per share for this stock long-term.

Please, kindly like, share your thoughts via comment and follow me for more.

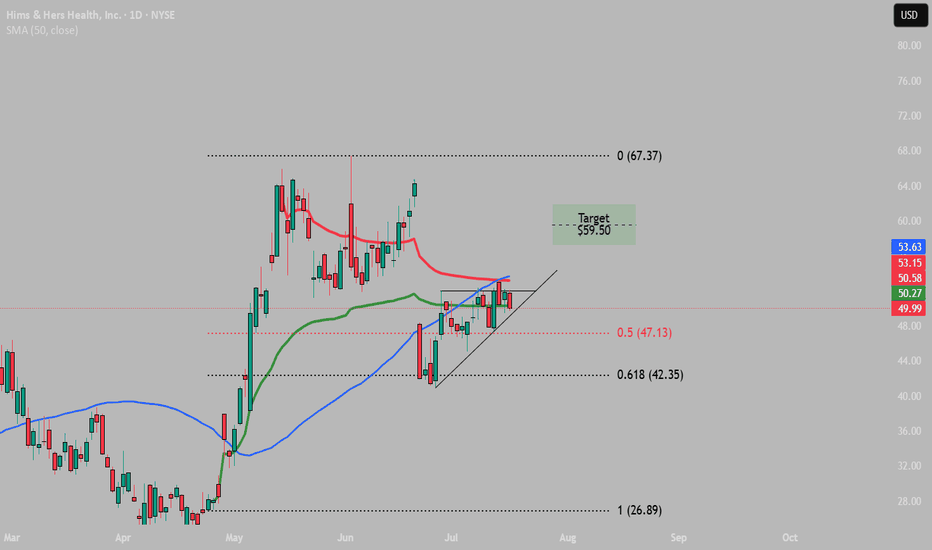

HIMS · 4H — Symmetrical Triangle Breakout Targeting $55 → $60Setup Breakdown

HIMS is forming a symmetrical triangle consolidation, with price tightening between rising support and descending resistance.

The structure follows a previous impulsive move, suggesting this is likely a bullish continuation pattern.

Volume is contracting — typical for pre-breakout setups — and price is holding above a key short-term rising trendline.

A breakout above $52–53 could initiate a fast move into the next resistance band.

---

🎯 Target Zone

🎯 Target Level Reason

Target-1 $55.50 (38.2% Fib) Volume gap fill + first resistance from prior consolidation range. A clean spot for partial profits.

Target-2 $60.00 (50% Fib) Strong historical resistance + Fibonacci confluence. Ideal level to take the rest of the position or trail a runner.

---

🛠️ Trade Plan (Example)

Component Action

Trigger Long on a confirmed breakout above $52 with volume ≥ 20-SMA

Entry Add-on Pullback retest of broken triangle resistance ($52) acting as new support

Stop-loss Close < $49.50 — invalidates the triangle

TP-1 $55.50 — take 50–70% off, move stop to breakeven

TP-2 $60.00 — exit or leave a small runner in case of further breakout

---

⚠️ Risk Notes

Earnings date approaching – trade may need to be closed or hedged before volatility spikes.

Break below $49.50 invalidates the pattern and opens risk to $46 or lower.

Watch for volume confirmation — fakeouts can occur if breakout lacks momentum.

---

✅ Checklist

Triangle structure with strong trendline support

Low-volume zone between $53–60 favors fast expansion

Targets align with Fib + volume profile

Risk clearly defined

Earnings awareness in place

> Disclaimer: This is not financial advice. Trade your own plan and manage risk appropriately.

$HIMS | Cup & Handle Setup FormingA classic cup & handle setup is building on the 4H chart.

Price just broke out of a falling channel (handle), and is now testing a key breakout zone between $48–$53. A daily close above $54–$55 with volume would confirm continuation.

I’ve mapped out three potential price targets ($73.88, $99.17, $145.34) based on the depth of the cup and Fibonacci extensions.

Watching:

RSI trending higher

Bullish trend intact via 8/21 EMA

Sub-$40 = pattern invalidation

Breakout + volume = go time. Watching closely this week.