MAT trade ideas

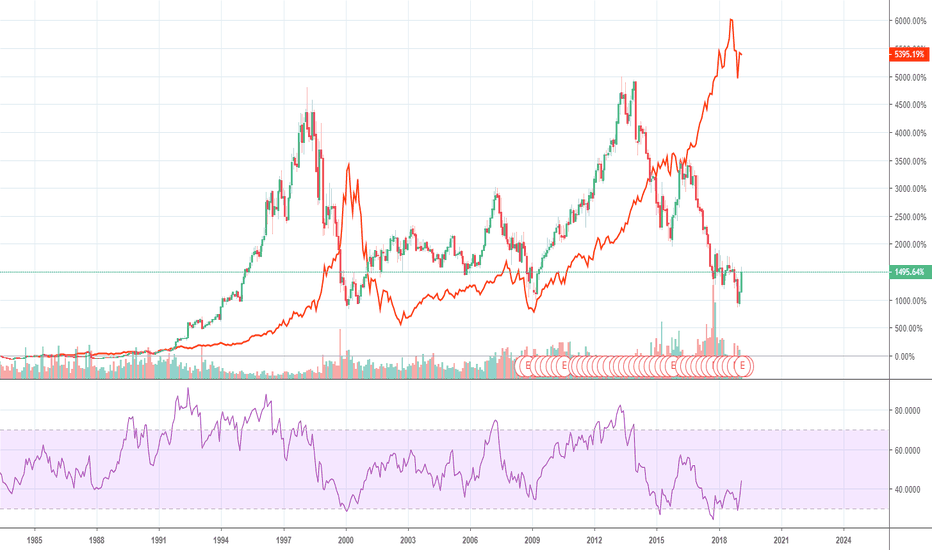

Fundamental Trade ShortAfter a spike in Early February it soon...ate up almost all of its gain the same day after a cut in earnings(Circled in black). Now why am I short? Well Let's take a look at demand for what Mattel sells. Toys, Board games, and dolls(famously Barbie). The plummet was due to a MASSIVE cut in earnings and terrible guidance for 2019 to be FLAT. Mattel blames Toys R Us' bankruptcy because it sells much of their toys (Which can be seen on the date of their official bankruptcy June 29 18 which marked the last recent high.) You'd think with places that Toys r Us went hand and hand with would also go out of business.... except they are. Game stop has partnered with Toys R Us several times and has performed miserly because people don't buy discs anymore they buy Downloads. Similarly, kids don't play board games much anymore they can play on gadgets or nobody wants to. The demand for board games has switched to a niche area for adults (i.e cards against humanity, Jackass etc...). However Mattel only sells traditional board games, particularly ones that people ignore more often unlike Hasbro(who have diversified their assets and... own monopoly). The demand is shrinking, and hence the price for Mattel is shrinking.

The only way i can see this turning around for mattel is if they manage to switch to a different market approach(introduce a revolutionary different approach never seen and that is a pipe dream at best). Anything is Possible.

$MAT MATTEL INC IN THE UNFORTUNATE EYE OF A STORMMattel has now pulled the Rock n Play sleeper from the market which has now been associated with the deaths of many poor little infants. There is no good outcome to such a issue for the company and families, it is inevitable that this will cause unease among investors, retailers and consumers.

mat-asset playi expect mat to begin to sell off assets to try to help their business/rebuild their brand image. their margins are on the rocks. inventories are high, and the level of leverage mat has on the books is pretty high. although speculative i feel that mat would be an ideal buyout candidate or intangible brands to be pieced apart. that reason along im holding some shares long

TRADE IDEA: MAT APRIL 18TH 15/15/17 BIG LIZARDMetrics:

Max Profit: $223/contract ($56 at 25% max)

Max Theoretical Loss/Buying Power Effect: $1277 (stock goes to 0); $1277 cash secured; ~$300 on margin.

Break Even: 12.77/share (7.6% discount over current price if assigned on the 15 short put); no upside risk

Delta: 43.26 (bullish assumption)

Theta: 1.09

Notes: I wasn't happy with what my screener was showing me for things to play this coming week, so figured I'd scrounge around for a few underlyings with high implied volatility that have earnings in the rear view mirror. One of these is MAT (50/58), which got taken to the wood shed last week.

Pictured here is a "Big Lizard" (Who comes up with these names?) that consists of a short straddle and a long call where the width of the short call vertical aspect (the short call + the long call) is less than the total credit received for the entire setup. Put another way, the risk associated with the short call vertical aspect ($200, since it's a 2-wide) is less than the total credit received ($223) so that if the underlying takes off like a poo rocket and breaks through the long call, you can still make money to the extent that the total credit exceeds the width of the spread (2.23 - 2.00 = .23). Ideally, however, you want price to remain between your break even of 12.77 and the short straddle at 15.00.

Obvious alternative plays:

The April 18th 13 short put, .62 credit, break even of 12.37 (a discount of 10.5% over current price), delta 33.95, theta .81.

The April 18th 15 short straddle, 2.56 credit, break evens of 12.44/17.56 (a discount of 10% over current price if assigned on the 15), delta 22.67, theta 1.8.

Good short on such a large price spikeMattel's sales decrease 10% each year for many years. No wonder here, if you had kids you'd know what they like more: iPads or dolls.

Hasbro showed us their numbers and what effect Toys-R-Us closure had on toys' sales. Question is: what tricks did Mattel use to come up with these numbers? Perhaps old school channel stuffing, they even went as far as reducing ad budget by 30% to show up with better than expected losses to the party. Barbie/HotWheels sales are up (really?), but all other toy lines are down by 20-30%. That's a pretty bad indicator when companies start to reduce their ad budgets: sales will start dropping even faster.

But they had no other choice IMO but to fix up these numbers by reducing expenses: if they didn't they would be out of S&P500 quite soon; they just deferred their fate for a while. In a year Mattel will be sub $5 stock and will be removed from $SPY

MAT - Good Short SignalThere was a good short signal, after breaking through the resistance line and 200MA, and fastening below its level.

Such signals as this one are very strong in nature.

The GAP, which breaks through the resistance level of the channel and in addition opens below 200MA, is one of the strongest signals for shorts:

Given the general picture of this action, I see no reason to skip this signal.

Good Luck!