Is the Golden Arches Losing Its Shine?McDonald's, a global fast-food icon, recently reported its most significant decline in U.S. same-store sales since the peak of the COVID-19 pandemic. The company experienced a 3.6 percent drop in the quarter ending in March, a downturn largely attributed to the economic uncertainty and diminished co

Key facts today

In the first quarter of 2025, McDonald's reported a 3% decline in total revenue, with U.S. same-store sales dropping 3.6%, marking the steepest fall since 2020.

McDonald's and its franchisees plan to hire up to 375,000 workers nationwide this summer, with shares experiencing a 0.4% decline following the announcement.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

233.32 MXN

171.44 B MXN

540.42 B MXN

714.78 M

About McDonald's Corporation

Sector

Industry

CEO

Christopher J. Kempczinski

Website

Headquarters

Chicago

Founded

1955

FIGI

BBG000HW8S73

McDonald's Corp. engages in the operation and franchising of restaurants. It operates through the following segments: U.S., International Operated Markets, and International Developmental Licensed Markets and Corporate. The U.S. segment focuses its operations on the United States. The International Operated Markets segment consists of operations and the franchising of restaurants in Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain, and the U.K. The International Developmental Licensed Markets and Corporate segment consists of developmental licensee and affiliate markets in the McDonald’s system. The firm's products include Big Mac, Quarter Pounder with Cheese, Filet-O-Fish, several chicken sandwiches, Chicken McNuggets, wraps, McDonald's Fries, salads, oatmeal, shakes, McFlurry desserts, sundaes, soft serve cones, pies, soft drinks, coffee, McCafe beverages, and other beverages. The company was founded by Raymond Albert Kroc on April 15, 1955, and is headquartered in Oak Brook, IL.

The 3 Step System Used To Buy This Stock Trying To forgive someone is very hard for me because I am emotional.Once a person disappoints me it's hard to trust that person again.

And because I enjoy keeping people accountable.Its not safe for me to enter that zone when I have not forgiven them.

So before I hold an account on anyone I need

McDonald's Corporation (MCD) – Lovin’ the GrowthCompany Snapshot:

McDonald’s NYSE:MCD is the undisputed global leader in quick-service restaurants, with over 40,000 locations worldwide and a brand that resonates across generations. The company blends cultural relevance with operational excellence, continuously innovating to stay ahead of changi

Comprehensive Research - McDonald’s Stock Set to SoarQuick read:

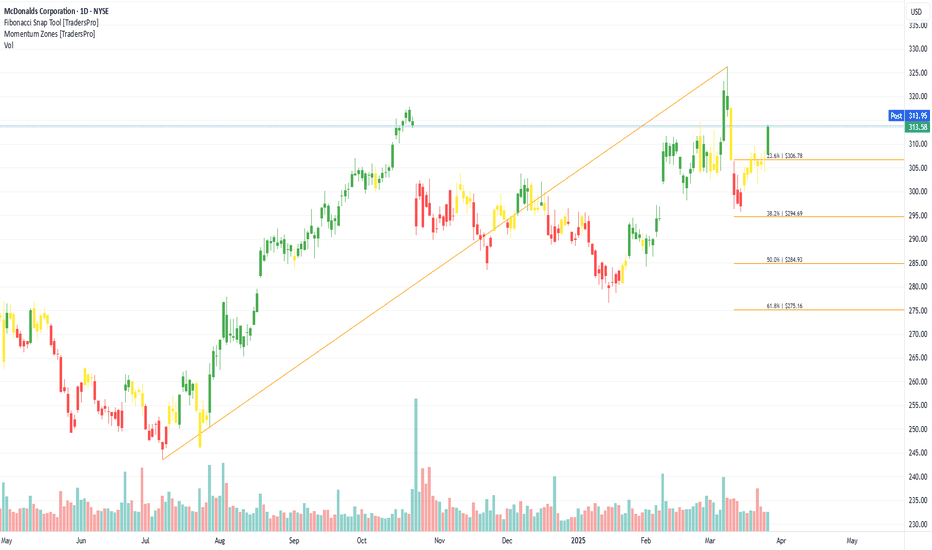

McDonald's stock is poised for a bullish move, with Wave 3 likely starting and strong support near 290.50–295.00. Traders should long on dips within this range, for next resistance levels, 326.00 and 348.00 with a invalidation below 276.00. This setup offers a solid risk-to-reward in a

McDonald's (MCD): Digital Expansion Fuels Stock StrengthMcDonald’s Corporation (MCD) is one of the most recognized global fast-food brands, known for its burgers, fries, and drive-thru convenience. With thousands of locations worldwide, McDonald’s continues to grow through menu innovation, digital ordering, delivery partnerships, and modernized restauran

McDonalds is a beast, but short term price dropI love MCD and will always love to eat and trade.

For me MCD is like water ETF. Automation will increase the profits in the future...

BUT price of the stock won't increase more in short term...It will drop.

It is not an investment nor trading advice do your own analysis. I am not responsible for

McDonald’s Builds Momentum After Quarterly ResultsMcDonald’s share price has been stuck in the slow lane for months, but its latest earnings report has given the stock a much-needed boost. A stronger-than-expected sales performance saw shares jump nearly 5% during yesterday’s session, signalling that investors are starting to take notice again.

Big Mac update Every time when you open a trade,you should expect negativity it's gonna help you to find your risks,risking management is the one that determines how long you gonna last in the trade,as a swing trader and long term trader,risking management is your friend besides good entries but the spirit of hold

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US58013MEU4

MCDONALDS CORP. 2025 MTNYield to maturity

7.64%

Maturity date

May 26, 2025

XS1075996907

McDonalds 4,125% 11/06/2054Yield to maturity

7.23%

Maturity date

Jun 11, 2054

US58013MFK5

MCDONALDS 19/49 MTNYield to maturity

6.92%

Maturity date

Sep 1, 2049

US58013MER1

MCDONALDS CORP. 2043 MTNYield to maturity

6.69%

Maturity date

May 1, 2043

MCD4971144

McDonald's Corporation 4.2% 01-APR-2050Yield to maturity

6.62%

Maturity date

Apr 1, 2050

MCD3816489

McDonald's Corporation 3.7% 15-FEB-2042Yield to maturity

6.59%

Maturity date

Feb 15, 2042

US58013MFC3

MCDONALDS CORP. 2047 MTNYield to maturity

6.56%

Maturity date

Mar 1, 2047

MCD4666684

McDonald's Corporation 4.45% 01-SEP-2048Yield to maturity

6.50%

Maturity date

Sep 1, 2048

US58013MEV2

MCDONALDS CORP. 2045 MTNYield to maturity

6.46%

Maturity date

May 26, 2045

US58013MFA7

MCDONALDS CORP. 2045 MTNYield to maturity

6.32%

Maturity date

Dec 9, 2045

XS248628502

MCDONALDS 22/38 MTNYield to maturity

6.32%

Maturity date

May 31, 2038

See all MCD bonds

Curated watchlists where MCD is featured.

Related stocks

Frequently Asked Questions

The current price of MCD is 5,952.00 MXN — it has decreased by −0.73% in the past 24 hours. Watch MCDONALD'S CORPORATION stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange MCDONALD'S CORPORATION stocks are traded under the ticker MCD.

MCD stock has fallen by −4.18% compared to the previous week, the month change is a −4.70% fall, over the last year MCDONALD'S CORPORATION has showed a 30.70% increase.

We've gathered analysts' opinions on MCDONALD'S CORPORATION future price: according to them, MCD price has a max estimate of 7,173.83 MXN and a min estimate of 5,912.50 MXN. Watch MCD chart and read a more detailed MCDONALD'S CORPORATION stock forecast: see what analysts think of MCDONALD'S CORPORATION and suggest that you do with its stocks.

MCD stock is 0.81% volatile and has beta coefficient of 0.29. Track MCDONALD'S CORPORATION stock price on the chart and check out the list of the most volatile stocks — is MCDONALD'S CORPORATION there?

Today MCDONALD'S CORPORATION has the market capitalization of 4.29 T, it has decreased by −3.89% over the last week.

Yes, you can track MCDONALD'S CORPORATION financials in yearly and quarterly reports right on TradingView.

MCDONALD'S CORPORATION is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

MCD earnings for the last quarter are 54.70 MXN per share, whereas the estimation was 54.53 MXN resulting in a 0.31% surprise. The estimated earnings for the next quarter are 61.09 MXN per share. See more details about MCDONALD'S CORPORATION earnings.

MCDONALD'S CORPORATION revenue for the last quarter amounts to 122.02 B MXN, despite the estimated figure of 125.00 B MXN. In the next quarter, revenue is expected to reach 129.84 B MXN.

MCD net income for the last quarter is 38.27 B MXN, while the quarter before that showed 42.05 B MXN of net income which accounts for −9.00% change. Track more MCDONALD'S CORPORATION financial stats to get the full picture.

Yes, MCD dividends are paid quarterly. The last dividend per share was 36.64 MXN. As of today, Dividend Yield (TTM)% is 2.23%. Tracking MCDONALD'S CORPORATION dividends might help you take more informed decisions.

MCDONALD'S CORPORATION dividend yield was 2.34% in 2024, and payout ratio reached 59.52%. The year before the numbers were 2.10% and 53.87% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 14, 2025, the company has 150 K employees. See our rating of the largest employees — is MCDONALD'S CORPORATION on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MCDONALD'S CORPORATION EBITDA is 284.89 B MXN, and current EBITDA margin is 53.85%. See more stats in MCDONALD'S CORPORATION financial statements.

Like other stocks, MCD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MCDONALD'S CORPORATION stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MCDONALD'S CORPORATION technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MCDONALD'S CORPORATION stock shows the buy signal. See more of MCDONALD'S CORPORATION technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.