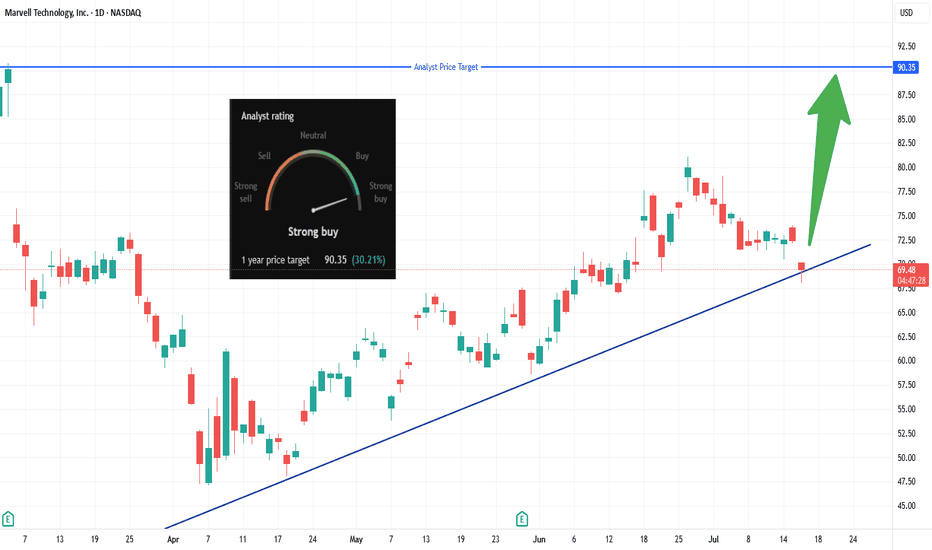

MRVL Long Breakout Setup, Eyes $90 Target!Looking to enter long on a clear breakout above $70.13 (today’s high).

• Entry: Above $70.13

• Stop-Loss: Below today’s low (~$68.50) to protect capital

• Target: $90.35 – per analyst consensus (~+30%)

✅ Why:

📈 Trendline bounce & momentum: Price holding strong above an ascending trendline from April suggests buyers are stepping in.

🏢 AI-chip catalyst: Marvell’s custom ASICs are gaining traction with Amazon, Microsoft, and Google—data-center demand is surging.

💰 Analyst confidence: Consensus is “Strong Buy” with average targets between $90–$94 (some as high as $133).

🧩 Market & Sector Tailwinds: AI chip stocks rallying; Marvell poised as lower-cost custom-chip alternative to Nvidia—and undervalued vs peers.

*** Be sure to follow us for more trade setups! ***

MRVL1 trade ideas

AI Innovations Signal Strong Long Opportunity

Targets:

- T1 = $76.79

- T2 = $79.34

Stop Levels:

- S1 = $71.39

- S2 = $69.10

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Marvel Technology.

**Key Insights:**

Marvel Technology (MRVL) is strongly positioned in the semiconductor industry with its advancements in AI hardware and cloud-driven solutions. The company's recent focus on AI accelerators has drawn attention from major players like Amazon, which favors Marvel's cost-effective innovation over traditional GPU providers. This strategic alignment sets Marvel apart as a long-term growth candidate in the ever-demanding AI and cloud markets. Furthermore, Marvel's diversified product base and penetration into emerging industries provide a strong foundation for stable growth.

The demand for AI-driven hardware across industries continues to rise exponentially. Marvel’s robust product portfolio in AI infrastructure further increases its appeal to institutional investors seeking exposure to the premium semiconductor market, particularly in light of economic tailwinds impacting technology growth as major corporations scale capacity.

**Recent Performance:**

Marvel Technology has shown resilience with steady market activity, supported by positive investor sentiment stemming from its focus on AI-driven semiconductors. Trading at $73.51, MRVL displays stability and potential for significant upside due to industry momentum. Recent price movement aligns with ongoing institutional partnerships and industry headlines, solidifying its current valuation.

**Expert Analysis:**

Market analysts favor Marvel for its targeted product offerings in AI acceleration and cloud computing. Amazon’s recent decision to adopt MRVL’s technology over Nvidia GPUs highlights Marvel’s ability to balance performance and cost-efficiency in competitive markets. This positions Marvel as a key semiconductor player, capitalizing on the demand for AI-centric solutions while diversifying its customer base. Analysts remain bullish on Marvel's growth potential, particularly its capacity to carve more market share in the cloud and AI hardware industries.

**News Impact:**

Amazon’s strategic partnership with Marvel Technology not only boosts MRVL’s reputation but may also signal potential widespread usage of Marvel’s AI accelerators across the tech industry. Such events not only validate Marvel’s technological innovation but also enhance its visibility as a provider of effective semiconductor solutions amidst the soaring demand for low-cost, high-performance AI applications.

**Trading Recommendation:**

Marvel Technology represents a unique long-term opportunity in the semiconductor sector, guided by robust partnerships, market-defining innovations, and growing industry demand. Investors should carefully monitor the $69.10 support level and the $76.79 resistance level as critical benchmarks for future price movement.

MRVL BullishIncreased volatility on weekly tf as indicated by BBWP. Significant volume increase on the weekly as well. Momentum indicators pointed up. Resistance 1 @ $78-80. Resistance 2 @ $85-$95 range. Psychological Resistance @$100. I have calls dated Aug.15th. $100 strike. Decent enough lotto ticket i think and if it hits it could be huge.....

MRVL .. a marvel move when you use TA like a childNot a fan of TA and think its just making excuses to draw lines and pretend that how life works....

but here are some doodles I came up with...it was too cluttered so I left the simplest one up and the rest follow just in a closer view...

Just top to bottom at the first two pivot peaks and then parallel channel to the bottom and use decimals for each line to replicate.

The others here are low to low bow connects with their equal reversal lines attached to their peaks, in between the bows.

And the dark blue is the same line from above but it is attached to every high peak thats important down the whole fall.

Blue lines:

Green lines:

Teal lines:

All together up close:

1hr chart....

but they are super secret

and the indicators I use with them

MRVL at turning point; rapid growth; stock price set to doubleMarvell Technology Inc. (MRVL) has recently shown signs of an upward trend, buoyed by positive analyst sentiment and strategic advancements in AI and cloud computing. Despite a challenging start to 2025, with shares down approximately 50% year-to-date (markets.businessinsider.com), analysts maintain a bullish outlook. The average 12-month price target stands at $116.40, suggesting significant potential upside from current levels (StockAnalysis).

Marvell's focus on custom AI silicon and data center solutions is driving optimism. The company's Structera CXL devices have achieved interoperability with AMD and Intel platforms, enhancing performance in next-generation cloud data centers (Benzinga). Additionally, Marvell's AI business now constitutes over half of its revenue, with expectations of 60% year-over-year revenue growth driven by AI and cloud segments (Seeking Alpha).

While short-term volatility persists, these developments position Marvell as a strong contender in the semiconductor sector, with potential for sustained growth as AI and cloud computing demand accelerates.

Back to 95Buying Marvell could be a smart move right now, especially given its strong position in high-growth markets like data centers, AI infrastructure, and 5G.

In fiscal 2024, Marvell generated over $5.5 billion in revenue, with its AI-related revenue expected to exceed $2.5 billion in fiscal 2025, showing aggressive momentum in this sector.

The company is also well-capitalized, with over $800 million in free cash flow last year, allowing for continued R&D and strategic acquisitions.

Trading at a forward P/E of around 30, it's not cheap, but investors are pricing in strong growth prospects in AI and cloud networking, which are expected to expand significantly over the next 1-2 years.

Especially now its in "discount" due to trade war fears.

Marvell Technology, Inc. (MRVL) Dips 16% On Earnings ReportMarvell Technology, Inc. ( NASDAQ:MRVL ) faced a sharp 16% decline in premarket trading on Thursday following the release of its fiscal fourth-quarter earnings report. While the semiconductor giant exceeded Wall Street’s expectations on both revenue and earnings per share (EPS), investor sentiment soured due to an uninspiring outlook.

Strong Growth, Weak Guidance

Despite the stock's decline, Marvell delivered solid earnings results for Q4:

- Revenue: $1.82 billion (+27% YoY), surpassing analyst consensus.

- Adjusted EPS: $0.60 per share, up from $0.46 a year ago.

- Data Center Segment: Revenue surged 78% YoY to $1.37 billion, reflecting strong AI infrastructure demand.

However, the market’s reaction was driven by Marvell’s fiscal Q1 guidance, which projected:

- Revenue of $1.875 billion, within analysts' expectations but lacking significant upside.

- Adjusted EPS forecast of $0.56 - $0.66, failing to excite investors anticipating a stronger AI-driven catalyst.

Technical Analysis

From a technical perspective, NASDAQ:MRVL now trades below key moving averages, reinforcing a bearish short-term trend. The stock’s RSI (Relative Strength Index) currently sits at 38, signaling weakness but not yet oversold territory, suggesting sellers may still have control.

MRVL Looks interesting here. Looks interesting here. Double bottom? Earnings coming up, let's see if we can test 126 again.

Marvell Technology, Inc. engages in the design, development, and sale of integrated circuits. Its products include data processing units, security solutions, automotive, coherent DSP, DCI optical modules, ethernet controllers, ethernet PHYs, ethernet switches, linear driver, PAM DSP, transimpedance amplifiers, fibre channel, HDD, SSD controller, storage accelerators, ASIC, and Marvell government solutions. It operates through the following geographical segments: United States, Singapore, Israel, India, China, and Others. The company was founded by Wei Li Dai and Pantas Sutardja in 1995 and is headquartered in Wilmington, DE.

Bearish Reversal CandleWith the Bearish Reversal Candle on 2.7.25 and today's small spread candle on low volume, this implies that the demand that was making prices rise has given way to supply pressure. With some help with bad news this week from Super Data Week we could easily see lower prices.

I will short/buy puts if the price closes below $110.40 daily with a target price of $98.75 and a stop at $115.18.

This is my idea and not a recommendation to buy or sell.

New high in? long-term trend has been intact, and the recent break into a new high has sparked a new high for this producer manufacturing stock. However, will Trump's tariffs derail it? Regardless, DE.US could be a long-term play going forward.

Price action

The stock has broken out of the corrective pennat, confirming the uptrend resumption.

Momentum

Long-term MACD's histogram is positive and signal line is rising steadily, confirming the long-term bullish momentum.

The stochastic Oscillator (62, 12, 12) is in the overbought zone but based on the chart, there is no strong selling pressure yet and hence, the divergence factor may continue to push price higher

The rate of change managed to rise sharply above the zero line.

Volume and Trend strength are in a healthy stage. Both are displayed by volume and Directional movement index.

Potential Risk:

The stock is at the all time high and may be a bear trap. However, 100 psychological level should be a good level to hold on to a rebound.

MRVL Marvell Technology Options Ahead of EarningsIf you haven`t bought the MRVL before the previous earnings:

Now analyzing the options chain and the chart patterns of MRVL Marvell Technology prior to the earnings report this week,

I would consider purchasing the 95usd strike price Calls with

an expiration date of 2024-12-6,

for a premium of approximately $3.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Matrix MarvelZones of influence for potential support and or resistance forces. Especially looking for potential inflection points at any of the rectangles or breaks of the zones especially after they end.

Will provide updates with potential candlestick formation setups but overall the market in sync with the zones should provide through the price action the signs and tools the traders should look out for.

The "matrix" is designed in such a way to eliminate potential bias, regardless of the big gray rectangle lurking above, in order to encourage an open mind regarding what can happen while also providing elements to help navigate more easily potential future scenarios in the analysis process.

Marvell Pulls Back After Earnings RallyMarvell Technology surged on strong results last month. Now some traders may think the chip stock will continue higher.

The first pattern on today’s chart is the bullish gap on August 30 after the quarterly numbers. That may reflect positive sentiment in the name -- especially given its potential datacenter AI exposure.

Second is the series of lower highs since March. MRVL has remained near that falling trendline recently, which could suggest resistance is breaking.

Third, listless sideways movement this year has produced close proximity between its 50-, 100-day and 200-day simple moving average (SMAs). Does that create potential for prices to expand?

Finally, stochastics could be turning up from an oversold condition.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

MRVL Marvell Technology Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MRVL Marvell Technology prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $9.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Marvell forecasts revenue growth driven by AI productsMarvell Technology, Inc. has reported a remarkable 10% quarter-on-quarter revenue growth, primarily driven by robust demand for its artificial intelligence (AI) products. According to the company's recent press release, Marvell anticipates continued growth across all end markets, with an expected revenue increase of 14% for Q3.

Matt Murphy, chair and CEO of Marvell Technology, highlighted the strong demand for AI and electro-optical products as critical contributors to the company's growth. He remains optimistic about growth prospects in all company markets in the upcoming quarter.

Technical analysis of Marvell Technology, Inc. (NASDAQ: MRVL)

Analysing potential trading opportunities based on the technical setup of Marvell's stock:

Timeframe : four-hour (H4)

Current trend : the stock is currently in an upward trend, trading within a bullish price channel

Short-term target : the immediate upside target is at resistance at 85.55 USD

Medium-term target : breaking past the resistance at 72.95 USD could open the way for further growth, potentially reaching the yearly high of 98.65 USD

Key support : positioned at 60.55 USD

Reversal scenario : a break below the key support at 60.55 USD would negate the bullish scenario, possibly leading to a decline toward 46.55 USD

Market outlook

Marvell Technology's stock has rebounded strongly and is now testing the upper boundary of a descending correction channel. A breakout above this channel could signal the continuation of bullish momentum, with initial targets at 85.55 USD and an extended target of 98.65 USD. An additional bullish signal would be a breakout on the RSI resistance line. Conversely, a decline below the key support of 60.55 USD could indicate a bearish reversal, potentially pushing the stock down to 46.55 USD.

Investors should closely monitor Marvell's performance as it navigates through these growth phases, particularly its emphasis on AI and electro-optical products. The upcoming quarterly results and market reactions will provide further insights into the stock's trajectory.