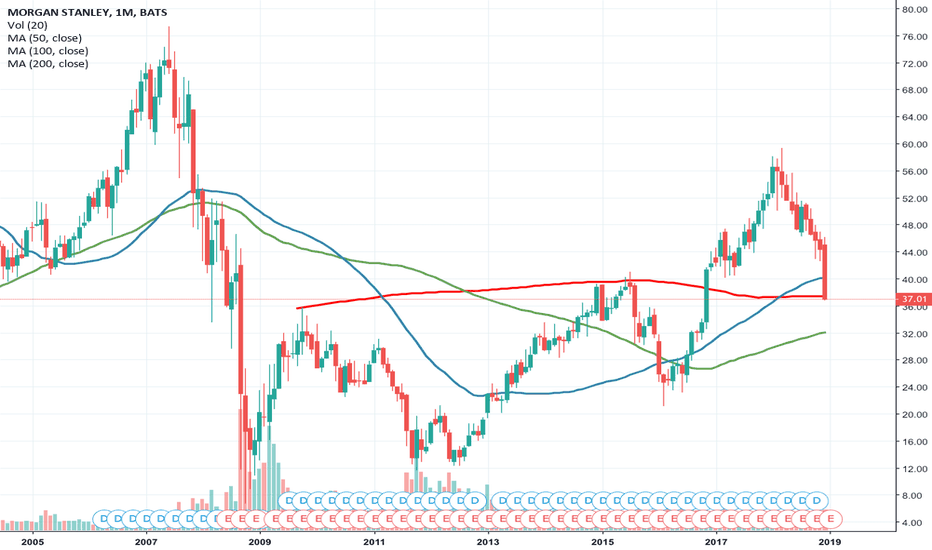

MS trade ideas

MS earnings name with gap during after-hours session! MS has earnings today and is gapping up in after hours (not a huge move but still could follow in pre-market). Volume profile is nice and clear with more then 800K shares and price action consolidated above 200sma with a smooth drifting pattern. Nice potential move up here touching hopefully 51

Morgan Stanley Establishes New Uptrend - Bullish Hi All,

MS should easily beat earnings since it's a busy IPO season and they are one of the major banks to underwrite the coming public offerings. I know that they are underwriting Uber's coming IPO.

Feel free to provide constructive critique. I have loaded up on May $45-$46 call options. I am also holding GS call options.

Morgan Stanley | Bearish sentiment ahead of earnings. Looking at Morgan Stanleys chart.

The SQZ indicator continues to turn hard green. Indicating further down side.

The stock has been ascending on descending volume. Bearish sentiment.

The MacD is about to have a bearish crossover.

The chart follows the bearish sentiment that is seen across the market.

Huge Sell off for Morgan StanleyMorgan Stanley shows very little growth potential even at the market dip. While it still a conservative hold for potential long term positions, the amount of risk is outrageous right now. Even after hiring of a new Chief Investment Officer and upgraded management, it looks like a strong sell off is definitely a market recommendation for Morgan Stanley as it is likely to decrease at $35 which will then be a better buy price. As a wealth management institution, one of the biggest for financial management professionals, the steep recent decline lowers the demand curve for their stock.