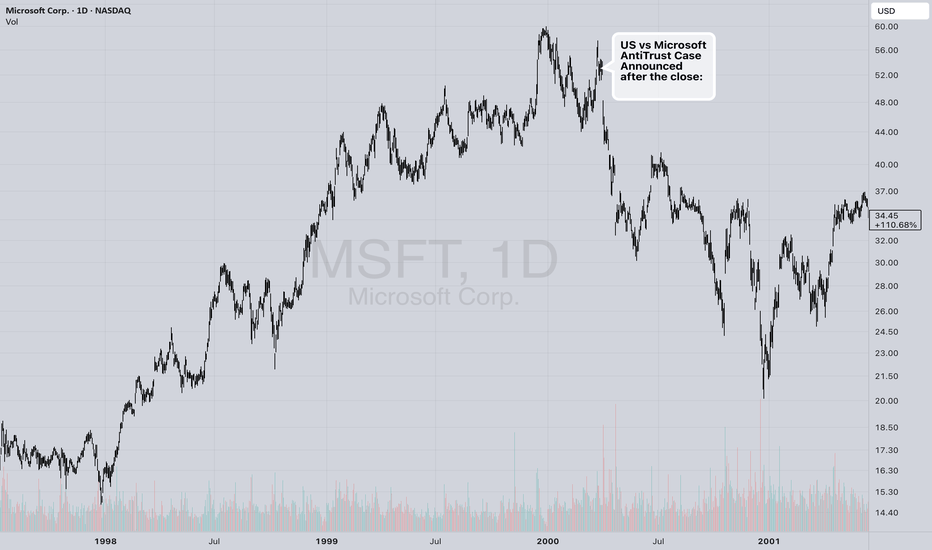

Does Everyone Remember Why The Bubble Popped in Y2K?I heard on Bloomberg Television this morning that they didn't have any recollection of a good reason for the stock market bubble of 1995-2000 to pop. I was stunned that a portfolio manager of such standing had the guts to say that he didn't understand why the market topped in 2000.

This is how hist

Key facts today

Shell Asset Management Co. increased its investment in Microsoft by acquiring an additional 71,920 shares in the second quarter, raising its total holdings to 349,437 shares.

Microsoft faced a cyberattack on its SharePoint servers linked to Chinese hackers, affecting several U.S. government agencies. No sensitive data is thought to have been compromised.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

266.32 MXN

1.62 T MXN

4.50 T MXN

7.32 B

About Microsoft Corp.

Sector

Industry

CEO

Satya Nadella

Website

Headquarters

Redmond

Founded

1975

FIGI

BBG000HSSV64

Microsoft Corp engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories. The company was founded by Paul Gardner Allen and William Henry Gates III in 1975 and is headquartered in Redmond, WA.

Related stocks

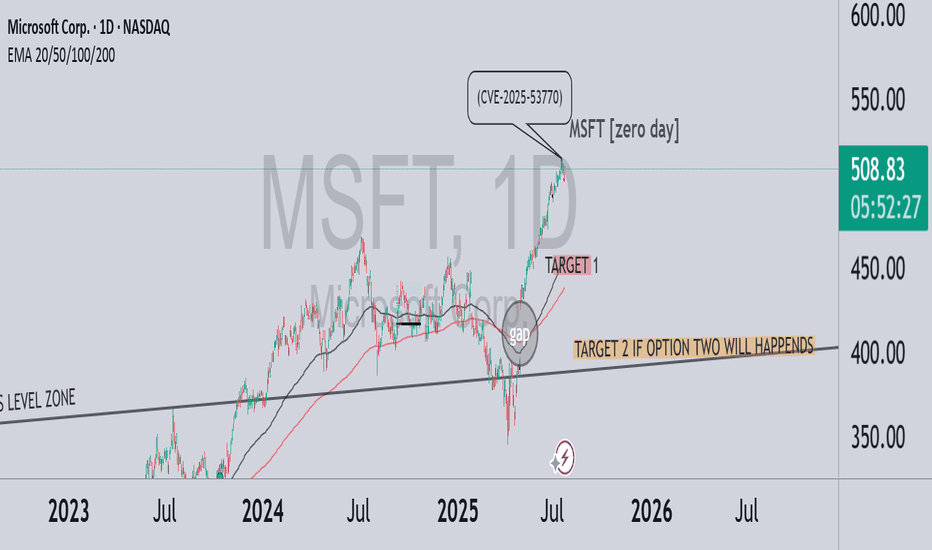

MSFT – A correction brewing? zero day CRWD-like scenario?In July 2025, a critical vulnerability in Microsoft SharePoint (CVE-2025-53770) was exploited by threat actors globally. Although the issue was first reported during the Pwn2Own Berlin competition back in May, Microsoft delayed the patch — allowing attackers a significant head start. Over 400 server

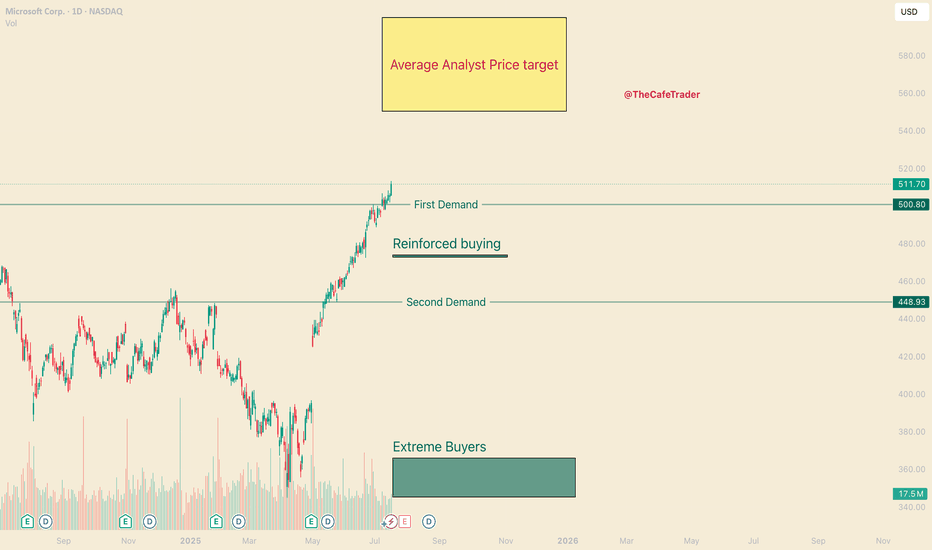

Don't Short MSFT. 2 long scenarios. Hi, I’m The Cafe Trader.

Today we’re diving into the heart of this very bullish run on MSFT. One of the key lessons I’ve learned:

Never get in the way of a strong bull trend — especially just after a breakout.

⸻

🔍 Price Action Overview:

MSFT has been respecting a strong trendline since its init

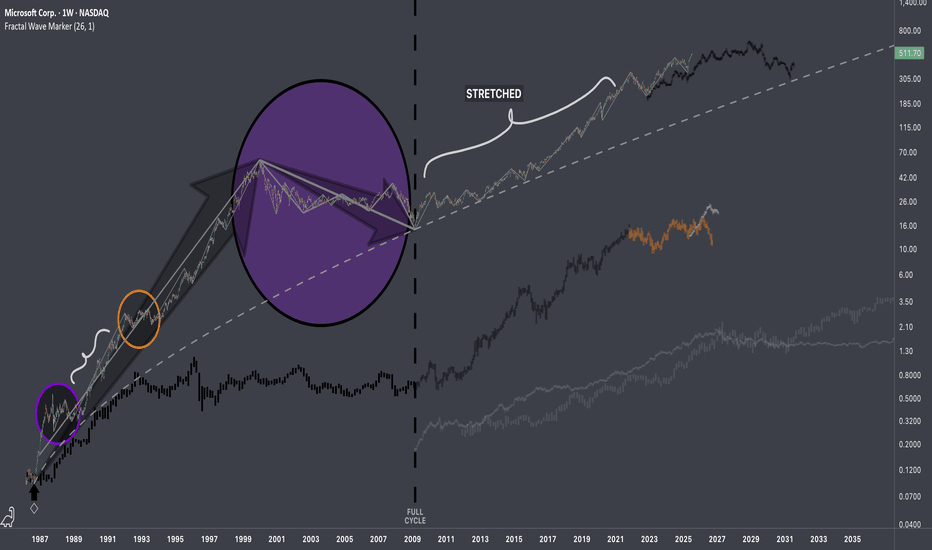

$MSFT: Fractal Hierarchy IResearch Notes

Fluctuations reappearing at broader scale.

If both are manifestations of the same pattern, then the next segments can be applied accordingly.

The remaining part can be deformed (depending on future volatility which can accelerate completion of composite sub-cycles)

Document

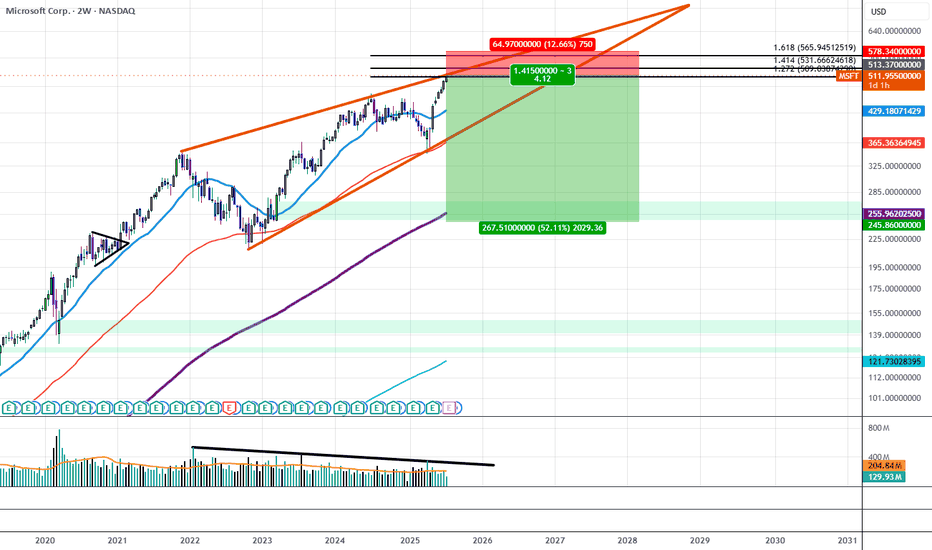

Microsoft Sees Declining Trading Volume Despite All Time HighsSince December of 2021, MSFT traded within a Rising Wedge structure that has gradually resulted in lower and lower highs in volume, at the same time IV on the Options Chain has begun to price down the strikes above $515 while Shorter Term Downside IV has begun to price up all the way out to $240.00.

MSFT - Should you Buy All Time Highs?Hello everyone, I’m TheCafeTrader.

Next up in our breakdown of the MAG 7 is Microsoft (MSFT) — this post focuses on a long-term swing trade setup.

For short-term analysis, head to my profile and check out the latest posts.

⸻

💡 The Setup:

MSFT continues to ride a strong wave thanks to AI growth,

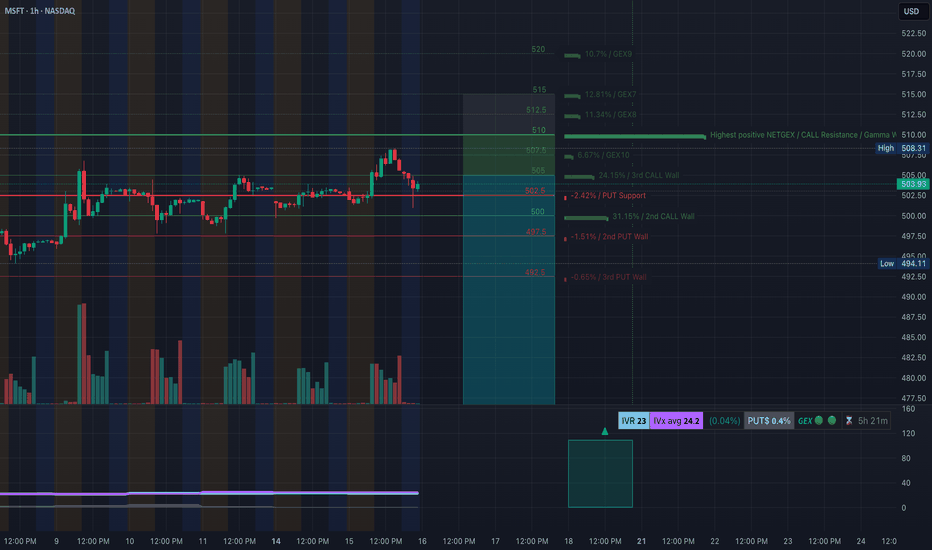

MSFT Setting Up for a Breakdown or Bounce - July 16MSFT Setting Up for a Breakdown or Bounce – Key Option Levels in Play 💥

🔹 Options GEX Analysis (Tanuki GEX View):

* Gamma Resistance (Call Wall):

→ $510 is the highest GEX level, acting as a ceiling.

→ $507.5 is the 3rd Call Wall and minor resistance.

* PUT Walls and Gamma Support:

→ $502.5 = HVL (

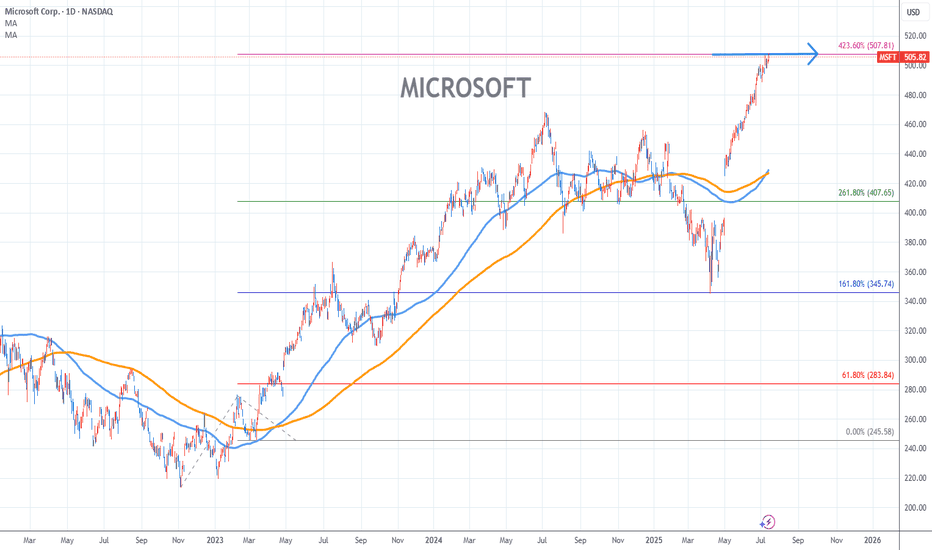

MICROSOFT Stock Chart Fibonacci Analysis 071525Trading idea - Hit the top > 507/423.60%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support a

MSFT at Gamma Wall Crossroads–Will 506 Break This Time? July 14🧠 GEX and Options Sentiment (TanukiTrade GEX)

* GEX Zone Summary:

* 📈 Call Wall 1 (503.5–506.7) → major Gamma Resistance.

* 🧱 Gamma Wall (506.77) = Highest positive NETGEX — key sell zone for market makers.

* 🟢 GEX Flow: Moderate call dominance (1.95%) — not yet extreme bullish.

* 🟣

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ATVI5026499

Activision Blizzard, Inc. 2.5% 15-SEP-2050Yield to maturity

8.75%

Maturity date

Sep 15, 2050

ATVI4499883

Activision Blizzard, Inc. 4.5% 15-JUN-2047Yield to maturity

7.80%

Maturity date

Jun 15, 2047

ATVI5026498

Activision Blizzard, Inc. 1.35% 15-SEP-2030Yield to maturity

6.14%

Maturity date

Sep 15, 2030

See all MSFT bonds

Curated watchlists where MSFT is featured.

Frequently Asked Questions

The current price of MSFT is 9,553.05 MXN — it has increased by 0.66% in the past 24 hours. Watch Microsoft Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange Microsoft Corp. stocks are traded under the ticker MSFT.

MSFT stock has fallen by −0.44% compared to the previous week, the month change is a 1.95% rise, over the last year Microsoft Corp. has showed a 23.42% increase.

We've gathered analysts' opinions on Microsoft Corp. future price: according to them, MSFT price has a max estimate of 12,991.83 MXN and a min estimate of 8,017.82 MXN. Watch MSFT chart and read a more detailed Microsoft Corp. stock forecast: see what analysts think of Microsoft Corp. and suggest that you do with its stocks.

MSFT reached its all-time high on Jul 17, 2025 with the price of 9,644.00 MXN, and its all-time low was 215.34 MXN and was reached on Jul 6, 2005. View more price dynamics on MSFT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MSFT stock is 1.20% volatile and has beta coefficient of 0.98. Track Microsoft Corp. stock price on the chart and check out the list of the most volatile stocks — is Microsoft Corp. there?

Today Microsoft Corp. has the market capitalization of 70.86 T, it has increased by 1.35% over the last week.

Yes, you can track Microsoft Corp. financials in yearly and quarterly reports right on TradingView.

Microsoft Corp. is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

MSFT earnings for the last quarter are 70.89 MXN per share, whereas the estimation was 66.01 MXN resulting in a 7.38% surprise. The estimated earnings for the next quarter are 63.32 MXN per share. See more details about Microsoft Corp. earnings.

Microsoft Corp. revenue for the last quarter amounts to 1.44 T MXN, despite the estimated figure of 1.40 T MXN. In the next quarter, revenue is expected to reach 1.38 T MXN.

MSFT net income for the last quarter is 529.06 B MXN, while the quarter before that showed 502.64 B MXN of net income which accounts for 5.26% change. Track more Microsoft Corp. financial stats to get the full picture.

Yes, MSFT dividends are paid quarterly. The last dividend per share was 16.18 MXN. As of today, Dividend Yield (TTM)% is 0.63%. Tracking Microsoft Corp. dividends might help you take more informed decisions.

Microsoft Corp. dividend yield was 0.67% in 2024, and payout ratio reached 25.42%. The year before the numbers were 0.80% and 28.09% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 228 K employees. See our rating of the largest employees — is Microsoft Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microsoft Corp. EBITDA is 3.10 T MXN, and current EBITDA margin is 53.74%. See more stats in Microsoft Corp. financial statements.

Like other stocks, MSFT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microsoft Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microsoft Corp. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microsoft Corp. stock shows the buy signal. See more of Microsoft Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.